How to Report NYC Identity Theft

in NYC and all over the world are constantly at work, finding new and creative methods to cash in using other people's personal data. And the unfortunate reality is that you're also at risk for , which can wreak so much havoc on your financial life. Nevertheless, there are steps you can take to minimize your vulnerability and detect it more quickly if it does happen.

New York State has taken several steps in recent years to address identity theft, punishable by up to seven years in prison. Additionally, they require individuals and organizations to safeguard their personal information, but more must be done. You should be very mindful of the information you provide online, especially on social media and all online platforms.

If by any chance, you ever find yourself in such a state, you'll need to report the incident so that the appropriate actions can be taken, and this is where DoNotPay comes in handy. Alongside NYC identity theft, we'll also help you report Experian, Equifax, IRS, and Social Security identity thefts.

What Is Identity Theft?

refers to the unlawful use of another person's identification data to commit fraud, such as making unauthorized purchases or transactions. Identity theft can be committed in several diverse ways, and it leaves the victims with damage to their finances, credit, and reputation.

Identity thieves can get your information by:

- Going through your mail

- Hacking into your devices

- Rummaging through trash bins to get receipts, as well as credit card and bank statements

- Collecting your data through fraudulent scams

- Stealing your wallet, ID, and credit cards

Indicators That You Might Be a Victim of NYC Identity Theft

Your credit report reflects all the credit accounts that are opened in your name – student loans, auto loans, mortgages, credit cards, among others. If a thief opens a new account with your personal data, it will show up on your credit report within a month or two. This is why it's crucial to keep monitoring your credit report so that you can uncover any identity theft in its early stages.

An unfamiliar new account and errors in your personal data such as your Social Security number may be a warning sign of potential theft. Other warning signs include:

- Bills or statements for legitimate accounts not showing up

- Bills or statements for accounts you never opened getting to your mail

- Unauthorized bank withdrawals or transactions

- Unauthorized authentication messages for an account you aren't familiar with

- Notifications that a tax return has been filed for you without your knowledge

- Being unexpectedly denied credit

What to Do If Your Identity Gets Stolen in NY

If you become a victim of NYC identity theft:

- Contact all the creditors to inform them of the situation

- Notify the police

- Alert all your banks to flag accounts as well as contact you for any unusual activity. Change all Pins and passwords.

- Report identity theft to the Federal Trade Commission (FTC)

- Has a fraud alert placed in your credit files

How to Prevent Identity Theft

Here are some of the ways:

| Be mindful of your passwords | Always create strong passwords and ensure that you don't use the same password twice. Additionally, you can opt for two-factor authentication and always ensure you password-protect all your devices. |

| Be careful with public WI-Fi | Ensure that you only use secure and trusted networks when paying bills, banking, or doing online shopping. |

| Never share your personal data over the phone | Authentic institutions – including the IRS, Social Security Administration, and banks – will never call you to demand things like your bank account number or Social Security number. On the other hand, scammers will. |

| Periodically check your credit reports | Like earlier said, coming across suspicious activities in your credit report, such as unfamiliar new accounts, could indicate potential fraud. Constantly checking the reports, therefore, helps you detect any such activity early enough. |

| Stop keeping your social security card in your wallet | This also goes for credit cards you rarely use. The fewer items you have in your wallet, the easier it will be to sort out the mess in case your wallet is stolen or lost. |

| Review notices from your insurance company and healthcare workers | Check for anything out of normal, such as unfamiliar dates of service or bills, as these could be indicators of medical identity theft. |

How to Report NYC Identity Theft on Your Own

You may report identity theft to the FTC online. You can also call FTC by phone at 1-877-438-4338.

How to Deal With Identity Theft Using DoNotPay

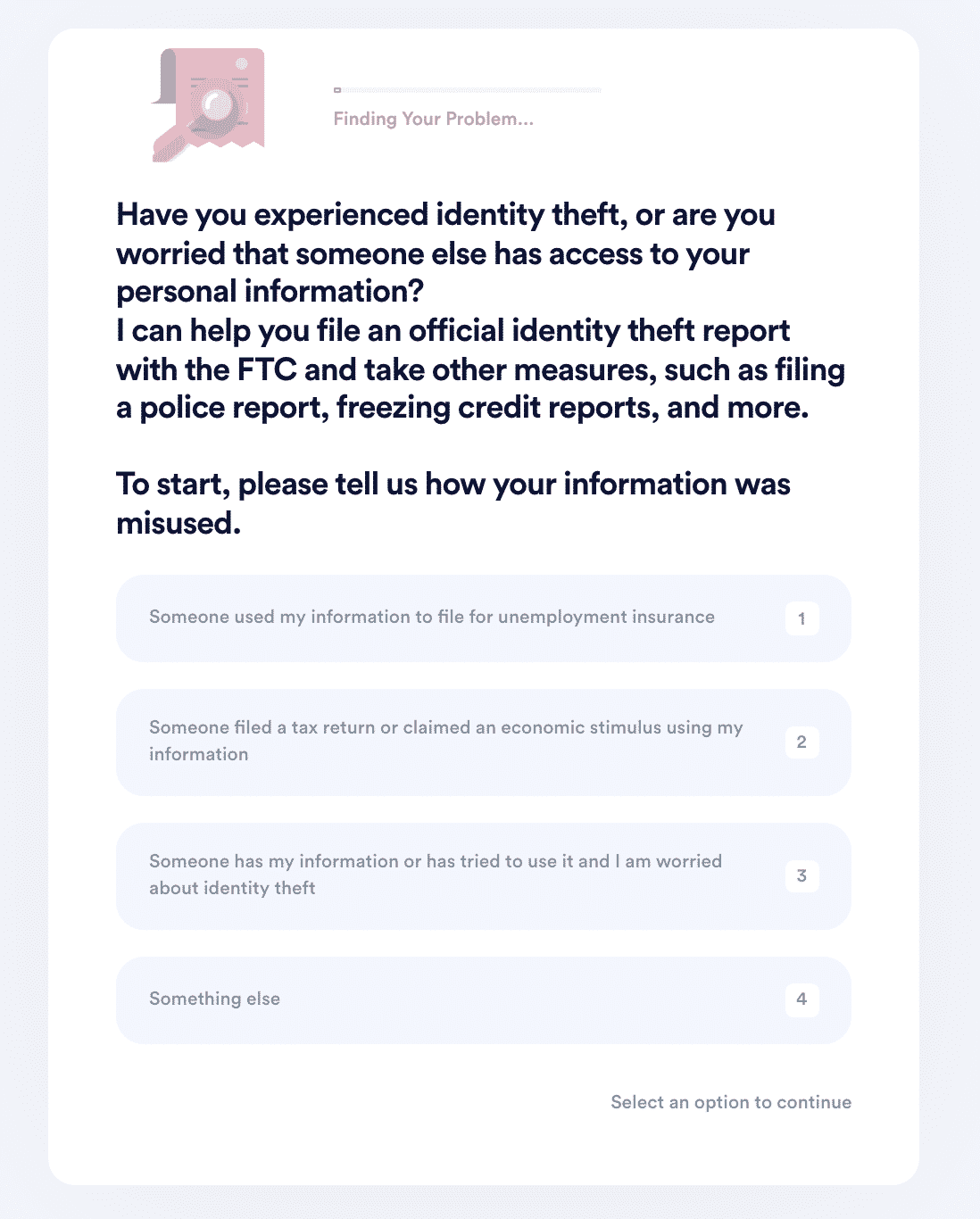

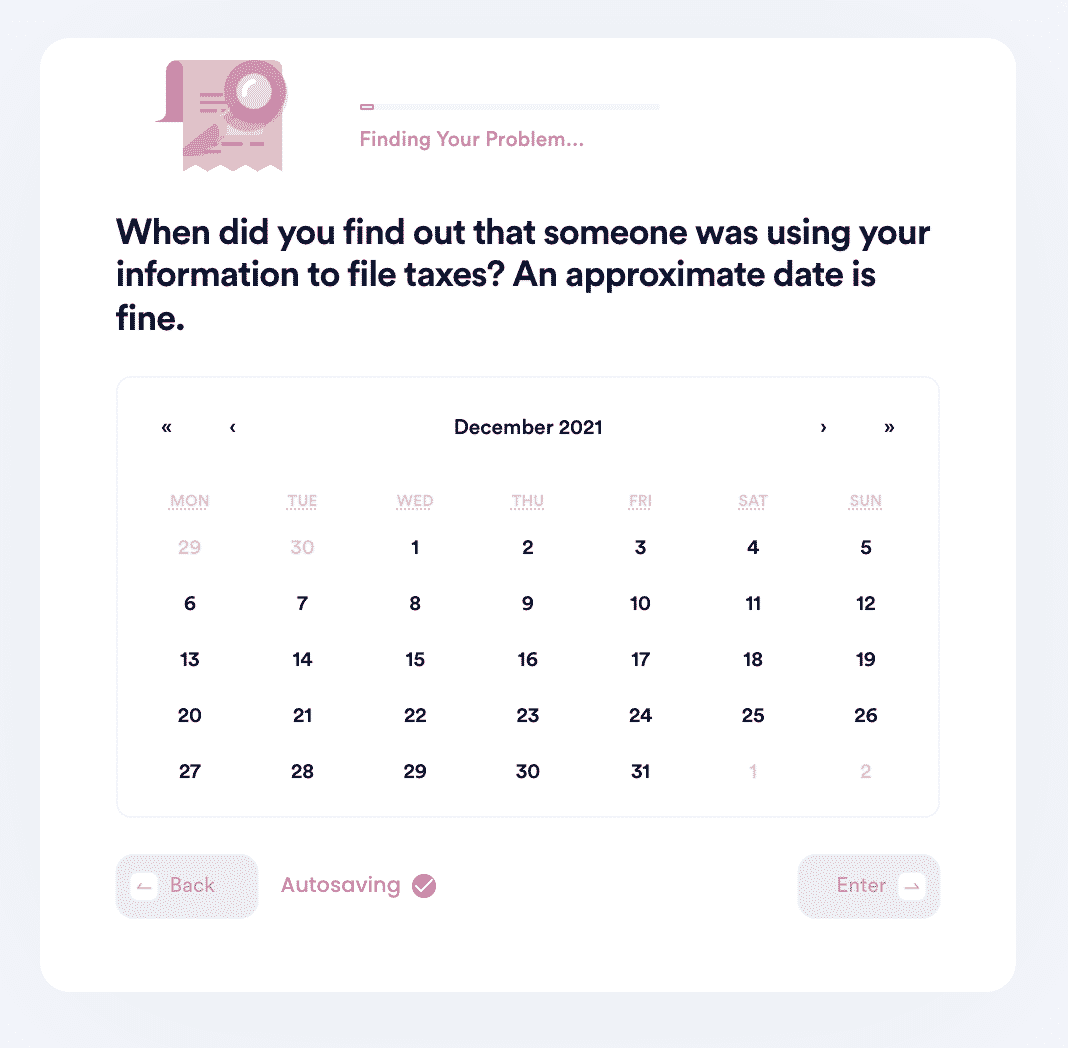

- Search "identity theft" on DoNotPay and select the type of incident you would like to report.

- Tell us more about the incident that occurred, including the location, date, time, financial loss, and any suspect information you may have.

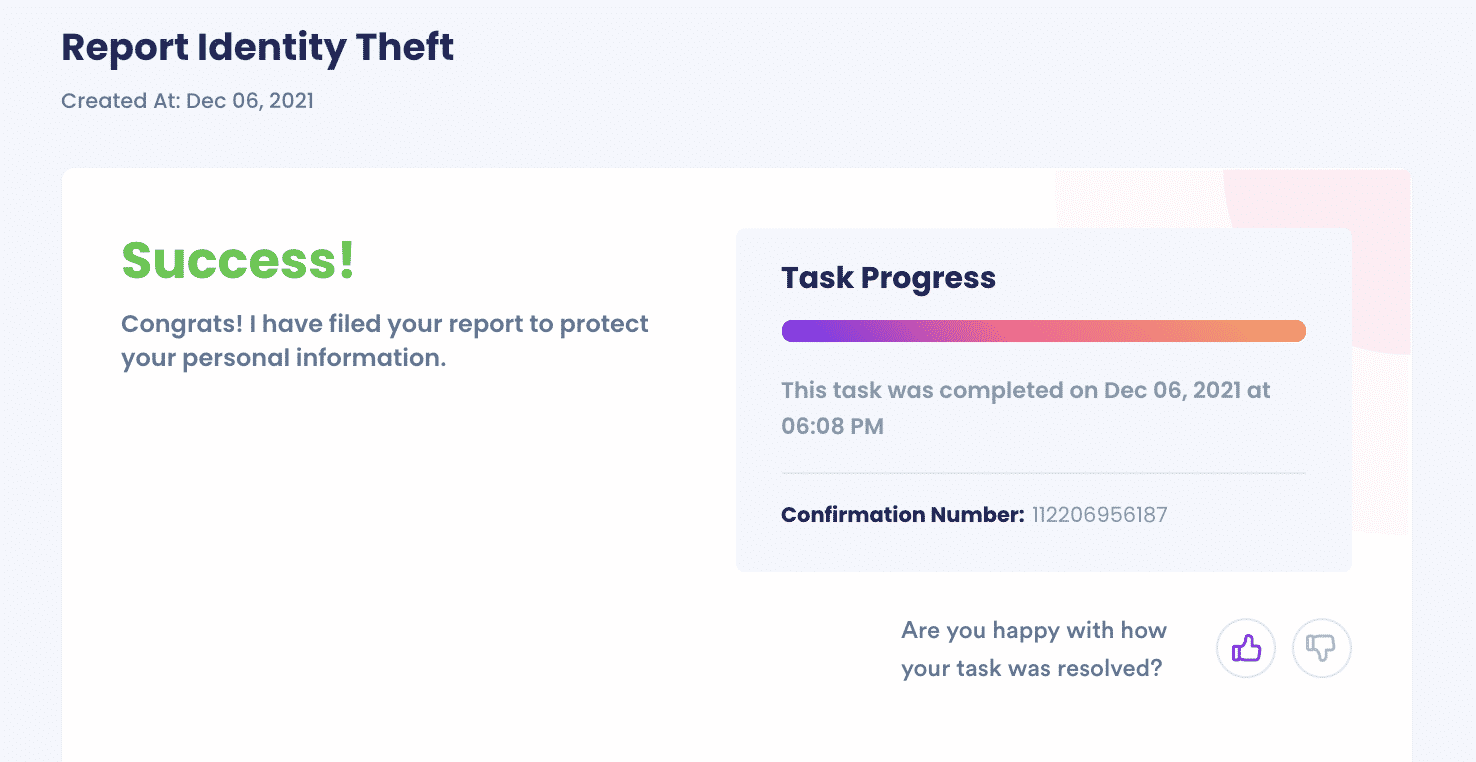

- We'll identify whether you should file an FTC report, contact the IRS, freeze your credit report, contact state agencies, or file a police report. Once we guide you through the best options, we'll automatically submit the reports on your behalf!

DoNotPay Works Across All Entities and Groups With the Click of a Button

At DoNotPay, we'll also help you to:

- Identify if someone filed for unemployment with your name

- Report credit card fraud

- Report stolen stimulus check

- Know how much you can send demand letters to for identity theft

What Else Can DoNotPay You Do?

- Contact government representatives

- Get refunds and chargebacks

- Send Demand Letters To individuals and organizations in small claims court

- Make insurance claims

- And much more!

Reach out to us to get more acquainted with our services today!

By

By