How to Report Identity Theft to the IRS in No Time

If you were would you know how to properly report the issue? Would you know where to go to information about resolving the problem? Insurance identity theft, financial identity theft, synthetic identity theft, and medical identity theft are all possible outcomes for consumers who are victims of tax identity theft. Consumers should be on the lookout for any symptoms of fraud and double-check their accounts and records on a regular basis.

In this post, let's look into identity thefts as they pertain to the Internal Revenue Service, and how DoNotPay can provide you with information and solutions to

How to Report an IRS Identity Theft

The IRS typically has many more identity theft issues than any other government entity. Our senior citizens are the largest group of individuals that are easy prey for these identity predators.

Senior citizens are not the only group targeted by identity thieves. Technically, if you have a social security number, you are at risk of having your identity stolen,

Follow these steps if you are a victim of identity theft:

| Step 1. File a complaint with the Federal Trade Commission (FTC) at identitytheft.gov | The FTC also contains sample letters to help you resolve issues with the credit bureaus, credit card issuers, and other companies with which you may do business. |

| Step 2. Contact one of three major credit bureaus to place a “fraud alert” on your credit records |

|

| Step 3. Contact your financial institutions | Close any financial or credit accounts that have been opened without your knowledge or that have been tampered with by identity thieves. |

What Can Be Done if I Suspect Someone Has Filed a Tax Return Using My Social Security Number?

The IRS has beefed up its cybersecurity protocol and will usually catch someone trying to file a tax return on your social security number. You may receive a notice in the mail from the IRS stating that someone has filed a tax return in your name and using your social security number.

When you get that notice in the mail, do the following:

- Call the number listed on the notice and let the IRS know that you indeed suspect your identity has been stolen and that you have received the notice from them stating the same.

- If you are a victim of identity theft, you can request the IRS to mark your account and notify you of any questionable activity. You can use Form 14039 Identity Theft Affidavit.

- You can also contact the IRS directly about this issue at 800-908-4490

- You can also refer to the fact sheet distributed by the IRS on identity theft issues.

You can also use the Identity Theft Victim Assistance resource tools from the IRS to prevent this from happening to you ever again. Also, you can refer to the web page of the IRS site titled Identity Theft Central for other tax-related issues and your stolen identity.

What Happens After You Report Identity Theft to the IRS?

You have filled out your Form 14039 and alerted the IRS to the situation. So what happens next?

The IRS will work hard on your case to get everything back under control with your taxes, particularly your tax refund if you are getting one. Those identity thieves are well aware of the tax filing season, and every aspect of your refund is under fire until it reaches you.

After your account has been flagged as an identity issue, the IRS will work on your case until it is resolved. The downside here is that it can take up to one year and sometimes more to completely undo what the identity thieves have done.

The IRS may issue you a special number to be used on your tax returns from now on. This number denotes that your identity was at one point compromised and that special care should be taken when reviewing your tax returns.

There Is a Much Faster and Easier Way to Handle Your IRS Identity Theft Issues!

That sinking feeling you got when you first realized your identity had been stolen has now turned into anger, frustration, and confusion. Your time is valuable and lost time chasing down identity thieves can never be replenished.

Tedious forms that have to be filled out, information scattered all over the internet, and a possible timeline of over one year before these issues can be resolved would try the patience of a minister!

Let's show you how fast, easy, and stress-free your IRS identity theft issues can be when you use the services provided by DoNotPay.

How to Use DoNotPay for IRS Identity Theft Issues

The services provided by DoNotPay are designed to level the playing field and make these things like identity theft a lot easier to deal with! Take a look at these steps to take.

How to Deal With Identity Theft Using DoNotPay:

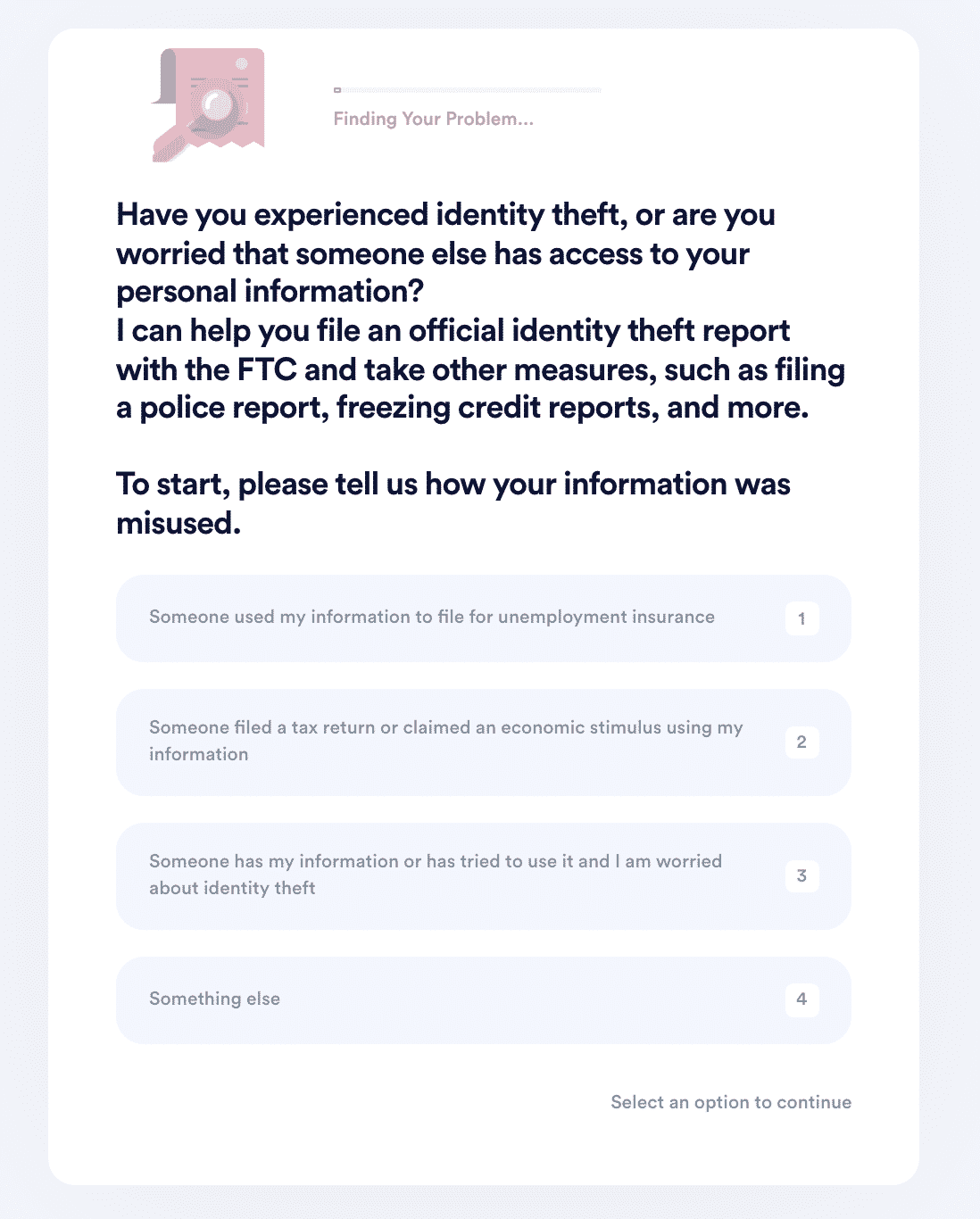

- Search "identity theft" on DoNotPay and select the type of incident you would like to report.

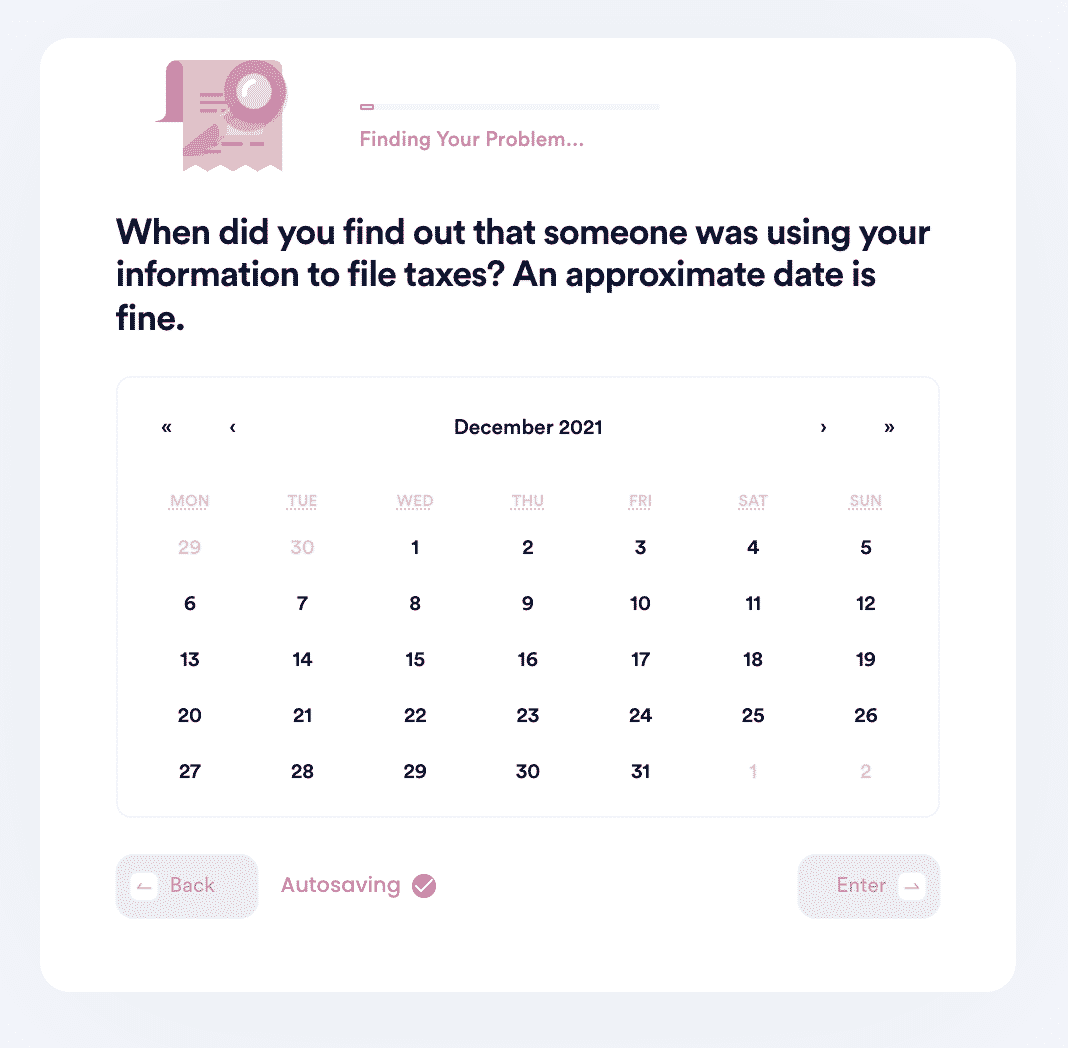

- Tell us more about the incident that occurred, including the location, date, time, financial loss, and any suspect information you may have.

- We'll identify whether you should file a FTC report, contact the IRS, freeze your credit report, contact state agencies, or file a police report. Once we guide you through the best options, we'll automatically submit the reports on your behalf!

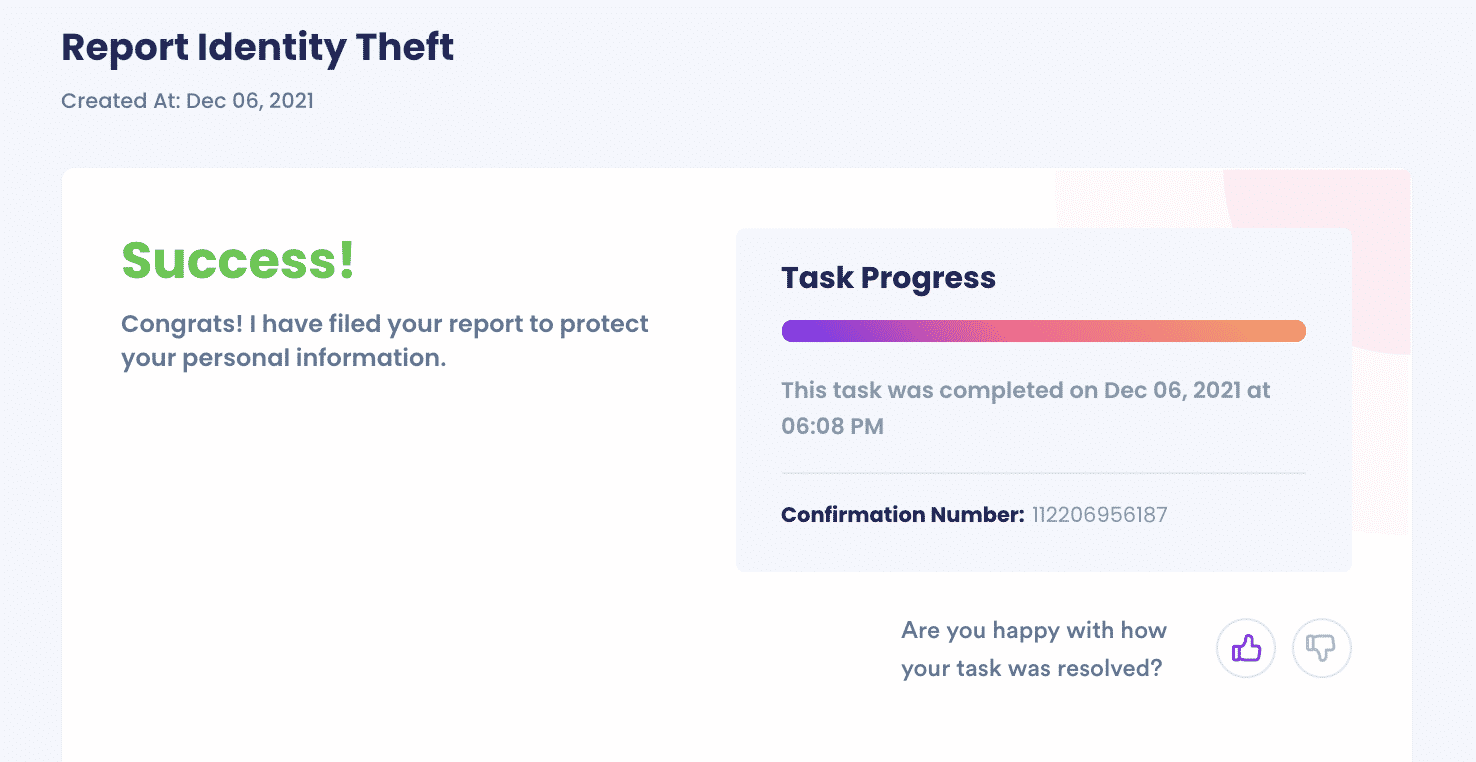

And that's it! DoNotPay will make sure your issue gets sent to the right place. We'll upload confirmation documents to your task for you to view, and if the contacts need more information, they will reach out to you personally via email or mail.

While you are waiting on DoNotPay to work on your behalf, you might want to file an identity theft complaint with the Federal Trade Commission (FTC) so they can address your problem as well as gather data concerning your issues and put this whole ordeal in your rearview mirror!

What Else Can DoNotPay Do?

Your IRS identity theft problems are just a small sample of what you can do with DoNotPay. Take a look at these other identity theft issues you can successfully navigate using DoNotPay!

- Learn more about identity theft

- Learn how to report identity theft

- If someone filed for unemployment under your name

- Learn about credit card fraud

- Social Security identity theft

- Someone stole my stimulus check

- Learn about Equifax identity theft

- Learn about Experian identity theft

- Learn about how much money you can send demand letters to for in identity theft cases

Let DoNotPay show you how fast and easy your IRS identity theft issues can be cleared up!