3 Steps to Get Your Car Back After Repo In Florida

Did you know that about 2.2 million vehicles are repossessed each year in the US? As soon as you default on your payment in Florida, a lender can collect the vehicle without taking you to court, according to Title 33 of Florida statutes. The laws also provide ways to regulate how a collector can avoid repossession without infringing on your rights.

While getting is possible, the process is not easy, especially when doing it alone. For this reason, you should sign up to DoNotPay to make the process easier and less emotionally draining.

How Do You Get a Car Back After Repossession?

You still have different options for getting your car back after repossession in Florida. The available options are:

1. Reaffirm a Car Loan

When you file for Chapter 13 bankruptcy, some lenders can allow you to reaffirm your car loan through a process called reaffirming a debt. Reaffirming a loan reinstates your liability to continue paying the car loan, including all the missed payments.

You will only qualify for the reaffirmation if you can show that you have enough money within your budget to continue paying the debt without putting too much burden on yourself or your family.

2. Car Redemption

A borrower can get their car back if they have more money at their disposal through the right of redemption. What this means is that you can get your vehicle back if you pay all the outstanding car balance.

Your lender will send you a written notice on your right to redeem your vehicle within a specified timeframe.

3. Voluntary Car Repossession

A borrower can voluntarily surrender a vehicle for repossession in Florida before the lender comes for it. The benefits of taking your car back to the lender include saving time and fees, which you would have paid had the lender come to collect it.

What Is Wrongful Repossession of a Vehicle?

Even though the lender has every right to take the vehicle back when you've defaulted on payments, their actions are limited. There are certain actions that, when taken during the process of repossession, can make it an unlawful repossession.

Elements of unlawful repossession include:

- Use of threats with or without the help of police

- Getting into the borrower's property that is fenced in or which requires authorization to access

- Physically abuse the borrower

- Damage the borrower's property

- If the lender accepted late payments from you in the past

The borrower has every right to send demand letters to the lender if any of the above actions occur during a wrongful car repossession, even if the borrower defaulted on car payments.

What Can I Do if My Car Is Illegally Repossessed?

You have every right to take action against the lender after wrongful car repossession. Suing the lender is challenging, time-consuming, and energy-draining, especially when you are doing it on your own.

Here are the actions you can take after an unlawful possession:

| Action | Details |

| Take Evidence of the Repossession | Document every part of the repossession from the moment the collection team comes to pick up the vehicle. In many cases, they will violate your consumer rights, which will make the repossession unlawful.

You can take photos and videos or witness testimony that could be helpful in your case. |

| Keep All the Important Documents | When the lender picks up the vehicle, they can sell the car. However, they are obligated to notify you first before selling through a letter called "Notice of Intent to Sell Property."

The letter serves the purpose of informing the borrower of:

|

| Hire an Attorney | An attorney is in a better position to tell you if any of your rights were violated during the collection process. In cases where the lender sells your vehicle but the money is not enough to cover the loan balance, they can collect the remaining balance which is called the deficiency. |

Once a judgment of deficiency is entered, the lender has the right to use other collection techniques such as garnishing payments to offset the car loan. So, it is essential that you have the help of an attorney.

Get Your Repossessed Car Back With the Help of DoNotPay

Getting your car back after wrongful possession is hard. All the different channels you have to go through on your own will frustrate you at the end of the day.DoNotPay provides you with a better alternative to plead your case without much hassle.

Here is how DoNotPay can help with car repossessions:

DoNotPay can help you file a demand letter for wrongful possession using your state's laws and help you reclaim your vehicle. In the case the repo was valid, you will have to pay off any balances you owe to reclaim your vehicle. If you can't afford the payments, DoNotPay can help you ask for a payment plan or negotiate the balance you owe.

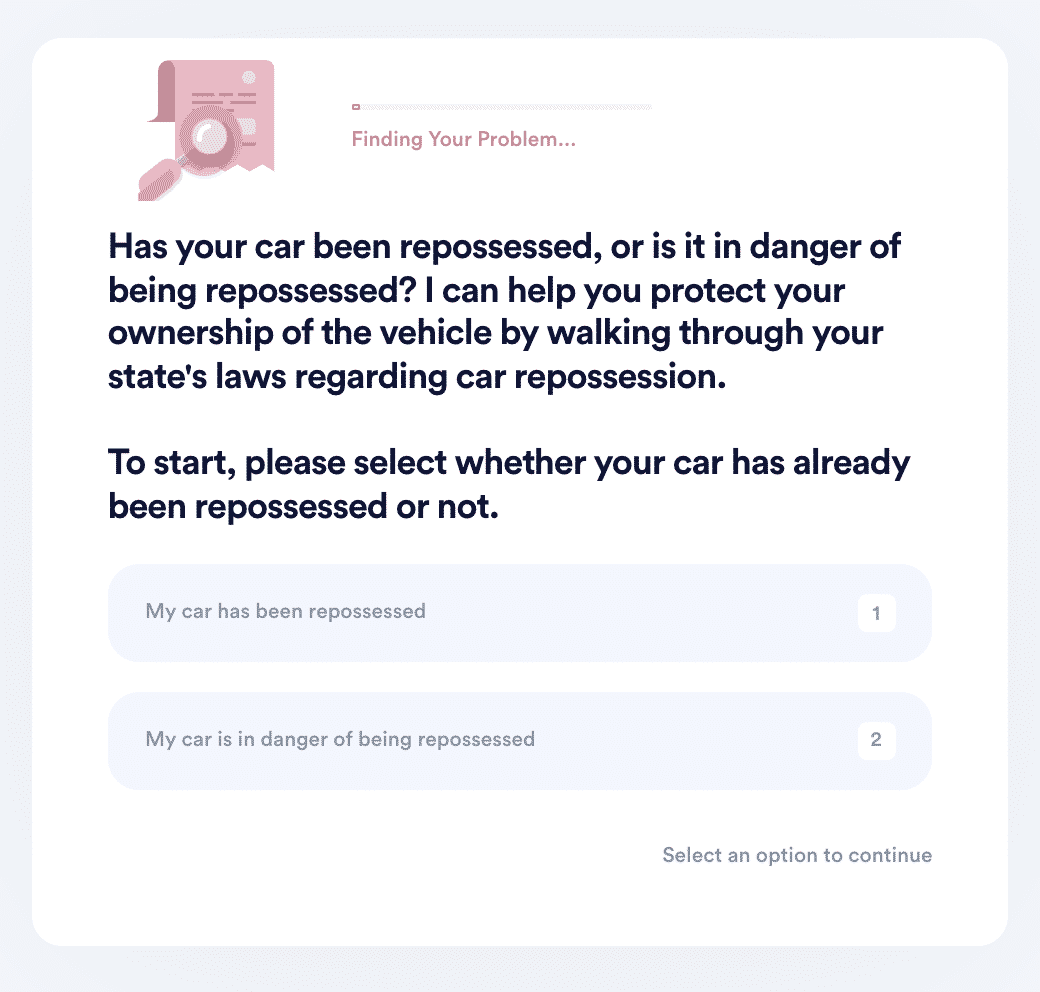

- Search "car repossession" on DoNotPay and select whether your car has been repossessed or is in danger of being repossessed.

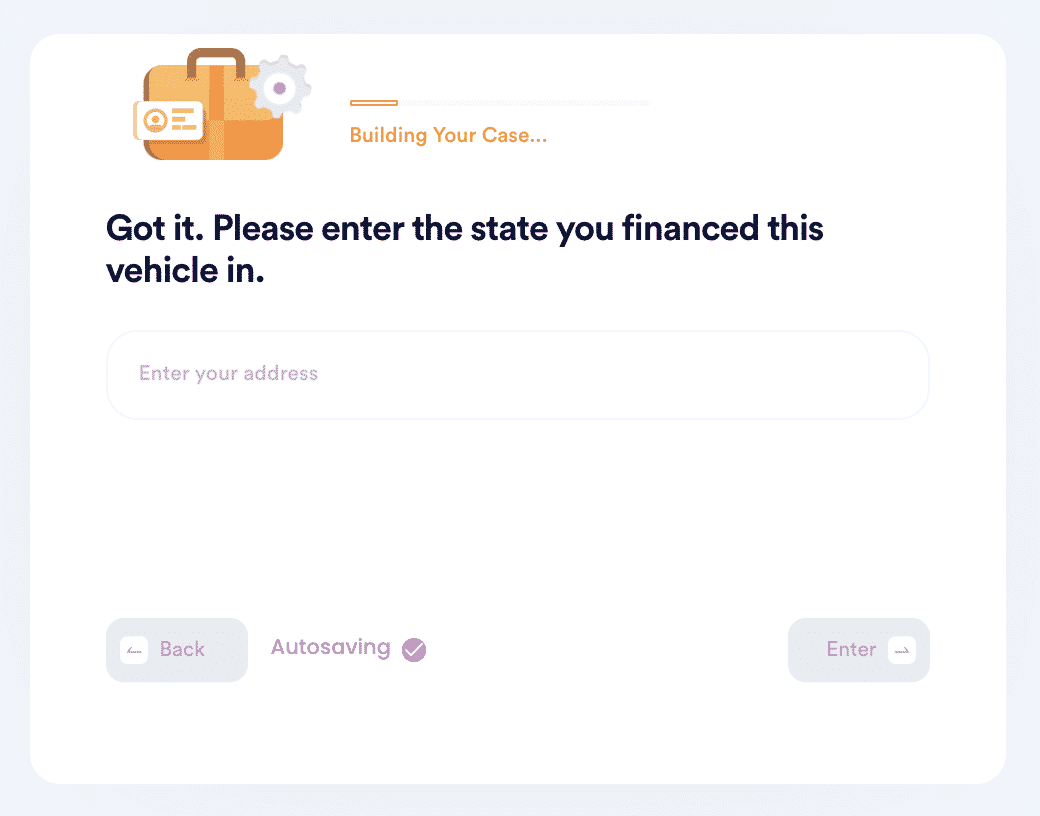

- Enter the state you financed this vehicle in, and let us walk you through your state's repossession laws to see if your car was or is being wrongfully repossessed.

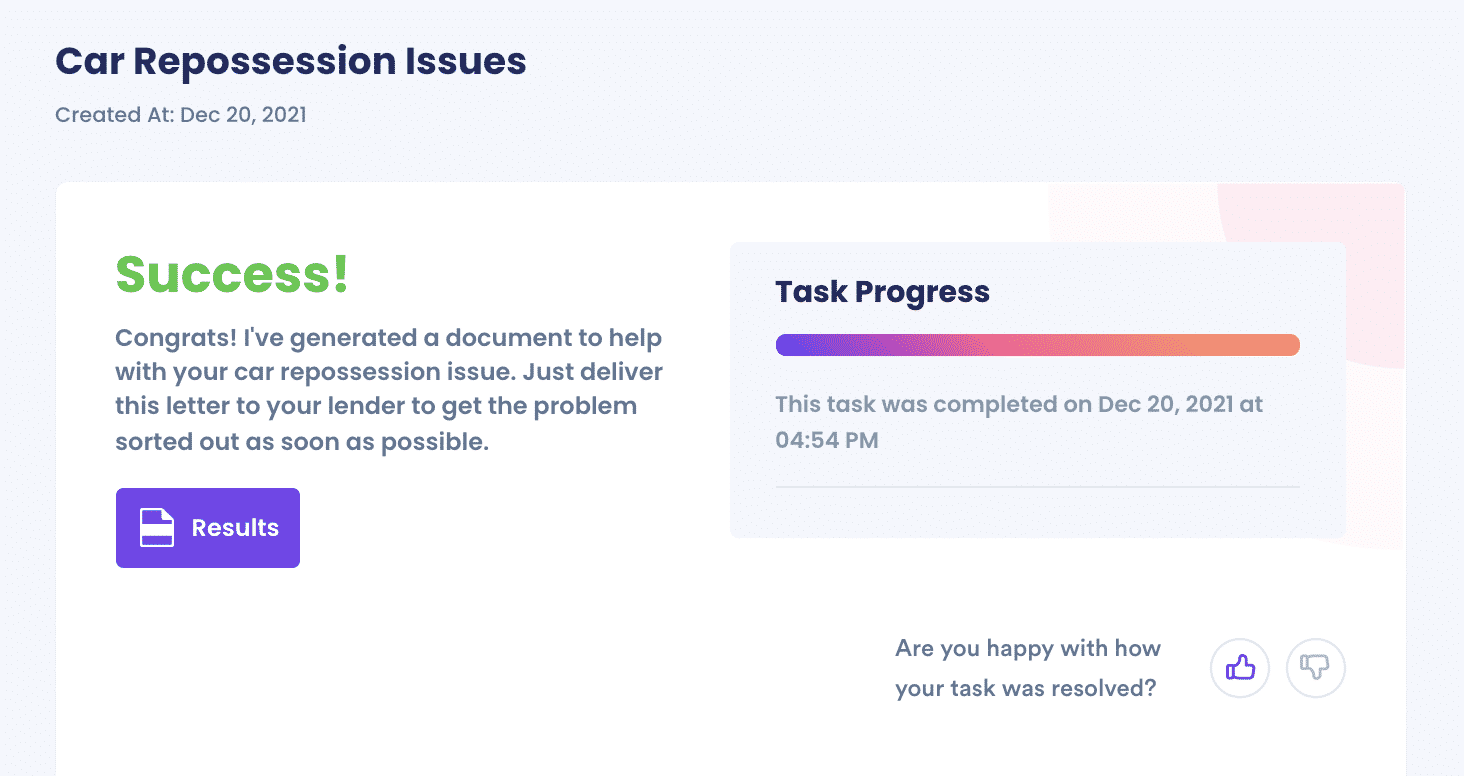

- If we can make a case for wrongful repossession, DoNotPay will file a demand letter on your behalf to the lender to fight against.

And that's it! DoNotPay will make sure your issue gets sent to the right place. We'll upload confirmation documents to your task for you to view, and if the contacts need more information, they will reach out to you personally via email or mail.

Why Use DoNotPay to Get Your Car Back After Repossession

is challenging. You have to go through various processes, deal with difficult lenders and collectors which can be draining. DoNotPay will simplify every process for you without any difficulties. All you have to do is sign up to the website and provide a little information about your issue, and we will take it from there.