How to Report Identity Theft to Equifax?

Identity theft can be overwhelming. It is a violation of your personal and financial life and can have devastating consequences. It is important to take immediate action if you suspect or find out that you are the victim of identity theft. Filing Experian, TransUnion, and reports are one of the first things you should do, and fortunately, DoNotPay is here to help.

Signs That You May Be a Victim of Identity Theft

Identity theft is a common form of fraud and can be committed by family, friends, or strangers.

What Is Identity Theft?

Identity theft happens when someone uses your personal information (name, social security number, address, driver's license number, etc.) to commit fraud. Perpetrators of identity theft may commit the following:

- Credit card fraud

- Unemployment fraud

- Steal your stimulus check

- Access your bank accounts

And among other things.

Warning Signs for Identity Theft

There are many signs of identity theft. It is important that you are proactive and diligent if you notice any of these signs, especially if you were informed of a data leak that may have compromised your personal information.

- You receive unfamiliar bills in the mail or stop receiving your regular mail or bills.

- You find unauthorized transactions on your bank or credit card statements

- There are unauthorized purchases or charges for your online accounts

- You receive calls from the fraud department of your financial institution for suspicious activity.

- You receive calls or letters from debt collectors about unfamiliar debt

- There is unfamiliar activity on your credit reports

- You cannot file income taxes because you have supposedly already filed

- You receive unsolicited information about unemployment claims in your name

- Your medical claims are denied, or you are billed for services you didn't receive

These are just some of the signs that you may be a victim of identity theft. When you see these or other signs, it is important to report identity theft immediately.

How to Report Identity Theft on Your Own

There are many steps to reporting identity theft on your own, and it is important to make sure you file reports with all institutions and agencies.

File an Equifax Identity Theft Report

There are several services to help with identity theft protection through Equifax.

- Get your free Equifax report and look it over carefully for unusual, suspicious and fraudulent activity.

- Place a fraud alert on your credit reports.

- Determine if you should place a credit freeze on your credit reports

- If you want to mail these forms in, go to Contact Us, scroll down to "by mail" to print the form(s) you need, and mail them to the address on the form.

- If you prefer to call, you can contact customer service at 1-888-Equifax (1-888-378-4329) from 9:00 am to 9:00 pm (ET), Monday through Friday, or 9:00 am to 6:00 pm (ET), Saturday and Sunday.

More Steps for Reporting Identity Theft

- Notify Experian and TransUnion, in addition to Equifax.

- File a report with the Federal Trade Commission

- Contact each institution or business where you have legitimate accounts to notify them of identity theft.

- Contact all institutions where your information has been used fraudulently to begin a fraud investigation.

- Depending on the type of fraud and what information or processes the perpetrator used, you may need to contact the Social Security Administration, the IRS, the USPS, the local passport office, and/or the DMV.

- File police reports with any police station or sheriff's office that has jurisdiction in your case.

- Consult an attorney if you are struggling with the process or want to send demand letters to for identity theft.

Let DoNotPay File Equifax Identity Theft Reports and More

DoNotPay can help you quickly file an . We can also file reports with TransUnion, Experian, the FTC, police reports, and more. We know this is a difficult time, and we are here to help you save time and stress.

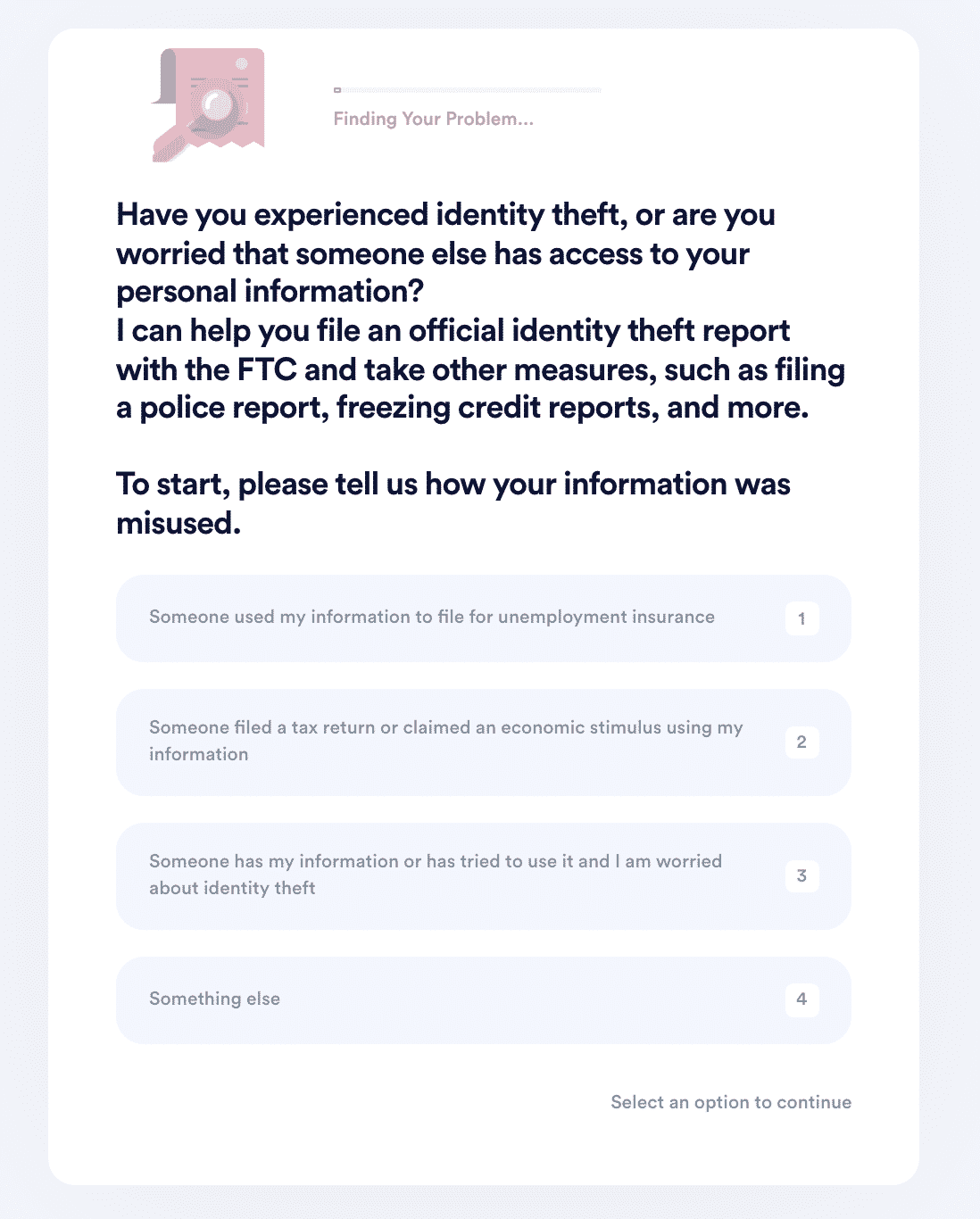

How to deal with identity theft using DoNotPay:

- Search "identity theft" on DoNotPay and select the type of incident you would like to report.

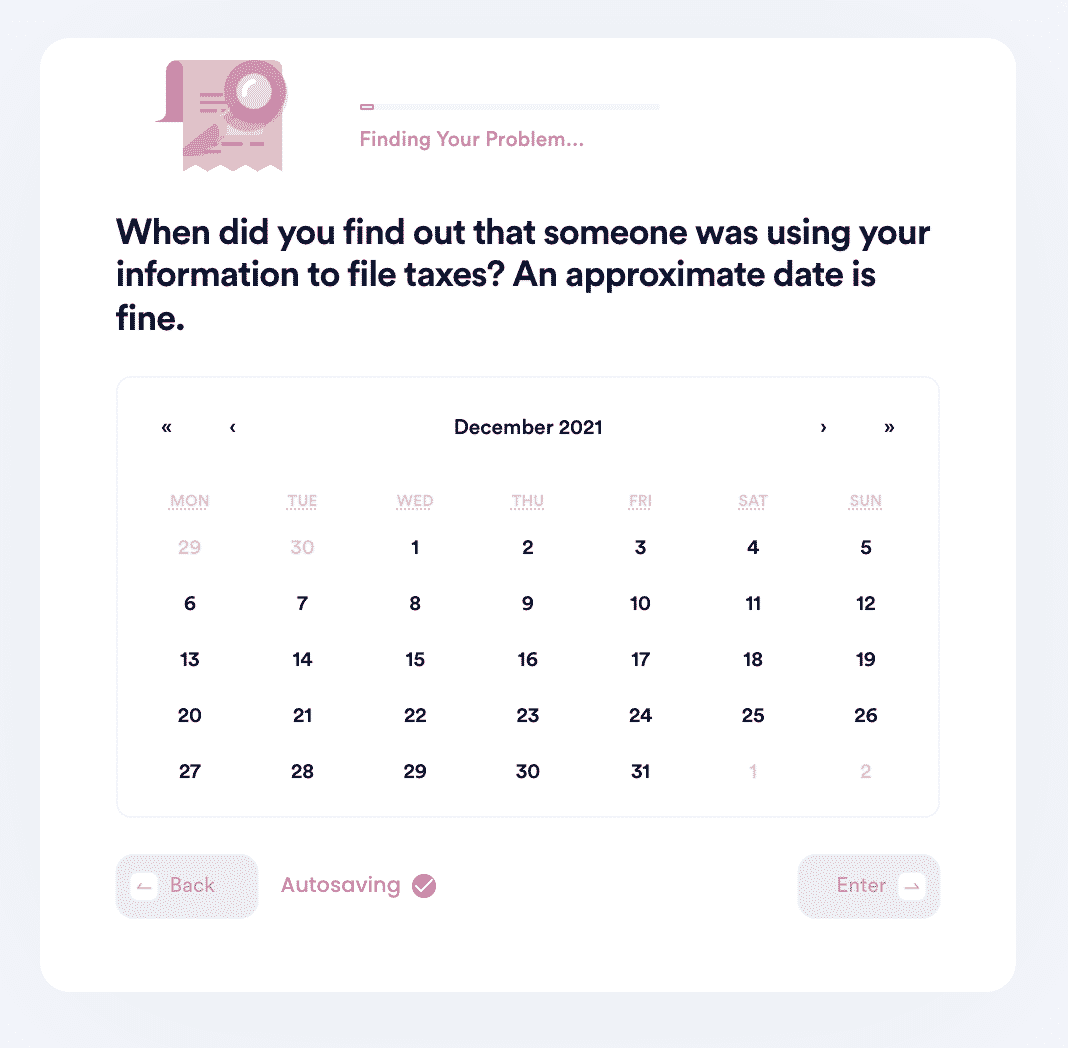

- Tell us more about the incident that occurred, including the location, date, time, financial loss, and any suspect information you may have.

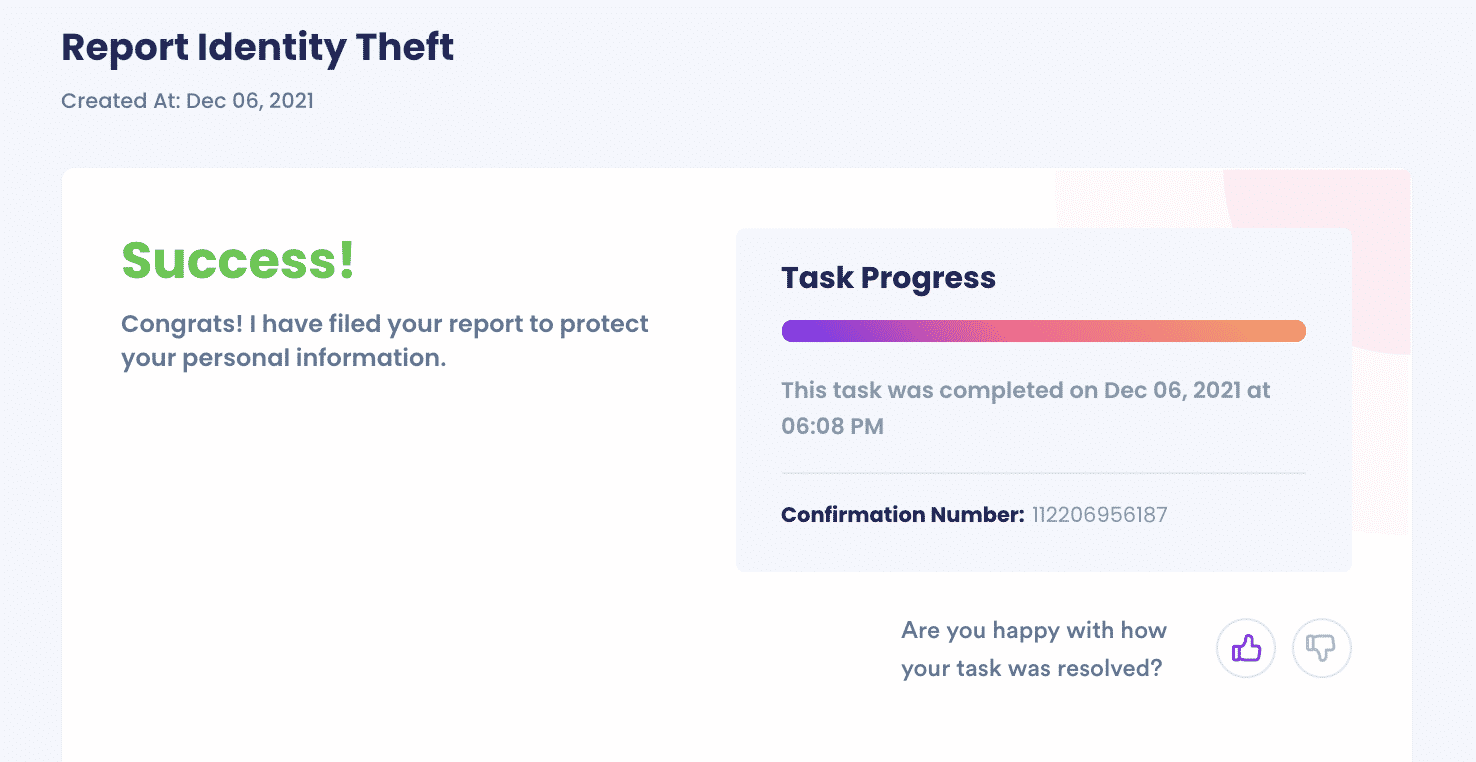

- We’ll identify whether you should file an FTC report, contact the IRS, freeze your credit report, contact state agencies, or file a police report. Once we guide you through the best options, we'll automatically submit the reports on your behalf!

And that's it. DoNotPay will make sure your issue gets sent to the right place. We'll upload confirmation documents to your task for you to view, and if the contacts need more information, they will reach out to you personally via email or mail.

What Else Can We Do?

Not only can DoNotPay help you quickly, easily, and successfully begin to recover from identity theft, we can help you in many other ways as well.

| Contact Government Representatives | Get Compensation for Victims of Crime |

| Handle Chargebacks and Refunds | File Insurance Claims |

No matter what your problem or concern is, DoNotPay is here for you.