Does Renter's Insurance Cover Power Outages?

The short answer is: Yes, can cover losses due to power outages. But like all things related to insurance, the real answer is more complicated.

If, for instance, the power outage is caused by a massive regional flood or earthquake, renter's insurance might not help.

Thankfully, you have DoNotPay in your corner. If you need to file a power outage complaint and seek refunds from an electric company, DoNotPay can help. Even if you don't have any insurance, you can get a refund for groceries or equipment damages caused by power outages.

This article will cover four main points of power outages and renters insurance:

- Renter's insurance contracts and covered perils

- What the insurance covers

- How to report a power outage and request refunds using the DoNotPay App

- How to contact your power company to request refunds

- And a few other tasks you can manage with DoNotPay

If you experienced a power outage that damaged your property or caused your equipment to fail, your renter's insurance might cover the damage, or it might not. Let's take a closer look.

Will my Renter's Insurance Policy Cover Damage Caused by a Power Outage?

First, you need to understand the notion of "covered perils." In insurance-speak, perils are issues that can cause damage to your property.

Covered Perils

On a , covered perils usually include:

- Fire

- Wind

- Lightning

- Smoke

- Theft

- Civil unrest/riot

- Aircraft crashes

- Explosions caused by any of the above

Notably, on most renter's insurance contracts, two perils that are NOT covered are regional floods and earthquakes. Therefore, if an earthquake or flood caused the power outage, your insurer might not cover the equipment damage or lost groceries.

But remember, even if the power outage was caused by a covered peril, like a fire, the smart move is to seek compensation from the power company first. That's because insurance companies keep a close eye on your claims and will raise your rates (or non-renew your policy) for too many claims.

What Does Renters Insurance Cover? | |

| Basic renter’s insurance policies cover a wide range and types of losses. This would include: | |

| Your personal property | Your renter’s insurance policy will reimburse you for the damage or destruction of your personal property up to your policy’s limits. Some limitations may apply when it comes to much more expensive items like jewelry or heirlooms. |

| Personal liability and medical bills | The insurance will usually cover your liability in addition to your personal property. This may help you when someone gets injured in your rental while you are away. This has its limits though but it may also cover any lawsuit costs. |

| Temporary living expenses | If something happens to your home that makes it uninhabitable, the insurance policy under the loss of use may cover your living expenses when temporarily living somewhere else. Only until your dwelling becomes livable again. |

| Other types of coverages | Other types of coverage may include additional riders for delivering your personal properties and additional coverage for things that aren’t automatically covered by renters insurance, like natural disasters. theft, and fraud. |

Insurers and Claims History

Insurance companies monitor your claims and report that information to each other. When you make several claims over a few years, your insurer can raise your rates. They can even refuse to renew your contract.

Then, consider your deductible. If your renter's insurance policy includes a deductible — money you need to kick in on a claim before insurance pays — it might not be worth starting a claim at all. There's no point in reporting $501 in lost groceries if your deductible is $500. You'll end up with $1 and a claims history.

For all these reasons, you should try to get compensated for this loss from the power company. And DoNotPay is the fastest and easiest way to do it.

How to Use DoNotPay to Get Compensated for Damages After a Power Outage

DoNotPay is the world's first AI Consumer Champion. If you need compensation from any power company after an outage — even big companies like SCE, PGE, DTE, and Oncor — DoNotPay can handle it for you. It's like having an attorney in your back pocket.

How to Get Compensation for an Outage Using DoNotPay:

If you want to get compensation for an outage but don't know where to start, DoNotPay has you covered in 9 easy steps:

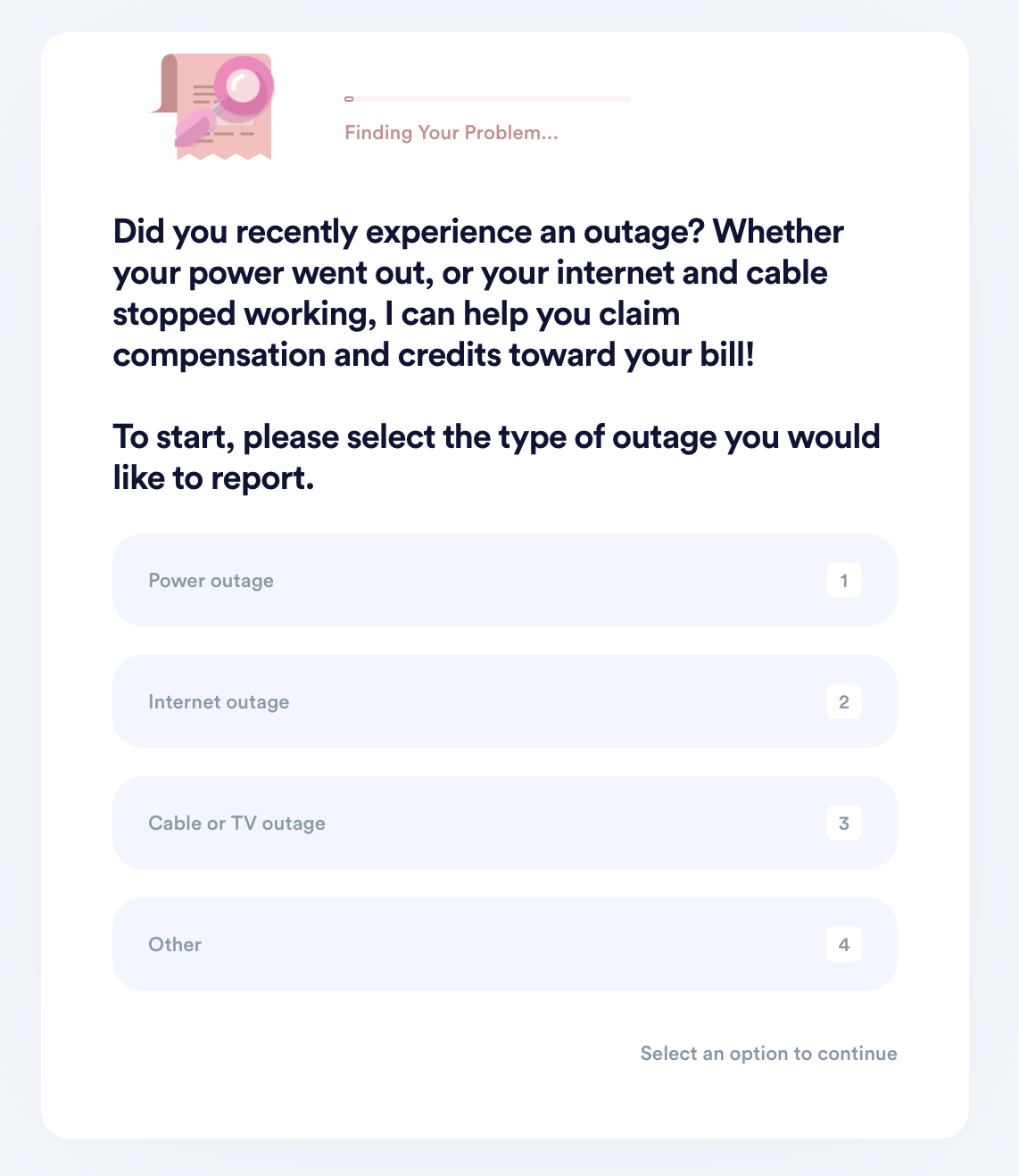

- Go to the Outage Refunds product on DoNotPay.

- Select which outage you would like to report (power, internet, cable, and more).

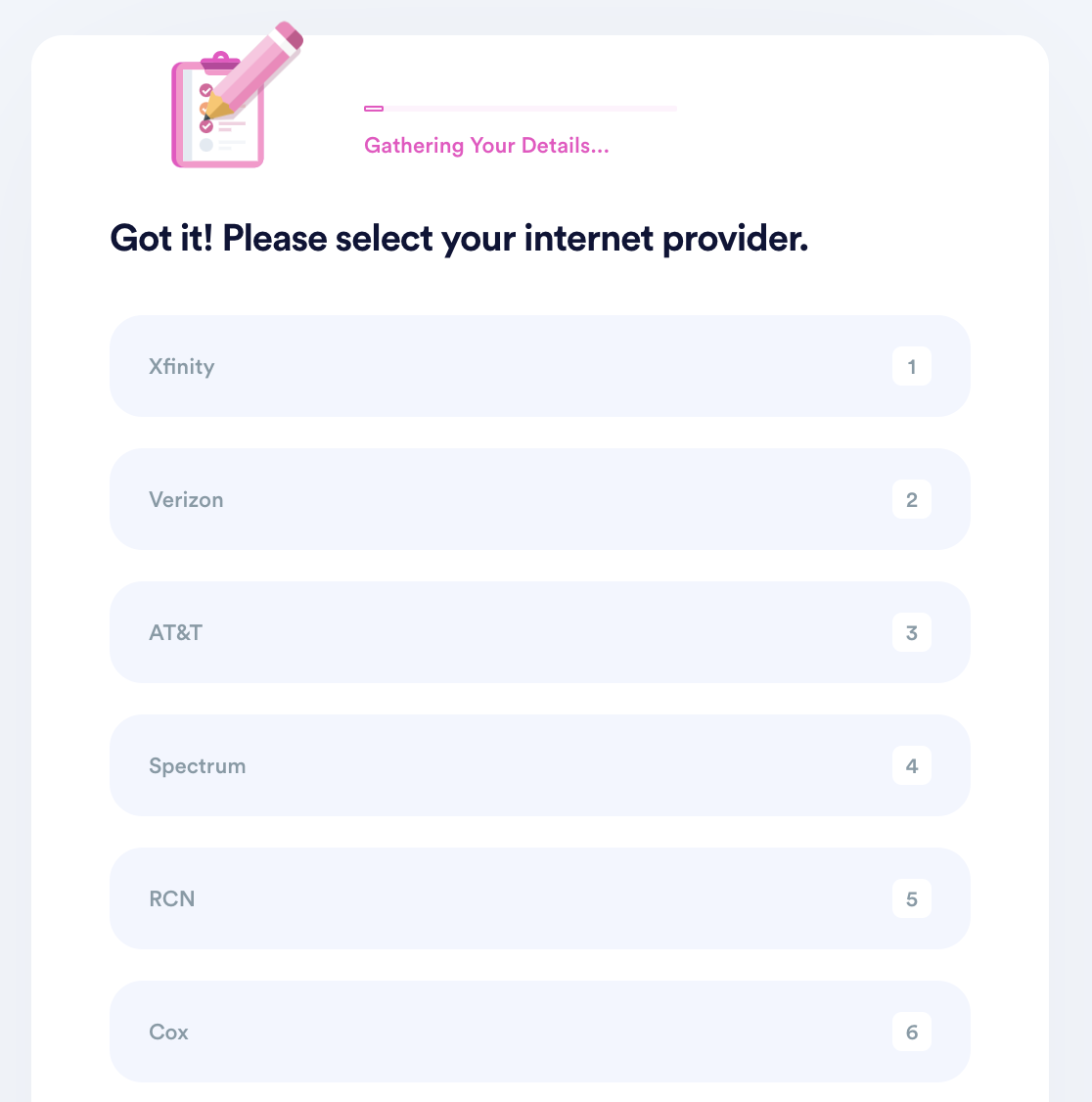

- Select your energy provider and enter your account number.

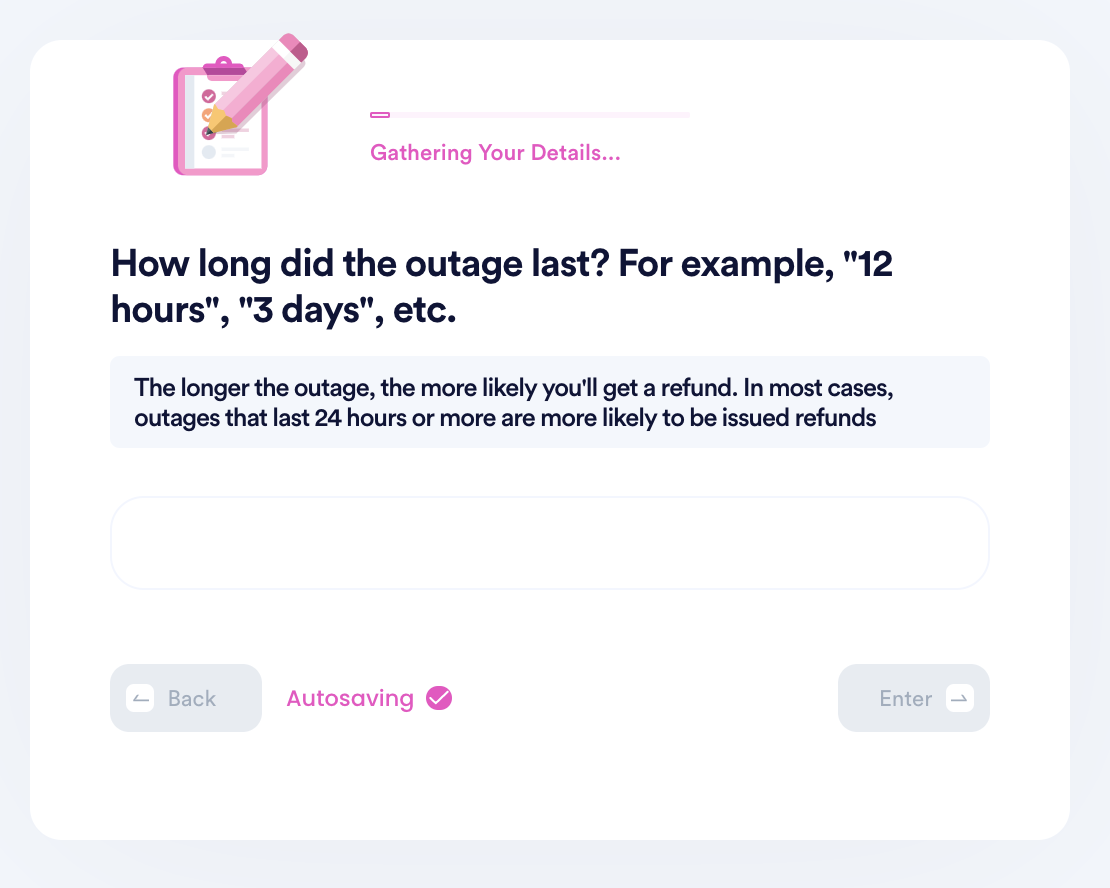

- Indicate when the outage started and how long it lasted.

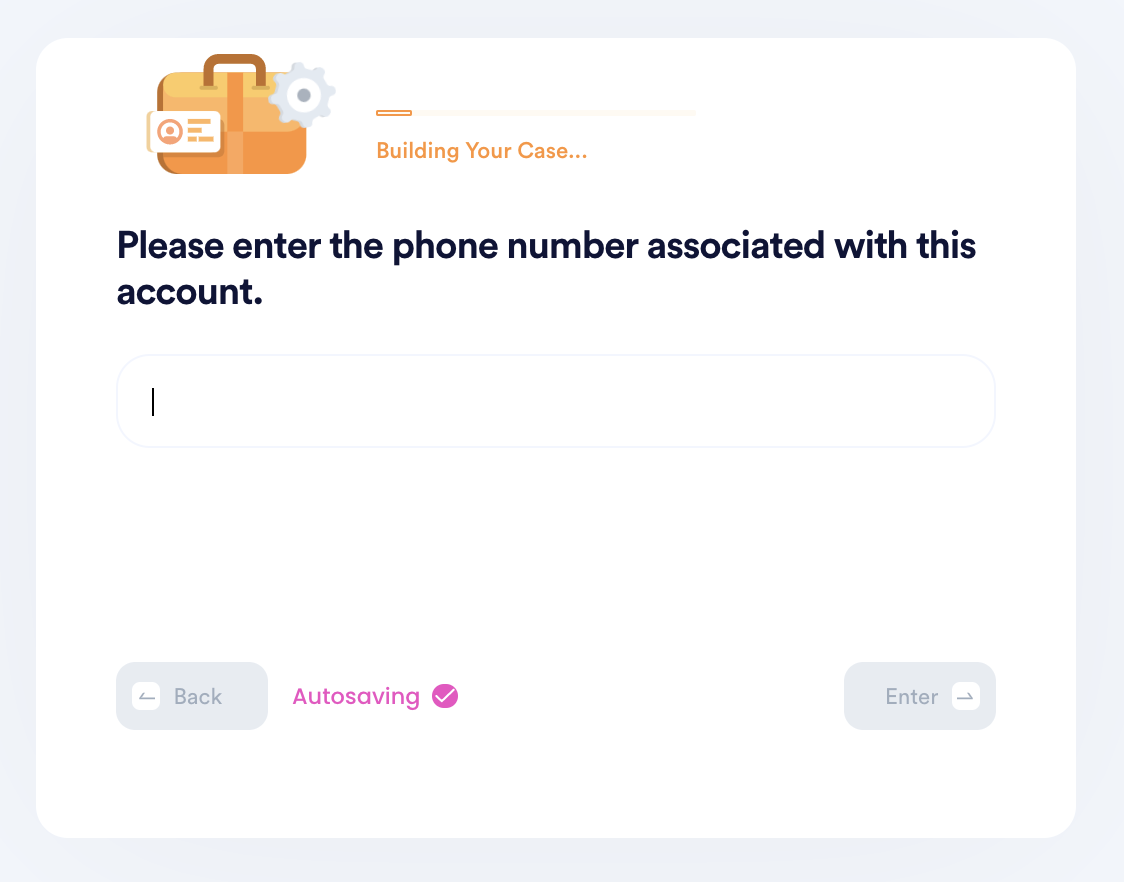

- Verify your account information.

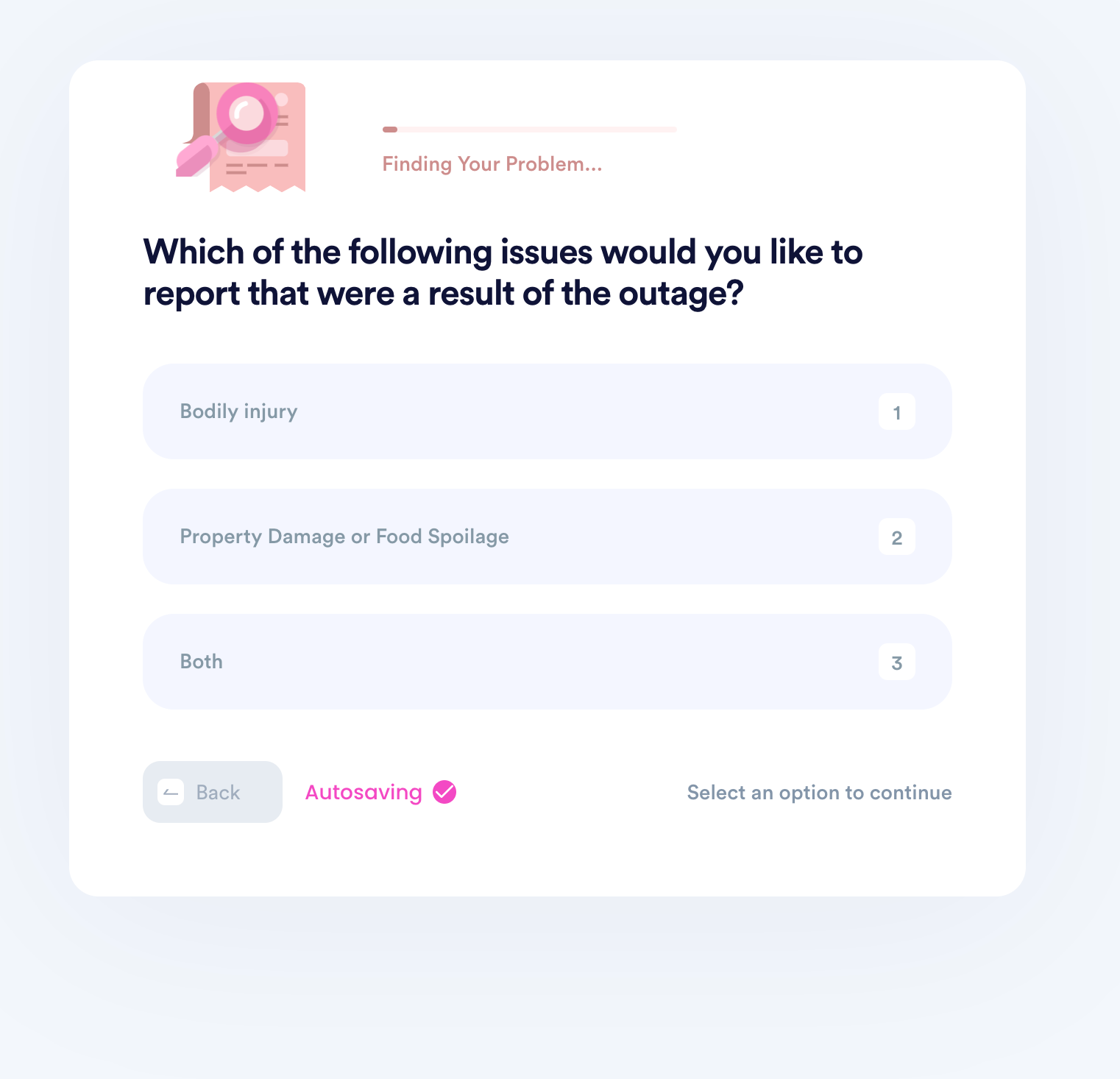

- If you want to be reimbursed for losses related to a power outage, choose whether you want to be reimbursed for personal injuries, damaged property, or both.

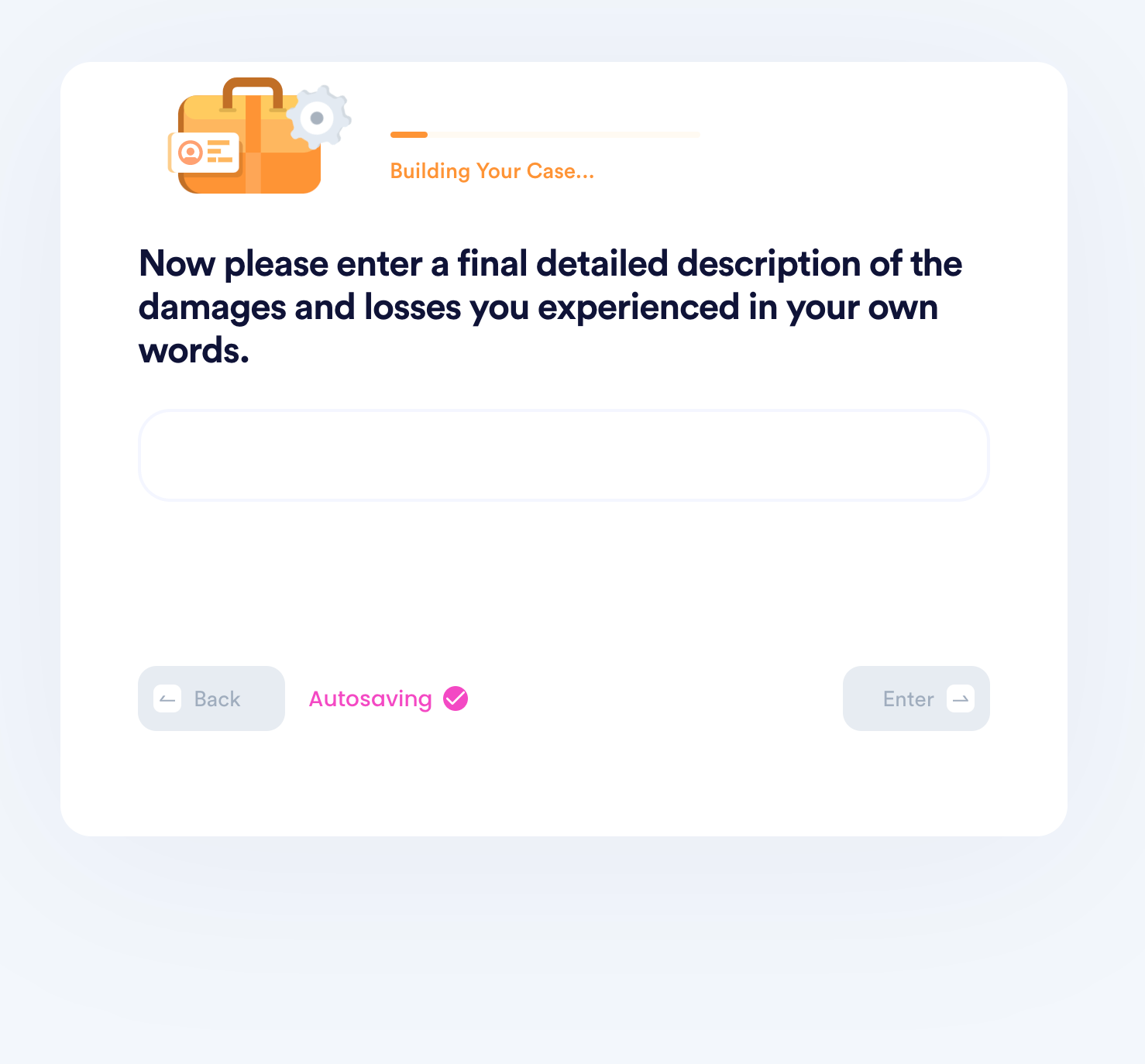

- Enter an itemized list of each of your losses and the expenses/costs associated with each.

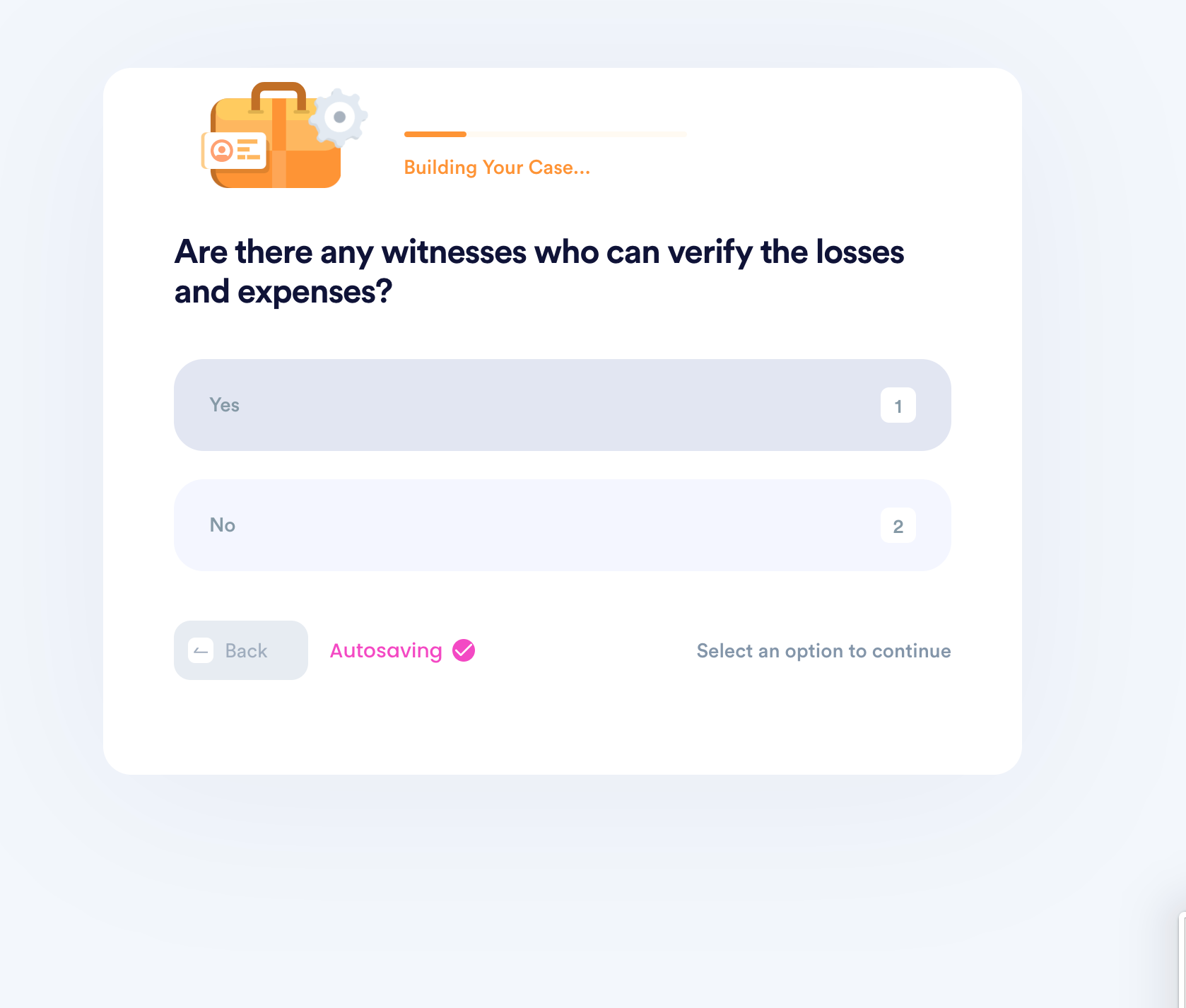

- Upload documents or photographic evidence that proves your losses. Also add the names of any witnesses who can attest to your losses if possible.

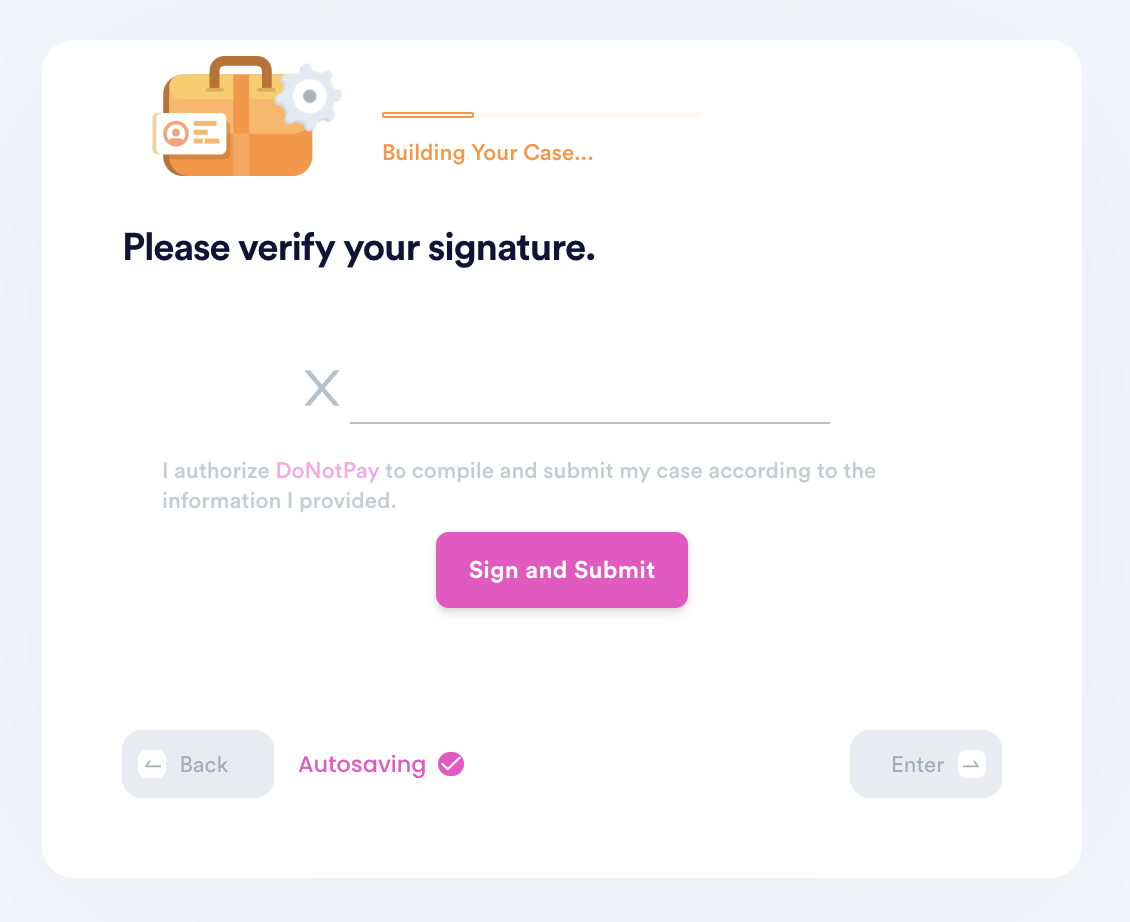

- Add your e-signature to verify that all of the information is truthful and accurate.

See how easy that is? And best of all, you can rest easy knowing all your paperwork is correct. Now let's think about how hard it is to get compensation from a power company without DoNotPay.

How to Get a Compensation for the Damage Caused by a Power Outage

It's not impossible to report your damage to the power company and ask for compensation. The trick is that many power companies have a reputation for fudging the records, losing outage reports, or claiming that an outage never happened. So be ready for a run-around.

When you report the outage and make your complaint, be sure to:

- Date the complaint and also include the date and times of the outage.

- Include your full name, account number, and service address.

- Describe your loss in specific numbers and send pictures.

- Keep a copy of anything you send to the company.

Why Use DoNotPay To Solve the Insurance Claim From Renter’s Power Outage

It's much easier with DoNotPay because we’re:

- Fast—You don't have to spend hours trying to solve the issue.

- Easy—You don't have to struggle to fill out tedious forms or keep track of all the steps involved in solving your problem.

- Successful—You can rest assured knowing we'll make the best case for you.

But That's Not All You Can Do With DoNotPay

Any time a company is giving you the run-around, DoNotPay should be your first resource. You can use it to report internet outages with companies like Spectrum. You can also use it to cancel timeshare agreements, manage your credit, and pay your monthly utility bills on time. Try it today. It's like having an attorney in the family!