Report and Prevent Credit Card Fraud With DoNotPay

Taking responsibility for your financial missteps is hard. However, taking responsibility for the frivolous spending of others is even more challenging. is currently one of the most prevalent forms of identity theft in the United States. With over 390,000 reports of fraudulent credit card activity made to the Federal Trade Commission (FTC) in 2020 alone, it's an issue that most will likely contend with at some point in time. If you've been saddled with debt that's not your own, DoNotPay can help. With DoNotPay, you can report identity theft to all appropriate agencies in just minutes. You can also take concerted steps to prevent this and all other types of identity theft from happening again.

What Is Identity Theft?

Of all the things that can be stolen, your identity is easily one of the most psychologically damaging. Identity theft can incite intense fears concerning your financial security and the safety of your loved ones. It can also make it difficult for you to trust others. Identity theft triggers many powerful emotions, from helplessness and hopelessness to outright rage.

Any time a person steals your personal information to commit fraud, it’s identity theft. With details such as your name, birth date, and social security number, identity thieves can:

- Open banking accounts

- Take out loans

- Apply for credit cards

- File taxes

- Get medical care

And more. Worse still, identity thieves have no intention of paying these accounts off. Given that the resulting debts will be in your name, you'll be held accountable for them, and your credit score will suffer. Being a victim of unresolved identity theft can make it virtually impossible to get new credit accounts of your own. Identity theft can even be a barrier to essential services and resources that victims need, such as:

- Utility services

- Housing

- Cellphone or Internet service

For anything that requires a credit check and a review of your credit score, unresolved identity theft will prove problematic.

There Are Many Different Types of Identity Theft

Credit card fraud is but one of many types of identity theft. As new financial products and communication mediums are introduced, fraudsters will invariably find more ways to take advantage of unsuspecting consumers. Currently, however, there are several prevalent types of identity theft that all consumers are advised to be on the lookout for:

- Tax Identity Theft

- Financial Identity Theft

- Medical Identity Theft

- Employment/Unemployment Identity Theft

- Criminal Identity Theft

- Online Identity Theft

Identity theft is sometimes categorized by the people it targets, such as child identity theft and senior identity theft. If someone applied for credit in your child's name, filed for taxes, and claimed them as a dependent for tax deductions or stimulus checks, this might be child identity theft. One of the most common forms of senior identity theft is social security identity theft.

There Are Also Many Types of Credit Card Fraud

According to the FTC, credit card fraud ranks among the fastest-growing types of personal identity theft. Credit card fraud occurs in multiple ways, including:

| CNP or Card-Not-Present Fraud | With CNP credit card fraud, personal and credit card information is stolen and then used to complete transactions online, by mail order, or by phone. |

| New Credit Card Application Fraud | Scammers use a person's social security number, birth date, name, and other identifying factors to open up new credit card accounts. |

| Credit Card Account Takeover | Once a person's identifying information is known, scammers can contact credit card companies directly, impersonate the cardholder, and change PINs and passwords to take the account over. |

| Card Skimming | Technology can be used to obtain information from the magnetic strips on credit cards. Skimming devices have been found attached to gas station pumps, ATMs, and other locations where cards are swiped. The collected information is then either used or sold. |

| Stolen or Lost Credit Cards | This involves using a card to complete transactions that have either been lost by the cardholder or stolen. It is the most basic type of credit fraud. |

How to File a Police Report for Credit Card Fraud

Most local law enforcement agencies do not have the time or resources to investigate individual fraud cases. Filing a police report won't ensure that scammers are caught and held accountable. However, it can help you start the process of repairing your credit report and your credit rating. To start, you'll need to know the accepted method for the jurisdiction in which you reside. There can also be different reporting procedures for the type of credit card fraud you've been a victim of. For instance, if your credit card was stolen from the mail, you'll need to contact the U.S.Postal Inspection Service to file your report.

With most local police departments, you can report identity theft in-person, over the phone, or using the appropriate link on their website if:

- The suspect has knowingly used, transferred, or obtained your personal or financial information

- Has done so with the intent to commit fraud or to aid and abet any crime

- Has established a new credit account

Telltale Signs That You’re a Victim of Credit Card Fraud

Most people don't identify credit card fraud right away. Certain types of credit card fraud are more difficult to spot than others. For instance, if someone has opened a new account in your name, you may not know about it until:

- Your credit applications are denied

- You notice suspicious activity when reviewing your credit report

- You start receiving collection letters or collection calls from credit card companies you've never used before

With account takeover, you'll know that trouble is afoot as soon as you attempt to access your online account information, use your card, or call your credit card company.

Credit Card Fraud vs. Identity Theft

When your credit card or credit card information is stolen and used to complete unauthorized transactions, this is credit card fraud. Identity theft is when scammers use your personally-identifying information to open accounts or engage in other fraudulent activities.

How to Prevent Credit Card Fraud

There are several things that you can do regularly to keep yourself protected from credit card fraud and most other types of identity theft:

- Regularly check your mail.

- Shred all documents and envelopes with personal data before putting them in the trash.

- Diversify your account passwords and usernames.

- Review your credit reports for errors and suspicious activity once each year.

- Use reliable antivirus software on all computers and personal devices.

- Clear electronics of all data before selling or donating them.

Suppose you believe that you've already been a victim of credit card fraud. In that case, you should additionally take action to freeze your credit by notifying TransUnion, Experian, or Equifax (the three credit reporting agencies). Due to information sharing across all three agencies, you only need to report one.

How to Report Credit Card Fraud to the FTC

You can report credit card fraud to the FTC by visiting their official website. You can use this platform to inform all scams, fraudulent activity, and bad business practices. After completing the online form, you'll receive a confirmation number and a printable confirmation page.

Next Steps if You’re Having a Hard Time Reporting Credit Card Fraud on Your Own

If you've attempted to file a police report with no success or if you're having a hard time dealing with the FTC, don't stress. Many consumers make the mistake of growing frustrated and giving up. Unfortunately, problems with identity theft don't simply go away on their own. Rather than leaving them unchecked, let DoNot Pay manage this process instead.

With DoNotPay, you can:

- Quickly file a police report in your jurisdiction

- Set up fraud alerts with the three main credit reporting bureaus

- File an FTC official report

- Freeze your credit reports

- And more

DoNotPay even has services to help you send demand letters to for identity theft.

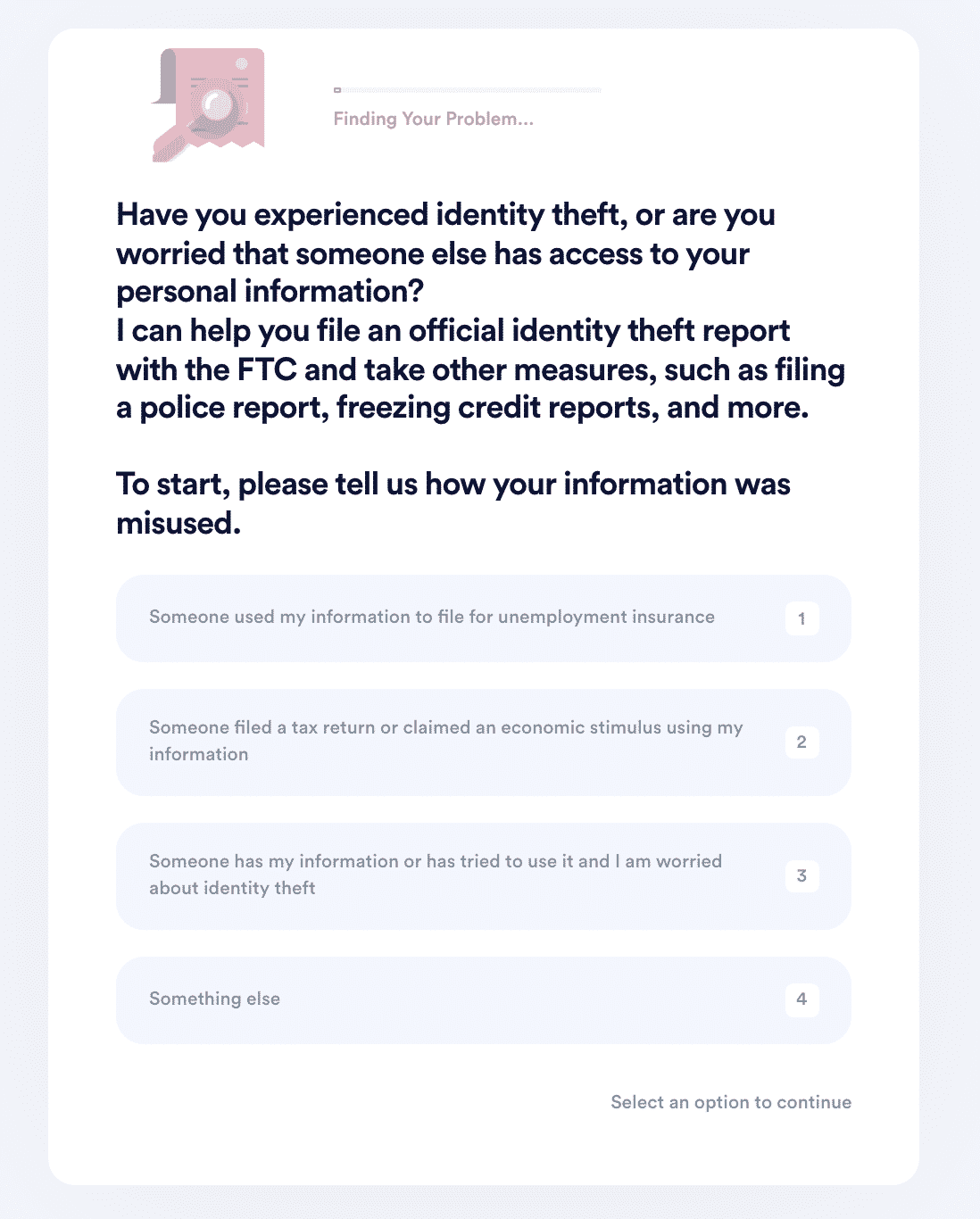

How to Deal With Identity Theft Using DoNotPay:

- Search "identity theft" on DoNotPay and select the type of incident you would like to report.

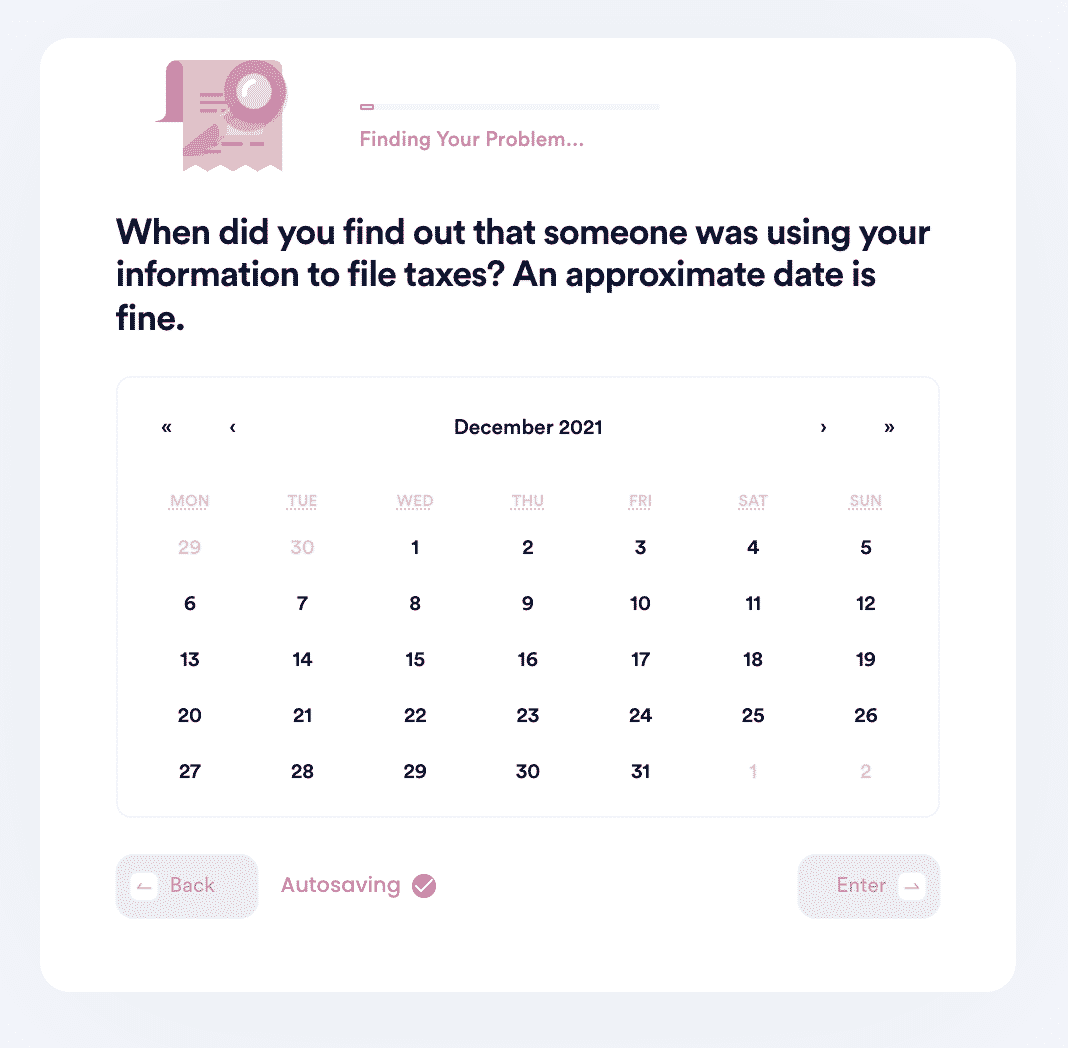

- Tell us more about the incident that occurred, including the location, date, time, financial loss, and any suspect information you may have.

- We’ll identify whether you should file an FTC report, contact the IRS, freeze your credit report, contact state agencies, or file a police report. Once we guide you through the best options, we'll automatically submit the reports on your behalf!

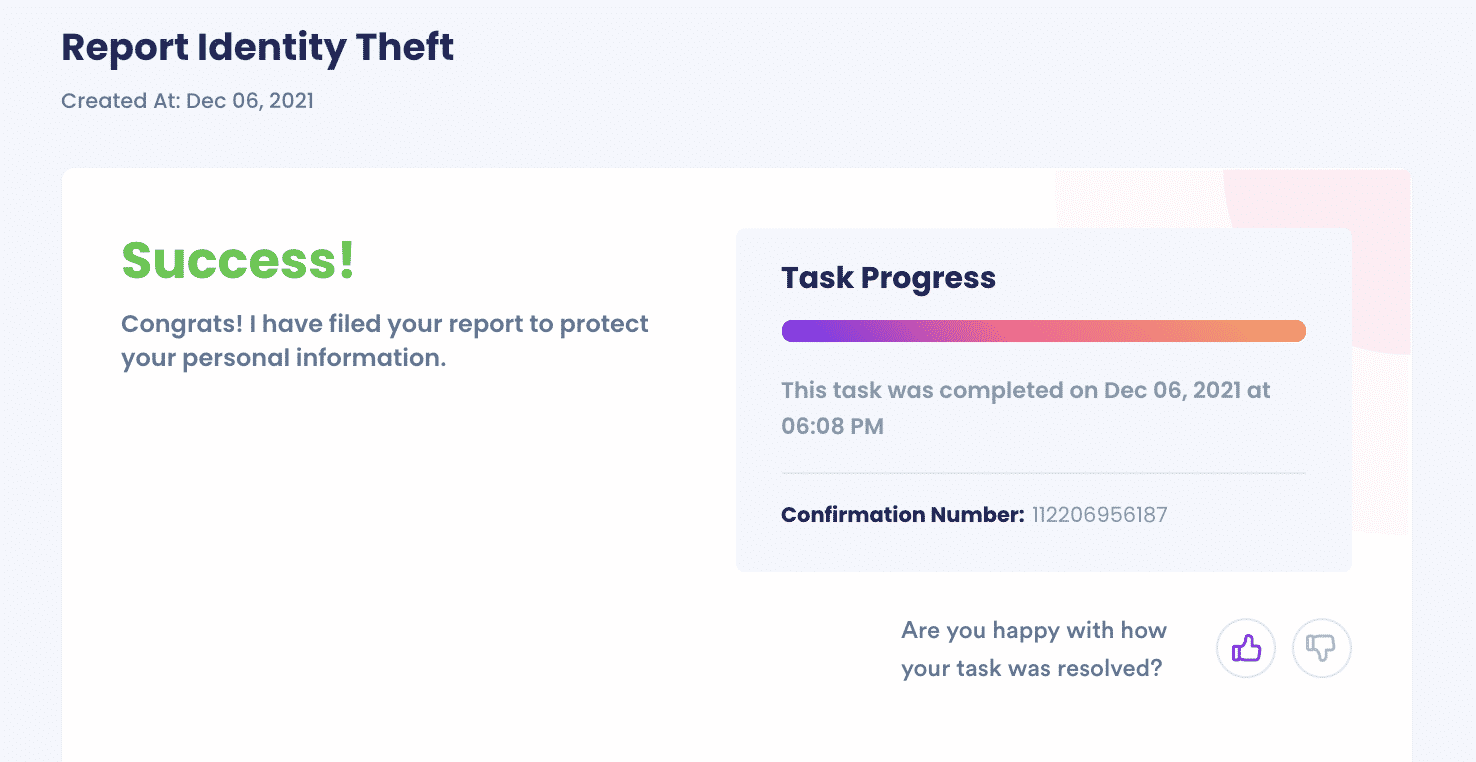

And that's it! DoNotPay will make sure your issue gets sent to the right place. We'll upload confirmation documents to your task for you to view, and if the contacts need more information, they will reach out to you personally via email or mail.

Why Use DoNotPay to Report Credit Fraud

Reporting credit card fraud on your own can be stressful and confusing. There are many different agencies to contact, numerous forms to complete, and multiple reports to file. With DoNotPay, you can be sure that no critical steps are overlooked. DoNotPay will help you inform all of the proper authorities, take all the right steps to protect yourself, and initiate the best possible corrective actions.

DoNotPay Works Across All Agencies and Groups

One of the most frustrating parts of being a victim of credit card fraud is having to contact a seemingly endless list of agencies and companies one by one. You might leave yourself wide open to additional identity theft problems if you overlook one. DoNotPay works across all agencies and groups so that you don't have to key in your personal information multiple times manually. DoNotPay can alert various credit card companies and numerous government agencies on your behalf. This way, you'll get the level of protection you want and need.

What Else Can DoNotPay Help You With?

Credit card fraud is one of the countless problems that DoNotPay can help you resolve. You can also use DoNotPay to:

- File an insurance claim

- Get help with chargebacks and refunds

- Connect with government representatives

- Process stolen stimulus check

And more. Suppose you're ready to tackle your problems with head-on, sign-up for DoNotPay now to get started.