File a Report About Cell Phone Identity Theft

Most of us do not ever really consider how much information we have attached to our However, cell phones have become identity thieves' newest target because of how much we save on them. The good news is, you can fight back against cell phone identity theft if you have the right tools in your pocket.

If you do not know where to start fighting back, there is help available. You can let DoNotPay guide you through all the necessary steps if you have been victimized.

What is Telephone Identity Theft?

According to the FCC, is defined as any unauthorized use of your cell phone through manipulation or tampering with a phone or service. This may include:

- SIM Swapping

- Cloning Information

- Subscriber Fraud

- Changing Your Plan Without Consent

- High Jacking Your Phone Number (Porting Your Number)

Basically, any use of your personal information can be taken by simply getting possession of your cell phone.

It may seem like something that should be easy to prevent, but this isn't always the case. Our devices are always with us. Cell phones are mobile PCs that can keep up with our family information, financial records, passwords, and everything else. What happens if you lose it, and someone gains access to all that is inside it?

How to File a Police Report for Mobile Phone Identity Theft

If you have lost your device or feel that someone may have swiped your SIM card to get your personal information, time is very important. There are several things you can do if you feel there is something to worry about. Some of the first things you should do will include:

- Contact the FTC to Tell Them of Scams or ID Spoofing

- Report Robocalls or Telemarketers to the Do Not Call Registry

- Freeze Your Credit Information Regarding Cell Phone Account Information (National Consumer Telecommunications and Utilities Exchange or NCTUE)

- Watch Your Bank Account

- Study Your Phone Bills

If you notice anything that does not appear to be right, you will need to contact your local police department, especially if the criminal begins to take your money, apply for credit cards, changes your address, and more.

Signs You May Be a Victim of Cell Phone Identity Theft

For some, the signs of cell phone ID theft may be the same as other types of identity theft. When others deal with it, it may look entirely different. It depends on what happens to you in your situation.

What does this mean for you? It means you need to always be aware of what is going on with your accounts, no matter how big or how small they are.

If your phone has been compromised, you may notice:

| Dropped Cell Service That Does Not Come Back | This could mean that your service has been discontinued by your service provider, especially if you have multiple phones and all become disconnected at one time. The scary part is that if they can access your cell phone company information, they may also be able to get your social security number. If this happens, you should contact your service provider to find out what is going on. There have been some cases where it happened because someone changed their account to upgrade phones. |

| Charges on Credit Cards or Bank Account | Charges on your credit card or bank account that you don't recognize are often one of the first clues that something isn't right. You should try to track down the origin of the charges to see if it triggers something you had forgotten. If nothing comes to mind, you should then contact your bank or credit card company to see if they have more information and if they are willing to dispute it for you. |

| Calls from Debt Collectors or Regarding Accounts You Did Not Create | Bills and accounts that are created without your knowledge, yet in your name, means that someone else has information that only you should have. Whether they got it from your phone or through other means, you have to treat it as though all your information is out there. |

This means contacting financial institutions, credit bureaus, and the police to try and salvage your good name. You may even want to contact the IRS if you have the app installed, and it saves your information on your device.

How to Prevent Identity Theft Phone Concerns

If you would rather know how to prevent phone identity theft, you should know that there are a couple of ways to increase your security. For instance: creating a pin or password that blocks all access to your phone's home screen.

This is a great first step in protecting your phone's contents. It will ensure that they may take your SIM Card, but they cannot get access to your saved bank account, email, and other information.

Another option is to keep in mind that your cell phone goes with you everywhere and can be lost. You can require two-step authentications to access sensitive information, things that only you know, and change your passwords often. Most important is that as soon as you realize your device is lost, immediately use another device to change passwords for banks, cards, email, and more.

Avoid clicking on spam emails or answering unsolicited calls where you may give out personal information. A lot of people have their accounts hacked because they feel there is a layer of protection when using just a phone. This is not true!

How to Send Demand Letters To for Identity Theft of Cell Phone Account on Your Own

Suing for identity theft is tricky. The first step is to prove that your identity was stolen and that things were done without your knowledge, but with your information. The second part of it comes down to trying to figure out who may have victimized you.

From there, you will want to start filing reports. These reports can be made to the FTC and your local police department. You should also contact credit bureaus to ensure that they know there has been a compromise. They will be able to freeze your credit accounts until you have a better understanding of what is going on.

This process can take time. It can be difficult to get everything settled well enough that you can take it to a small claims court and get restitution for any money that you may have lost.

If you don't want to deal with the process alone, there is help available. DoNotPay understands what it means to lose your identity and what it takes to get it back!

How to Deal With Identity Theft Using DoNotPay

When you turn to DoNotPay for help, you do not have to deal with anything except telling us about your situation. You can stop worrying about how to report identity theft. We make it fast, easy, and secure because we know that you have already been through enough.

All you have to do to report is:

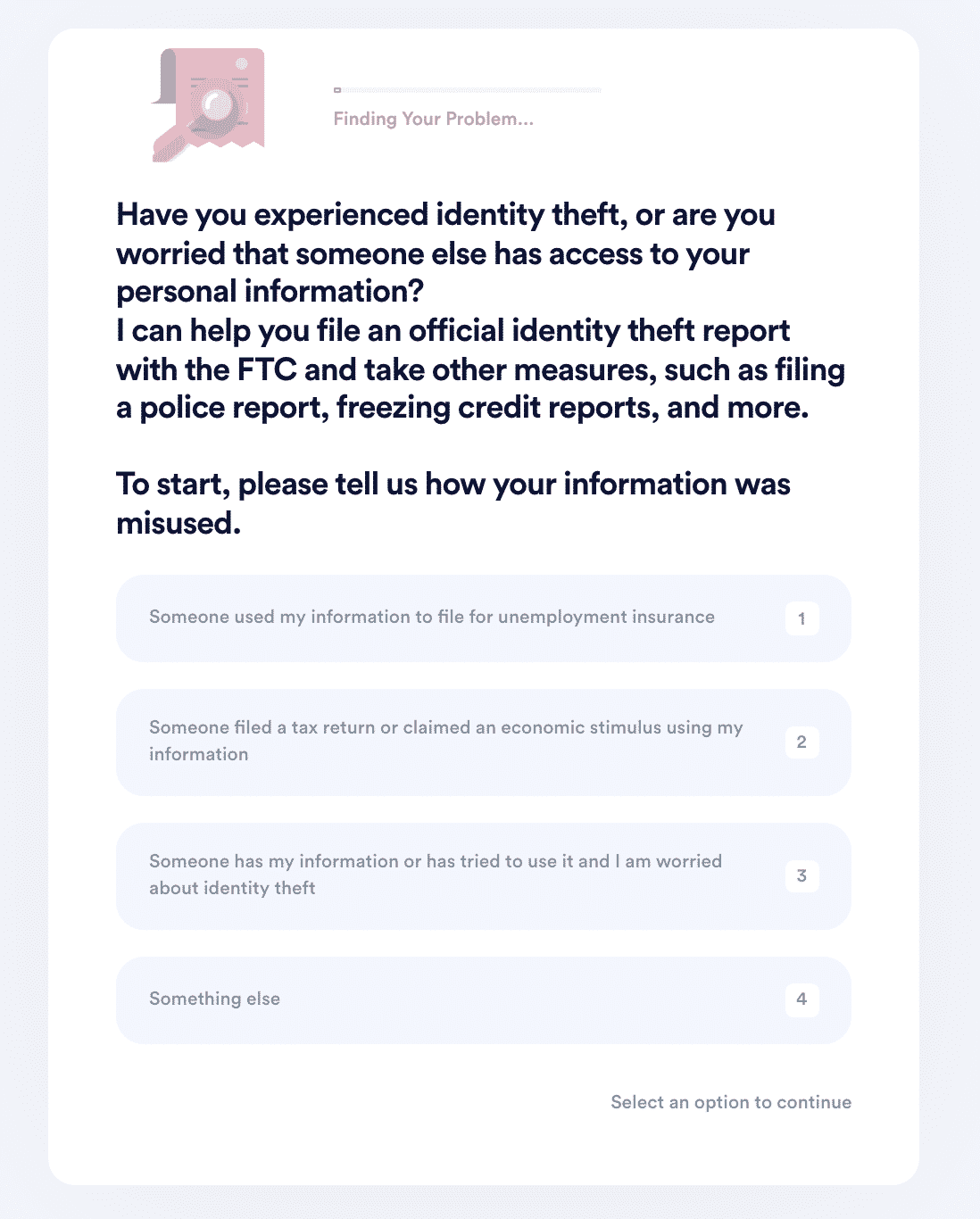

- Search "identity theft" on DoNotPay and select the type of incident you would like to report.

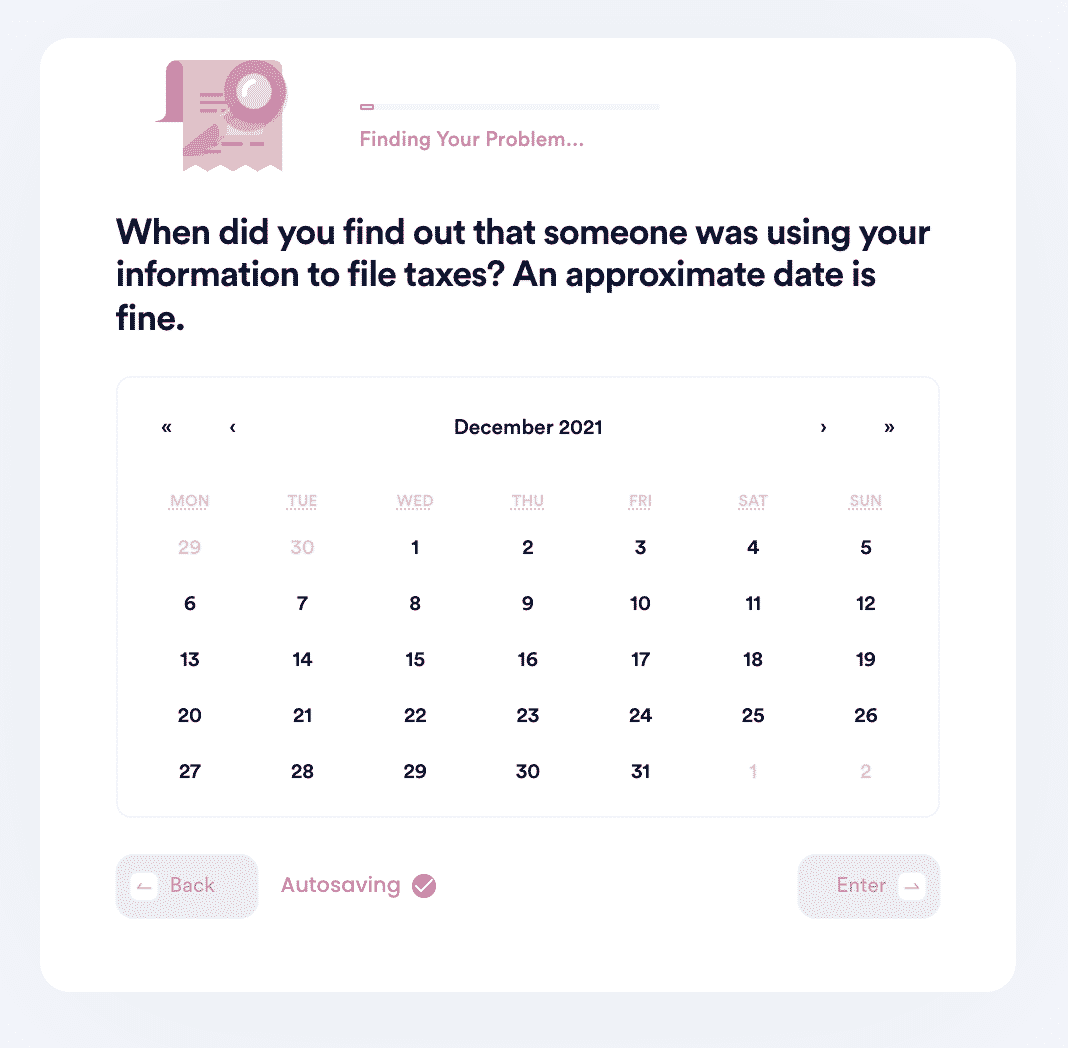

- Tell us more about the incident that occurred, including the location, date, time, financial loss, and any suspect information you may have.

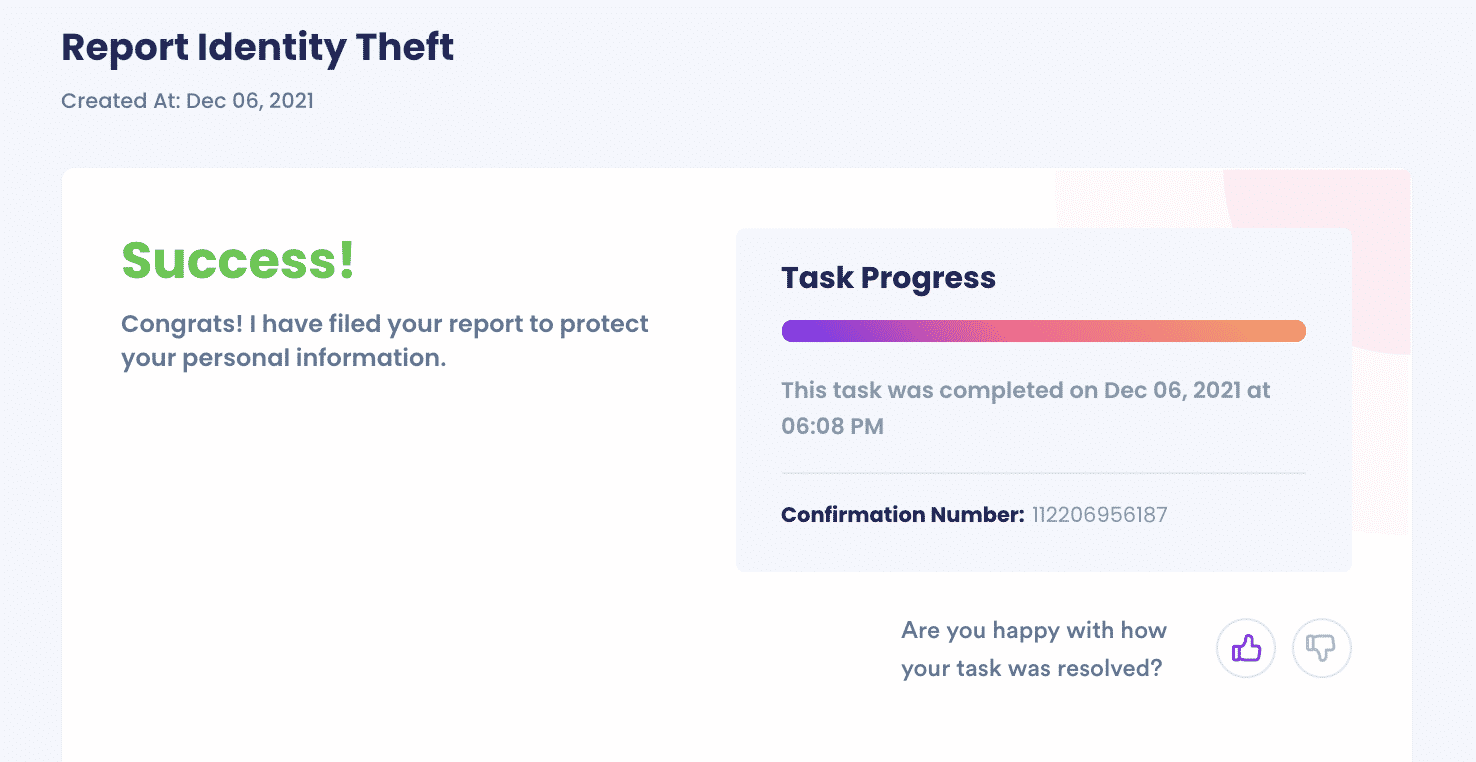

- We'l identify whether you should file a FTC report, contact the IRS, freeze your credit report, contact state agencies, or file a police report. Once we guide you through the best options, we'll automatically submit the reports on your behalf!

And that's it. DoNotPay will make sure your issue gets sent to the right place. We'll upload confirmation documents to your task for you to view, and if the contacts need more information, they will reach out to you personally via email or mail.

What Else Can DoNotPay Help You With?

DoNotPay is the world's first online robotic lawyer group. With this title, we can easily achieve things that cause stress for other people. is just one of the many services that we can provide. Other services include:

- Appealing Banned Accounts

- Providing Burner Phones/Numbers

- Cancel Subscriptions

- File Small Claims

- Victim Compensation

- Fighting Text Spam

- Stop Email Spam

- Block Robo Calls

- Someone filed for unemployment in my name

- Credit card fraud

- Social security identity theft

If you have a problem that you are unsure how to solve without a little help or advice, DoNotPay can provide the information and resources you need. All you have to do is visit us online or through our app. We will take care of providing you with the rest.