Are You a Victim of Ancestry.com Identity Theft? Let DoNotPay Help You With This!

While it's very unfortunate that an identity thief targeted you, it's worse that you now have to live with the consequences of your identity being stolen and clean up the mess yourself. The most damaging thing about identity theft is that its effects can last for months, sometimes even years. If you are a victim of identity theft on Ancestry.com, it is important to understand your rights and to file the proper reports so that you can begin to reclaim your life.

Because dealing with identity theft can be challenging on your own, DoNotPay is here to help. Using our new Identity Theft product, we will help you learn how to report identity theft cases such as IRS identity theft, credit card fraud, Equifax identity theft, and Experian identity theft, just to mention a few.

What Is Identity Theft?

happens when a person uses someone else's personal information to carry out fraudulent activities for their selfish gains. Such information could include but is not limited to your name, credit card information, social security number, and physical address.

An identity thief may use your information to:

- Take loans

- Increase your credit limit

- Open new bank accounts

- Purchase items using your name

- Access medical services

- File fraudulent tax returns

Whatever your case may be, is here to help you understand how you can recover from your identity being stolen and help you send demand letters to the identity thief where possible.

Signs That You May be a Victim of Identity Theft

The following are sure signs that you may be a victim of identity theft. If you notice any of these signs, you should act immediately.

- You notice unauthorized transactions on your financial statements and credit card reports.

- You get unfamiliar bills in your mail.

- You stop receiving your regular bills. This could mean that an identity thief has changed your mailing address.

- You get calls from debt collectors asking you to pay unfamiliar debts

- You are unable to file your taxes because your taxes were already filed

What to Do if You Are a Victim of Identity Theft on Ancestry.com

If at any one time you notice that you have given your personal information to a fraudulent site purporting to be Ancestry.com, or you notice that your credit card has been illegally accessed after a transaction with the service provider, do this immediately:

- Attach evidence of the fraudulent transaction information alongside a detailed description of the identity theft incident

- Send the complaint to fraud@anestry.com

- You can also call Ancestry directly on 1-800-262-3787 to report your issue.

How You Can Prevent Being a Victim of Identity Theft on Ancestry.com

It is first important to understand that Ancestry.com is very committed to delivering the best services to its customers. To achieve this, sometimes, you will receive an email or call from an Ancestry representative. These agents will contact you for the following reasons:

- Remind you of a pending renewal

- Check to see how you are doing with your family search.

- Notify you of new services that may help you in your history search

- Authentication of recent transactions

The representative will never ask you for the following information:

- Confidential billing information without providing unique account information of the transaction in question

- Your Social Security Number

Let DoNotPay Help You Recover from Ancestry.com Identity Theft

In addition to taking a toll on your finances, identity theft can have dire psychological impacts on you and your family. Instead of walking this journey alone, let DoNotPay help you with each step. Through the new Identity Theft product, we'll walk you through each report you should file and the steps you should take to make sure your information stays protected.

DoNotPay Can Help You in the Following Ways:

- File an official report with the FTC

- Alert state agencies about unemployment insurance fraud

- Alert the U.S. Department of Justice's National Center for Disaster Fraud (NCDF) about unemployment insurance fraud

- Contact the IRS about tax fraud

- File a police report

- Contact the credit bureaus to set up fraud alerts and freeze credit reports.

How to Deal With an Ancestry.com Identity Theft Case with DoNotPay

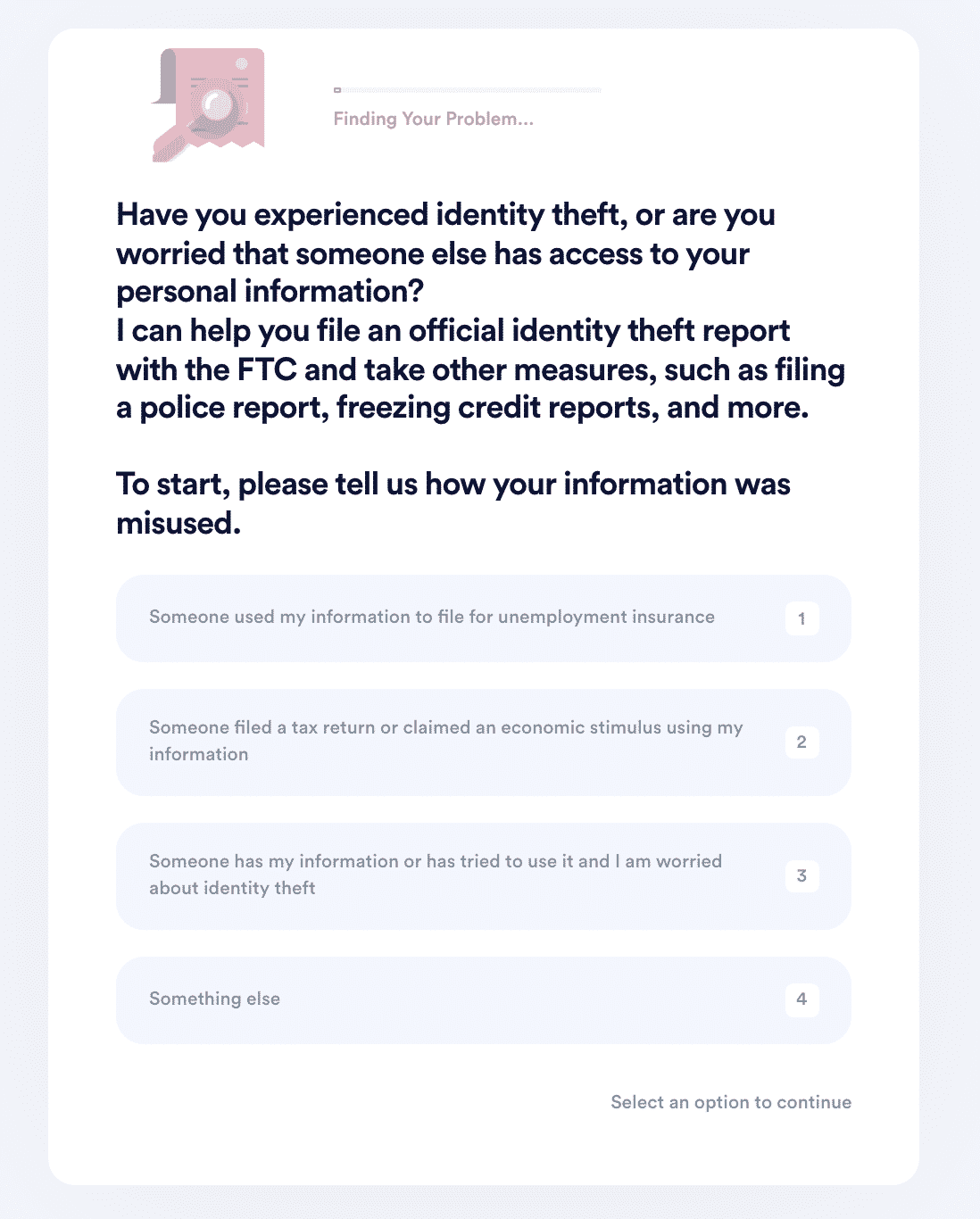

If you want to report a case of identity theft with DoNotPay but do not know where to start, DoNotPay has got you covered in three easy steps:

- Search "identity theft" on DoNotPay and select the type of incident you would like to report.

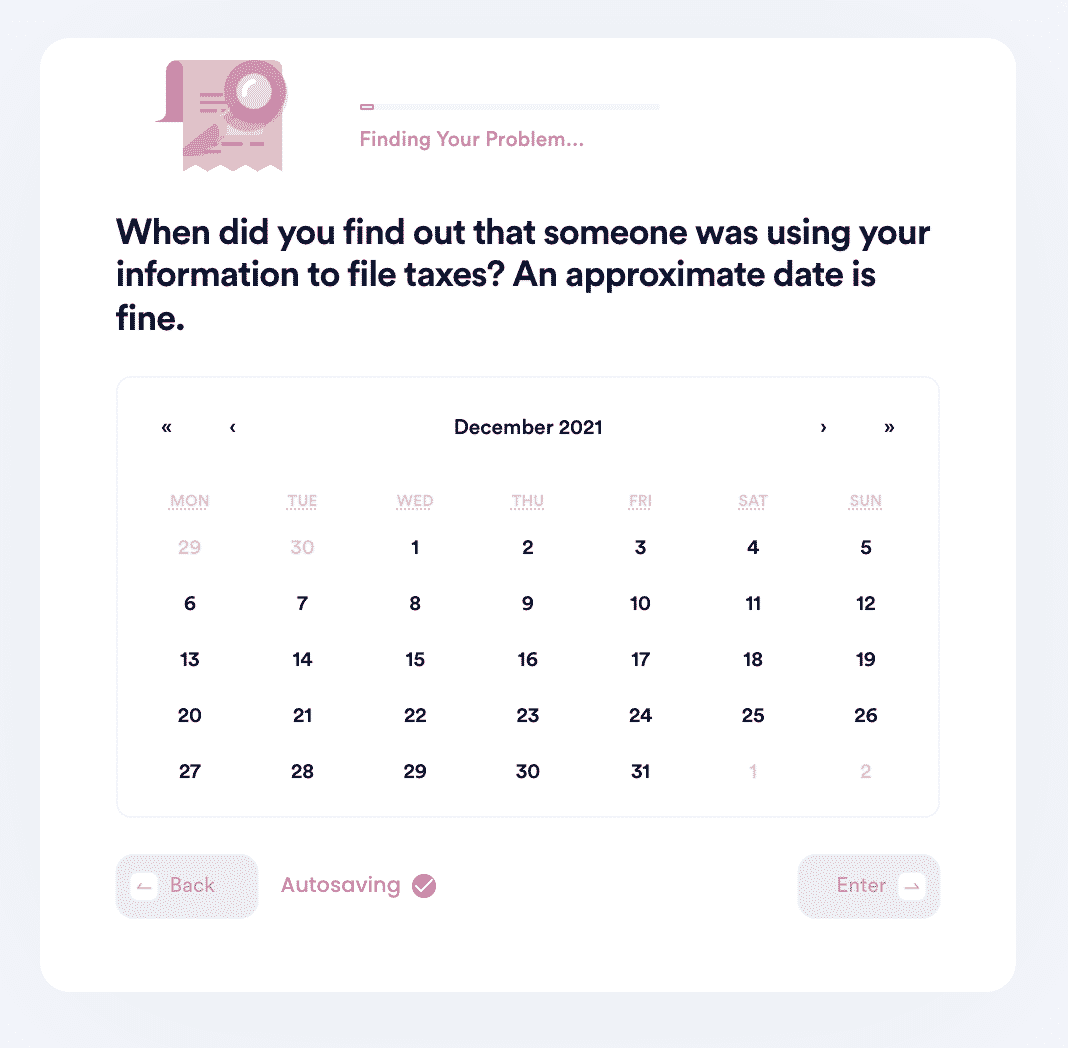

- Tell us more about the incident that occurred, including the location, date, time, financial loss, and any suspect information you may have.

- We'll identify whether you should file an FTC report, contact the IRS, freeze your credit report, contact state agencies, or file a police report. Once we guide you through the best options, we'll automatically submit the reports on your behalf.

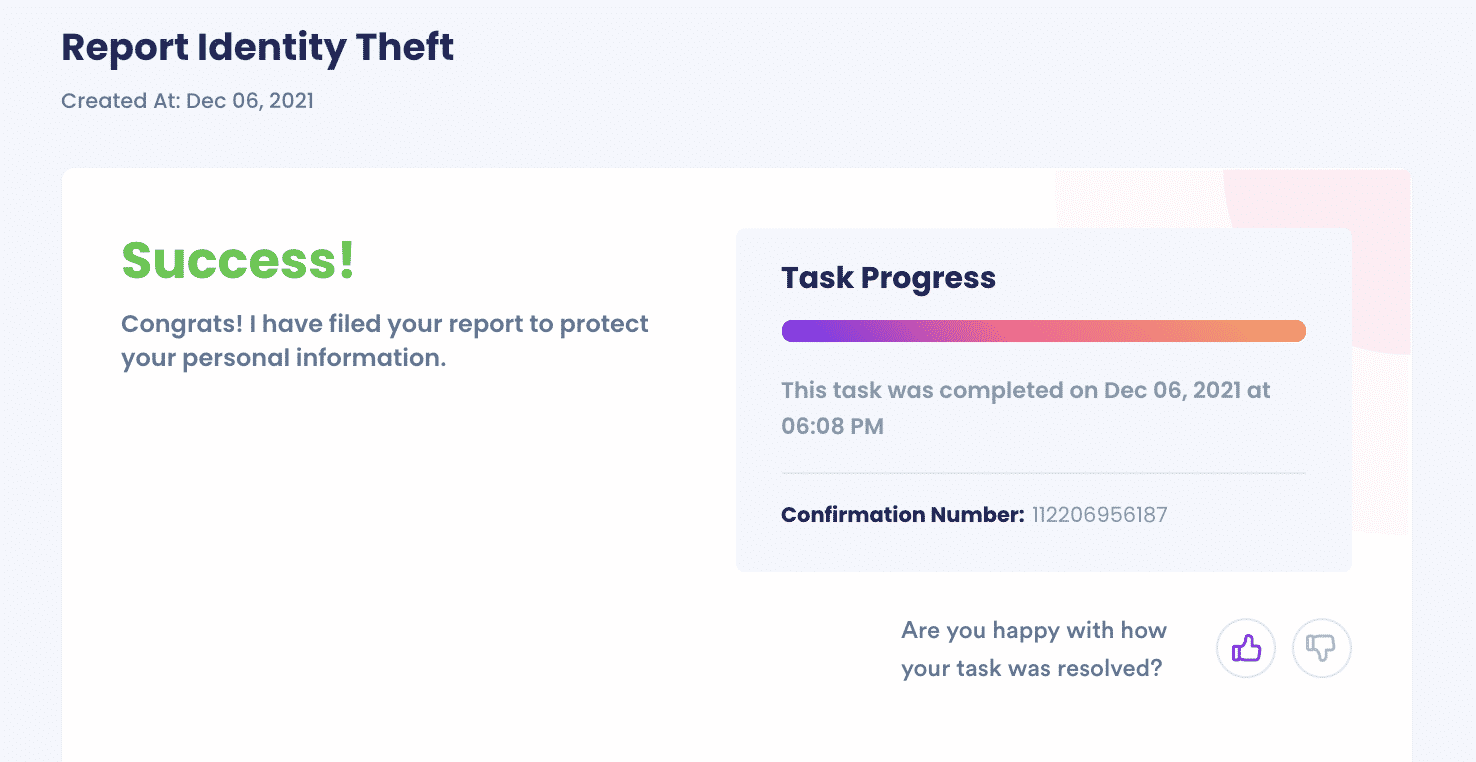

And that's it. DoNotPay will make sure your issue gets sent to the right place. We'll upload confirmation documents to your task for you to view, and if the contacts need more information, they will reach out to you personally via email or mail.

Why Use DoNotPay to Deal With Ancestry.com Identity Theft?

- DoNotPay is fast

- DoNotPay is simple

- DoNotPay is successful

What Other Services Can DoNotPay Offer?

DoNotPay can provide you with many other services, such as:

| Learning more about identity theft | Educating you on how to report identity theft | Knowing what to do if someone filed for unemployment under your name |

| Learning about credit card fraud | Educating you on social Security identity theft | Learning what to do if someone has stolen your stimulus check |

| Learning about Equifax identity theft | Learning about Experian identity theft | Learning about how much money you can send demand letters to for in identity theft cases |

And so much more. What are you waiting for? Let help you solve your social and issues today.

By

By