A Beginner's Guide on How Cash Back Works On Credit Cards

Cashback is a credit card benefit that reimburses you for a small percentage of any amount you spend on every purchase above a certain dollar cap. It also refers to a debit card transaction where, as a cardholder, you receive cash when you make a purchase—generally, a small amount above the item's cost.

So,? To help you get a clear vision, DoNotPay has created a guide about how cashback works on credit cards. We will also discuss how you can redeem your cashback, the best cashback credit cards you can use and how DoNotPay can help you earn cash back on your purchases.

What Does Cash Back on Credit Cards Mean?

Cashback on credit cards is a small amount of money you receive from your credit card issuer. It can be in any amount, but it's a small percentage of the amount you spend on your credit cards most of the time. For example, if your cashback is 1%, then for every $100 you spend on your credit card, you will receive 1$ as cashback.

Most fund the amount earned on your statement to help reduce your credit card bill. Others send the cashback earned to your bank account so you can withdraw it as cash or redeem it as vouchers and gift cards.

How Do Cashbacks Work?

In its simplest form, cashback on credit cards is a small refund for spending your money on a particular credit card. You earn a small percentage of the amount as cashback for each dollar you spend on the card above a certain threshold.

This means you earn money for your everyday spending and can put it towards your next big purchase or save it for a rainy day. A cash advance, on the other hand, allows you to take out some cash from your credit card at a fee used as a short-term loan. This is generally for emergency or urgent situations only.

Cash backs come in different forms, from flat rebates to bonus points. It can be a simple statement credit or a gift card, or sometimes, it may be in the form of an item. Rewards are normally earned in specific categories.

Rewards you can earn on a cashback credit card include:

- Discounted gas station purchases

- Discounts on dining out

- Discounted online shopping at specific stores

- Shopping vouchers and gift cards

- Statement credit

- Rebates at the end of your card cycle

- Bonuses

How to Redeem Cash Back on Credit Cards

Redeeming cash back rewards on your credit card will depend on the type of cashback credit card you have. Here are several ways you can use to redeem your cash back rewards:

- Request a statement credit - you can request a statement credit to offset your credit card balance. You can do this by visiting your credit card issuer and requesting a statement credit.

- Check or bank deposit - you can claim your cashback rewards through direct bank deposit or via check or PayPal by requesting it through your card issuer's online account management system. However, before using this option, your cashback must reach a certain limit like $25, $50, or $100.

- Transfer to a different card - you can choose to transfer your cashback rewards to a different credit card to use it as a statement credit, buy gift cards or transfer to your bank account.

- Use your cashback as rewards points - some cash back credit cards are linked to the issuer's rewards program, such as frequent flier miles or hotel stays. You can convert your cashback rewards into points instead of requesting cash.

- Redeem as gift cards: If you have your cashback rewards in the form of gift cards, you can redeem it at specific stores or online shops.

Before choosing a particular option for redeeming your points:

- Check your card issuer's policy on cashback rewards redemption.

- Compare how each option works and choose one that allows you to maximize the benefits.

- Check your card's details and issuer's policy to see whether there is a minimum cashback threshold before you can redeem it.

The Best Credit Cards for Cash Back

To maximize cash back rewards, it is best to choose a credit card with the highest percentage of cashback you can get. Depending on the card you use, there may be a cap on the amount or percentage of cashback you can earn. Here are the best cash back credit cards to consider:

| Credit Card | Cashback |

| Chase Freedom Flex | Best for everyday shopping with a welcome bonus of $200 and 5% cashback on purchases up to $1,500 that rotate quarterly |

| Blue Cash Preferred Card from American Express | Best for gas, commuting, and grocery shopping with up to 6% cashback for annual grocery purchases of up to $6,000 |

| Savor Rewards Credit Card | The best card for dining and entertainment, allowing you to earn unlimited 4% cashback on entertainment and dining, 3% cashback at grocery stores, and 1% on all other purchases. |

| Discover it Cash Back | Best for big spenders, offering up to 5% cashback on everyday purchases. |

| Citi Custom Cash Card | Best for flexibility with an intro offer of $200 and cashback of up to 5% on your top eligible category. |

| Citi Double Cash Card | Best for balance transfers, offering up to 2% cashback on every purchase. |

How to Get Cash Back on Purchases on Your Own

Cash back rewards are offered once you purchase using your credit card and hit the set dollars threshold. In short, all you have to do to earn cashback is by spending money on eligible purchases. Here is how you can earn cashback on your own:

- Make purchases on eligible products or services and hit the set amount required to earn cashback rewards. For example, you may have to spend $500 to get 1% cashback or buy gas worth $100 for $1 cashback.

- Make more purchases to earn more cashback and increase your rewards.

- Once you hit the required cashback points set by your card issuer, you can then redeem your cashback either as a direct bank deposit, check, statement credit, or gift card.

How To Get Cash Back on Credit Cards With DoNotPay

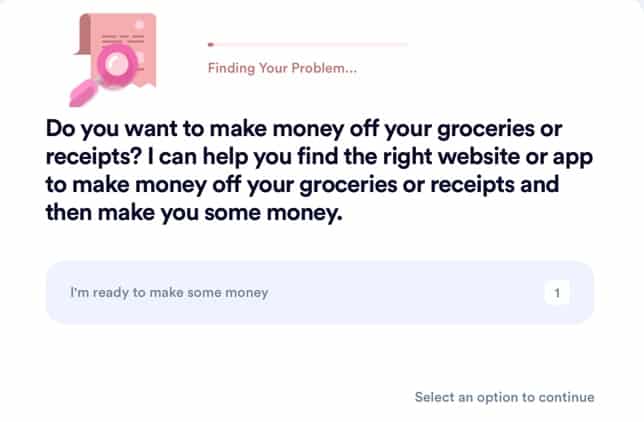

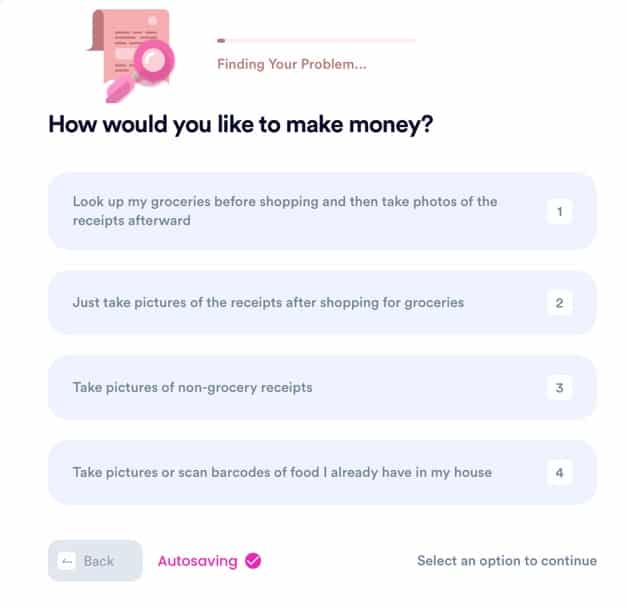

Getting cashback with your credit cards only takes three steps:

- Search for Cash Back on the DoNotPay website.

- Kick off the process to find the right app or website for you.

- Answer some specific questions so that we can help you start making money!

And that’s it! DoNotPay will send you the best cashback options we can find and help you to start earning more cashback on your purchases!

What Else Can DoNotPay Do?

Cash backs are an excellent way to save money on everyday purchases. You can redeem the rewards or save them for a bigger purchase. Whether you want to earn cashback on your Apple card, cash back apps, Apple Pay, Citi card, Walmart card, or Discover It card,

DoNotPay has got you covered. We will find the best cashback options to help you save huge on your purchases.

Besides earning cash backs, DoNotPay helps you solve a myriad of everyday tasks, including:

- Get gift card cashback

- Find missing money

- Negotiate bills you can't afford

- Appeal parking tickets

- Get free trials

- Help with credit cards

- Access customer service of any company

- Get free raffle tickets

Access DoNotPay on your today to help you get cashback rewards on your purchases and solve other everyday issues you might face.

By

By