Ally CashBack Credit Card: Is It Worth It?

Ally Financial is a digital financial service that serves different consumers, including individuals, automotive dealers, and corporate clients. Like many financial services, Ally has a credit card from TD Bank that offers cashback on specific spending. Like other financial services such as Discover, Apple Pay, and PayPal, you can use Ally's credit card to get cashback on your spending.

Since Ally operates primarily in automotive finance, insurance, mortgage finance, and corporate finance, getting a cashback on their credit card can be difficult. You don't have to worry about this possibility ever again. With DoNotPay Get Cashback Reward, we can help you get your easily. Follow the steps below, and let's help you get the best out of your Ally credit card cashback.

Does Ally Financial Offer Credit Card Cashback?

Yes. Ally offers credit cashback on various spendings. You can get an on your grocery, gas refill, and other purchases. New consumers can enjoy Ally's credit card cashback with a $100 bonus once they make a total of $500 purchases in the first ninety days.

How does Ally Cashback Credit Card Work?

The Ally cashback credit card works through:

- Grocery

- Gas station refills

- And other purchases

You get the following cashback on your purchases:

- 2% on your grocery and gas purchases

- 1% on other purchases

- Uncapped rewards that don't expire for open accounts and with a good standing

The Ally Cashback credit card stands to be one of the best Cashback credit cards, especially with the following unique features:

| An introductory APR for new accounts | A new account receives a 0% introductory APR for the first twelve months and a competitive interest rate for purchases and balance transfers. |

| A 10% reward on deposits made on Ally account after a cashback earning | This means that if you earn $100 as cashback from purchase and deposit it into your Ally account, you'll have $110 in total in your account. |

| No annual fees | This ensures that consumers can access their cashback credit cards. |

| Partnership with TD bank and Visa | To guarantee wider acceptability |

Even though Ally's cashback credit card seems a good choice, one of its downsides is the possibility of reducing your 2% cash back savings on grocery buys or fill-ups made on the warehouse stores like Sam's Club and Costco.

Overall, this is a good cashback credit card for people who are new to the cashback program and want a hassle-free option they can start with.

How Do You Apply for an Ally Cashback Credit Card?

You must be 18 years old in most states, 19 if you live in Nebraska or Alabama, and 21 in Mississippi to apply for an Ally cashback credit card. If you meet this requirement, you should follow these steps:

- Visit the Ally website and click apply now. This will direct you to a third-party website.

- Complete your application. You might be required to provide personal details such as your name, date of birth, Social security number, employment information, and so on.

Please note, Ally requires their applicants to have a good credit score ranging between 670 to 850. Applicants with higher credit scores will likely have a better credit limit and a lower APR.

You should not expect an immediate decision on your application since TD Bank is the managing bank of Ally's cashback credit card. So, you should hear back from them through email within two weeks. However, you can contact Ally to learn about your application's progress.

How Do You Redeem Your Ally Cashback Credit Card Points?

To redeem your Ally cashback credit card points, you should follow these steps:

- Log into your Ally account

- Choose whether to deposit the reward to your Ally account or receive it as a statement on your next bill.

No charge applies to redeem your rewards. However, you must have at least $25 worth of rewards in your credit card cashback balance to redeem them.

How to Get an Ally Credit Card Cashback With DoNotPay

Having an Ally Cashback credit card can be an excellent opportunity to save on your expenses. Unfortunately, most people don't know how to get an Ally cashback credit card. DoNotPay offers the perfect solution with the following three easy steps:

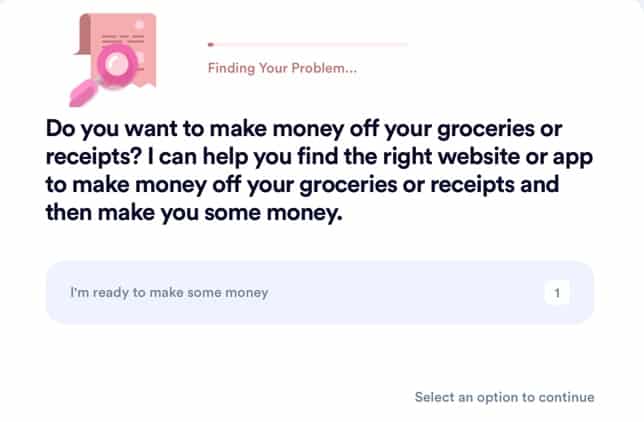

- Search for Cash Back on the DoNotPay website.

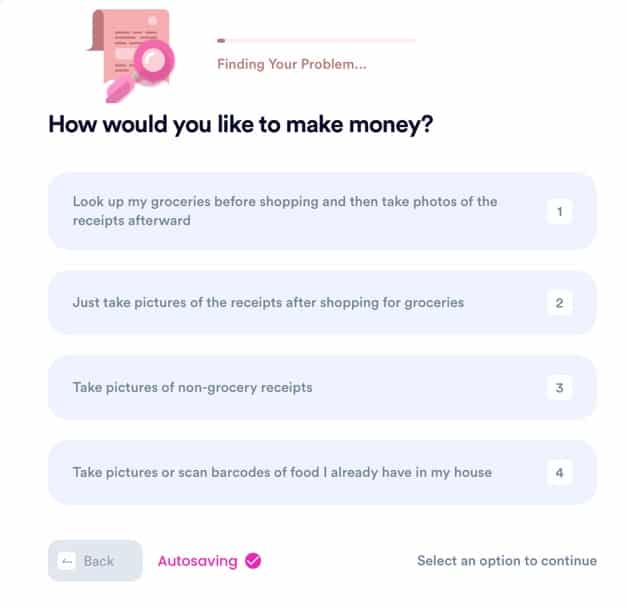

- Kick off the process to find the right app or website for you.

- Answer some specific questions so that we can help you start making money!

And that's it. DoNotPay will find out whether you have an Ally cashback credit card, and you can use it to start earning cashback on your usage. With our service, you don't have to follow all the steps that Ally has set to complete your registration process. We can help you complete this process in the easiest way possible.

What Else Can DoNotPay Do?

Our services don't end at Ally's credit card cashback. We can help you learn about your Walmart cashback credit card, Citibank cashback card, Apple card cashback, and other cashback apps. today to save money and time!