Who Should I Contact To Send Demand Letters To HOA Insurance?

Do you live in a community that requires an HOA? Living in a community with an HOA can be a great way to keep the community clean, help maintain property values, and add a layer of support for residents. With that said, there are times when you may have an and you feel the need to send demand letters to.

Most residents don't interact with their HOA board on a regular basis, which can make it difficult to know who to get in contact with when a problem arises. At DoNotPay, we know how important it is to have access to the information you need when there is an important matter at hand.

Your HOA insurance is designed to protect you, and if you feel they are not honoring their responsibility, suing may be the next best option. Read on to learn the reasons you may need to send demand letters to your HOA insurance, who to contact, and how to file a complaint to get the process started.

What is HOA Insurance?

An HOA is a homeowner's association that consists of a non-paid board of residents in the local area. They work together to address:

- Issues in the community

- Establish and enforce rules of the community

- Provide support in ensuring that everyone maintains the public space

Depending on your community's HOA, the board will have control over certain things. For instance, some HOA communities maintain parks, pools, or tennis courts by keeping them clean. Some HOA programs even provide security by aiding in neighborhood watch programs.

In addition to this, HOAs have liability protection for accidents that happen in a common space of the neighborhood. For instance, if damage occurs in a building in a common area, the HOA is supposed to cover these instances. If they don’t you have the .

Understanding HOA Insurance

HOA insurance, also known as an HOA master insurance policy, is designed to cover the , medical, and repair costs associated with an accident that occurs in a common area. This provides a convenient cushion for residents on the property. For instance, if you live in a condo and there was damage to the exterior walls of your property, the HOA insurance will cover the cost of damages.

Things Not Covered in an HOA Insurance Policy

While HOA insurance is designed to provide protection to its residents, it's important to note that this protection is limited. There are some things that your insurance won't cover, such as:

- Liability for injuries

- Damages that occur on your own property

- Damages that occur within your home or condo

It's also important to keep in mind that HOA insurance is limited to the damage it covers that occurs in the common areas. For instance, if the damage exceeds the limit of the association policy, the residents may need to financially contribute to cover the cost of some damages.

Reasons to Send Demand Letters To Your HOA Insurance

There are a few instances when you may want to send demand letters to your HOA insurance. Some reasons include:

| Misappropriation of Funds | Every month, residents pay a specific amount of money that goes towards their HOA insurance policy. This insurance policy, in turn, is supposed to provide coverage for damages that have occurred in the common area of the community, along with some medical needs. If the HOA insurance policy claims that there isn't enough money to pay for certain damages although your policy should cover it, it's a good idea to send demand letters to. |

| Issues with Repairs | If you are paying your HOA fees on time but the HOA is slow to make repairs to your property, the best option may be to file a lawsuit to get them to move. |

Who to Contact When Suing HOA Insurance

Understanding is often difficult. For starters, the HOA board isn't necessarily an administrative body. They are other residents in the neighborhood who have been formed to create a board.

One of the first points of contact when deciding to send demand letters to an HOA is to contact the HOA's board of directors. The HOA is responsible for ensuring that the issues within the community are properly handled. If you would like to file a lawsuit, residents can take up their issues with the board members who should be able to follow up with the issue.

Easily File an HOA Complaint With DoNotPay

Are you having a hard time getting the HOA to move on issues that they are responsible for? You may want to consider filing a formal complaint. Even if you plan on filing a lawsuit, having a complaint on file that documents your communication will help your case. Luckily, DoNotPay is here to help you file a complaint with your HOA with ease.

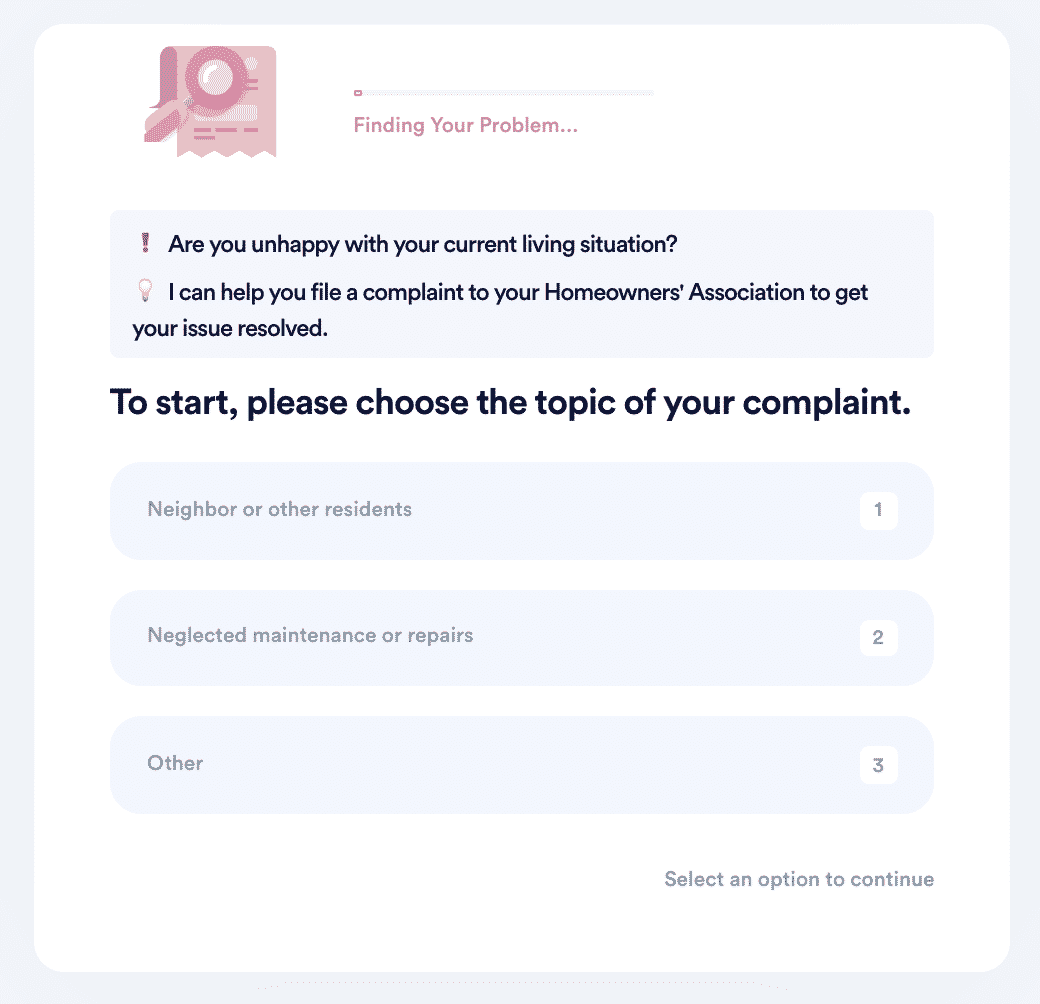

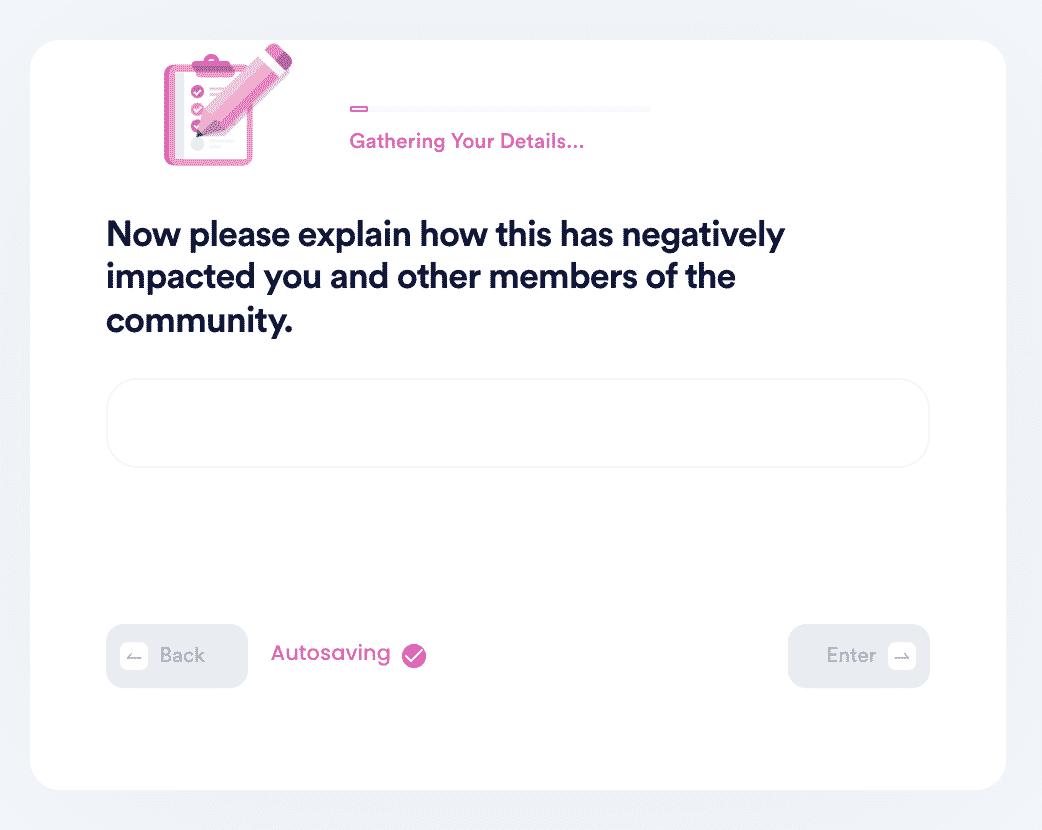

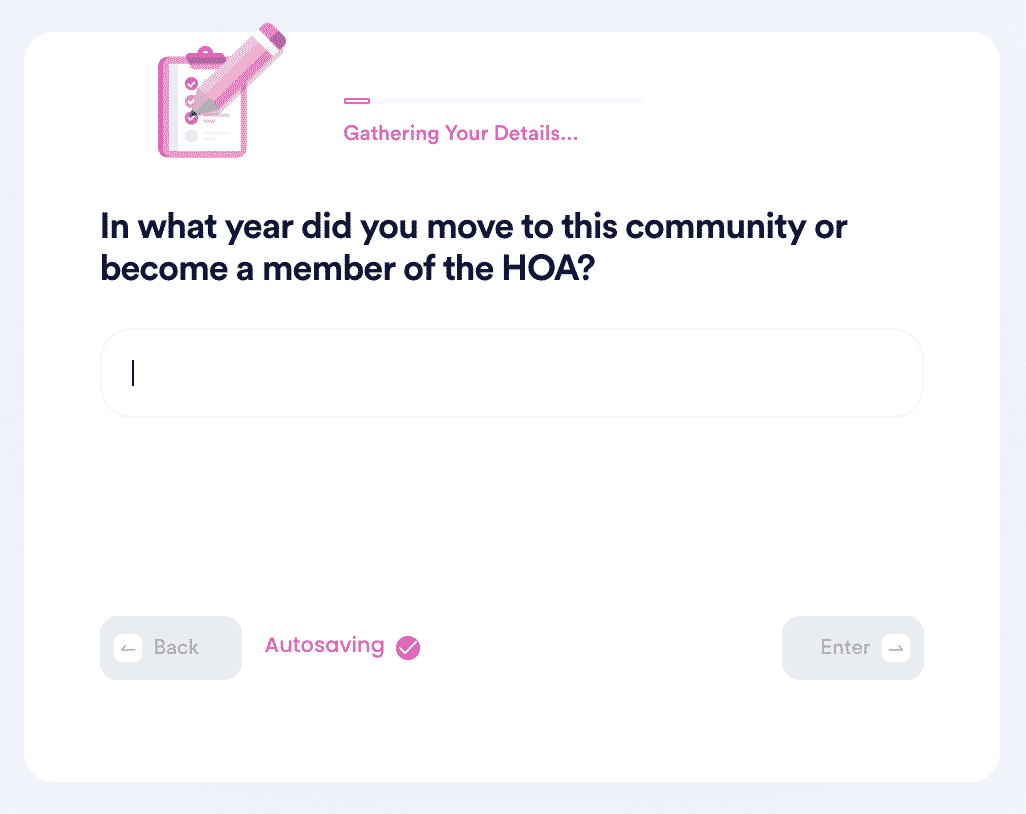

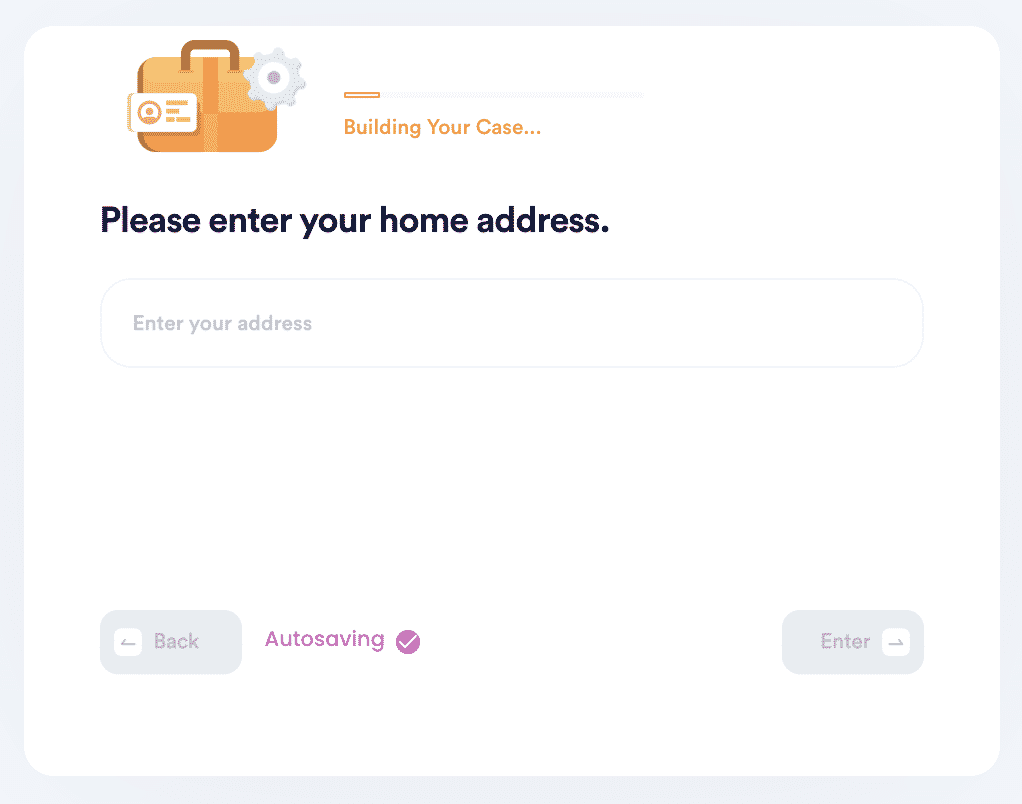

If you would like to file a complaint, all you need to do is:

- Choose and describe the nature of your complaint (neighbors, maintenance, etc).

- Explain how this problem has negatively affected you and how you want the HOA to address the problem.

- Tell us how long you've been a member of this HOA.

- Confirm your home address so we can generate state-specific arguments on your behalf!

DoNotPay can help you with a variety of other issues, including:

- HOA Noise complaint

- Disputing HOA late fees

- HOA discrimination concerns

- General disputes with HOA

Are you ready to ? Sign up with DoNotPay today to get started!