How to Remove Late Payments From a Credit Score Hassle-Free

If you needed to would you know how? Late payments to your credit score are like gasoline to a fire, and they only make matters worse.

In this post, let's look at trying to remove these late payments all by yourself and then show you a fast and easy solution to removing late payments from your credit score in the form of a letter.

Removing Late Payments From Your Credit Score by Yourself

Late payments on your credit score are sometimes the sole indicator to a lender about your overall creditworthiness. Frequent late payments will indicate your likelihood of making your future payments on time for the duration of the loan you are trying to get.

Late payments could be forgiven by your loan officer if;

- You or your family are experiencing hardship

- You can prove the late payments were not your fault

- You normally make all your payments on time

If you have a good history of making payments on time, the late payments may be forgiven. Forgiven by your loan officer, but still tainting your credit report.

You need to remove these items from your credit report permanently for the simple fact that they may be the one thing keeping you from securing a loan in an emergency.

If you have several late payments that are spread across multiple financial institutions or credit card companies, then you are going to be contacting each one of them separately to go through this process of asking for forgiveness. This will consume your time and energy at a rapid pace.

There is a much better way to remove late payments from your credit report.

Additional Problems You May Encounter

If you can devote a serious chunk of your time to contacting all the different credit vendors, your chances of getting forgiveness of these late payments are 50/50 at best.

If you are trying to rebuild your credit, then going forward, you may miss one of the late payment creditors, causing your efforts to fail. If you do get a loan with your late payments showing on your credit report, you are probably going to be paying a lot extra in interest fees since you will be at a high risk of making payments on time.

Some creditors suggest you send a letter to them explaining the reason for the late payments. This is called a goodwill letter, and the object here is making sure your letter ends up in the right hands, viewed by the right person or people.

Wouldn't it be nice to have that would be hard at work on your behalf, removing late payments from your credit report? There is such a solution.

How to Use DoNotPay's Sample Letter for Removing Late Payments From Credit Scores

DoNotPay was designed to level the playing field and make things like sample letters for removing late payments from a credit report fast and easy.

How to clean up your credit report using DoNotPay:

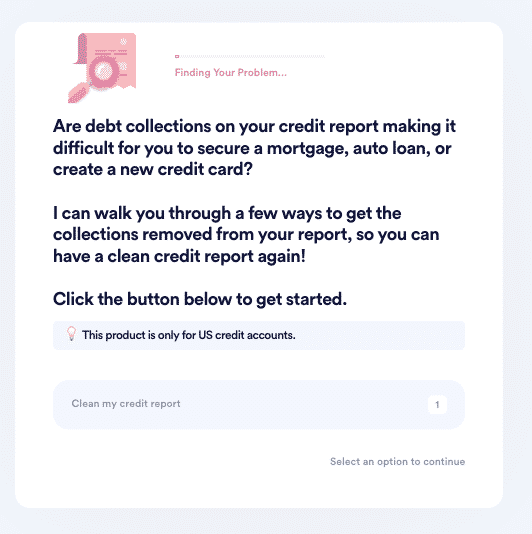

If you want to clean up your credit report but don't know where to start, DoNotPay has you covered in three easy steps:

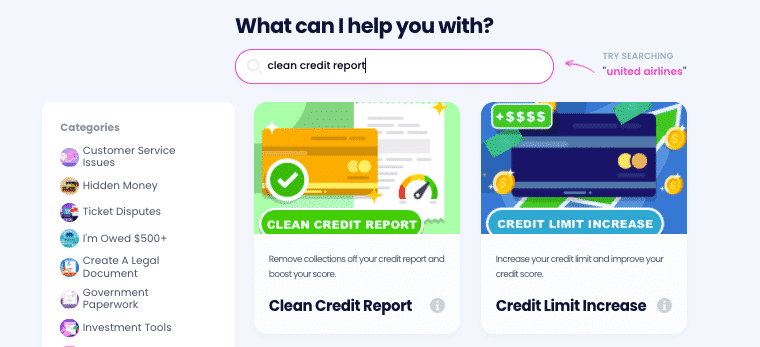

- Search Clean Credit Report on DoNotPay.

- Prepare a recent copy of your credit report that you can use as a reference.

- Let us guide you through the four potential options:

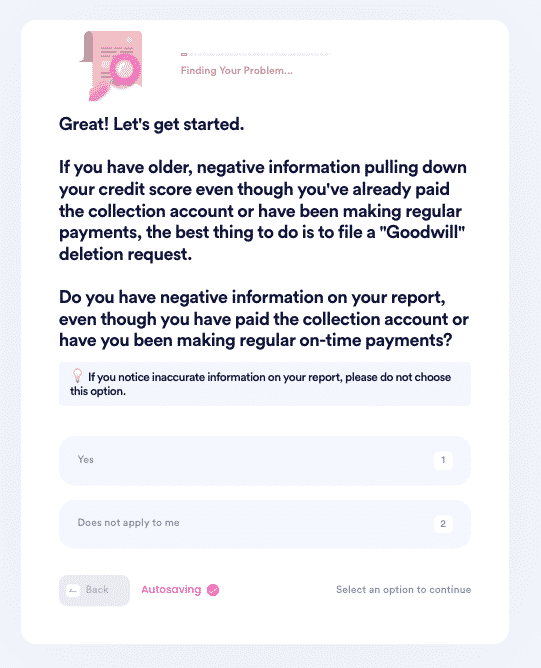

- If you've already paid off your debt, we'll help you file a Goodwill Removal Request to get it removed.

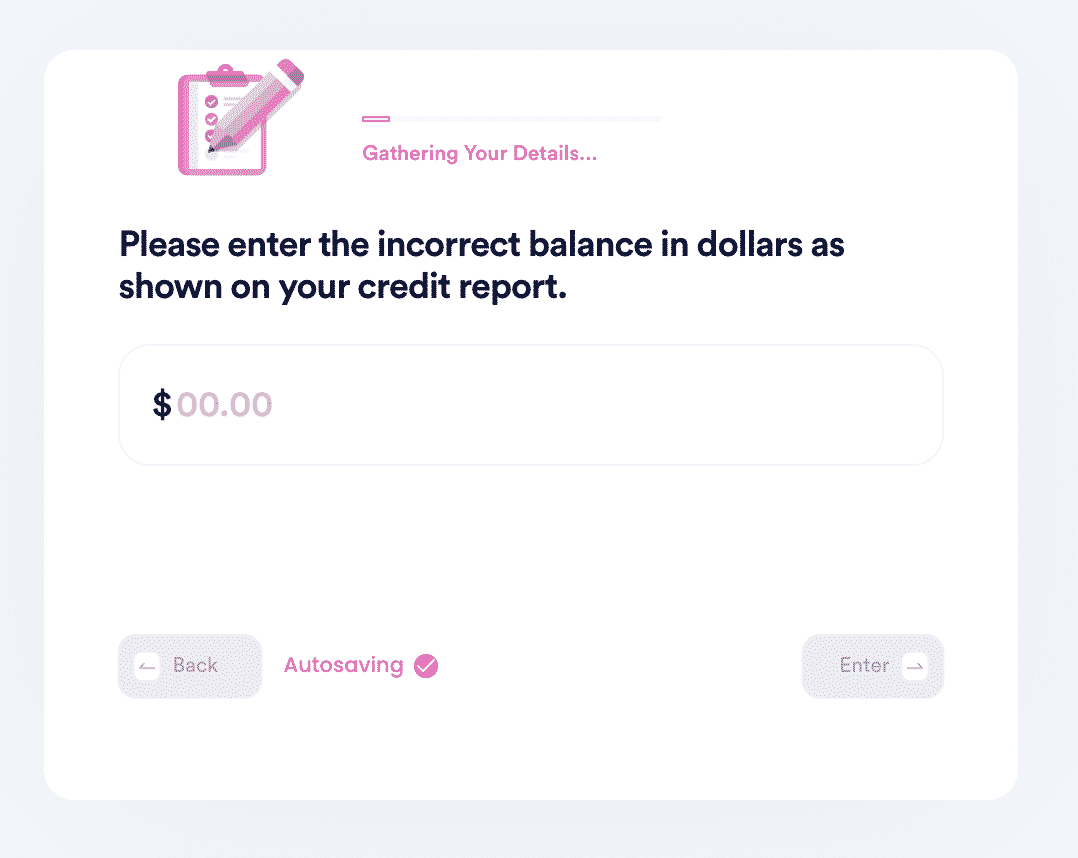

- If you notice any errors in your report (we have a list of common errors you can use), we'll help you file a credit dispute with the creditor or major credit bureaus.

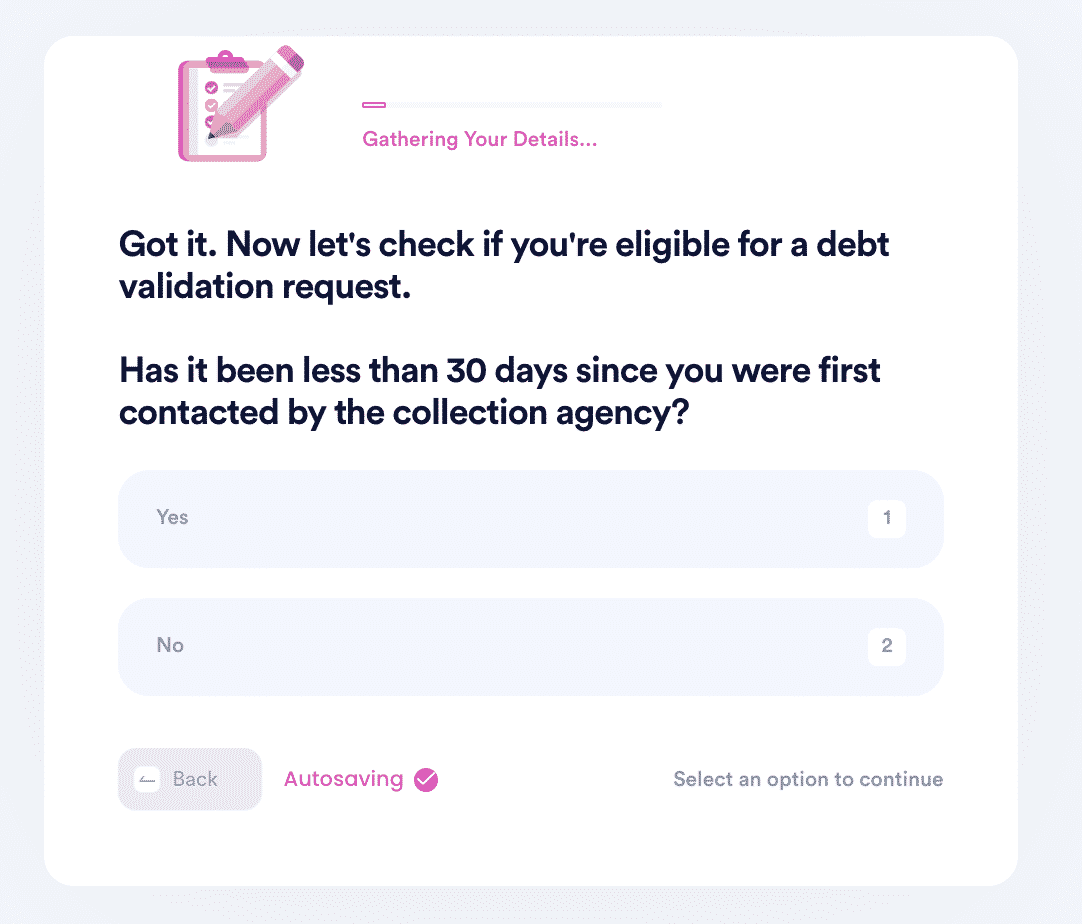

- If there are no errors, we'll check if you're still eligible to file a debt validation request. If they can't validate your debt, they're required to remove it from your report, and they can't collect it.

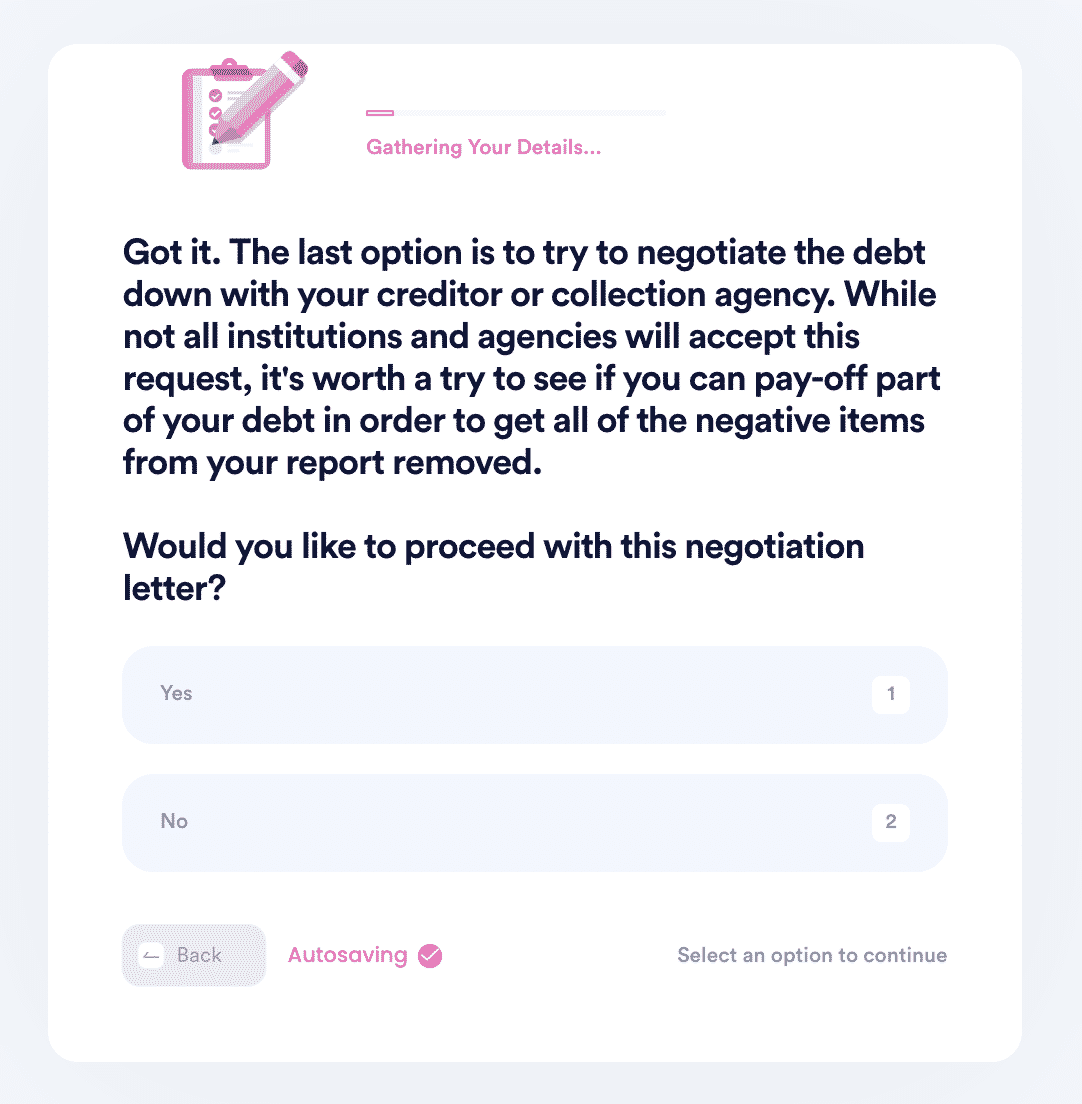

- Lastly, if none of the above options work, we'll help you file a pay-to-delete negotiation letter. You can customize the amount you are willing to pay in exchange for getting the item removed.

- If you've already paid off your debt, we'll help you file a Goodwill Removal Request to get it removed.

And that's it. DoNotPay will be hard at work on your behalf to begin cleaning up any discrepancies on your credit report, including sending those Goodwill Letters to remove late payments and begin raising your credit score.

Why Use DoNotPay?

DoNotPay is your one-stop, all-inclusive information hub for cleaning up your credit report.

Still not convinced? Look at these three reasons you can trust DoNotPay.

DoNotPay is:

- Fast: After a few basic questions, DoNotPay is on the job.

- Easy: Using DoNotPay is as easy as filling out an online survey.

- Successful: DoNotPay has resolved thousands of issues on credit reports to date.

Spend your time doing something fun, not worrying about late payments on your credit report.

What Else Can DoNotPay Do for Cleaning Up Credit Reports?

Your sample letters for removing late payments on your credit report aren't all you can accomplish with DoNotPay.

Look at these other credit score related issues you can navigate using the DoNotPay platform;

| Learn how to improve credit scores | Learn about credit dispute letters |

| Learn how to dispute credit reports | Learn how to remove late payments from credit reports |

| Learn more about debt validation letters | Learn how to fix credit scores |

| Learn how to remove debt collections from a credit report | Learn how to remove inquiries from credit reports |

Why not let DoNotPay show you how fast and easy it can be to using their sample letter.

By

By