How Is Upcoding Being Monitored by Payers?

The US healthcare system relies heavily on third-party payers. Between private health insurance companies, federal programs like Medicare and Medicaid, and state-run programs like California's MediCal, most patients pay only a small portion of their medical costs.

At first, this seems like a favorable arrangement. But a challenge for payers (insurance companies and programs) is that healthcare professionals sometimes take advantage of the bureaucracy, paperwork, and red tape to over-charge for services.

Medical fraud is usually accomplished through upcoding and upbundling. This is not a victimless crime. The victims are the premium-paying beneficiaries of health insurance companies or taxpayers, who ultimately end up footing the bill while providers laugh their way to the bank.

Today, we'll discuss and what you can do as a consumer to help.

How Do Payers Monitor Upcoding?

Since it's federally funded, Medicare has the most power regarding fraud investigations. The Medicare Fee for Service (FFS) Recovery Audit Program routinely identifies and corrects improper payments. It operates in all 50 states and acts like a big accounting firm. They aren't forthcoming about their audit methods, which makes sense because that would give unscrupulous providers ways to get around them.

- As a federal organization, Medicare can also request other audits.

- Medicare beneficiaries are encouraged to report fraud.

- Whistleblowers, usually staff at a hospital or healthcare provider's office, can also report fraud.

Upcoding and upbundling can be challenging to prove without personal knowledge of a patient, which is why Medicare encourages beneficiaries to read their benefits statements closely and report their concerns if they suspect fraud.

Medicare offers a reward to people who report medical billing fraud. The amounts of these rewards are undisclosed, but Medicare says the more money saved when the fraud is closed equals more significant rewards for the whistleblower.

Here’s how to contact Medicare to report fraud:

| Medicare Plan | How to Report Fraud |

| Original Medicare |

|

| Medicare Advantage Plan

or Medicare Drug Plan |

|

Insurance Companies Rely on the FBI to Investigate Fraud and Monitor Upcoding

Payers rely on the FBI to investigate medical fraud and , whether it's:

- Upcoding - charging the payer for more expensive services than they received

- Double-billing - charging the payer twice for a single service

- Upbundling - charging the payer for multiple services (like an entire hospital stay when the patient was only present for a few hours)

- Phantom billing - occurs when a provider charges for services that were never received at all

These all fall under FBI jurisdiction.

Consumer Solutions to Avoid Upbilling

As a patient, it's essential to be sure your health insurance only pays for the services you receive. That's why it's important to read your benefits statements closely and compare them to your actual experience. If you suspect a billing hiccup (mistakes DO happen), you should contact the provider first. Give them a few days to correct the issue and request proof of the change.

If the provider refuses to make the adjustment, report them. DoNotPay is here to help. And if you don't get the results you like, we can help you report the provider for fraud and even send demand letters to them in small claims court.

How to Get Your Medical Bills Corrected with DoNotPay

If you discover some errors on your medical bills or benefits statements and wish to write a demand letter for bill correction but don't know where to start, DoNotPay has you covered in 5 easy steps:

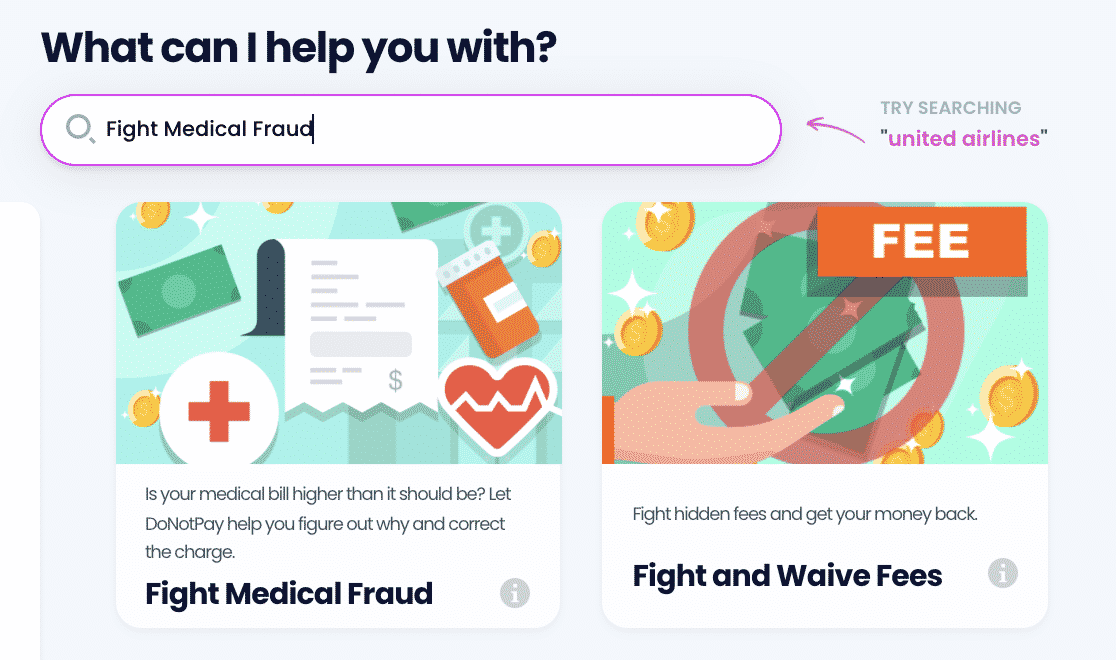

- Search Fight Medical Fraud on DoNotPay.

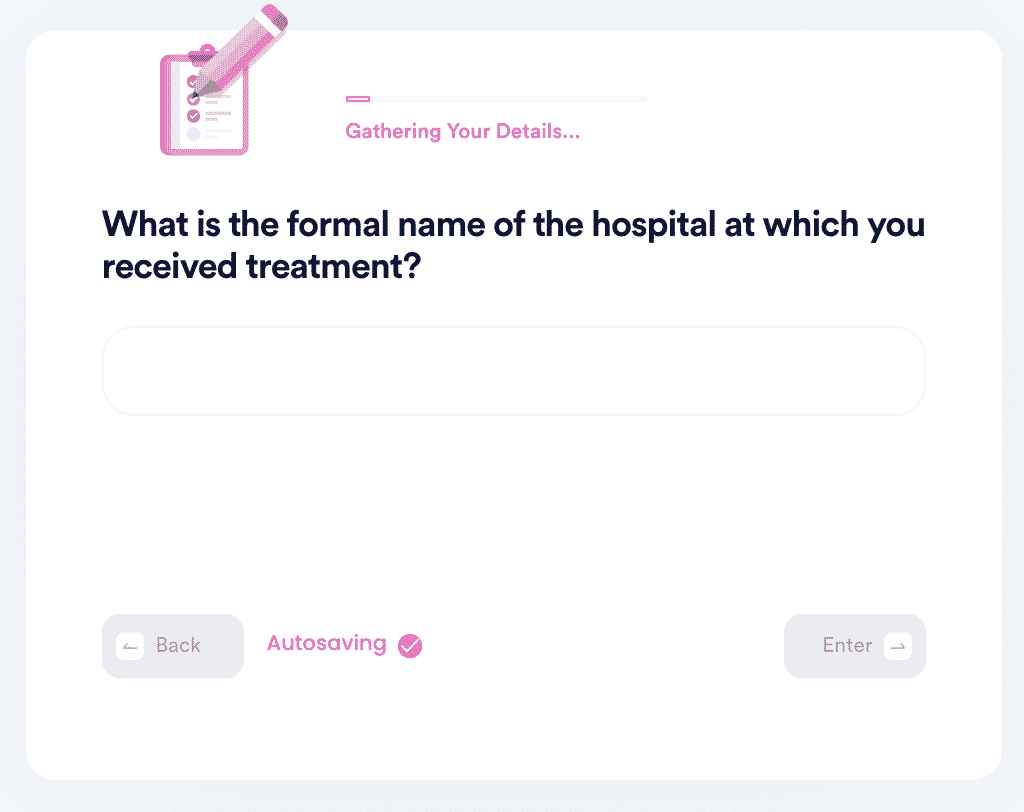

- Tell us the date of your visit, what you were treated for, and where you were treated.

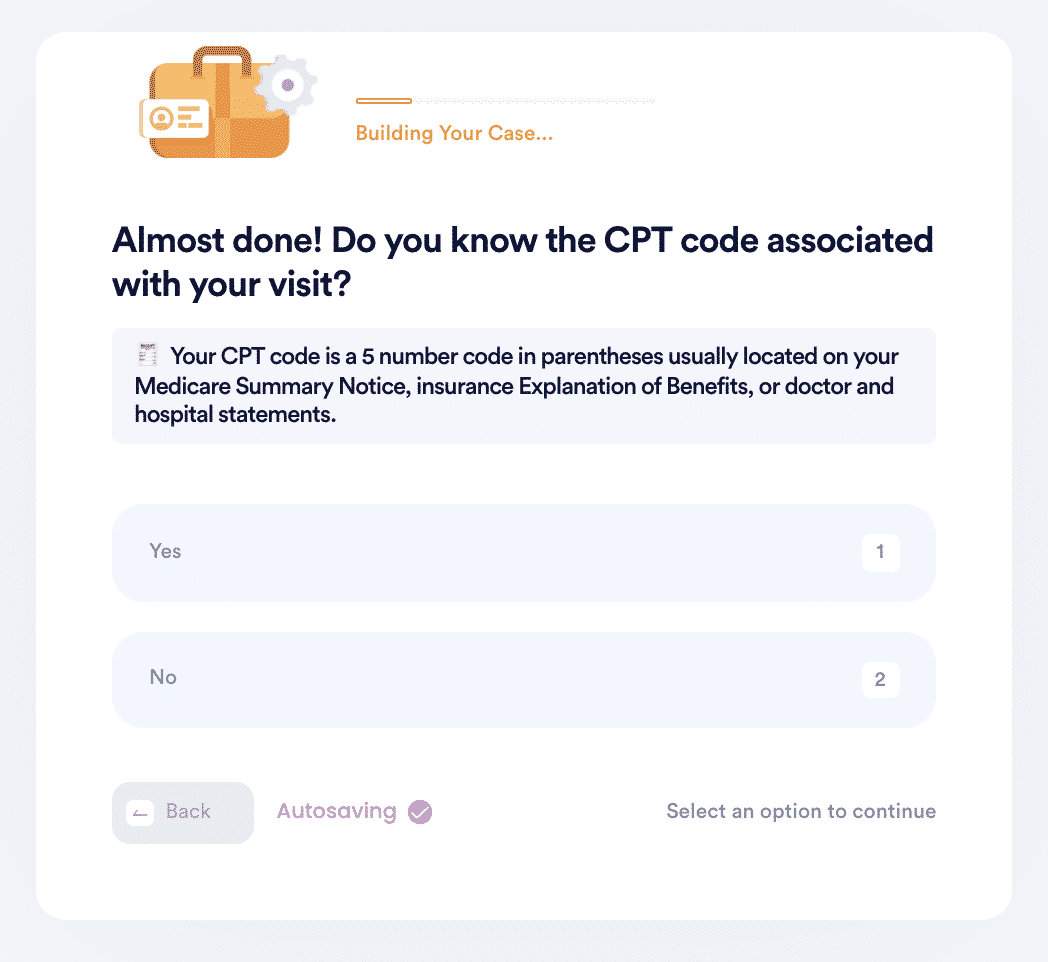

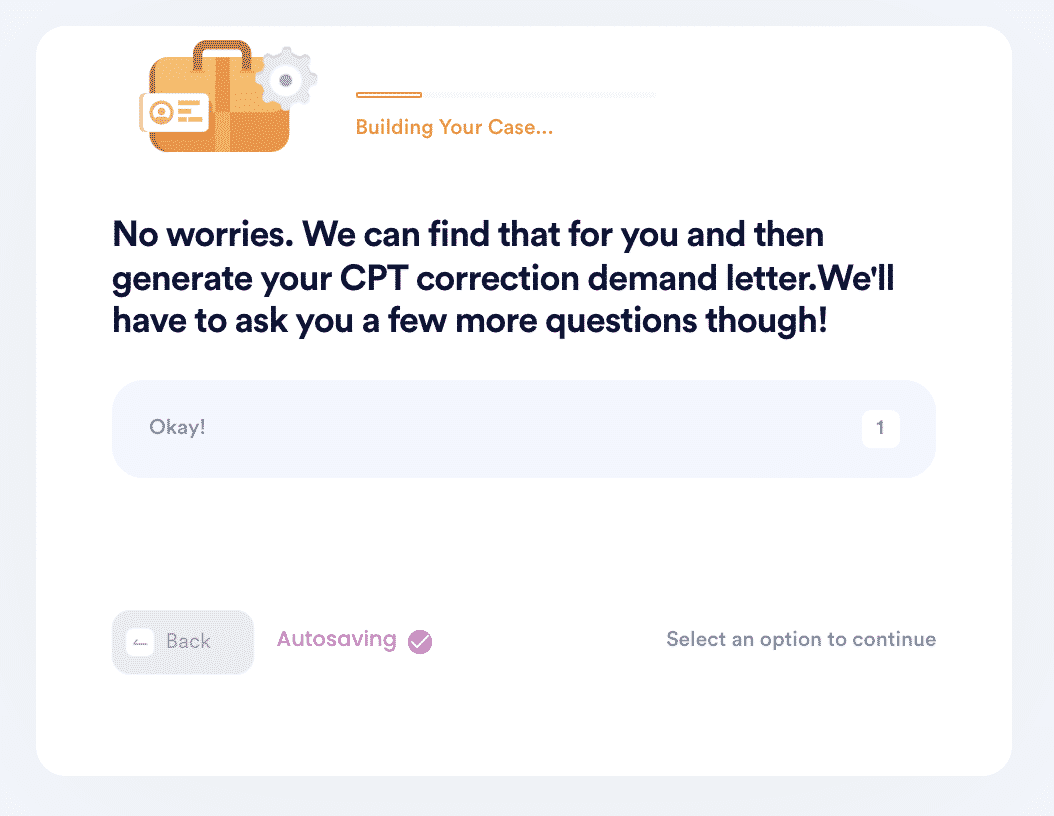

- Let us know what CPT code your visit was filed under. If you don't know, we'll generate a letter for you to send to your physician to request the code.

- Choose the correct CPT code or let us know if you want us to find it for you.

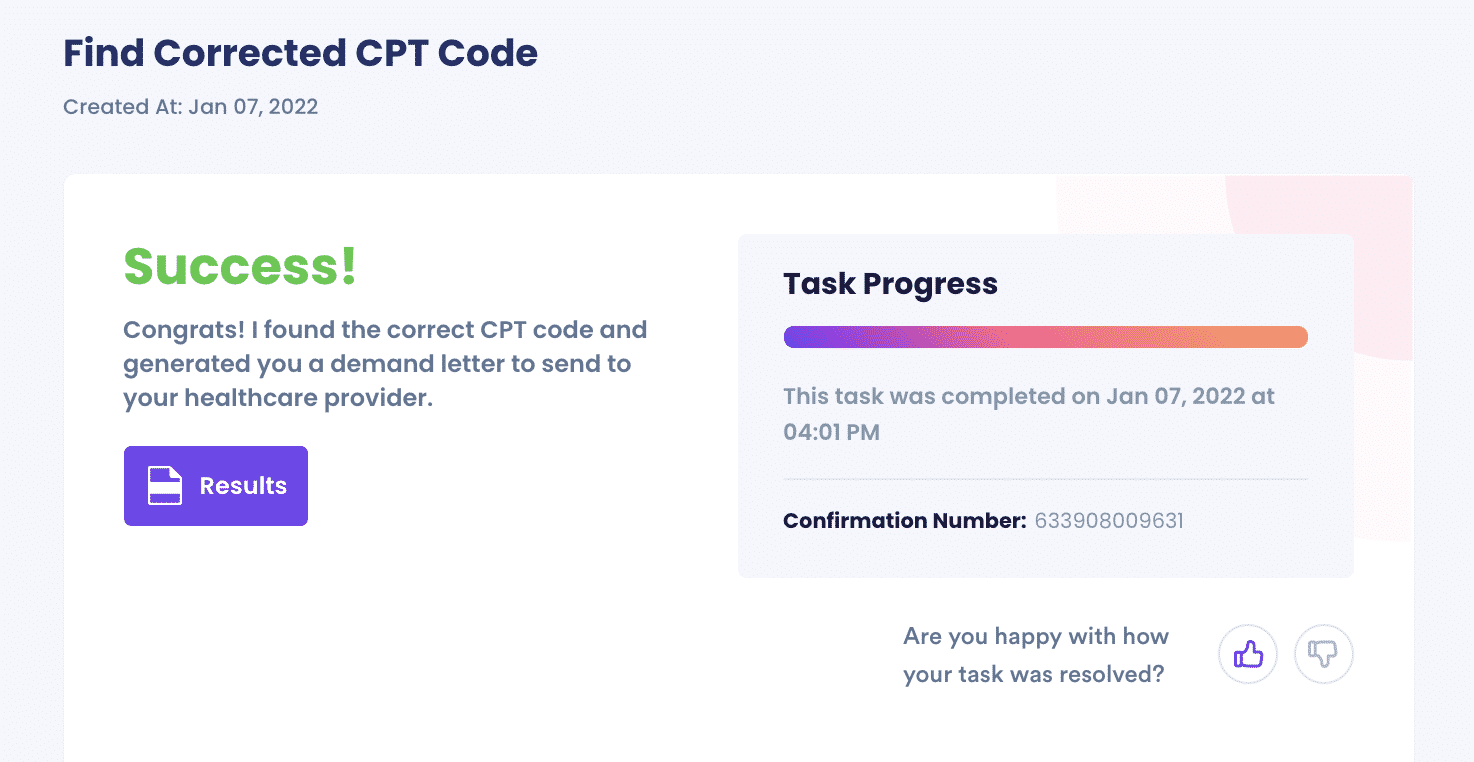

- And that's it! DoNotPay will automatically find the correct CPT code for your visit if you don't know it and then generate a demand letter on your behalf to send to your physician for a bill correction.

Now sit back and let the healthcare provider or hospital do their thing. It might take a few weeks, but you'll receive a corrected bill, and your insurance company or Medicare / MediCal will send you a new benefits statement.

Why Choose DoNotPay to Solve Medical Fraud and Billing Problems?

At DoNotPay, we know medical billing issues can be a huge headache. And even though payers do their best to these issues, billions of fraudulent dollars are paid to US providers yearly. And it's the taxpayers and insurance beneficiaries that end up paying for it.

Still, no one wants to spend hours playing phone tag with hospital administrators.

And there are hundreds of other ways you can use the app. If you need help with bills, DoNotPay has a solution. If you need to stand up to a landlord trying to evict you, the app can help. You can even use DoNotPay to search for good deals and report gas gouging. Spend some time on DoNotPay today and see all the ways you can save.

By

By