Ultimate Step-by-Step IRS 83(b) Instructions

If you were recently given shares of company stock, would you know the for tax purposes? Perhaps you need a bit of information regarding this particular form such as what it is, and why do you need it.

Either way, in this post, we will address those issues concerning your responsibility to the Internal Revenue Service. We will also go into the for filling out this form and enlighten you on an easy solution.

What Is the 83(b) Election, and How Do I Complete This Form by Myself?

Many corporations will offer shares of their company stock as a part of an executive's compensation package. The shares are considered restricted stock meaning that it will be several years before the stock is worth anything.

When that stock becomes vested, the owner will then be required to pay taxes on the stock's actual worth. The 83(b) Election allows employees to pre-pay in advance the taxes on the shares based on the fair market value at the time they were granted.

When the stock becomes vested it will then be worth substantially more.

The 83(b) Election is your way of letting the IRS know that you have these shares, and you would like to make an advance tax payment provided the shares will increase in value. Think of it as an insurance policy that you will use when the stock is worth something.

How to Fill Out IRS 83(b) Election Forms

Whoever coined the phrase, "Patience is a virtue", never filled out an IRS 83(b) Election form!

The first thing you will need to do is compile the following information:

- Your name, address, and phone number

- A description of the property (X number of shares in my company)

- The date you received those shares, and what tax year the shares were given

- Restrictions placed on the shares (vesting period, or the time you can sell those shares)

- The fair market value of the shares without the restrictions at the time they were granted

- Any amount paid for the shares

- The dollar amount that you are reporting as gross income (fair market value minus anything paid)

When you enter Section 83(b) Election on the IRS search box it comes up as 'Nothing found matching that description’. Several variations of that were entered, and the IRS has no information available.

What's Next?

When your employer grants these shares to you, they are responsible for also giving you a Section 83(b) Election form package. If your employer does not provide you with these documents, then you must turn to online services that provide templates for the Section 83(b) Election.

If you are familiar with Google Docs, there is a template in their template directory portion of that platform.

Once you have secured the proper set of documents follow this schedule for sending out the four copies you are required to make:

- Send two copies to the IRS.

- Be sure to include all the following in a single envelope:

- IRS fax transmittal sheet

- Copies one and two of the signed original 83(b) election form

- Provide self-addressed postage-paid envelope with copy two for the IRS to date, stamp, and return

- Send these copies via US Postal certified mail with return receipt to the IRS offices where you file your annual taxes

- Send a copy to your company.

- Retain a copy for your records.

Don't you have more important things to do rather than chasing down and filing documents all at your expense?

There is a much better way to file your 83(b) election forms. Let's take a look at how one particular service can eliminate your 83(b) election confusion and frustrations!

How to Use DoNotPay for 83(b) Elections

DoNotPay was designed to make things like your 83(b) Election simple. Look at just how easy it is to use DoNotPay's 83(b) Election product.

How to file an 83(b) election form using DoNotPay:

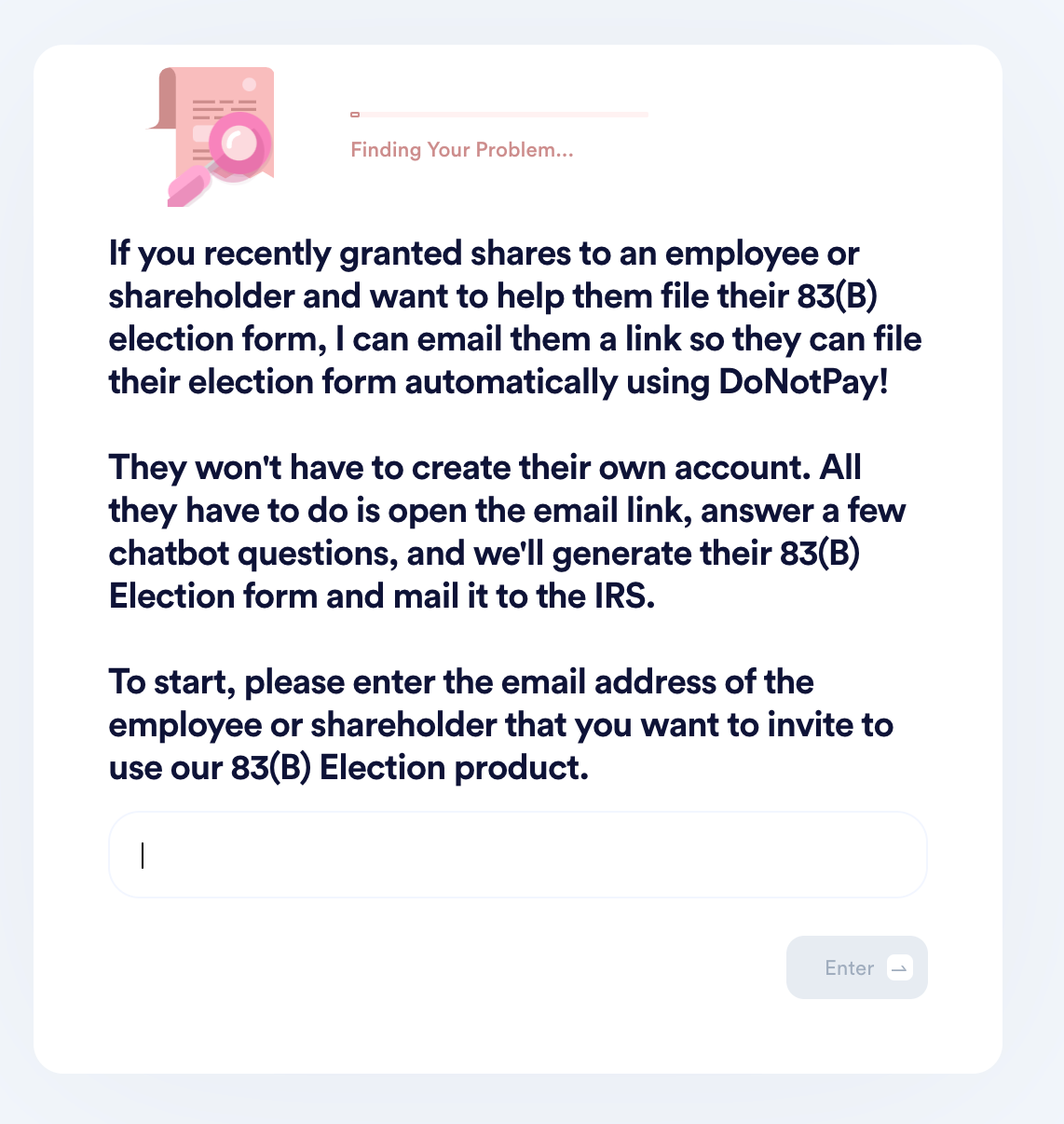

If you want to file an 83(b) election form but don't know where to start, DoNotPay has you covered in 3 easy steps:

- Enter the email address of the employee/shareholder you want to grant shares to.

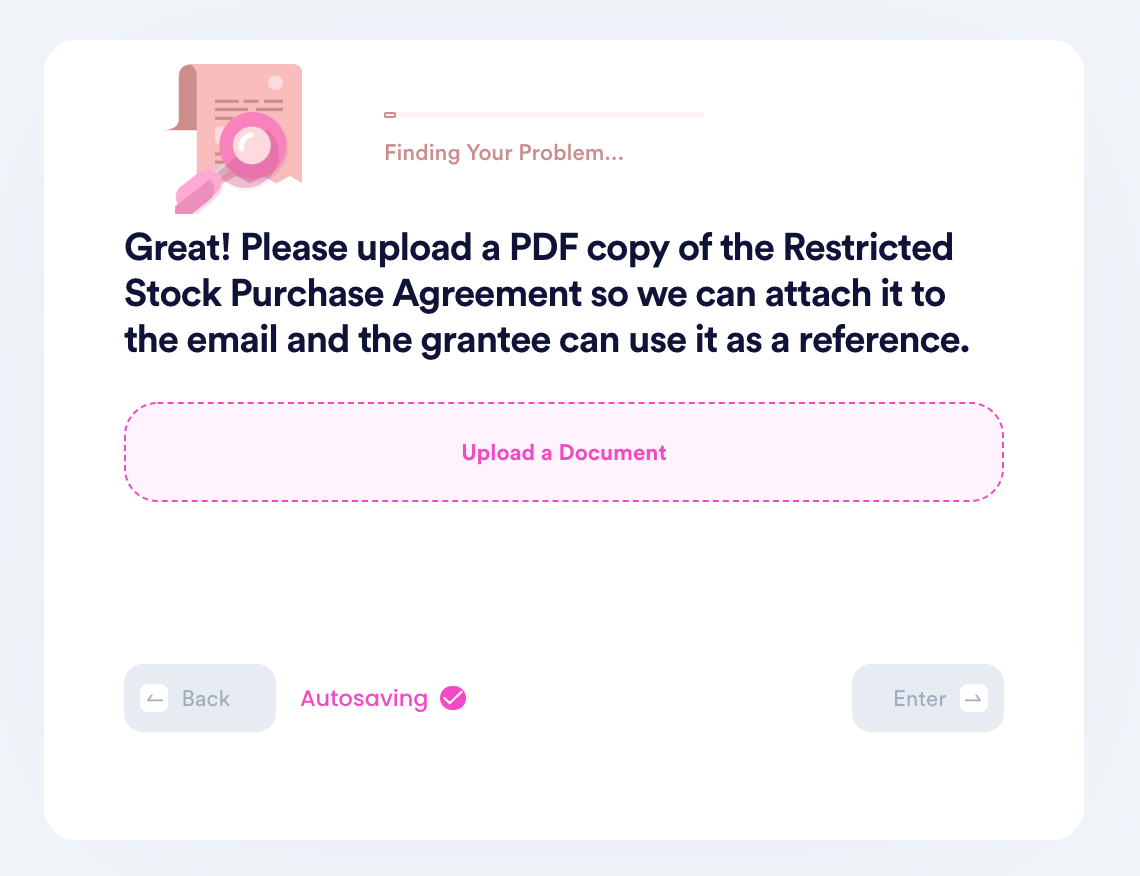

- Upload a copy of the Restricted Stock Purchase Agreement.

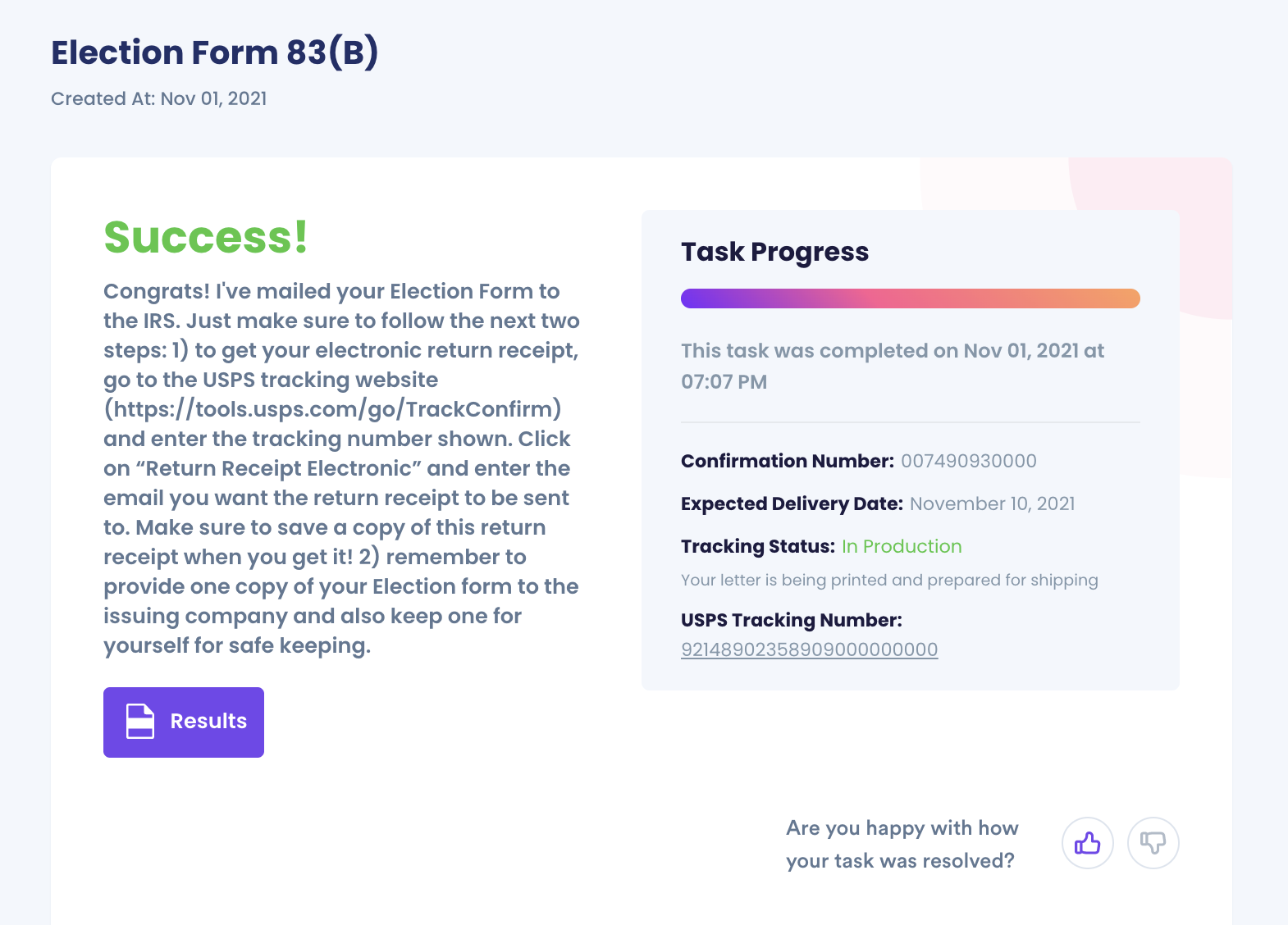

- And that's it! We'll email the grantee with a special link so they can access the DoNotPay 83(B) Election Form Filing Product and file their forms automatically. You'll be able to see the completed task on your dashboard, and the grantee will receive a tracking number to track the status of their shipment as well.

Spend your time doing something besides getting confused and frustrated with your 83(b) Election forms and their proper filing procedures!

Why Should I Use DoNotPay?

DoNotPay is your one-stop all-inclusive information hub regarding your 83(b) Election. Still not convinced? Look at these three facts about DoNotPay and then decide!

| DoNotPay is FAST! | You don’t have to spend hours trying to file an 83(b) election form. |

| DoNotPay is EASY! | You don’t have to struggle to fill out tedious forms and keep track of all the steps involved in filing an 83(b) election form. |

| DoNotPay is SUCCESSFUL! | You can sit back and relax knowing that we will do all the work for you. |

DoNotPay is highly recommended by some industry leaders and the number of success stories produced by DoNotPay continues to impress!

What Else Can DoNotPay Do?

Your 83(b) Election issues can be spread across several avenues. Look at these other services offered by DoNotPay as part of their 83(b) Election product;

Let DoNotPay show you how easy and quick filling out your IRS 83(b) Election can be!

By

By