All About 83(b) Election and Stock Options

There's an idiom you are likely familiar with about how the only sure things in life are death and taxes. If you search for information about 83b stock options, you are probably concerned about the tax consequences of receiving stock options or company shares. Fortunately, DoNotPay can help you.

What Is an 83(b) Election Form?

An 83(b) election form is a letter you send to the IRS notifying them of your intent to be taxed on the acquisition of company shares at the time they were granted, instead of later, when they are vested.

The grant date is when an employee receives a company stock or stock option. When an employee has earned ownership of the company shares or stock options, they are vested.

Essentially, an employee is electing to pay taxes on the value of the stock currently instead of waiting, assuming that the stock will increase in value and save money in the long run.

The table below outlines situations where filing an 83(B) election is more and less advantageous:

| Situations where filing an 83(B) election is more advantageous | Situations where filing an 83(B) election is less advantageous |

| The income amount is small | The income amount is large |

| Growth is expected to be moderate to strong | Growth is expected to be low to moderate |

| Low risk of share forfeiture | Moderate to high risk of share forfeiture |

How Long Do You Have to Make an 83(b) Election?

You must file an 83(b) election within 30 days of when the shares are granted. Ideally, you should file as soon as possible to avoid the possibility of missing the 30-day filing period. If you spend any significant amount of time researching your options, simply delay filling out the election form or accidentally forget about it, you could run into some obstacles as your deadline approaches. To save yourself time and headache, you may find that filing electronically through a secure portal like DoNotPay can help you file an 83(b) form without the hassle and get it submitted before the 30 days expire.

How to File an 83(b) Election Form on Your Own

Filing an 83(b) election form may be important, but it can also be tedious.

83(b) Form for the IRS

- Most importantly, you must remember to have everything filed and submitted within the allowable time frame.

- Complete the IRS 83(b) form and follow all instructions carefully.

- Make several copies of the form.

- Include a self-addressed stamped envelope.

- Address your envelope to the appropriate IRS Service Center. You can do an online search to find out which IRS Service Center district you live in and use the correct address.

- Go to the post office and pay a small fee for certified mail. Fill out the certified mail form. The postal worker will affix it to your envelope. You can also request (and pay another small fee) for a return receipt - this will ensure that you receive the signature card returned to you so you can be assured it was received.

83(b) Copies

The copies you made are to serve various purposes. You need to mail or send one copy to your employer. You should keep one copy of the form for your tax return for the year you filed the election. Always keep at least one copy for yourself and file it with your other important documents. You should also consider digitizing a copy of the form for safekeeping and sending a copy to your accountant.

Let DoNotPay Quickly File an 83(b) Election Form

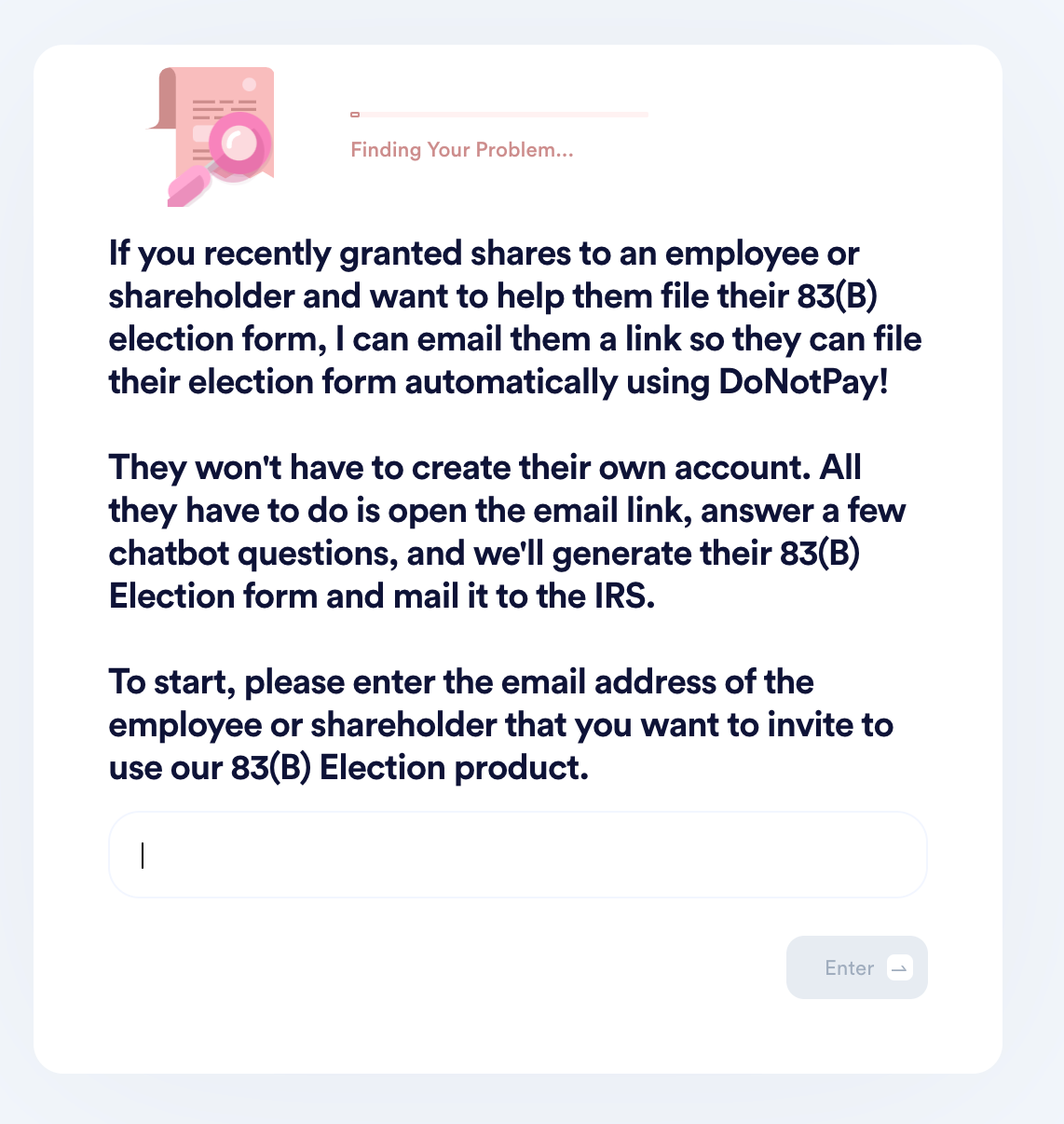

Understanding or helping others understand and filing the election form on time can be confusing and tedious. If you want to file an 83(B) election form but don't know where to start, DoNotPay has you covered in 3 easy steps:

- Enter the email address of the employee/shareholder you want to grant shares to.

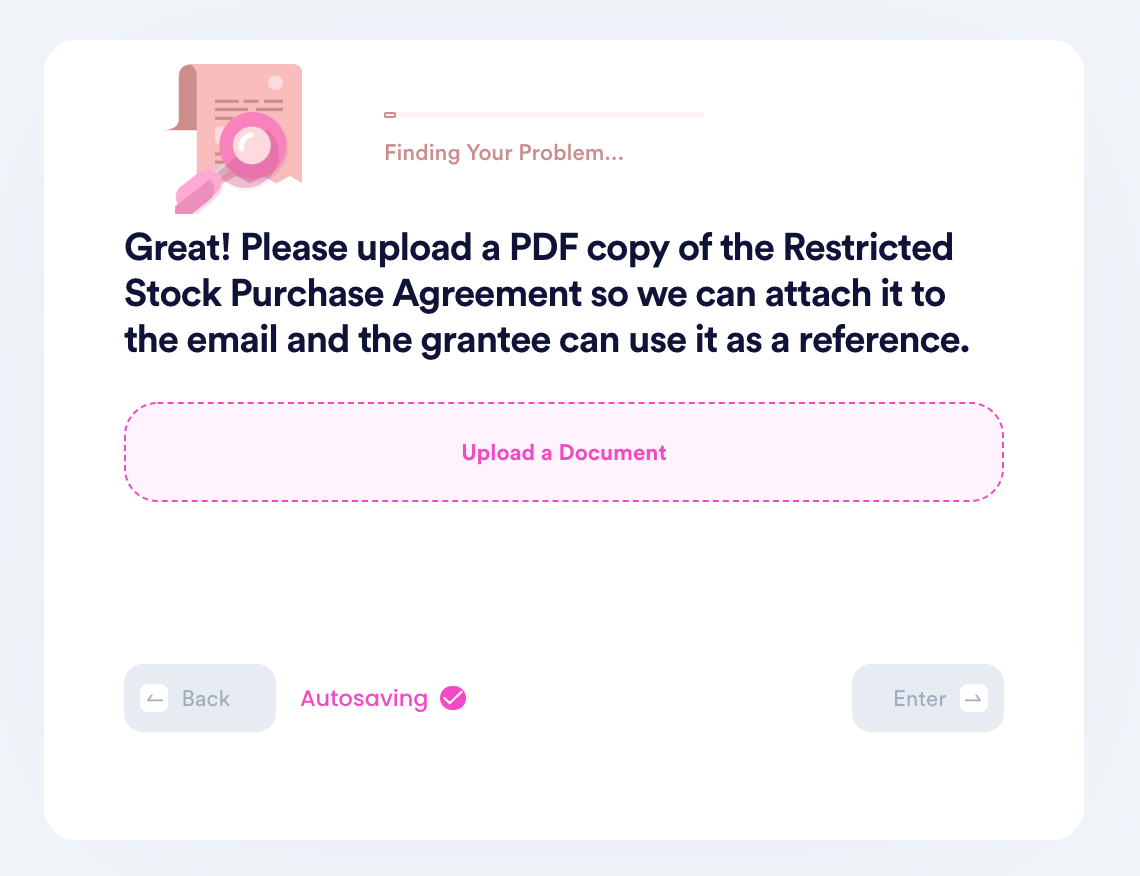

- Upload a copy of the Restricted Stock Purchase Agreement.

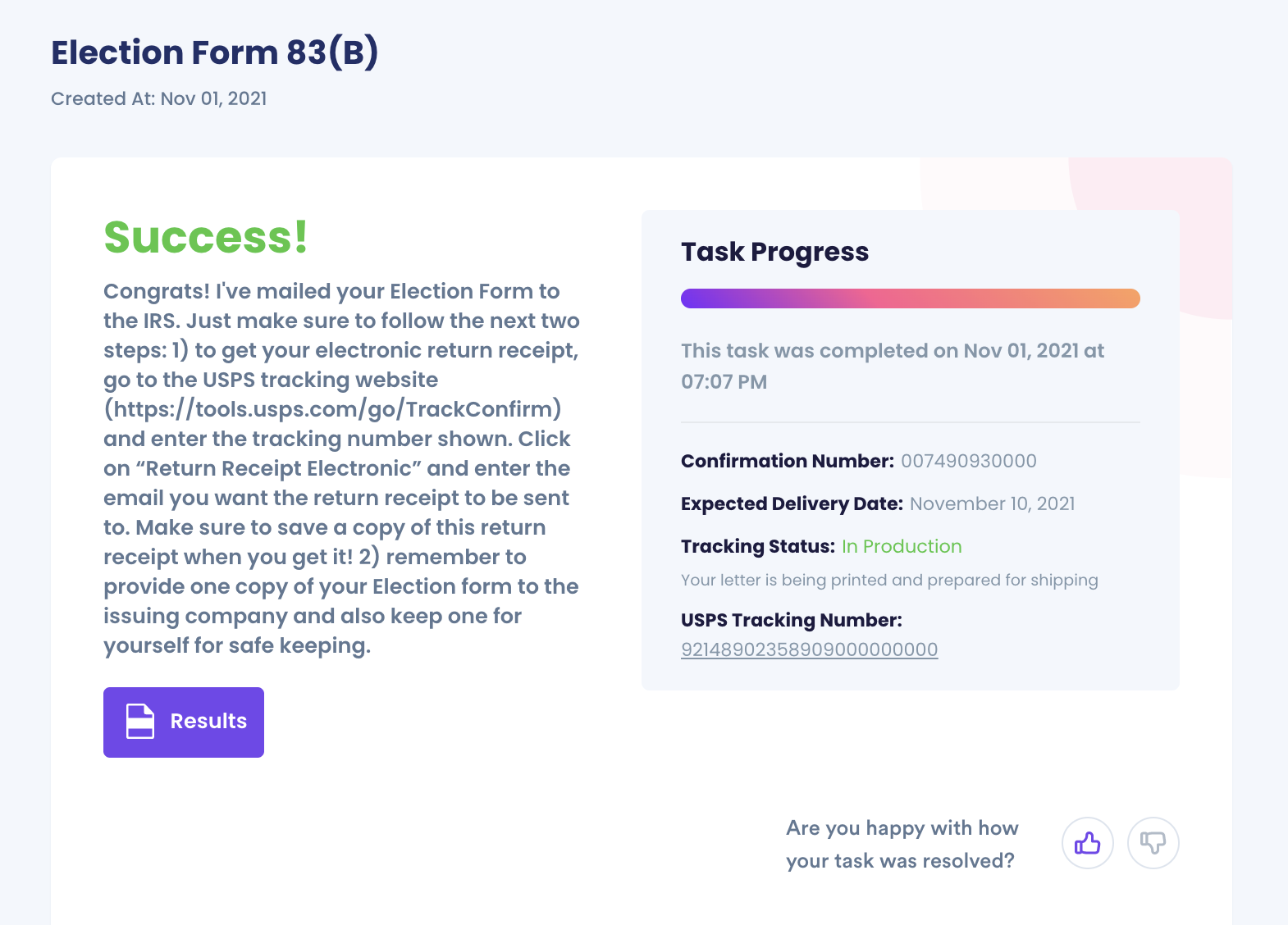

- And that's it! We'll email the grantee with a special link so they can access the DoNotPay 83(B) Election Form Filing Product and file their forms automatically. You'll be able to see the completed task on your dashboard, and the grantee will receive a tracking number to track the status of their shipment as well.

DoNotPay makes the entire process fast, easy and successful. Our professional and secure service saves time and can even help you get those 83(b) election forms filed before the deadline. We take precautions to ensure everything is done accurately, and you don't have to spend valuable time worrying about tedious forms. We do the work, and you get back to business.

DoNotPay Can Help You Understand 83(b) Elections

We realize that 83(b) elections can be confusing, but that is why we are here - to answer questions and help you navigate the process of filing. At DoNotPay, you can also learn more about:

What Else Can DoNotPay Do for You?

Helping you with 83(b) elections is just one of the many ways DoNotPay can help. We are also available to help with:

- Small Business Loan Request Letters

- Online Faxes

- Filing a Complaint

- Copyright Protection

- Breach of Contract

No matter what problem or concern you have, DoNotPay is here to answer your questions and resolve your issues.