Wrong Car Repossessed? 3 Steps to Get Your Car Back!

Car repossession is if the creditor and car repo agent follow the proper procedures to repossess your vehicle. Creditors engage repo agents in recovering cars for auction. Sometimes, repo agents breach some laws, leading to wrongful car repossession. A bank can also repossess your vehicle by mistake, leading to a breach of the loan agreement.

You can recover your vehicle if you detect any , especially where specific laws have been broken. However, the process is challenging and time-consuming, especially when the creditors and car repo agents are uncooperative. The process is slightly simple if a bank made a wrong car repossession. You are only required to review the terms and conditions of the loan agreement and notify your bank. The process is easily reversed if you have not violated any terms and conditions of the loan agreement.

DoNotPay can help you address a , especially where the repossession agent violated some consumer protection laws during the recovery process. The car repossession can only proceed if all the conditions for car repossession are met. Therefore, you must know your rights regarding car repossession to shield you from wrongful car repossession. DoNotPay helps you file a demand letter for wrongful car repossession per your state laws. It guarantees you reclaim your car so long as your claims are valid.

The Car Repossession Process

Creditors immediately start a car repossession procedure if you become delinquent in your loan repayment. Creditors must adhere to various consumer protection provisions to avoid wrongful car repossession. In most cases, they hire third parties, especially car repossessing agencies, to recover the vehicle from you. You are advised to always pick up all your belongings inside the car before a car repo agent leaves with your car.

You should always ensure you consult your creditors in case of any late payments. Creditors do not need a court order to repossess your vehicle. Missing or delaying payments without any communication is a violation of the loan agreement.

Justified car repossession is hard to revert. You can only recover your car by paying the defaulted amount in full or negotiating practical terms with your creditor. In essence, the lender can take you to court to pursue any leftover amount if the car auction did not fully settle your car loan.

Important Information You Should Note During the Car Repossession

You should note down the following details during the repossession. It might help you develop a strong case of wrongful car repossession if the creditors or repo agents break any laws during the car repossession. Be sure to include:

- Date and time of the event

- Car repossession agency name, agent's name, and tow truck license plate number

- Police officer name, badge number, and department

- Copy of the police report and number

- Witnesses' names and phone numbers

- Any photographs of the damage to the vehicle or property during the repossession

- Statement or video showing the car repossession process

The creditor should send you the following notices after justified car repossession:

| Notice | Details |

| Notice of intent to sell the car | It states the terms to:

|

| Deficiency Note | It is sent after the car auction notifying you of the sale amount deducted from the balance owed. It also informs you of the surplus or deficits after the auction. |

Addressing a Wrongful Car Repossession by Yourself

You can make a claim, especially if the creditor and car repo agency violated your consumer protection laws. It is always advisable that you involve an experienced consumer rights lawyer such as DoNotPay to help you file a strong case of wrongful car repossession.

Using DoNotPay to Address Wrongful Car Repossession

DoNotPay can help you file a demand letter for wrongful car repossession according to your state laws. You have to present compelling evidence that the car repossession was illegal to reclaim your vehicle. If the repossession was valid, DoNotPay can help you negotiate practical payment terms of the balance you owe to protect your car from being auctioned.

Follow the simple steps below under the car repossession product on DoNotPay to file for wrongful car repossession:

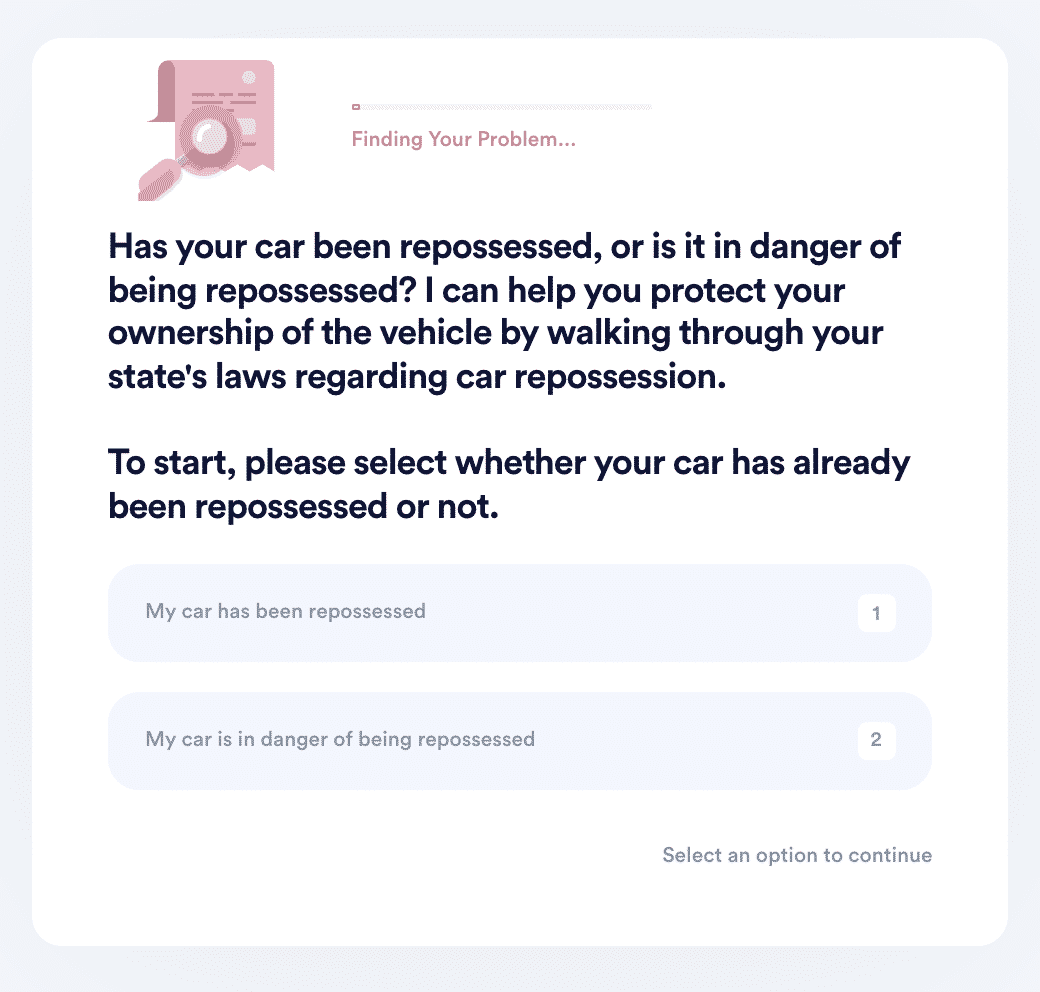

- Search "car repossession" on DoNotPay and select whether your car has been repossessed or is in danger of being repossessed.

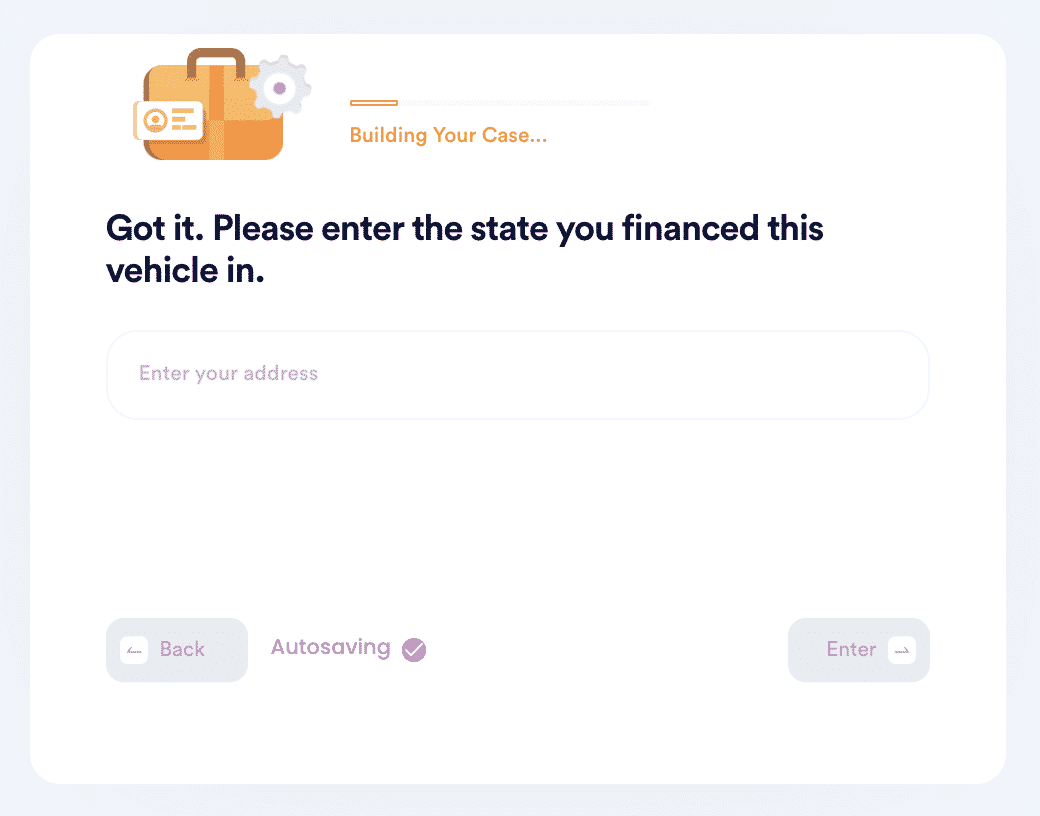

- Enter the state you financed this vehicle in, and let us walk you through your state's repossession laws to see if your car was or is being wrongfully repossessed.

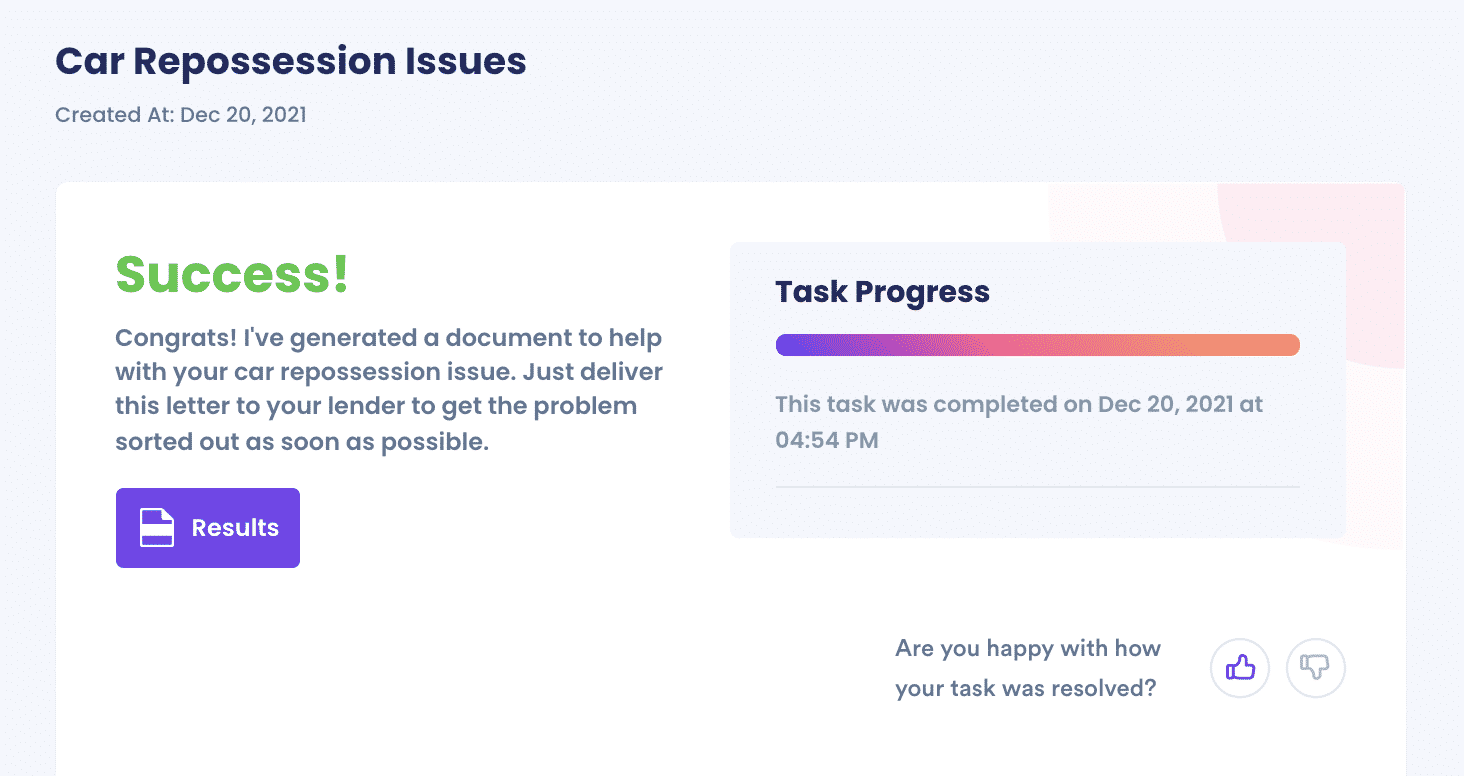

- If we can make a case for wrongful repossession, DoNotPay will file a demand letter on your behalf to the lender to fight against.

And that's it. DoNotPay will make sure your issue gets sent to the right place. We'll upload confirmation documents to your task for you to view, and if the contacts need more information, they will reach out to you personally via email or mail.

Main Reasons You Should Use DoNotPay:

It is fast. It only involves following simple steps under the car repossession product.

It is dependable. You are guaranteed to succeed in reclaiming your vehicle while using DoNotPay after a wrongful car repossession.

It is transparent. DoNotPay does not use any malicious processes to address client problems.

Other Social and services DoNotPay Offers:

- Finding unclaimed money

- Accessing free fast food

- Drafting financial aid appeal letters

- Finding lost items

- Inflation pay request

Check out DoNotPay's car repossession product to recover your car after wrongful car repossession!