How to Report Price Gouging From Homeowners' Insurance

Price gouging is illegal in most states, but that doesn't stop some . They get away with it because many don't know what price gouging is or who to report it to.

Homeowners' insurance providers aren't the only ones that engage in price gouging. Price gouging on Amazon is a problem, but it's unclear what to do about it.

Amazon isn't the only online place where price gouging happens; price gouging happens on eBay too. Whenever there's a valuable commodity, you'll find price gouging. That's why it's most common in gas stations and drug stores.

If you've been a victim of price gouging, you deserve to report it and be compensated. This article will talk about what price gouging is, how to report it if you are a victim of price gouging and how DoNotPay makes it quicker and easier than reporting it yourself.

What Qualifies as Price Gouging?

" Price gouging refers to when retailers and others take advantage of spikes in demand by charging exorbitant prices for necessities, often after a natural disaster or other state of emergency. "

"In most states, price gouging is set as a violation of unfair or deceptive trade practices law. Most of these laws provide for civil penalties, as enforced by the state attorney general, while some state laws also enforce criminal penalties for price gouging violations."

How Do You Spot Price Gouging in Homeowners ' Insurance?

If your state has had some natural disaster and insurance companies have paid out a lot of money, keep an eye on your insurance rates. While it's normal for insurance rates to rise somewhat over time, you may be the victim of .

What Should I Do if My Homeowners ' Insurance is Price Gouging?

According to insweb.com, the insurance companies with the highest net premiums include:

- State Farm

- Allstate

- Liberty Mutual

- Berkshire Hathaway Insurance (including Geico)

- Travelers Group

These insurance corporations are likely the most advertised, which explains why they are the largest. If you're being gouged by one of these giants, you only have two choices either get a lawyer and send demand letters to or hope the state attorney general wants to fight. There must be a better way.

What Goods and Services Can Be Protected From Price Gouging?

Any necessary good or service set at an inflated price can be considered price gouging.

Where Do I Report Price Gouging?

You should report any potential price gouging to your state Attorney General. You will generally need:

- The name of the store or vendor where you saw the item and their address.

- Product details, including, but are not limited to, the product type, brand, size, and price.

- The date, time, and location you saw the product.

- You can improve the investigation by providing a picture of the item.

What Do I Need to Send Demand Letters To My Homeowners ' Insurance or Start a Class Action?

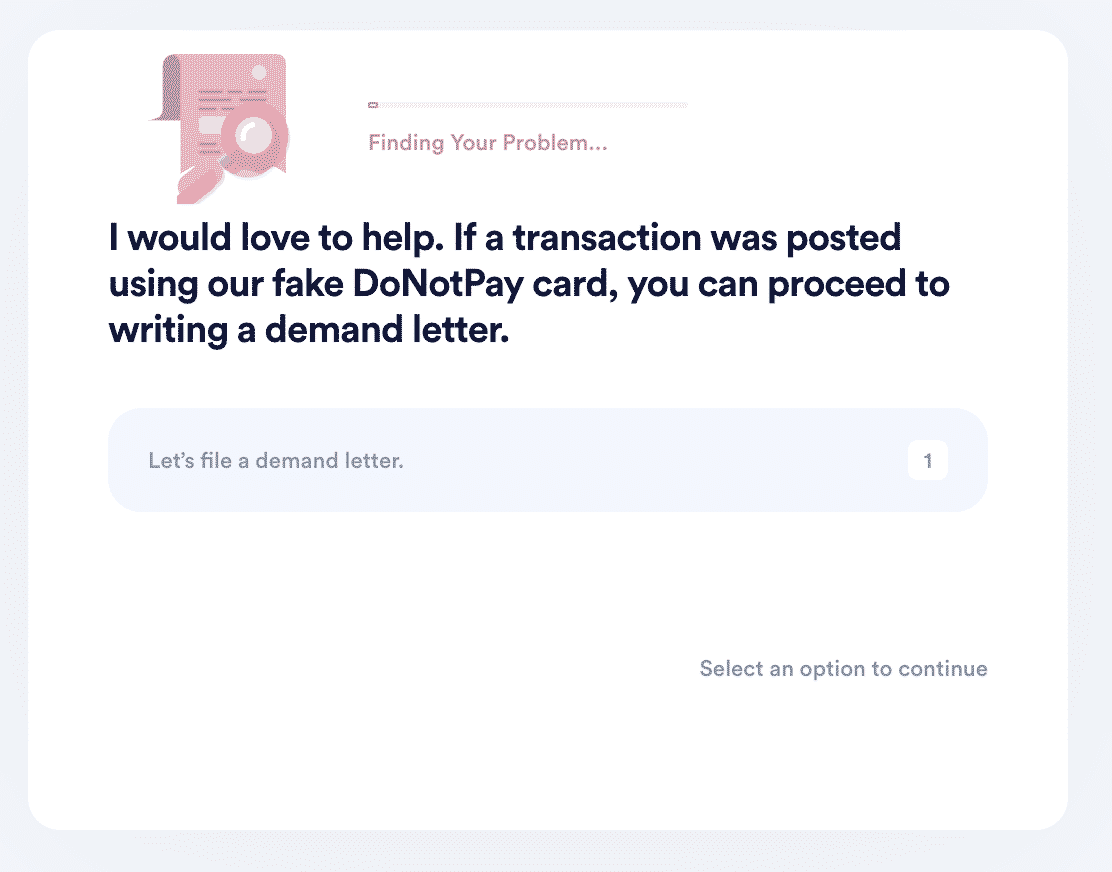

You need help, and sadly most lawyers don't want to take on large insurance companies. Luckily, DoNotPay can help you send demand letters to your homeowners ' insurance or start a class action lawsuit.

How to Protect Against Price Gouging Using DoNotPay

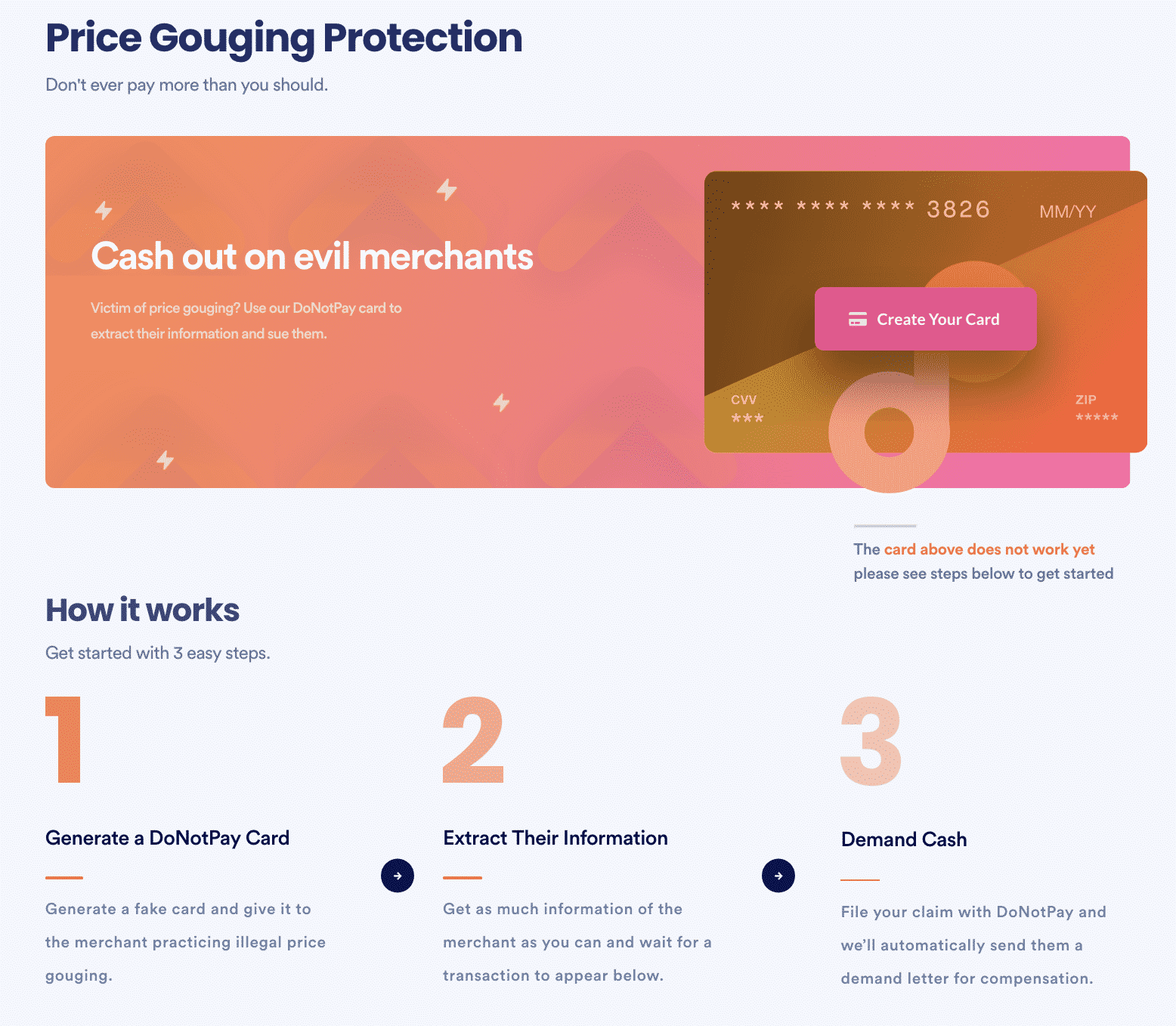

If you want to protect against price gouging but don't know where to start, DoNotPay has you covered in 5 easy steps:

- Open the Price Gouging Protection product on DoNotPay.

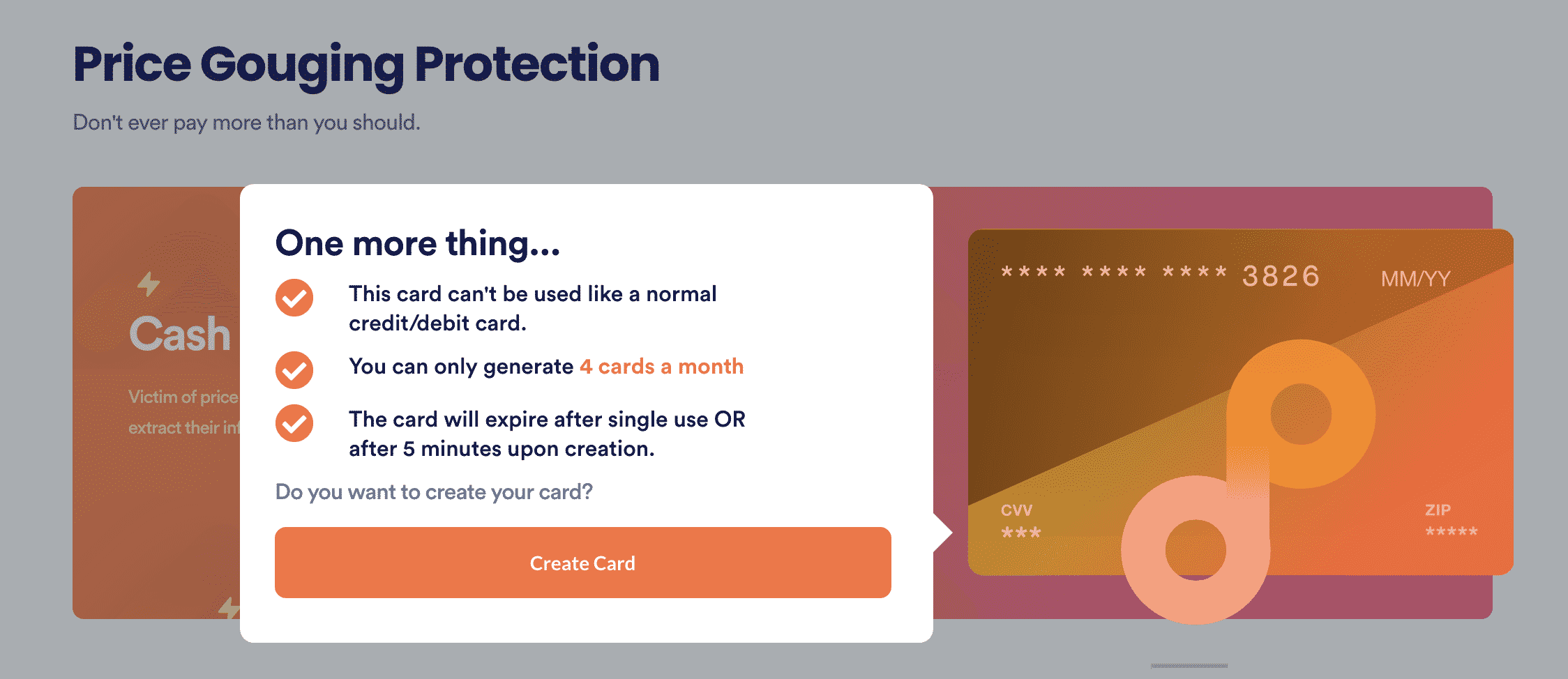

- Generate a fake credit card to use with the merchant.

- Complete the transaction with the fake credit card.

- Save a photo of the transaction as evidence and start the demand letter process.

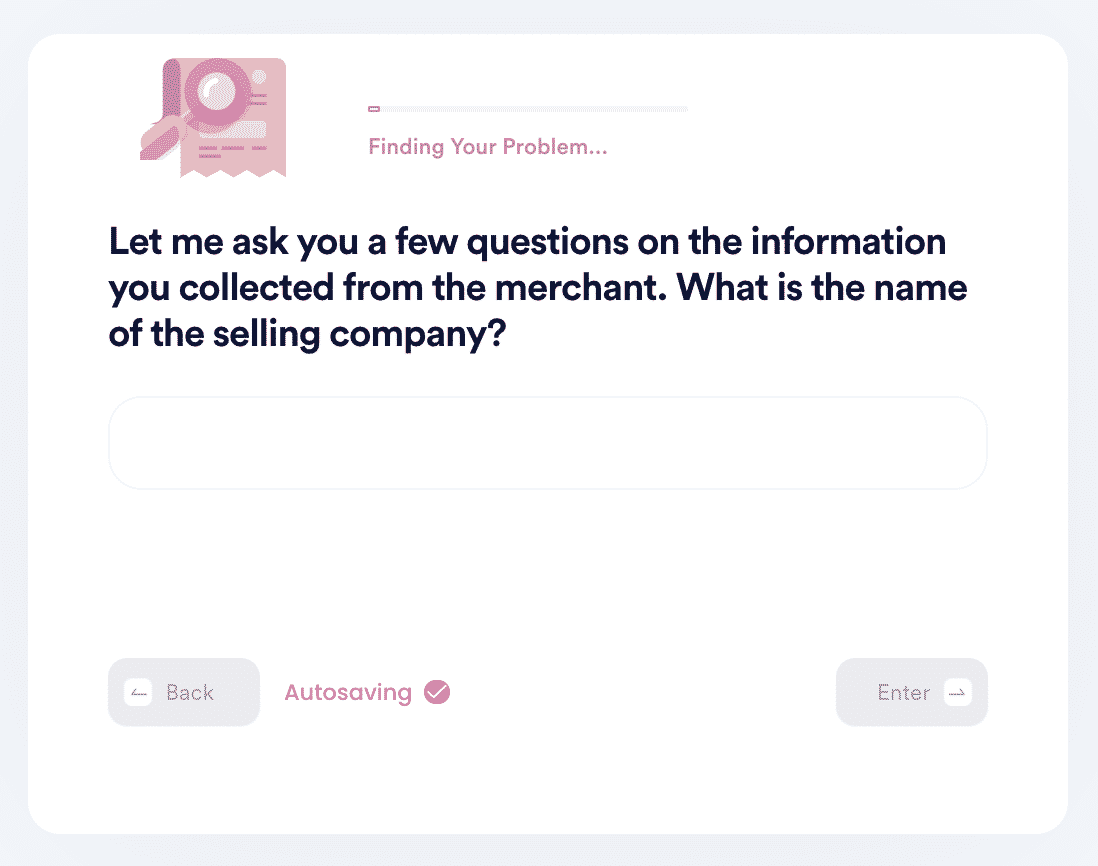

- Answer a few questions through our chatbot about the merchant and transaction.

Why Use DoNotPay to Report Your Homeowners' Insurance for Price Gouging?

You probably won't get much help from your state's district attorney against a large insurance firm, and lawyers are expensive. DoNotPay is the perfect solution to stop your homeowners' insurance from price gouging.

| Fast | Instead of spending hours talking to lawyers or your district attorney, DoNotPay helps you quickly. |

| Easy | DoNotPay collects the evidence and deals with the issues, so you don't have to. |

| Successful | We've helped thousands of people report their homeowners' insurance for price gouging, and we can help you too. |

DoNotPay Works Across All Merchants and Companies Too

DoNotPay doesn't just help you report price gouging. It can help you with so many other things too.

- DoNotPay can help with price gouging protection the same way it can with reporting tax fraud.

- Or it can help you report price gouging to the government of California the same way it can to the government of New York.

What Else Can DoNotPay Do?

DoNotPay has a multitude of other services that can help you tackle other issues you may encounter, such as:

- Canceling cable and credit cards

- Getting chargeback and refunds

- Helping manage your bills

- Assisting you in small claims court

Don't put up with price gouging. Let DoNotPay help today.

By

By