How to Fight Breach of Peace During Repossession Process

Your creditor has the right to take possession of your property if you default on your lease contract. The repossession process is supposed to be legally processed and executed peacefully.

Sometimes, it is hard to have a peaceful property repossession, resulting in a breach of peace. For instance, if a repo agent tows away your car despite your protests, it is considered a breach of peace.

Getting justice for a breach of peace repossession often takes an extended period, depending on various factors. Use DoNotPay to quickly and successfully advocate for yourself in a .

What Does the Law Say about Property Repossession?

Property repossession is in the US. According to Federal Regulations Code 38, a creditor has the authority to repossess property acquired on credit if the debtor defaults on the payment agreement.

There are laid out guidelines that dictate how a repossession should be carried out, including

- Creditor involving a repo agent or towing company to help in the repo process

- Notifying local police of an impending repossession

- The repo agents should not break into your premises or access locked property without your permission

- Local police may be present during the repo but should in no way interfere or help in the process

The creditors have the liberty to resell your property or send demand letters to you for defaulting on the payment agreement. There is no set time limit for a repossession to occur. Your car can be repossessed any day after you default on your payment.

What Is a Breach of Peace?

A breach of peace occurs when repossession is conducted against the law. A breach of the peace when attempting to repossess a vehicle can include the following actions by the creditor to repossess the vehicle and here’s what you need to do:

| Situation | What to Do |

| Threatening to send the debtor to prison | A repo agent may claim you're breaking the law by trying to stop the repossession, and even threaten to have you arrested or sent to prison; but as long as you're not hurting anyone, these are empty threats. This is a civil matter, not a criminal one. You won't go to prison for missing your car payments or for trying peacefully to stop the repossession. |

| Breaking into the home of the debtor | If you need to protect your car from repossession, close it up in a garage or put it behind a locked fence. This is only a short-term solution, but it gives you time to call a KC bankruptcy lawyer and stop the repossession from going through. |

| Repossess the collateral despite the consumer's objections | If the borrower becomes aware of the repo man's intrusion and objects to the repo man being on their property, the repo man must leave or they're trespassing. |

| Entering into a closed garage | Protecting borrowers' garages as the law protects the rest of their homes makes sense because homeowners expect that their right of privacy and seclusion extends to all of their homes and unlawful entry into their garage also creates a risk of retaliatory violence. |

| Threatening the use of physical force or violence | If a repo man threatens you physically or wields any sort of weapon when approaching you, report it to the police as soon as possible. |

| Forcing the debtor out of his vehicle | In general, repo agents are not supposed to touch you or use force on you, unless in self-defense. |

If the repo agent tows your vehicle from your private driveway without breaking into your premises, it does not count as a breach of peace. The exchange of harsh words and verbal confrontation also doesn't count as a breach of peace.

A qualified lawyer must assess the totality of the occurrences and the circumstances before a situation is labeled as a breach of peace.

What to Do After a Breach of Peace during Repossession

If your creditors, repo agents, or the police cause a breach of peace, you have the authority to send demand letters to them for actual and statutory damages under federal and particular state laws.

What Do I Require to Send Demand Letters To for a Breach of Peace Repossession?

Before setting out to send demand letters to your wrongdoers, you need evidence and a basis for your case. Make sure you have the following:

- A video recording of the complete occurrence

- Name of the repo company

- Name and badge numbers of the involved police officers

- Copy of the police report on the incident

- A photo of the affected property

- Date and time of the repo

The repo agents or your creditors are required to pay the penalty or compensate you for any damage you incurred during the incident.

Advocate for a Breach of Peace Repossession with the Help of DoNotPay

Seeking justice after property repossession might be a challenging task. Sometimes, the analysis of breach of peace occurrences might overlook critical details, leaving you with no leverage. DoNotPay can help you successfully advocate for yourself after a breach of peace repo by simply signing up and providing information as prompted.

Besides fighting against breach of peace repossession, DoNotPay can help you regain your repossessed property and vehicles.

How DoNotPay Can Help with Car Repossessions

DoNotPay can help you file a demand letter for wrongful possession using your state's laws and help you reclaim your vehicle. In the case the repo was valid, you will have to pay off any balance you owe to reclaim your vehicle.

If you can't afford the payments, DoNotPay can help you ask for a payment plan or negotiate the balance you owe.

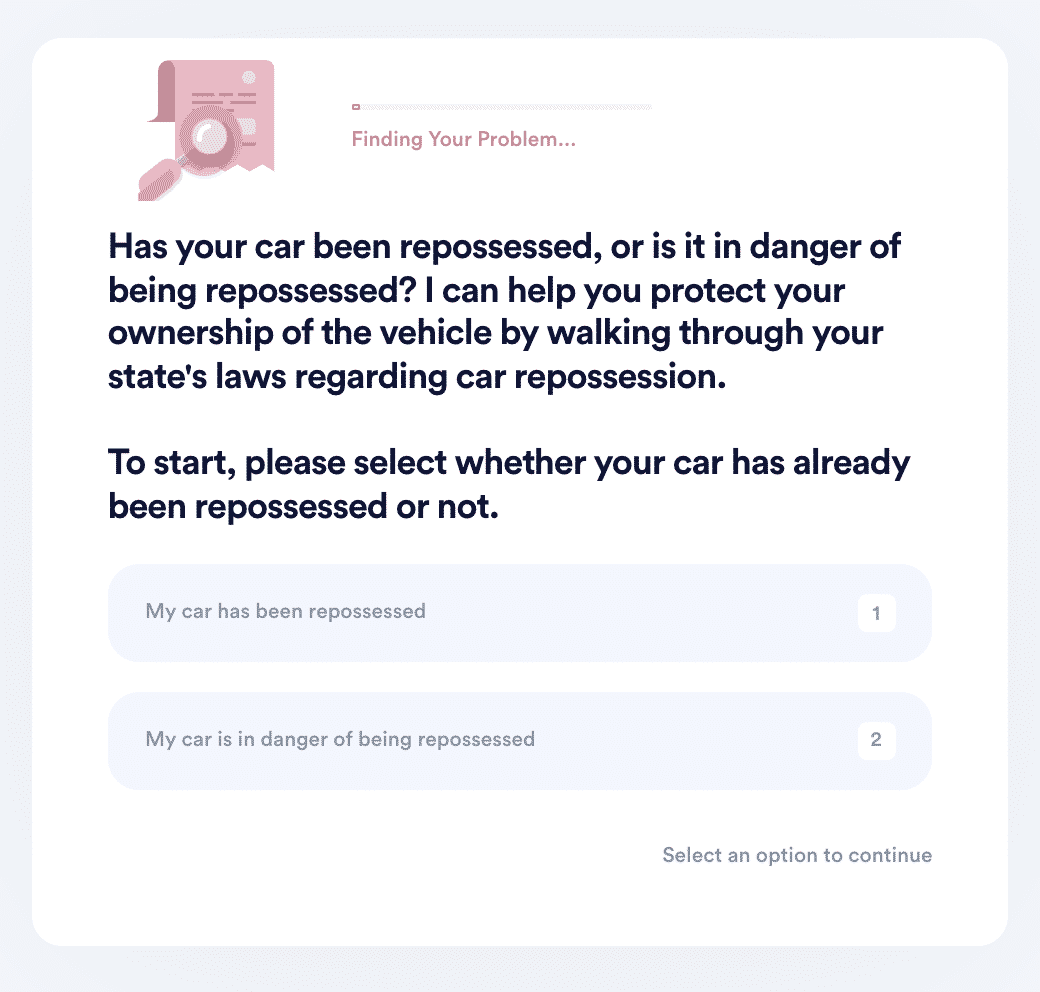

- Search "car repossession" on DoNotPay and select whether your car has been repossessed or is in danger of being repossessed.

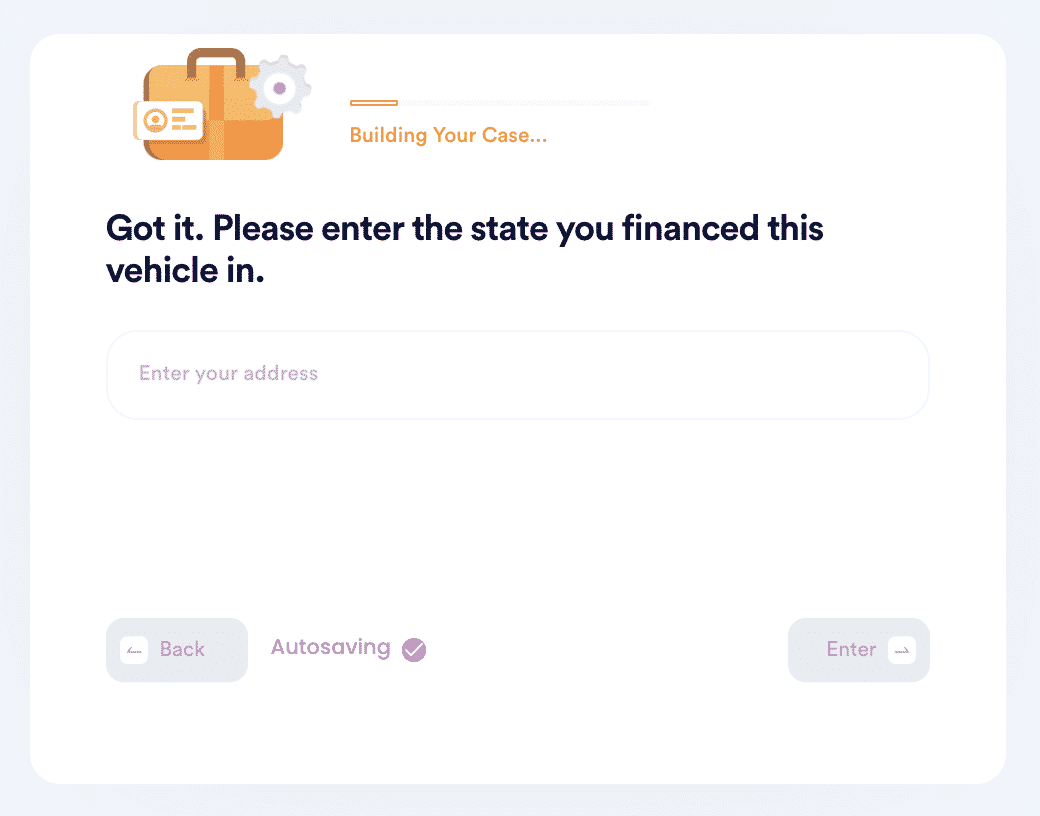

- Enter the state you financed this vehicle in, and let us walk you through your state's repossession laws to see if your car was or is being wrongfully repossessed.

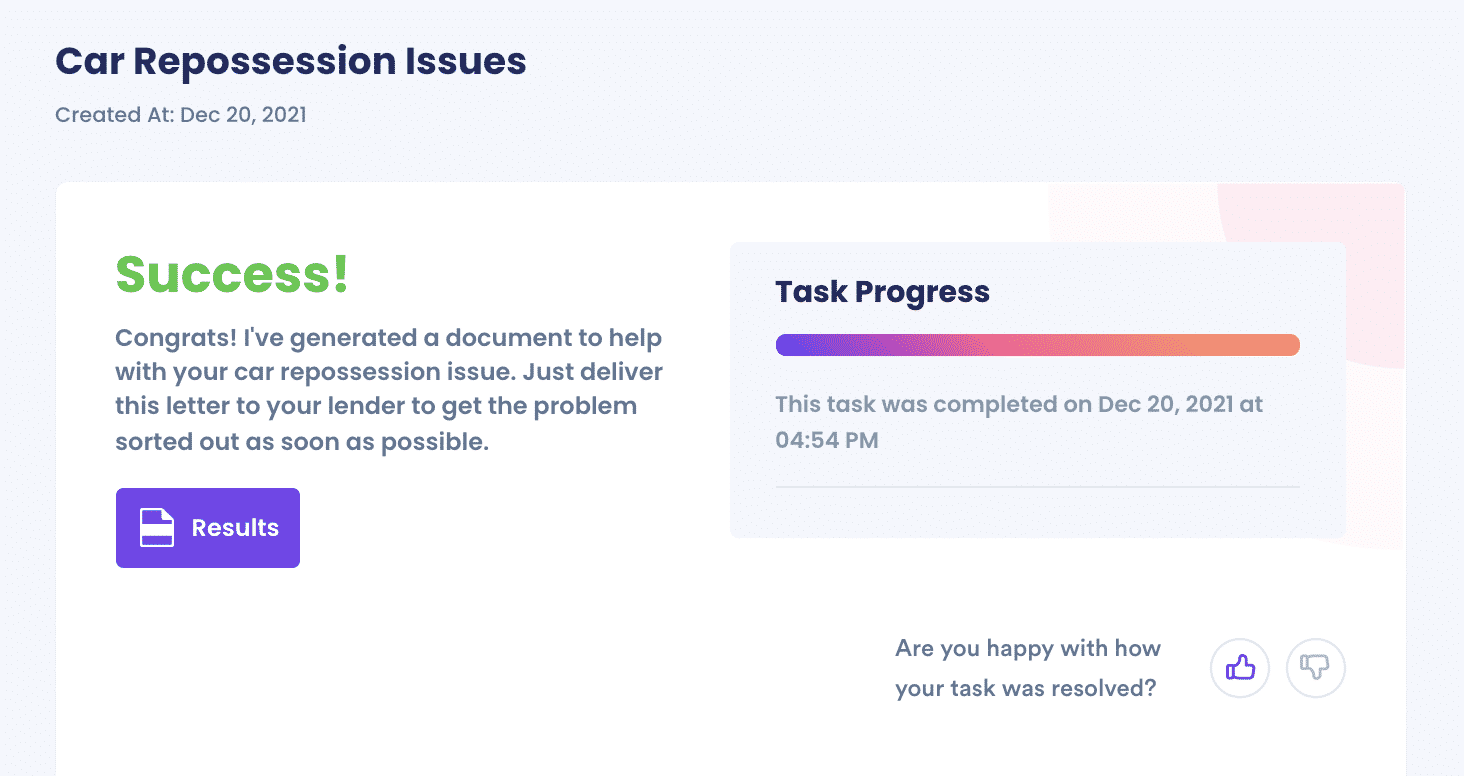

- If we can make a case for wrongful repossession, DoNotPay will file a demand letter on your behalf to the lender to fight against.

And that's it! DoNotPay will make sure your issue gets sent to the right place. We'll upload confirmation documents to your task for you to view, and if the contacts need more information, they will reach out to you personally via email or mail.

Why Use DoNotPay to Resolve Your Car Repossession Issues?

DoNotPay is your AI Consumer Champion. Sign up on our website to access our Property Repossession product and successfully advocate for yourself after a .

The Property Repossession product allows you to advocate for a breach of peace with just a click of a button. The process is smooth, fast, and reliable.

DoNotPay Can Help You With Other Services

DoNotPay works with private companies and government entities to do more than reduce your trading fees. We simplify your tedious paperwork, save you time lining up in offices, and bring the service right to you just by a click of a button.

Sign up on our website and enjoy the following services and more:

- Acquire a clean credit report

- Cancel any service and subscription

- Send Demand Letters To for breach of contract

- Appeal for a banned account

- Apply for chargebacks and refunds

- And may more

Try it today!