Hit It Big in the Pennsylvania Lottery? Is There PA Lottery Tax on Winnings? Here 's What You Need to Know

Whether you hit the jackpot or just won enough for an ice-cold soda, winning the lottery can be a lifesaver when you least expect it. It's not all wine and roses, however. Winning the lottery has its downside, and Pennsylvania lottery taxes are the most significant factor.

As far as the federal and state governments are concerned, lottery winnings are taxable income. Lottery winnings are taxed in the same manner as salaries, wages, and other earnings. You must report the total amount of lottery winnings to the IRS.

This is the percentage of taxes you have to pay if you win the lottery:

| Federal tax rate | The federal government taxes 24% of all winnings off the top. The remainder of the money is also taxable. The winner is expected to pay those taxes when they file their yearly taxes. |

| Pennsylvania tax rate | . The size of the jackpot, city of residence, and city of purchase determine the exact amount of taxes owed. |

Paying taxes is a part of life in America, but that doesn't make it any easier. It can be a complicated, confusing, and even scary process. Fortunately, DoNotPay provides an easier way.

Are Gambling Losses Tax Deductible in Pennsylvania?

The short answer is yes. Gambling losses are tax-deductible, although the process is cumbersome. You can only deduct to the extent of your winnings and only if you itemize. Keeping track of your winnings and losses is mandatory to deduct. This includes, but is not limited to:

- Any type of lottery

- Raffles

- Horse races

- Dog races

- Casino games

- Poker games

- Sports betting

Another prerequisite to deducting losses is keeping diligent records that include:

- Date and type of gambling

- Name and address of gambling venues

- People you gambled with

- The amount you won and lost

There are six primary documents commonly required by the IRS to accept deductions for gambling losses. You will have to put them in a safe place until tax time. The documents include:

- Form W-2G

- Form 5754

- Wagering tickets

- Canceled checks

- Credit card records

- Receipts from the gambling venue

While , it's a long and confusing process. If you don't have experience in tax law, it could be even worse.

What Kind of Lottery Winnings Does Pennsylvania Tax?

Pennsylvania taxes any object or service considered a prize. Items won could be cash and non-cash prizes and mixed prizes. A prize is defined as anything offered in a contest, lottery, or raffle.

Cash Prizes

A cash prize is anything paid in cash or with a cash equivalent such as checks, money orders, or electronic deposits. Annuity payments count as cash prizes.

Non-cash Prizes

Non-cash prizes are real and personal property that isn 't cash, tangible and intangible. A store gift card is an example of a non-cash prize.

Mixed Prizes

As the name suggests, mixed prizes consist of cash and non-cash prizes. An example could be a cash prize with associated taxes and fees prepaid for the recipient. Those taxes and fees are considered a cash prize and apply to Pennsylvania personal income tax, even if the non-cash prize is not taxable.

What isn't considered cash or non-cash prize in Pennsylvania isn't always easy to determine. It's better to be safe than sorry regarding state and federal taxes. Always consult a tax professional if you're going to compute your taxes by yourself.

Pay Your Lottery Taxes in PA the Easy Way With DoNotPay

Save time and aggravation when paying your Pennsylvania lottery taxes with DoNotPay. Getting started is easy. It's just five simple steps.

1. Search gambling tax deduction on DoNotPay.

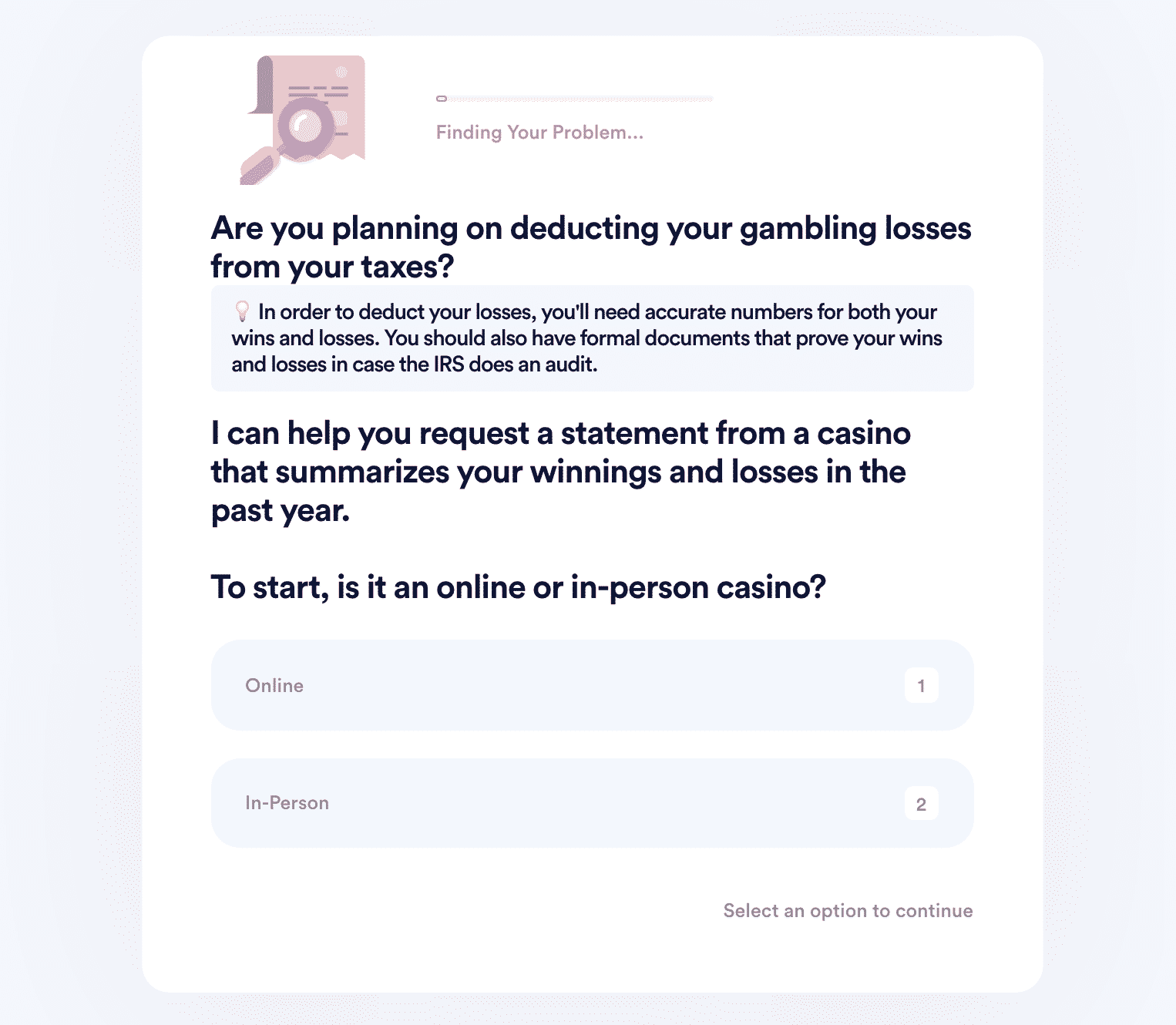

2. Enter the name of the casino and indicate whether it's online or in- person.

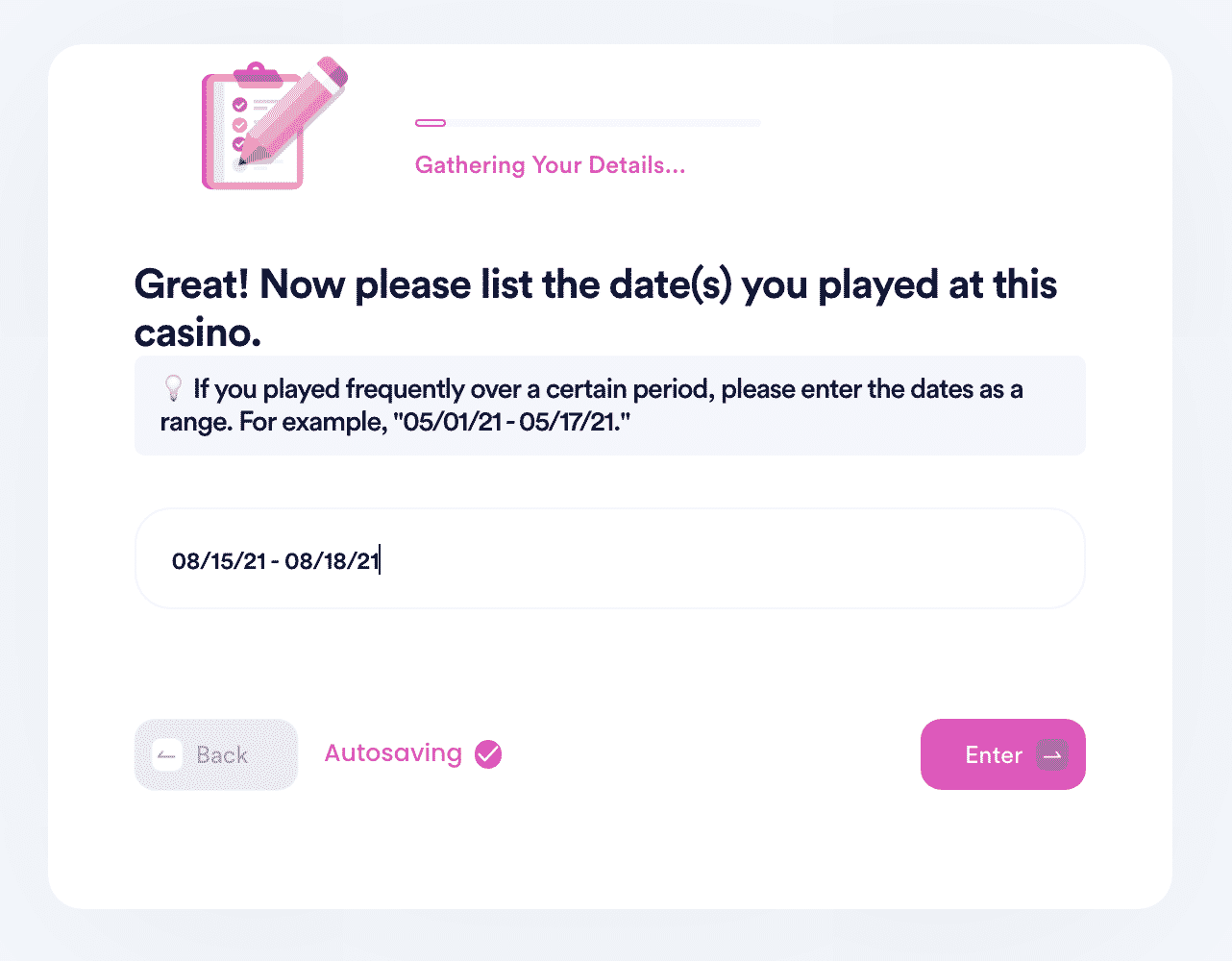

3. Tell us more about the dates and games you played, so the casino can identify your playing records.

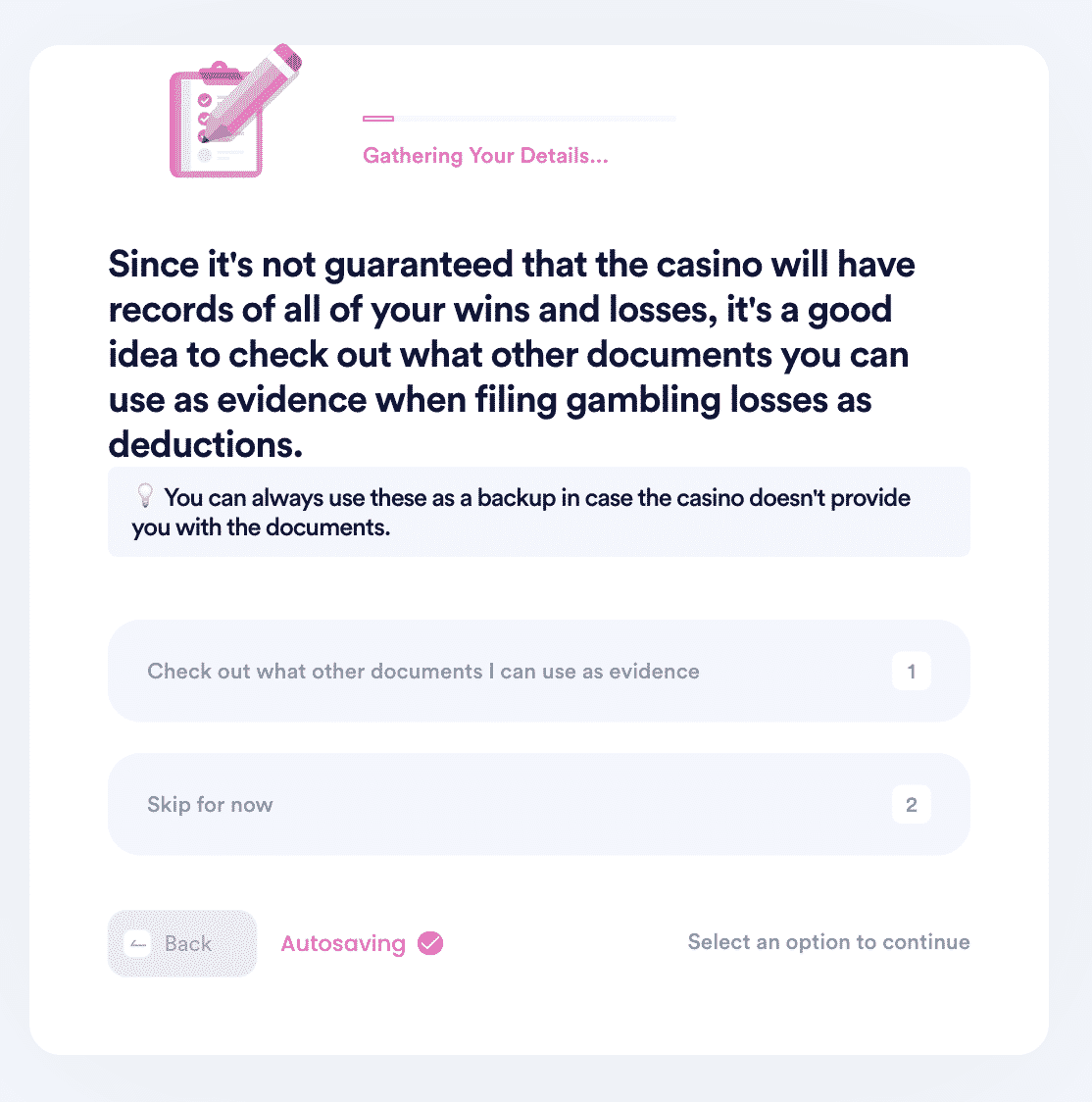

4. Select whether you have a players card or other form of membership with the casino and enter the relevant details. You also have the option to review other documents you can use as evidence when filing deductions.

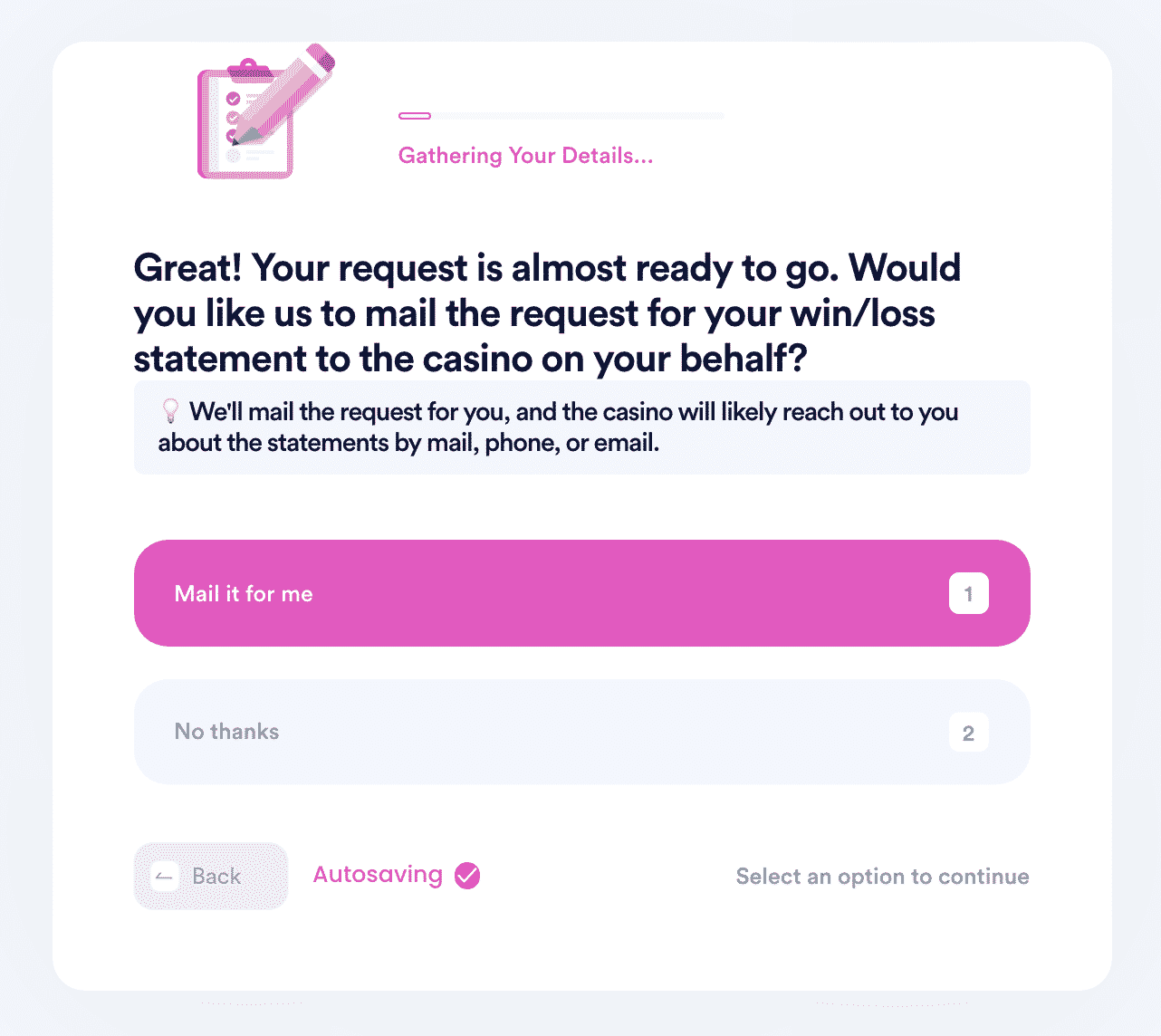

5. Select whether you want DoNotPay to mail the form for you.

Why Use DoNotPay for Pennsylvania Lottery Taxes?

The Lottery Tax product from DoNotPay makes paying lottery taxes in Pennsylvania a breeze. There are no trips to the post office, printing, copies, or computer woes--best of all, no guesswork. Y ou 'll know within minutes if you owe any PA lottery tax and, if so, how much.

DoNotPay Works Across Multiple Entities With Ease

DoNotPay is a one-stop destination for many of life's most irritating tasks. We can help you register a trademark, appeal parking tickets, and fight corporations. Lottery winners can find DoNotPay especially helpful for all the most common questions, such as how much you can win before paying taxes and how gambling loss taxes work in other states, such as Ohio.

DoNotPay also provides a lottery tax calculator, helps you understand how much you can win before you have to pay, and everything you need to know about gambling loss taxes.

DoNotPay is the AI Consumer Champion that can help you do everything from paying lottery taxes to filing a lawsuit. Our patented software is successful, efficient, and affordable. Let us help you simplify your life today.