How Michigan Collects Taxes On Your Lottery Winnings?

Doing any kind of gambling is going to lead to risk sooner or later. What happens if you win the and end up having to pay taxes? You might be able to get tax deductions depending on if you had any gambling losses.

Our DoNotPay app helps you take tax deductions on gambling in a way that doesn't involve protracted steps.

Are Losses in the Michigan Lottery Tax Deductible?

Any winnings in the Michigan state lottery are certainly taxable and need reporting on your income tax returns. Now a major gambling center in America, Michigan keeps a close eye on making sure everyone pays their taxes on all forms of gambling in their state.

What about any losses while playing the lottery? It's possible to deduct losses if you itemize on your return. However, your gambling losses can't exceed your wins in any given year.

All gambling wins and losses need substantiating when reporting to the IRS. The way to make this less confusing is to keep all records of your Michigan lottery wins or losses.

Still, much of this is a complicated process taking far too much time.

What if You Don't Remember Your Gambling Wins/Losses

Perhaps you don't keep exact records of your gambling wins or losses. While you should, it's easy to forget when your life gets busy.

Our DoNotPay app helps you with this through one specific method where we contact the casino where you play regularly. They can provide information on your specific losses or wins.

If you would like to avoid struggling to record your wins and losses in the future, you may consider using one of the following methods (and the advantages of each) for tracking those outcomes:

| Pen and paper | You are always welcomed to use a notebook, pen, and paper to log your wins and losses as you record them. If you are an infrequent gambler, or if you are hyper aware of your wins and losses, this method may work just fine for you. |

| Bet tracking software/app | Many bet-tracking apps and pieces of software exist that can automatically tabulate your wins and losses for you as you record them. Simply plug in the wagers as they are made and the outcome. The app/software will do the rest. |

| Request a printout of your account statement | Casino players with accounts set up with the casino beforehand can request a printout of their wins and losses from that casino. The establishment should have those records on hand and available when requested. |

How to Take Tax Deductions From the Michigan Lottery On Your Own

You may want to contact the casino in question where you played your Michigan lottery ticket. Or, if you won the lottery by playing a ticket independently, you'll want to contact the Michigan lottery office.

If you contact your casino, you might want to ask about:

- A recent law that allows more deductions for your gambling losses to offset a previous loophole.

- A record of your most recent gambling losses.

- All other information about your gambling/lottery plays so you can use the information to send to the IRS.

Contacting any of these places is going to take time. In many cases, it may involve long wait times on the phone or filling out forms via mail or online. Who has the time to deal with procedures like that?

Next Steps if You Can't Take Tax Deductions from the Michigan Lottery By Yourself

Doing those above steps is not easy when you're busy with other things in life. You could hire your CPA to look into your tax losses on your gambling. Going this route might save you time, but it'll also add to the bill of services they render.

Most CPAs don't work for cheap if they have to do extra tasks when preparing your taxes.

The best solution is to use our DoNotPay app to help you with gambling losses in various ways.

Solve Your Michigan Lottery Tax Dilemma Using DoNotPay

We make it easy to request a gambling win/loss statement using our five easy steps:

1. Search Gambling Tax Deduction on DoNotPay.

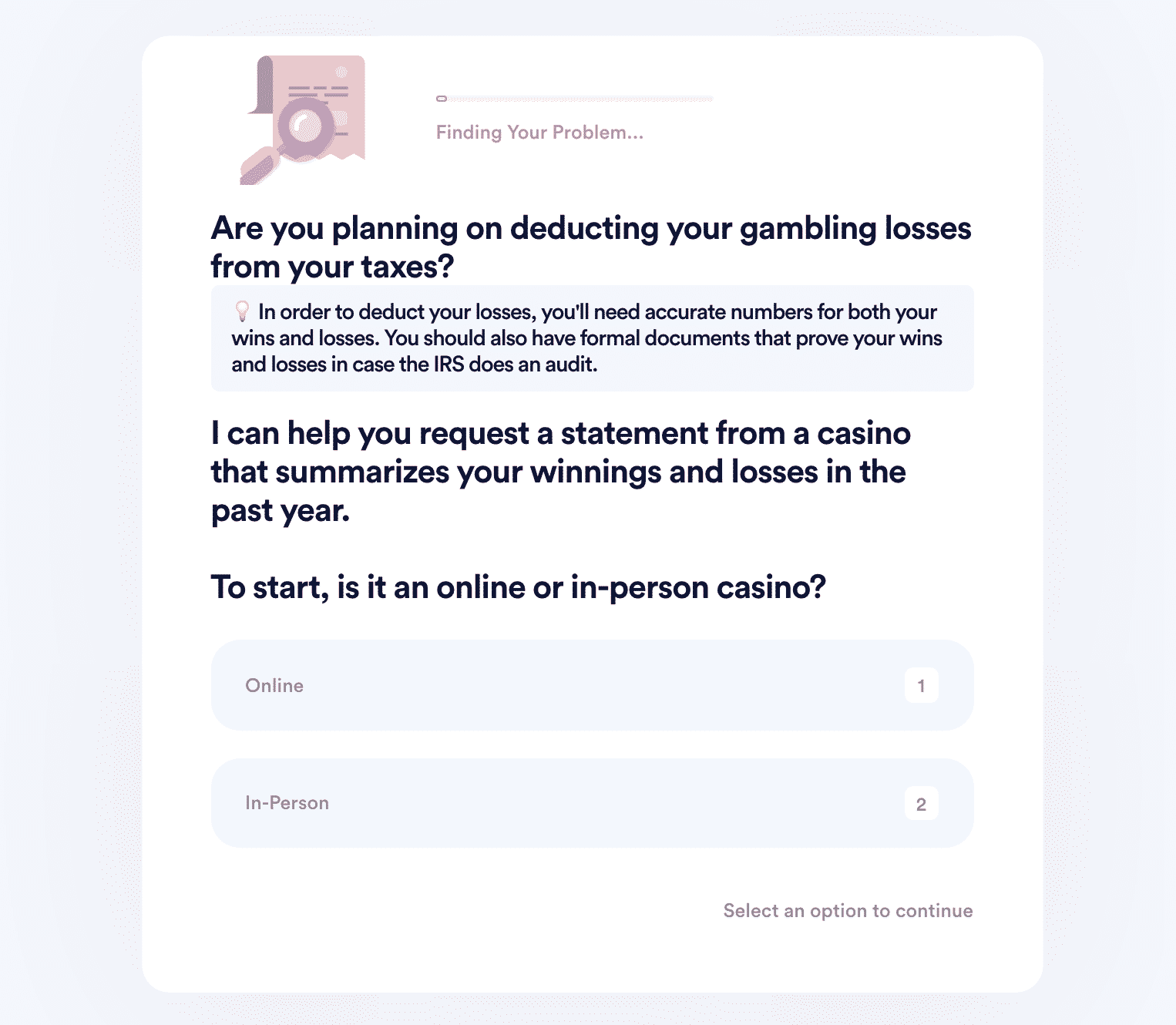

2. Enter the name of the casino and indicate whether it's online or in-person.

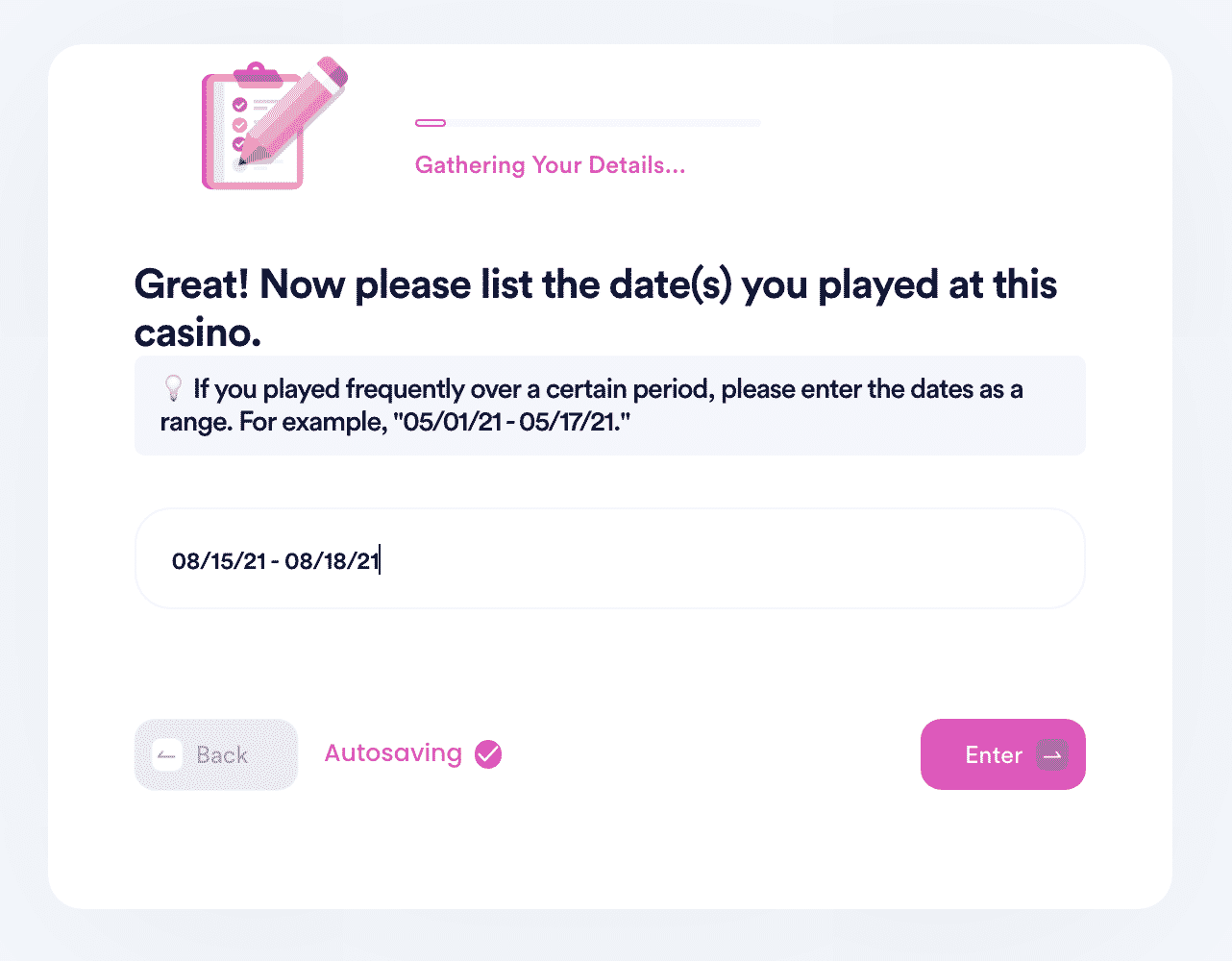

3. Tell us more about the dates and games you played, so the casino can identify your playing records.

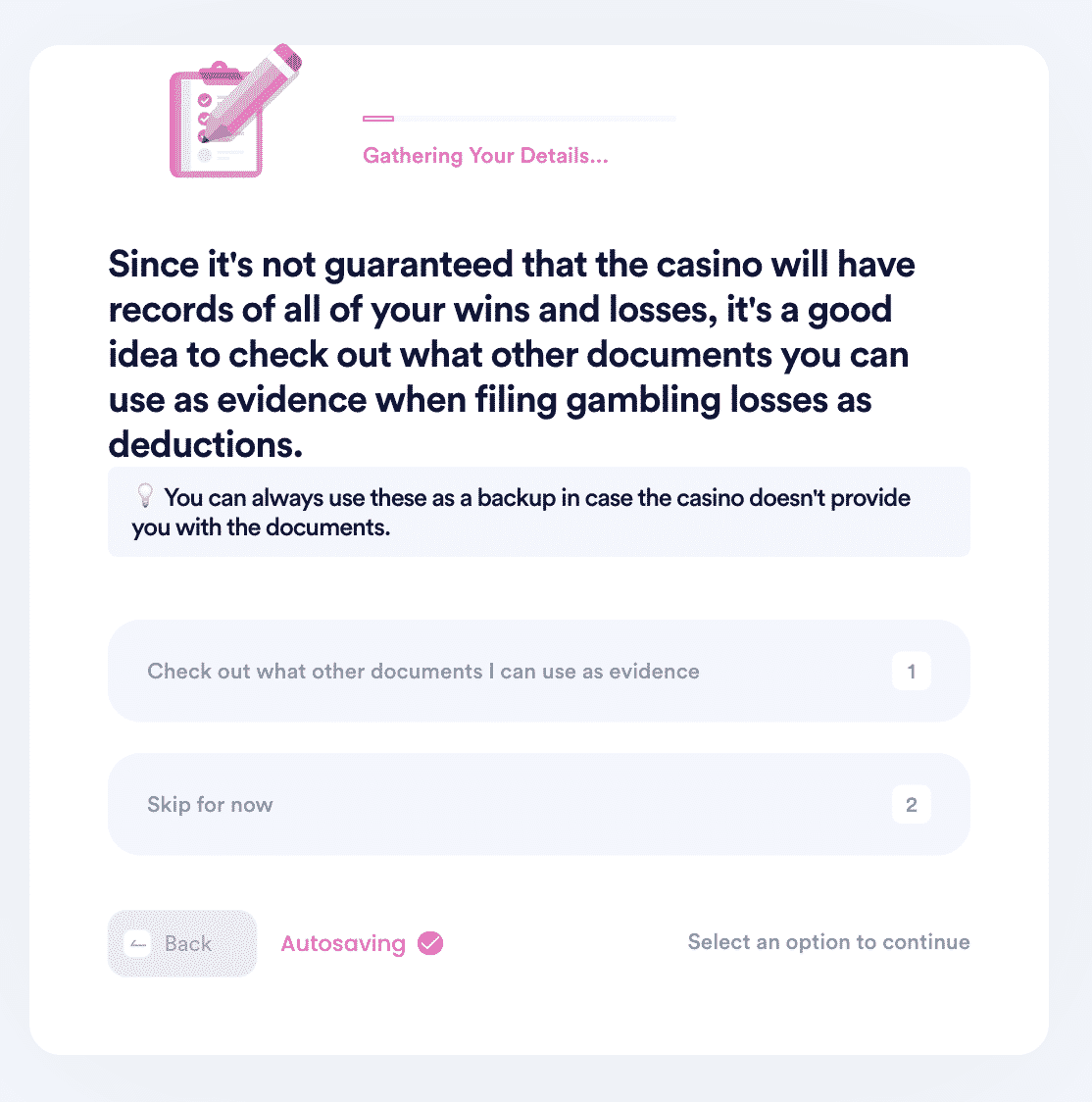

4. Select whether you have a players card or other form of membership with the casino and enter the relevant details. You also have the option to review other documents you can use as evidence when filing deductions.

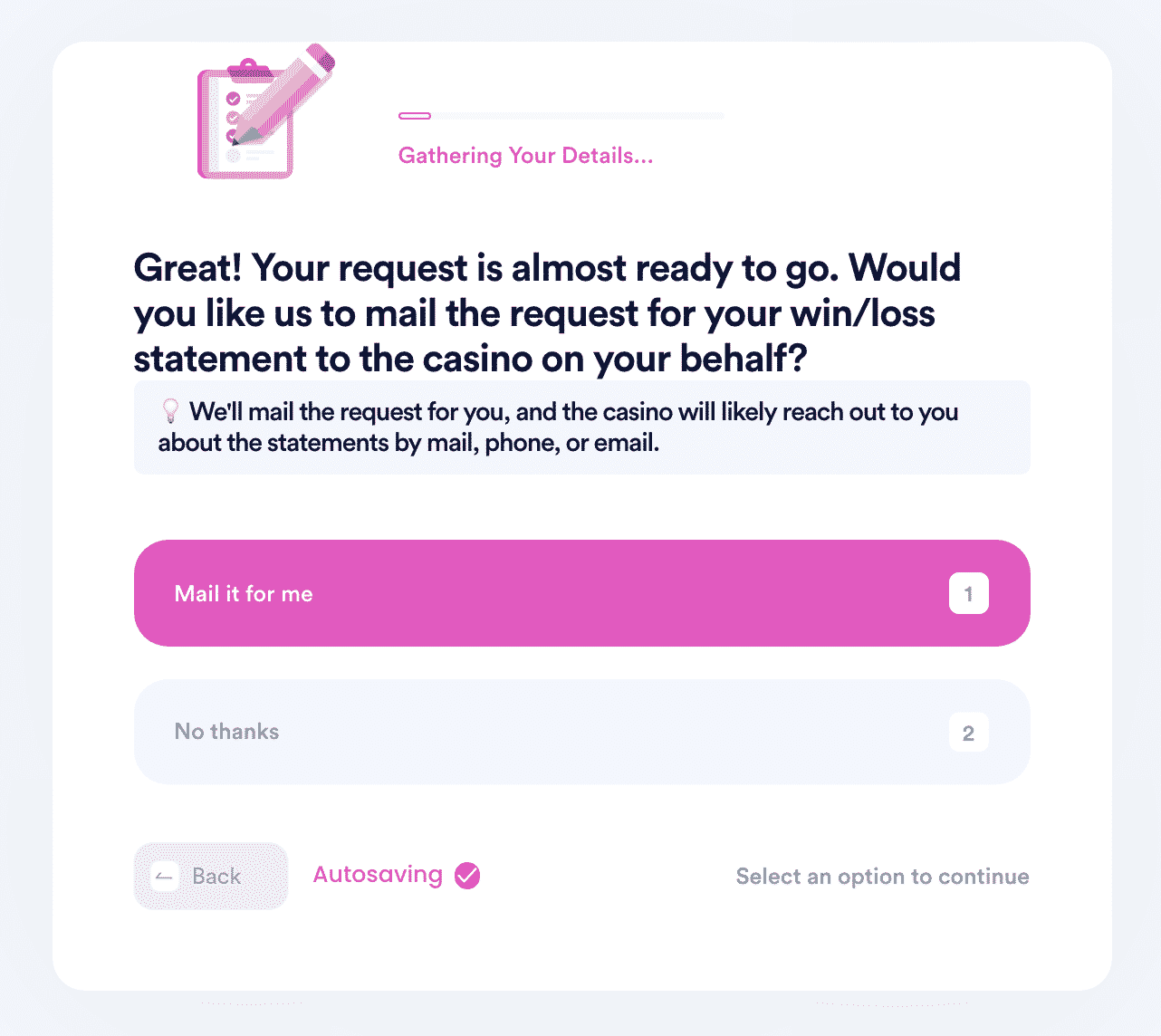

5. Select whether you want DoNotPay to mail the form for you.

Why Use DoNotPay to Take Tax Losses on the Michigan Lottery?

We've created three good reasons why using our app is what you need to take your loss:

- It's fast - No more having to wait on customer service phone lines or filling out complicated forms to see what your gambling losses are.

- It's easy - We do all the casino/lottery contact work for you so you don't have to.

- It's successful - Many people continue to turn to our app to help take tax deductions on gambling. We guarantee the same success rate.

DoNotPay Works Across Multiple Companies

In addition to helping you get a Michigan lottery tax loss statement, we can help with so much more. Our ability to work with multiple companies is why we have such a high success rate with our users.

For example, we can help you cancel subscriptions to major companies just as quickly as getting the tax information you need from a casino. In addition, we can help you get refunds on numerous products/services as easily as getting your gambling tax deductions.

We'll also help with other gambling losses in other states, like Ohio.

What Else Can DoNotPay Do for You?

As an AI service, we also offer numerous services and other business tasks to make life easier. We can:

- Help you file lawsuits in small claims court.

- File complaints against major corporations.

- Deal with credit card issues or debt.

Visit us to find out more about our comprehensive features.