Illinois Lottery Scratch-off Taxes: The Hard Truth About Instant LottoWinnings

If you have ever walked into a gas station, grocery store, liquor store, or many other locations in the State of Illinois, you have probably noticed a wide assortment of colorful paper offerings at the front counter enticing you to buy one. You may not have thought about the associated with these games. These games or "scratch-off" tickets from the Illinois State Lottery are popular. They offer the player the opportunity to spend a few dollars in exchange for a chance to win a handsome sum, perhaps.

A player will simply scratch off the special coating put on these tickets to reveal numbers, symbols, or some other combination of factors that will indicate if they are a winner or not on that ticket. They are simple to play, and many people regularly win small prizes.

Depending on how much you've won determines how you can claim your winnings.

| $600 or less | You may claim your winnings at any authorized lottery retail location. |

| $601 to $100,00 | You may utilize the mail-in prize claim system. Ensure you sign all tickets before you place them in the mail.

You may also redeem your winnings at any lottery office. |

| $100,000 or more | Call the Lottery headquarters to schedule an appointment to make an in-person claim. |

However, the games have more winners than losers and collect significant money for the state lottery system. All of that said, you may still need to know about what kind of taxes you might expect to pay if you happen to be a lucky winner.

DoNotPay is a resource used by many lucky lottery and casino winners to help nail down exactly what they need to do to file their taxes correctly. We will be taking a look at what they have to offer.

Lottery Winnings and Losses Calculated for Tax Purposes

Maybe you have wondered, "How much is the tax on $1,000 in Illinois state lottery?". The State of Illinois requires that purposes. Therefore, you need to know the following if you have won more than $600:

- How to calculate your wins and losses on the lottery for accurate reporting purposes

- The percentage that you should expect to set aside to cover your taxes on the winnings

- Which tax year to report your winnings in

After striking it lucky on your lottery ticket, you will need to have some pretty organized systems and accurate reporting to report your winnings to the government correctly.

How to Calculate Illinois Lottery Scratch-off Taxes on Your Own

You can choose to get a ledger out and start marking down your wins and losses on that ledger to try to determine if you have made the correct payments to the state government or not. Doing so is somewhat burdensome, and you will probably end up with numbers that are not perfect. Will you really try to figure out how much you have spent on lottery tickets all on your own? There are some significant issues that you could run into with this, including:

- Inaccurate accounting of all of the tickets that you have purchased

- Disputes over how much you have won versus how much you spent

- A lack of clarity over which wins need to be reported

It is possible to accidentally declare an incorrect total to the state regarding your lottery winnings. That is troublesome because it means that you might inadvertently be underreporting your taxes. The scary thing about that is that you could end up in hot water with the IRS for putting down something that was not even close to correct. The penalties for misreporting your taxes could be:

- Establishment of tax penalties and repayment plans.

- Bank levies and wage garnishments.

- penalties in extreme cases could involve probation or even jail time.

You DO NOT want to take a chance on misreporting your lottery winnings, and that means you do not want to rely on your memory to get these figures right.

Getting Your Win/Loss Statements

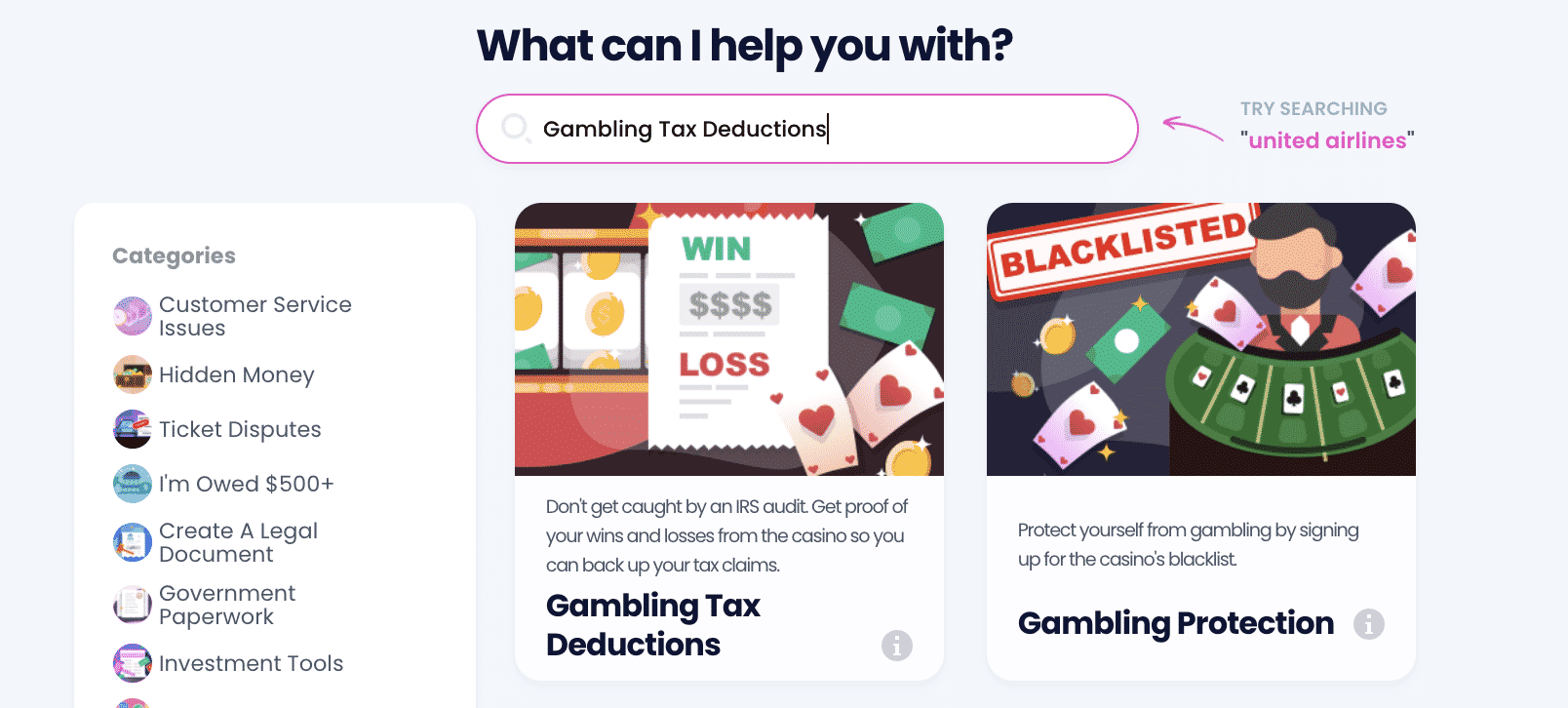

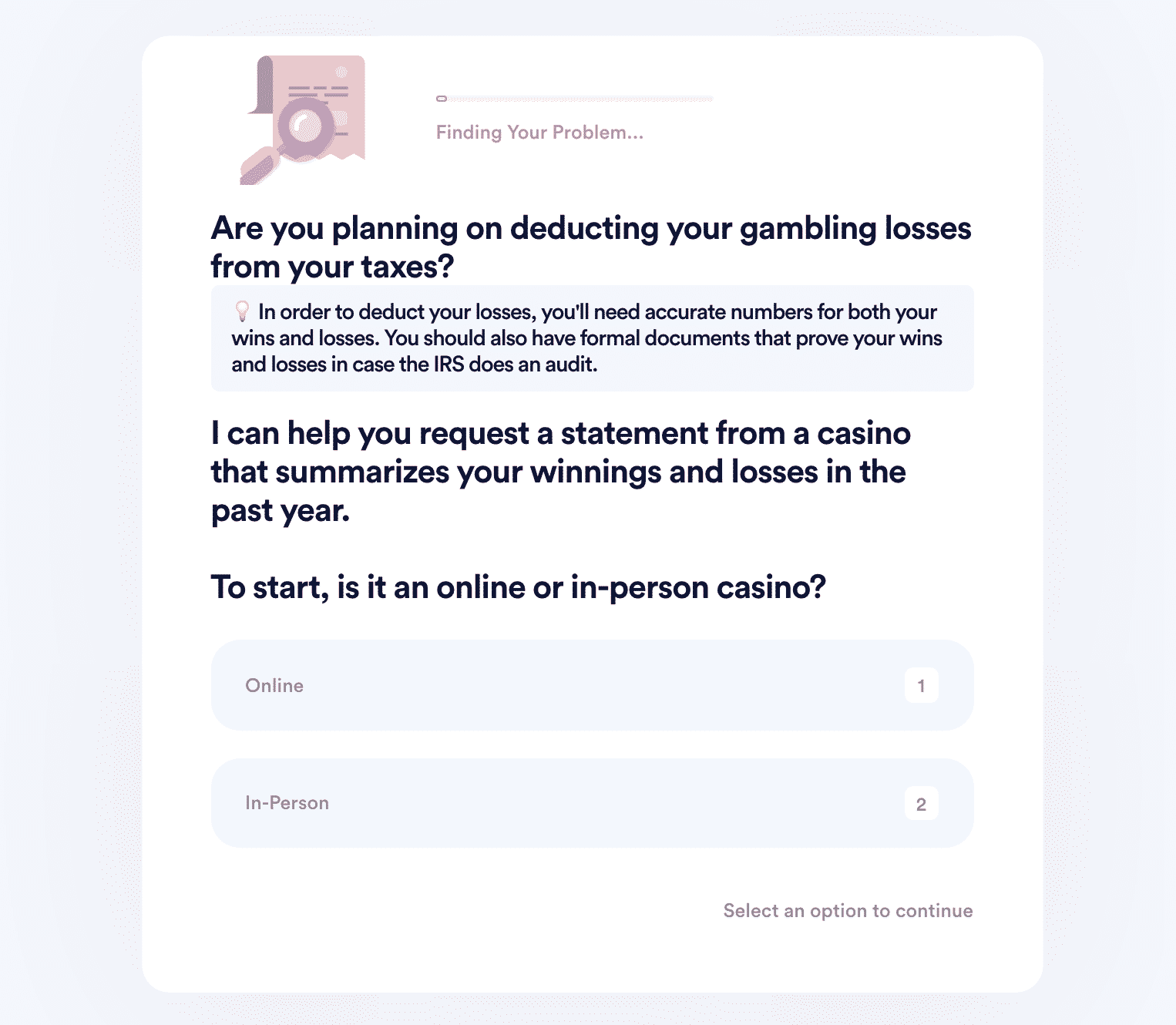

If you want to request a gambling wins/losses statement but don 't know where to start, DoNotPay has you covered in 5 easy steps:

1. Search gambling tax deduction on DoNotPay.

2. Enter the name of the casino and indicate whether it's online or in- person.

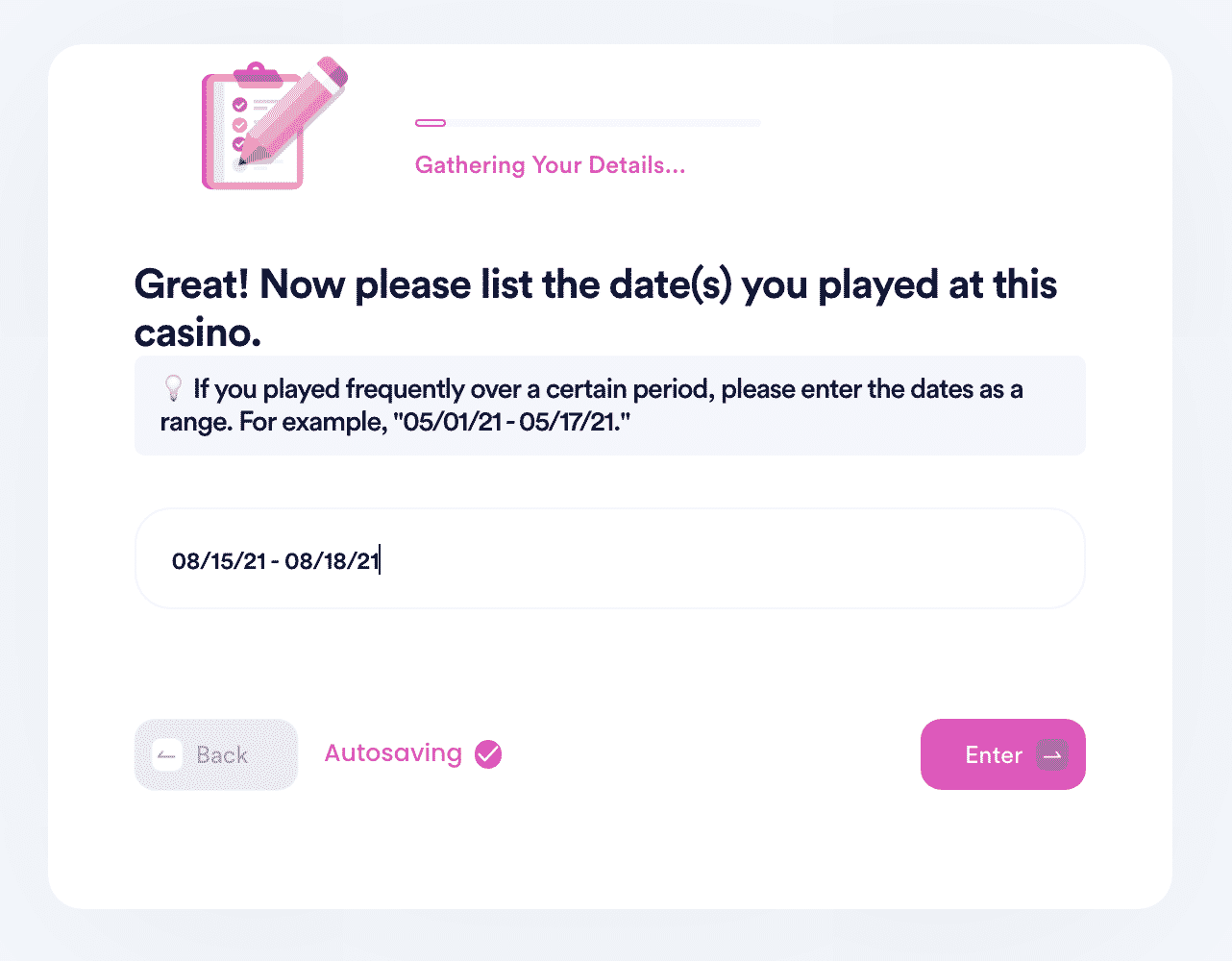

3. Tell us more about the dates and games you played, so the casino can identify your playing records.

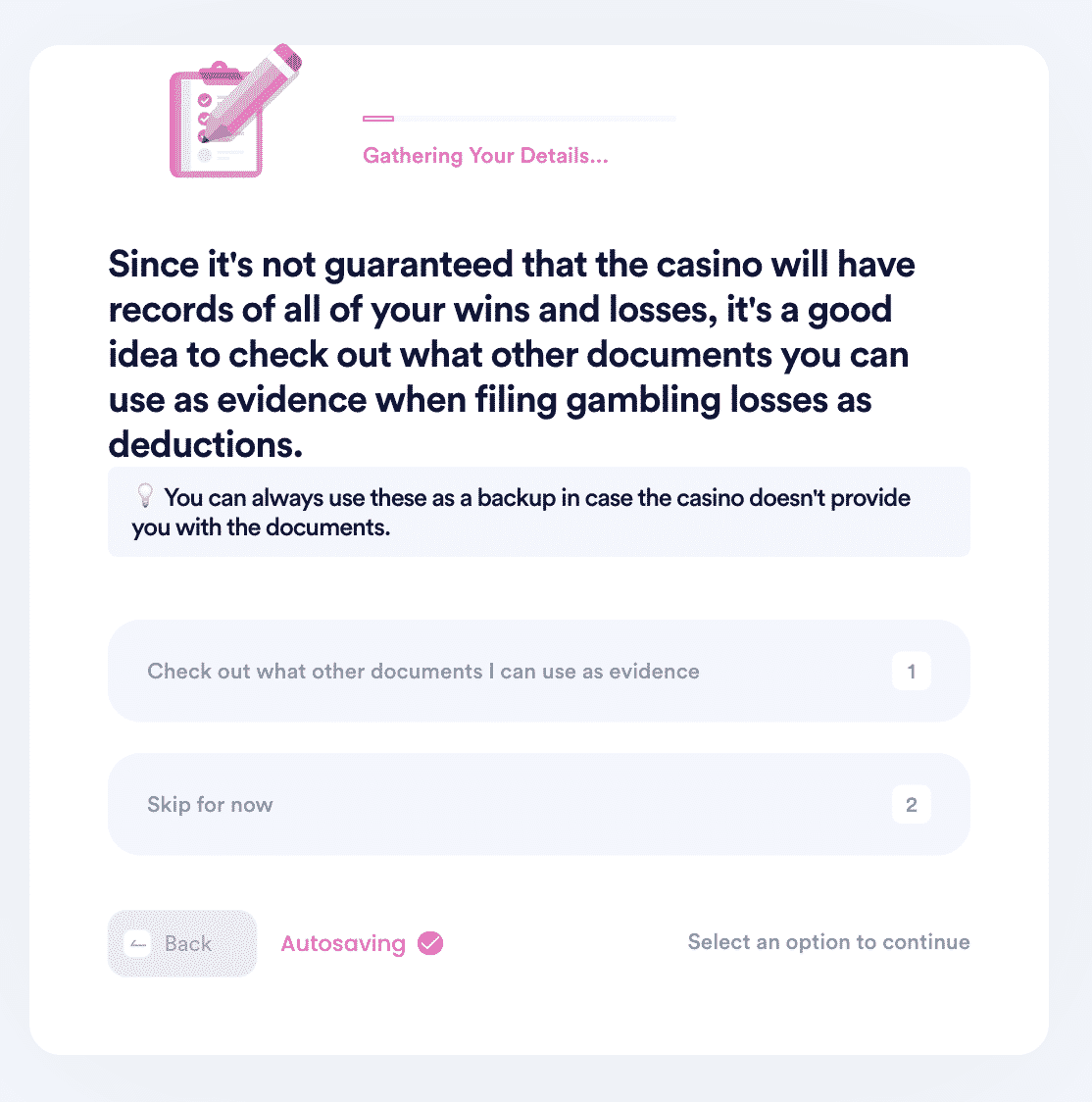

4. Select whether you have a players card or other form of membership with the casino and enter the relevant details. You also have the option to review other documents you can use as evidence when filing deductions.

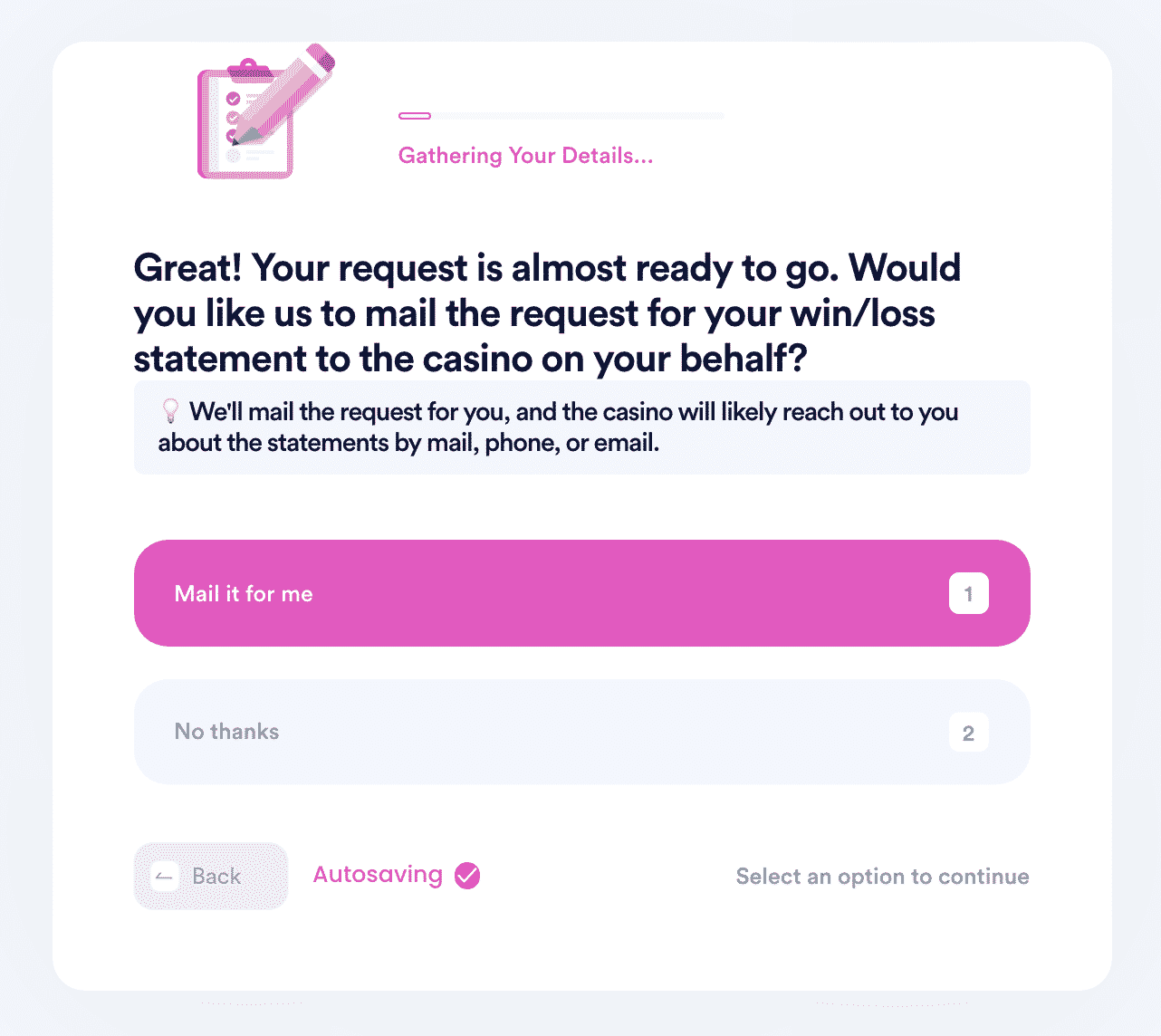

5. Select whether you want DoNotPay to mail the form for you.

How DoNotPay Can Help

There are services from DoNotPay that can help you properly report and pay your taxes on lottery winnings. You may discover that you owe a larger bill to the government than what you expected, which is never fun. Still, you will have accurate information that you know has been correctly reported and documented . DoNotPay makes sure of the following:

- You are only paying what you truly own to the government.

- You are correctly reporting the amount that you have won.

- You don't have to worry about harassment from the IRS or other government agencies over your reporting.

You can breathe a little easier knowing that you have a program in place that can assist you with the process of getting those taxes reported accurately. People like to think that they have all of this in hand and are not going to make some of the mistakes that others before them have made, but it is just so easy to do with strange tax reporting rules. You deserve to relax and enjoy the winnings that you got so lucky to win in the first place. Let DoNotPay help get the government off your back.

People who have used their program before report that it is fast, accurate, and user-friendly. They have never seen a service work so brilliantly for them before, and they would never go back to the old way of trying to do all of this for themselves. Winning a significant prize in the lottery may be a once- in-a-lifetime experience for many people, but they must know how to handle it when it happens. When you need to know how to report Illinois gambling winnings and losses or similar systems in any other state, you need the help of the professionals at DoNotPay.