How to File Gambling Losses Tax Within Minutes

The first rule of gambling is "Only stake what you can afford to lose."

If you win big on a gamble, "the taxman" is always ready to claim his share. It's only fair that "he" also gets to claim gambling losses. It's important to keep track of all your gambling activities and document your wins as well as your losses for tax purposes.

The tax filing process is complex and sometimes you may opt for professional tax services to help you stay compliant. Alternatively, using DoNotPay to file your takes away the hassle. You can access all the necessary documents on one platform and even calculate your deductions within minutes.

Are Gambling Losses Tax Deductible?

According to tax laws in several states, gambling proceeds and lottery winnings are considered earned income and are therefore subject to both federal and state taxation. This means that gambling losses are tax-deductible.

State taxes on gambling winnings range from 3% to as high as 10%. IRS gambling taxes, on the other hand, are:

- 24% for US citizens and residents with SSN%

- 28% for US citizens and residents without SSN

- 30% for non-US citizens

Residents of states that charge lottery taxes will have their lottery winnings withheld by up to 37% to cater to both state and federal taxes.

When filing your returns, you can deduct gambling losses as expenses. However, according to the IRS codes, your deduction is limited to the amount you declare as winnings. For example, if you had $10,000 as gambling winnings and $15,000 as losses, you can only deduct your losses up to $10,000.

Currently, there are only 15 states in the US that don't state gambling taxes. These include:

- Alabama

- Alaska

- Delaware

- California

- Florida

- Hawaii

- Nevada

- Mississippi

- South Dakota

- New Hampshire

- Texas

- Tennessee

- Washington

- Utah

- Wyoming

How to Handle Gambling Losses

Gambling losses include all expenses associated with the gambling activity, such as:

- Raffle ticket costs

- Money staked

- Travel expenses to the gambling facility

The IRS does not allow you to subtract losses from your winnings. If you need a tax break for your losses, you must also declare winnings. It's important to note that casinos and other gambling facilities have an obligation to report winnings above $600. The threshold may vary depending on the type of game. DoNotPay can help you keep track of all your gambling expenses and help you calculate how much you owe in gambling taxes.

If you or your loved one is struggling with gambling addiction, DoNotPay can also help you file a ban request to help prevent you from depleting your funds.

What Documents Do You Need to File Gambling Taxes?

The documents required for reporting gambling winnings and losses taxes include:

- Schedule A, Form 1040

- Form W-2 G for declaring your winnings

- Publication 529 for miscellaneous deductions

- Gambling receipts

- Gambling tickets

- Gambling statements

- Any other records proving your gambling activity

How to File Gambling Losses Taxes on Your Own

Whether you won big and made huge losses, they both have to reflect on your tax report. The IRS doesn't take kindly to those who attempt to defeat tax. Note that reporting huge gambling losses may trigger an audit by the IRS. There are three options for filing your gambling losses tax:

| Online | To file your taxes online, you must have an account with the IRS portal. Visit the IRS website and select individual taxpayers. Fill out Form 1040 by reporting wages and other types of income, including your gambling winnings. Fill out Form W-2 G for withheld taxes on your gambling winnings.

Next, fill out publication 529 with your gambling losses and ensure they don't exceed your declared gambling winnings. Upload scanned copies of your gambling tickets, receipts, or credit card statements. Once you're done, you'll receive an email confirmation from the IRS notifying you of your e-filing status. |

| Download the required tax forms from the IRS website or put in a request for the forms by calling 1-800-829-3676. The documents will be mailed to you.

Fill out all the forms and attach copies of your gambling receipts, tickets, and any other related receipts. Send the forms via mail to our designated state IRS office. Every state in the US has an IRS office. Click here to find yours. | |

| Professional tax filer | Filing taxes is hectic and without the right information you may end up having to file an amended return. Professional tax filers need access to your information and all documents detailing your income and expenses to file taxes on your behalf. This requires the utmost trust because the IRS will hold you accountable for any errors in your returns.

Filing your gambling returns with DoNotPay prevents third-party access to your information. |

File Your Gambling Losses Tax with the Help of DoNotPay

Keeping track of all your gambling activities is challenging. Since taxes are filed once a year, you may not have all the necessary documents to show your losses. This may lead you to miss out on a huge tax break. DoNotPay can help you access everything you need to file and claim what is owed to the IRS.

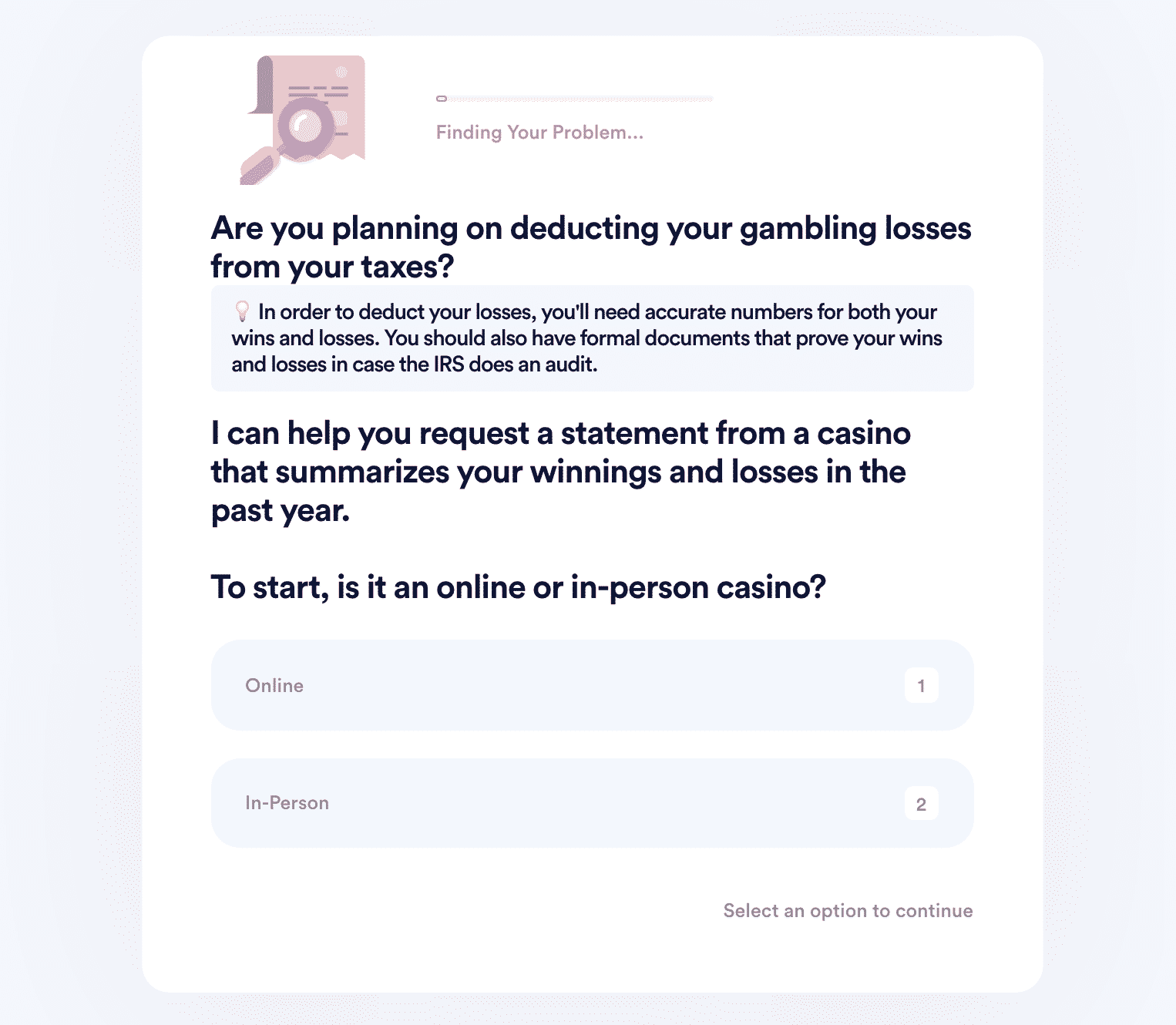

If you want to request a gambling wins/losses statement but don't know where to start, DoNotPay has you covered in 5 easy steps:

- Search gambling tax deduction on DoNotPay.

- Enter the name of the casino and indicate whether it's online or in-person.

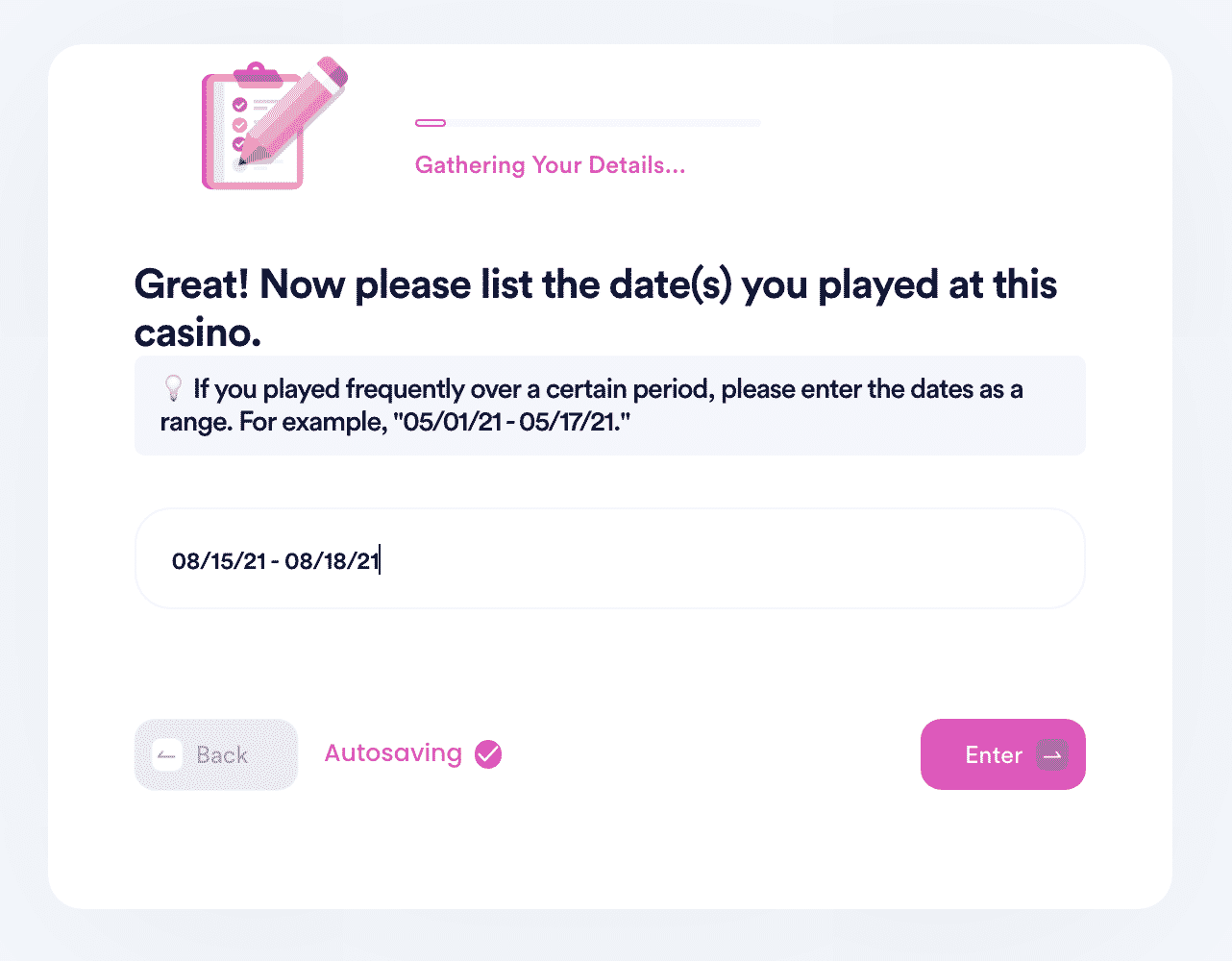

- Tell us more about the dates and games you played, so the casino can identify your playing records.

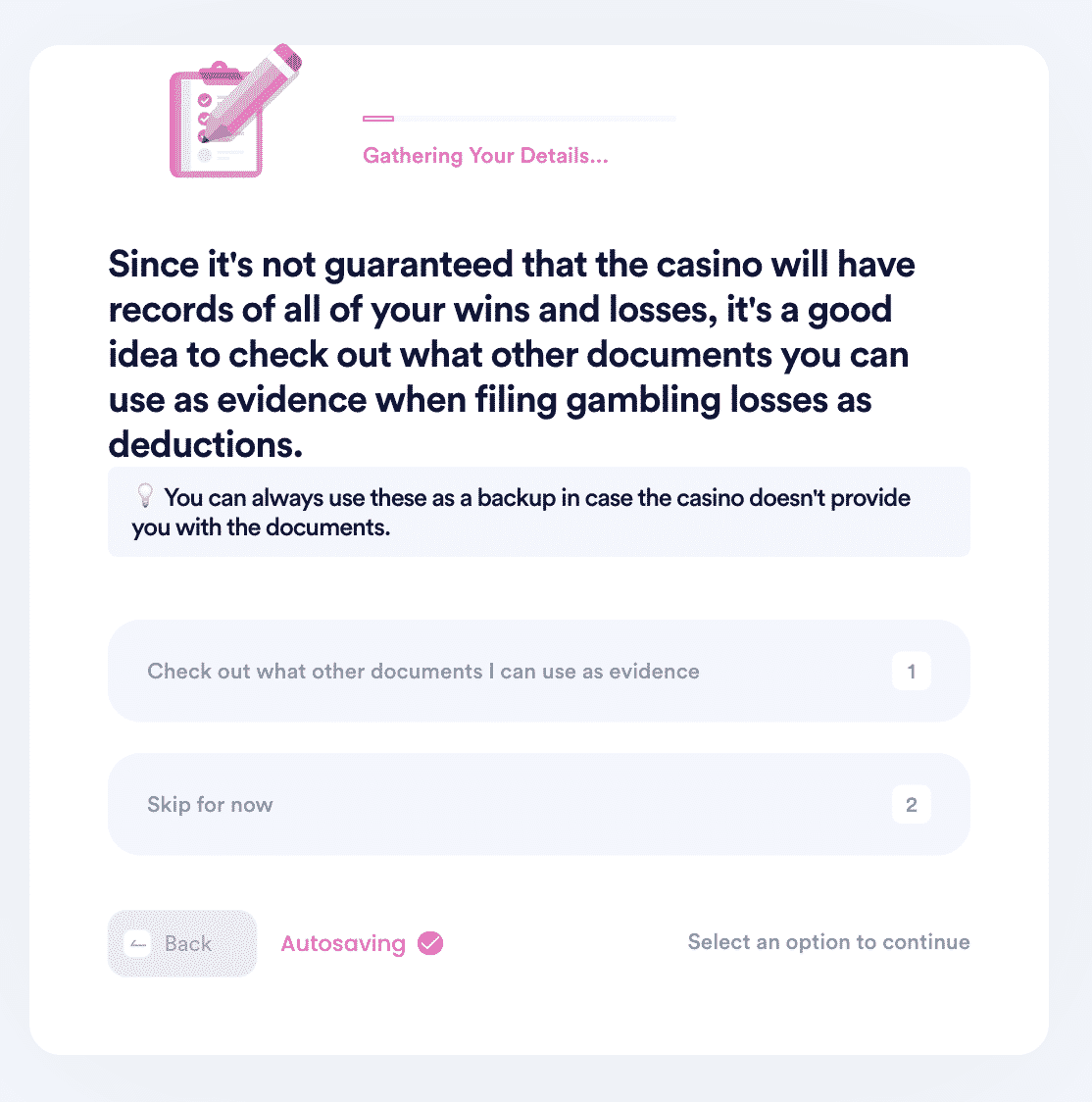

- Select whether you have a players card or other form of membership with the casino and enter the relevant details. You also have the option to review other documents you can use as evidence when filing deductions.

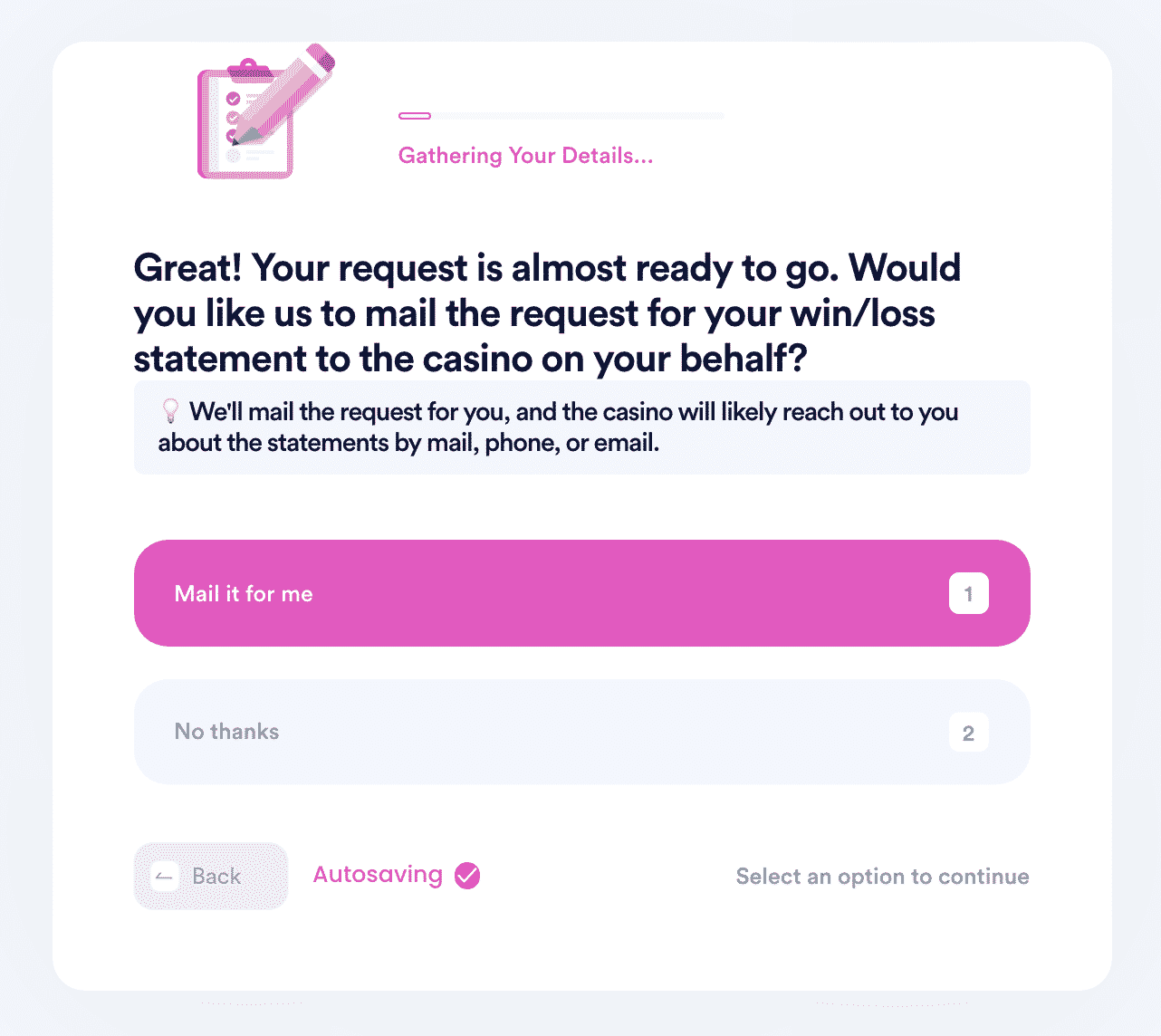

- Select whether you want DoNotPay to mail the form for you.

Why Use DoNotPay to File Gambling Losses Tax

DoNotPay provides you with the fastest, easiest, and most reliable way to . If you don 't have access to all your gambling receipts, don't worry, we can help you find them. Don't miss out on tax savings just because of missing documents. DoNotPay works with all service providers, groups, and entities to grant you access to all your documents on one platform and file your taxes within minutes.

DoNotPay can help you with other taxes issues as well, including:

- Taxes on lottery winning

- Lottery tax calculator

- How much money can you win without paying taxes?

- Ohio lottery tax