How to Get Your Citibank Driver's Edge Rebate Form

If you have a fairly good credit score, and your fascination with automobiles runs deep, then the Citibank Driver's Edge rebate program was designed with you in mind!

But when it comes time to claim your rebates from your Citibank Driver's Edge credit card do you know to find the proper form for the specific rebate you are trying to cash in on? The Citibank Driver's Edge card offers several types of rebates and each of them requires you to use different forms for claiming your rebate.

Here we are going to look at the Citibank Driver's Edge Platinum Card and show you how to access the proper by using the 'Claim My Rebate' suite of tools from the world's only AI Consumer Champion, DoNotPay!

What is the Citibank Driver's Edge Platinum Card?

The Citibank Driver's Edge Platinum Card is a credit card with a unique approach to its rebate program. Those rebates are focused on vehicle perks and other automotive benefits. If you have a good credit score and a flair for cars, trucks, or SUVs this is the card for you! You can even use your rebates for new vehicle purchases

offers several types of rebates and incentives that can be used for repairs, service, and maintenance of your vehicle. Each Citibank Driver's Edge Cardholder is entitled to one million dollars worth of travel accident insurance and a 6% cashback rebate on all supermarket, gas station, and drug store purchases during the first year of membership and 1% to 3% per year thereafter.

You can also earn cash for your annual amount of miles driven. Citibank will pay you for every mile with the annual cash-out limit on your mileage of $1000 per year!

The annual limit per vehicle is capped at $5000 for rebates associated with the service and maintenance of the vehicle.

Citibank Driver's Edge Rebates

Most Citibank customers report using their Driver's Edge cards for all purchases and allowing their rebate amounts to build up so when something like;

- AC Service

- Major Brake Job

- New Tires

- Replacement Battery

comes up there is essentially an account for those unexpected vehicle maintenance issues.

You also earn three points for every dollar spent on your Citibank Driver's Edge Card that can be redeemed for products, goods, and services listed in the Thank-you Rewards program from Citibank.

Getting the Right Form When Claiming Your Citibank Driver's Edge Rebates

This is where things begin to get a bit confusing. You need to convert some of your Citibank Driver's Edge rebate money to credit on your card to pay for the brake job the mechanic just performed. This is supposed to be exactly the scenario this card was developed for, but all is not as it seems.

Although you can access your rebates for credit on your card the first thing is needing the right link to the right rebate form. Many customers were rather unhappy about their difficulties in accessing these forms and the extra needed information to redeem the rebate.

For instance, if you were needing to convert rebate money to useable credit one of the requirements to do so is to include a screenshot of the receipt for the repair. To obtain a receipt you have to first pay for the repair! Then there are different rebate forms for different procedures.

Here are the corresponding links to the procedures.

- Claiming your rebate for vehicle repair or maintenance

- Claiming your rebate for new vehicle purchases

- Claiming your rebate for miles driven

Wouldn't it be nice to have an online information center for the tools needed to get your without any confusion or frustration?

There is!

Use DoNotPay to Get Your Citibank Driver's Edge Rebate Form!

DoNotPay is your one-stop information center for your Citibank Driver's Edge Rebates. DoNotPay levels the playing field to make issues like this a fast and easy process.

If you need help with your related rebate issues, you can relax knowing that DoNotPay is hard at work on your behalf to get you the rebates you are entitled to.

Don't worry if you have never used DoNotPay because it truly is the easiest way to unlock those rebates that some credit card issuers hope you will get tired of pursuing and give up.

Here's how it works:

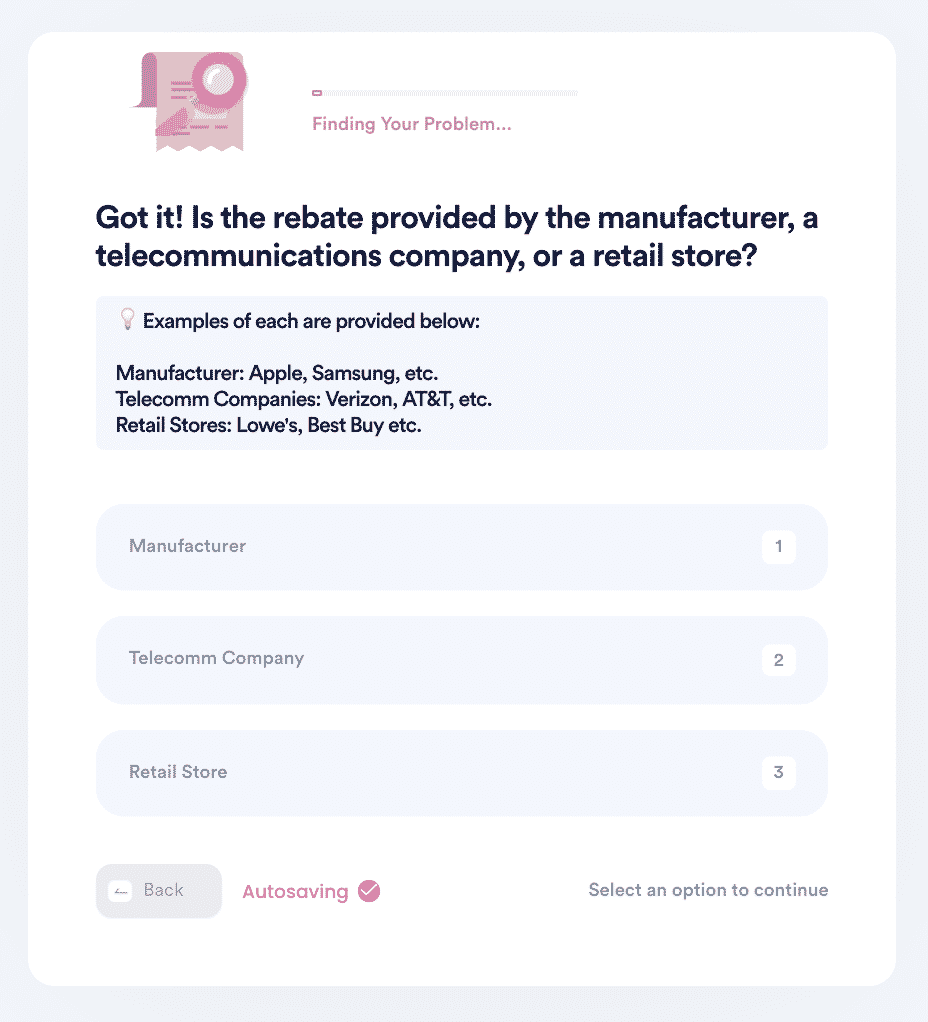

- Search rebates on DoNotPay and select the type of rebates offer you want to claim (is it for a car, electronic gadget, household appliance, etc).

- Tell us more about the purchase, including the product name, brand, serial number (if relevant), and whether you bought it online or in-person.

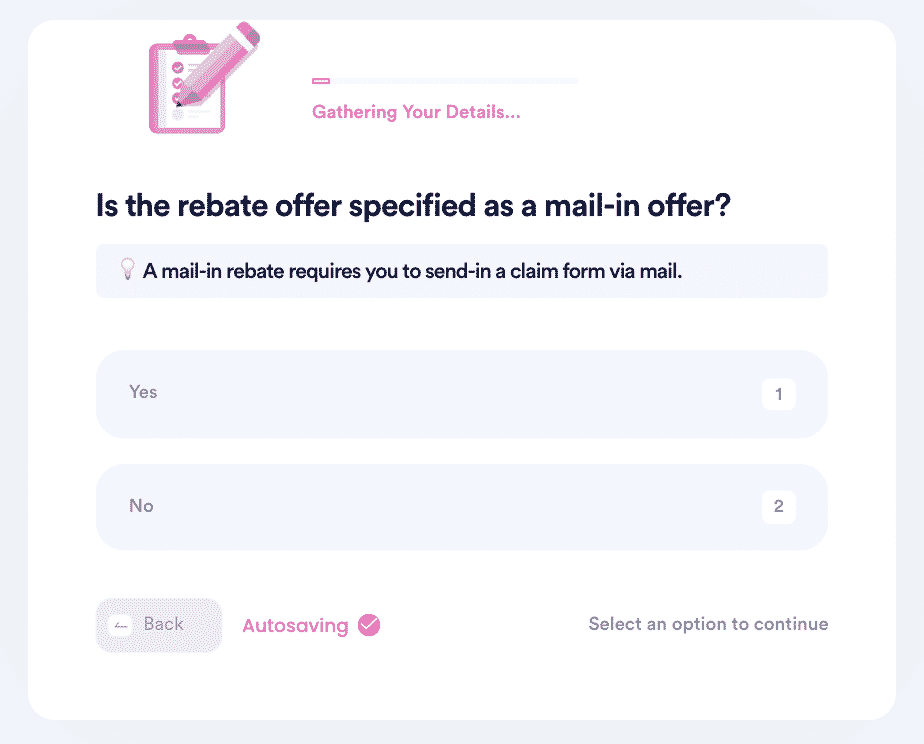

- Select whether the rebate is online or mail-in. Upload your evidence documents, including receipts, and any necessary forms, and confirm your contact information.

And that's it! DoNotPay will file your rebate claim on your behalf by mail or online, so you can convert those rebate dollars to usable credit on your Citibank Driver's Edge Credit Card!

Are There Any Other Rebates I Can Claim by Using DoNotPay?

Your are just a small sample of the other rebates you can claim with DoNotPay at your disposal! DoNotPay has helped thousands of people just like you get the rebates they were entitled to and your issue is no different!

We can help you find and use rebates for all sorts of products from all sorts of companies like:

| Menards | Goodyear tire | Verizon | Macy's |

| Home-depot | New car | Michelin | Mass Save AC |

Let DoNotPay handle your rebate issues with your Citibank Driver's Edge Card today!

What Else Can DoNotPay Do?

DoNotPay can help you solve other problems such as:

- Schedule DMV appointments

- Reduce property taxes

- Help with bills

- Find missing money

- File a complaint

- Discover and apply for scholarships

- And many more!