All You Need to Know About American Express Business Cash Back Rewards

American Express offers 16 card options for businesses that are looking to simplify financial records while tracking employee spending. Two of the offer cash back for credit card purchases. But do you even know how to take advantage of cash back rewards? We will investigate these two cards here so you can decide which card will better fit your business needs and offer you the most rewards. Get all of the cash back benefits you deserve by understanding how to use your business cash back credit cards correctly. Get even more cash back with these informative articles:

- Walmart has cash back limit.

- Find out how to get money back from PayPal.

- What is cash back? Find out now.

- What are the best cashback credit cards?

- Find cash back apps.

Cash Back Or Cash Advance? Do You Know The Difference?

You may have thought cash back is what you get from the cashier after making a purchase. They will often ask if you need cash back on your transaction. That type of cash back is actually a cash advance. Like making a withdrawal from an ATM with your debit card, except you are given an advance on your credit limit, which you then pay off with interest. Cash back credit cards reward you with a percentage of your purchase back, usually 1% to 5%. Cash back credit cards can pay big returns when used for the right purchases.

Why Your Business Needs an American Express Business Cash Back Card

- A business credit card is one way you can bring all of your finances together, whether you want to track employee spending or just simplify your financial records. A business credit card makes it easy to do both.

- Frequent travelers and frequently purchased business needs like office supplies can earn you rewards.

- Get all your business expenses on one statement for better financial control and expense tracking.

- Employees can be issued their own cards for better accessibility.

Here’s a quick reference to understand the difference between the two :

| American Express Blue Business Cash Card | The Plum Card from American Express |

|

|

Other Cashback Options

You do not need an American Express to get cash back, there are lots of offers that can put money back in your pocket where it belongs. We know you do not have an extra hour to search for discount offers before shopping. You do not have to when taking advantage of these offers because DoNotPay does it for you.

- There is an app for that. There are many cash back apps.

- In-store cas hback offers.

- Online cash back offers.

- Cash back rebates after purchase.

- Receipts can get you cash back.

DoNotPay Can Get You Cashback

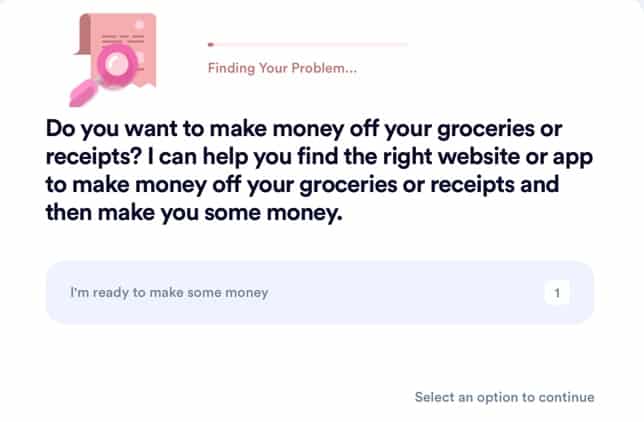

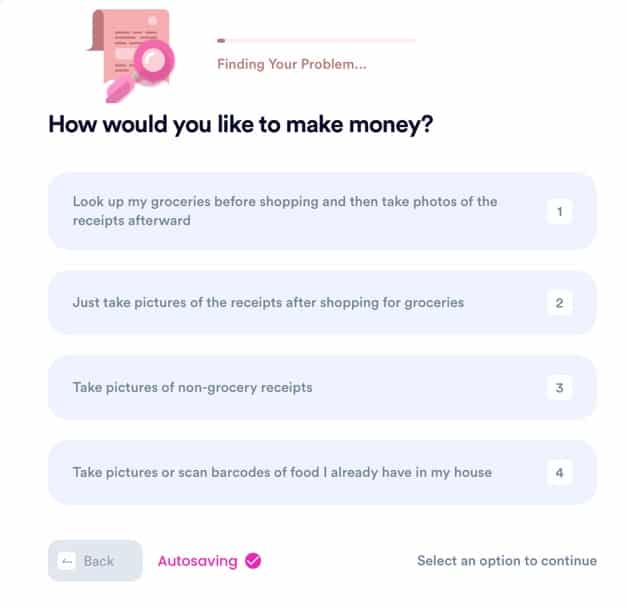

With DoNotPay, the Get Cash Back product aims to find ways to get cash back at the stores you already shop at. The product will search for local in-store cash back offers and connect you with cash back apps based on your shopping habits.

It only takes three easy steps to get a cash back:

- Search for Cash Back on the DoNotPay website.

- Kick off the process to find the right app or website for you.

- Answer some specific questions so that we can help you start making money!

And you are done! DoNotPay will send you the best cash back options and help you earn more cash back on your purchases!

Cash Back Quickly, Easily, and Successfully

Can't get enough cash back? Of course not. You can never get enough cash back, right? With the from DoNotPay, the cash back just keeps coming.

- Citi cash back card benefits

- Discover It cash back credit card

- Cash back apps to check out now

- Does an Apple card give cash back?

- How does cash back work on credit cards?

- Can you get cash back with Apple Pay?

Endless Savings

The ways to save with DoNotPay are endless. DoNotPay products really have you covered from virtual credit cards for getting free trial offers to finding help with bills. You can fight parking tickets as easily as you can get free raffle tickets. Need to locate missing money? You can do that and get gift card cashback too. And you will never again be stuck waiting for customer service. Just jump the line.