How to Get a GoBank Transaction Dispute Settled Quickly

GoBank isn’t a bank on its own, but it’s a brand of Green Dot Bank. This brand offers great online banking options and an app that makes keeping up with your finances on the go simple and fast.

While you work hard to manage your finances and safeguard your personal information, there may come a time when there’s a transaction on your GoBank account that isn’t yours. Reporting a transaction that isn’t yours can be a pain. DoNotPay makes it easier to .

How To Dispute a GoBank Transaction on Your Own

You always have the option to dispute a GoBank transaction without the help of DoNotPay, but it may be a tedious and lengthy process.

Here are your options:

| On the Mobile App | GoBank encourages you to use the mobile app to file a dispute. At the bottom of the list of transactions, click the “Dispute a Charge” option and the system will walk you through the process of filing a dispute. |

| By Phone | Contact GoBank directly at (855) 459-1334 and speak with a representative to file a dispute. Make sure you have your account numbers ready to provide over the phone. You’ll also need to verify your personal information and answer detailed questions about the transaction. |

With the DoNotPay app, you can simplify this process and take care of your GoBank transaction dispute in only a few minutes.

GoBank Refund Policy

If there’s a fraudulent charge on your checking or savings account, you only have two days after the date of the transaction to notify GoBank. The bank will refund any fraudulent charges minus $50 on your account.

A fraudulent charge on a GoBank credit card may be refunded up to 100 percent. You have 60 days from the date of the statement to notify GoBank.

Follow these steps if you notice an unauthorized charge on your account:

- Cancel the compromised card to avoid any additional fraudulent charges.

- File a dispute with GoBank immediately.

- Contact the local police to find out if you need to make a report.

- Make sure there are enough funds in your accounts to cover your transactions.

The DoNotPay app can help you start this process quickly when you have a GoBank transaction to dispute.

How Long Does It Take to Get a Refund Through GoBank?

If GoBank confirms that the disputed charge was fraudulent, you should receive your refund within 10 business days. However, if they need to further investigate the transaction, your refund may be provisional for up to 45 business days.

Common Issues When You Dispute a GoBank Transaction

Disputing a transaction and waiting for a refund can be a tedious and stressful process, especially when things don’t go according to plan. Here’s a look at a few problems you might experience:

- In some cases, the investigation of your GoBank transaction dispute can take up to 45 business days. It can be daunting to know that your refund is only provisional.

- The merchant may claim the transaction wasn’t fraudulent.

- GoBank may ask you to share additional evidence that you didn’t make the transaction.

With DoNotPay, you can navigate these issues seamlessly and get your funds back into your account quickly.

How To Dispute a GoBank Transaction With DoNotPay

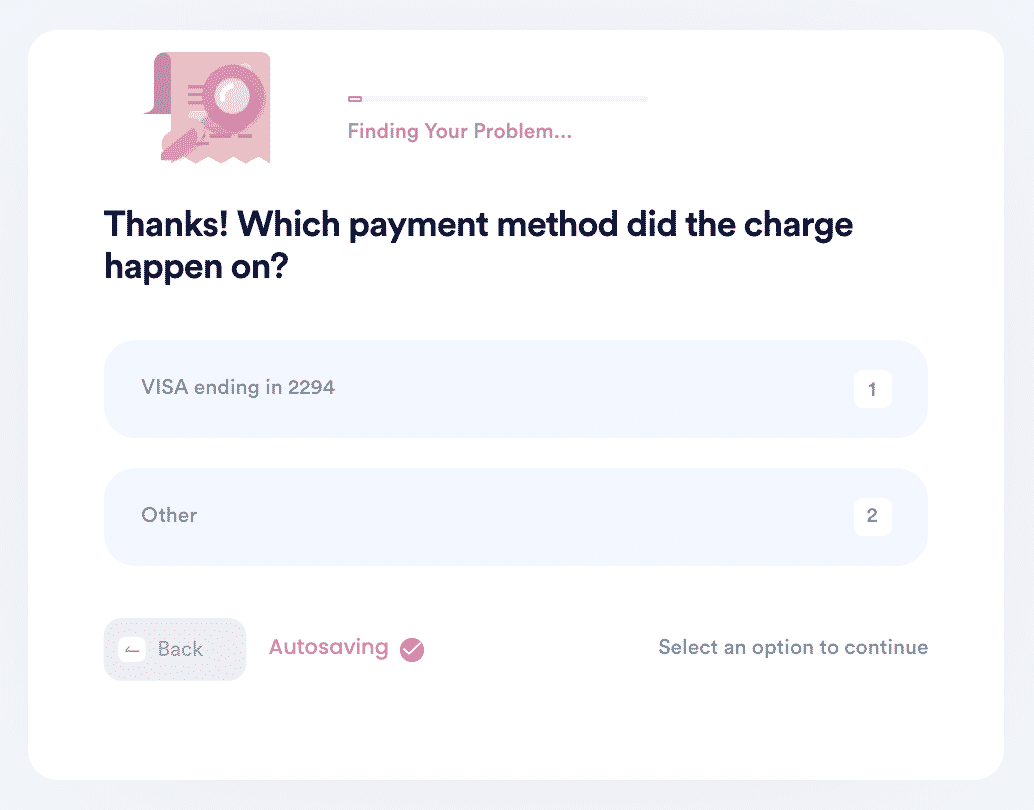

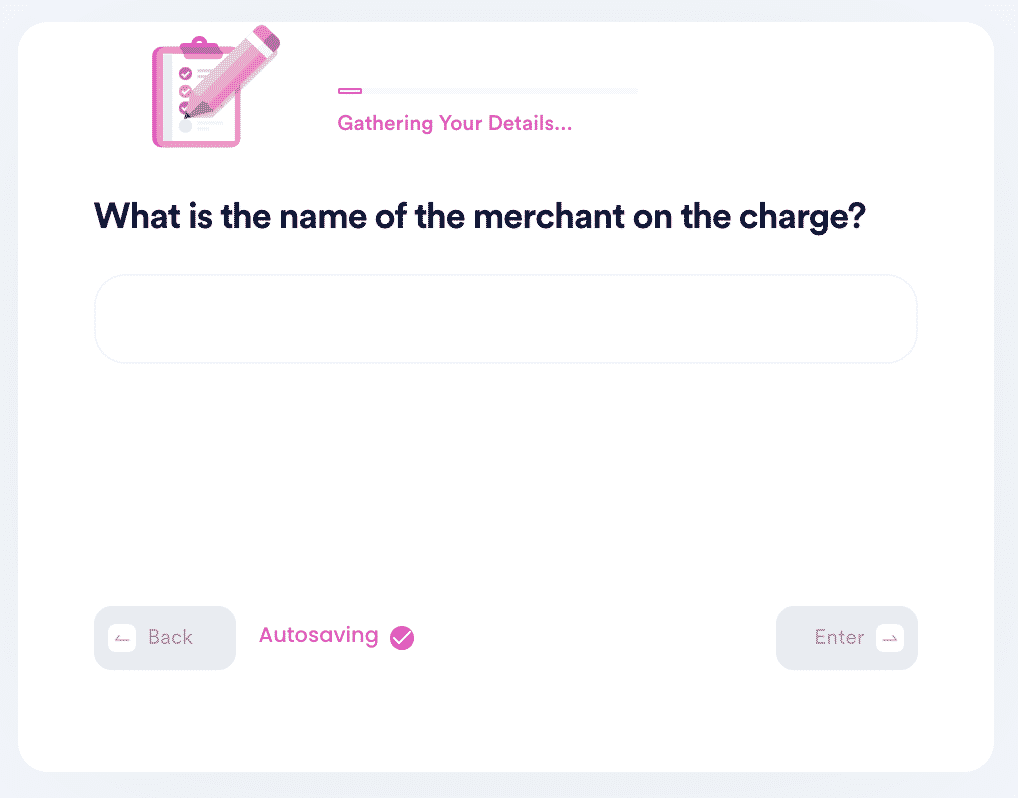

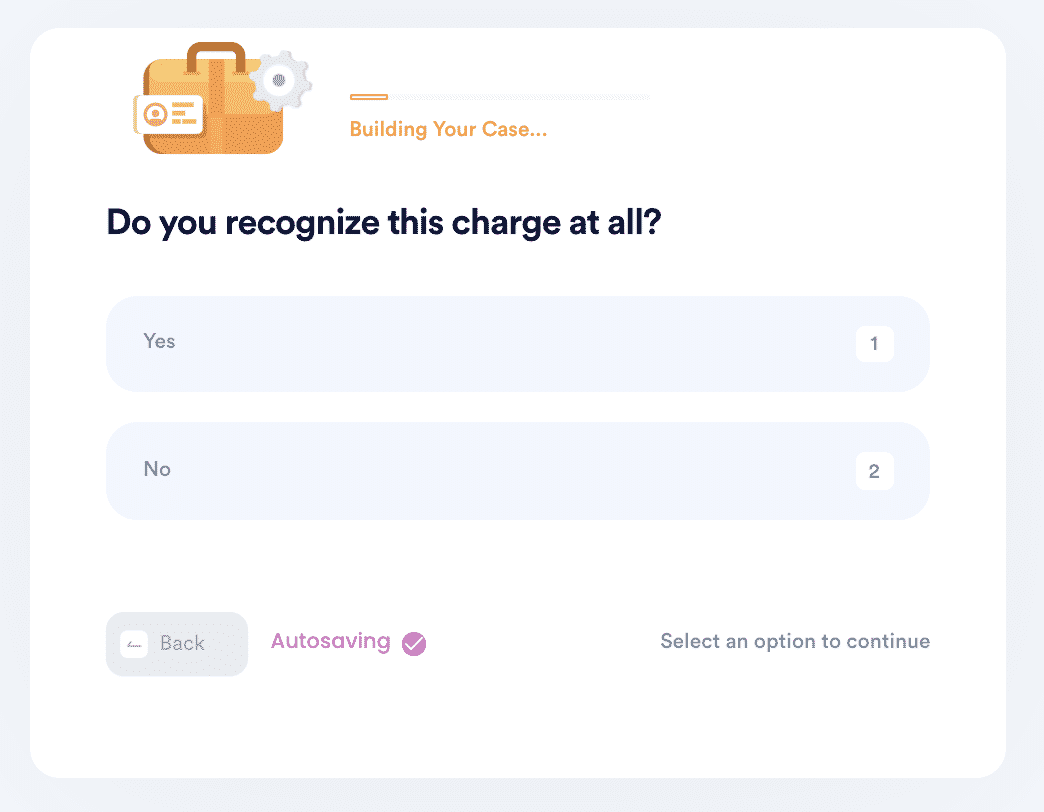

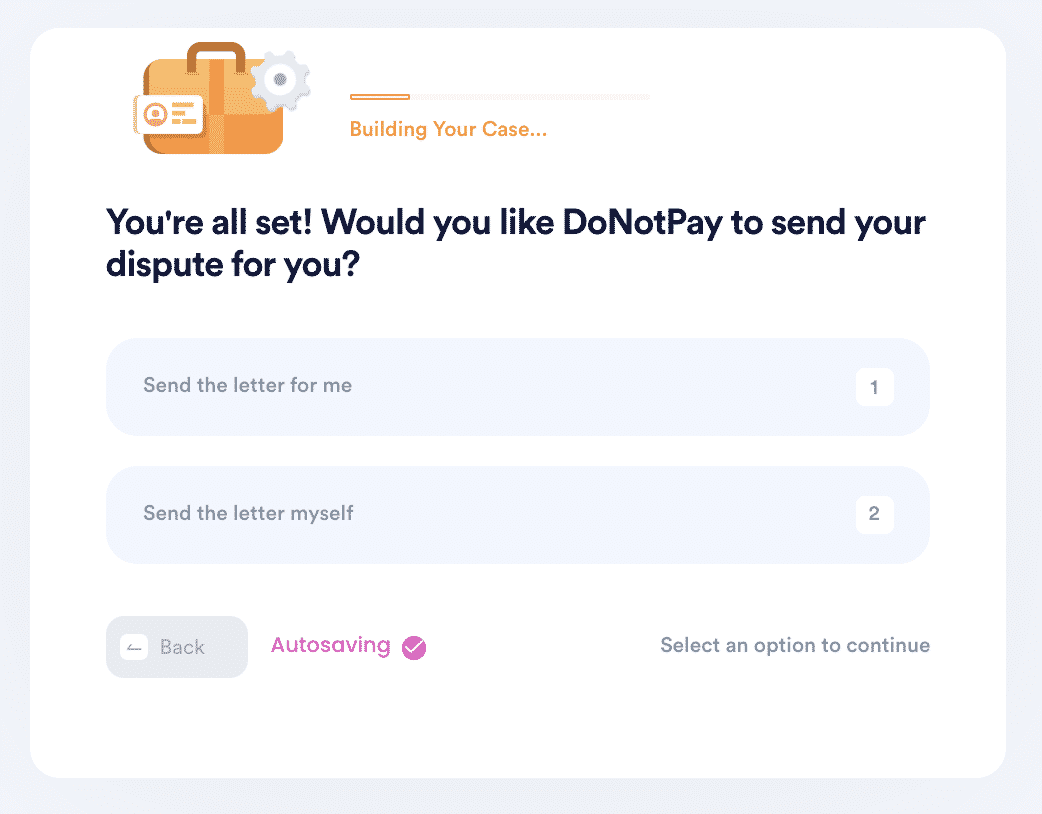

When there’s a transaction on your GoBank account that isn’t yours, DoNotPay is ready to help you dispute it. In the app, select the “Chargeback Quickly” product. The DoNotPay app will walk you through the steps of your dispute with a series of prompts:

- Select GoBank from the list of financial institutions and choose the account type: Start by selecting a checking or savings account, and the prompt on the next screen will offer a list of banks.

- Provide information about the disputed transaction: Enter the name of the merchant who charged your account and confirm the details after the prompt. You will verify the date and amount of the transaction in a similar manner.

- Review additional information about the transaction: The DoNotPay app walks you through a series of prompts to gather more information, including any past purchases with the vendor, or anyone who may have access to your bank accounts.

- Submit your dispute: Decide whether you would like to complete the dispute yourself, or finish the process through the app. If you choose to have DoNotPay file for you, you will need to confirm and sign before the dispute is sent to GoBank.

DoNotPay will file your dispute with GoBank directly on your behalf, making the process quick and easy.

How Can You Check the Status of Your Refund Request?

If you would like to check on the status of your refund while you wait, you will need to contact GoBank directly and speak with a representative. Make sure you have your confirmation number from the dispute ready to provide over the phone.

What Else Can DoNotPay Do?

With the DoNotPay app, you can quickly file transaction disputes and so much more. Here are a couple other services you can access through the app:

- Hide your real credit card numbers securely with a virtual credit card.

- Get a refund when a flight is canceled or delayed.

Have another transaction to dispute? Use the “Chargeback Quickly” product on the DoNotPay app to simplify the process with these businesses:

By

By