Experian ProtectMYID Reviews: Is It the Best Option for You?

Boosting your credit score can help you survive the harsh economic times. With a positive credit score, lenders determine your creditworthiness and are ready to extend a helping hand. Getting Experianprotectmyid reviews from credible sources can help you make an informed decision. You may need to search Experian Boost reviews from credible sources to help in decision-making. Experian Boost helps you increase your credit score while also raising your FICO® score.

Sometimes, improving your credit score may take longer than expected or even fail to materialize altogether. This may prompt you to seek help from a third party such as DoNotPay. DoNotPay offers an automated platform that allows you to access a range of services faster and easier. With this easy-to-use platform, you can access and get to know how secure your data is with the company. DoNotPay also helps you access other reviews including Equifax free credit report reviews, LifeLock reviews, FastWeb reviews, and FormSwift reviews to help you make an informed decision.

What Experianprotectmyid Reviews Mean

With , you get to know how safe your data is in the hands of the renowned credit bureau, Experian. With the protectmyid services from Experian, your data is insured against theft and you can rest assured that all your bank details are safe. Your data will be safe and in case of any attempt to hack your information, the system will not only resolve the issue but will also protect your data from future theft attempts.

You also get alerts when there's an attempt to access your data without your consent. Additionally, you get more information on your credit score on this platform so you can make an informed decision.

What To Look For on My Experianprotectmyid Credit Dispute

If you suspect that your identity has been compromised, you can contact Experian customer support and raise your issue.

Here is what you should look out for:

- Attempts to log in to your Experian account

- Fraud alerts

- Difficulty accessing your credit report

- Any disputes involving your credit report with Experian

How to Successfully Dispute Your Credit Report

If you have issues with your Experian credit report, you can approach the issue in various ways as discussed here:

- Contact the company's customer support via phone or mail

- You can also submit your dispute online through the company's website

- Contact a third party such as DoNotPay to make the process fast and simpler

- Use the saturation technique- here; you present a goodwill letter to different parties who have the power to help you out.

How To Get Experianprotectmyid Reviews on Your Own

If you need to know more about the company, you can do so in various ways.

Here is how you can confirm the authenticity of this product:

- Open your web browser and type Experianprotectmyidreviews

- Scroll down the web results and select one including DoNotPay

- Open the link to see what people are saying about this product

- You can visit the company's website or other credible and reliable sources and get to know if the product is legitimate.

If you need to report any issues directly to the company, here are the contact details:

| Method | Contact info |

| Phone | 1 866 751 1323 |

| databreachinfo@experian.com |

What To Do if You Cannot Get Experianprotectmyid Reviews on Your Own

Getting the solution for your issue can get frustrating at times and even take too long to resolve. However, there are other ways that you can use to resolve your issue fast and easy. If you cannot solve the issue you are looking for on your own, you can let a third party help you out. With the help of DoNotPay, you get to learn how to remove inquiries from credit reports with just a few clicks.

Get Experianprotectmyid Reviews With the Help of DoNotPay

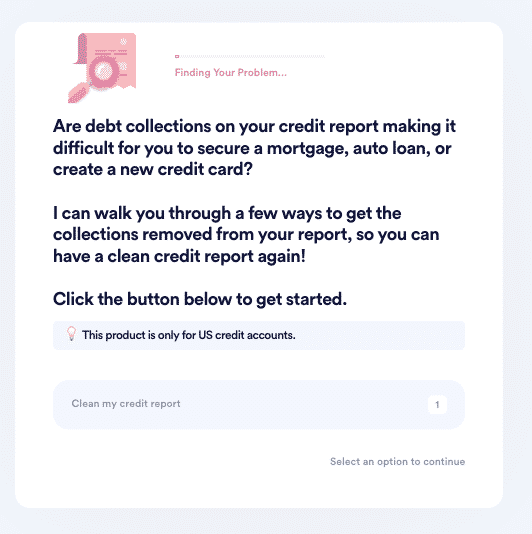

DoNotPay offers you a fast and easy way to dispute credit reports or resolve any issues you may be having with Experian.

If you have tried other avenues but haven't succeeded in getting the solution to your problem, let DoNotPay help you get in the following 3 easy steps:

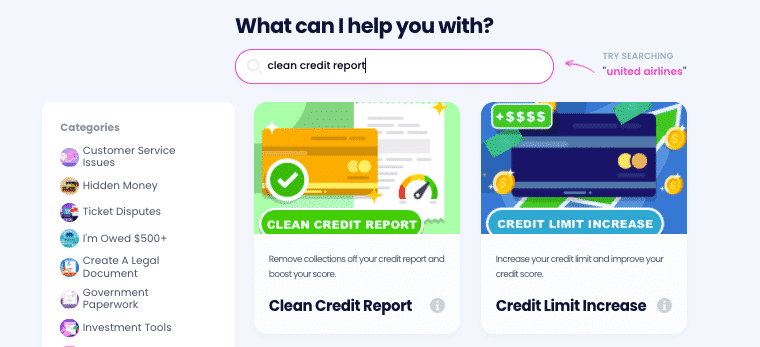

- Search Clean Credit Report on DoNotPay.

- Prepare a recent copy of your credit report that you can use as reference.

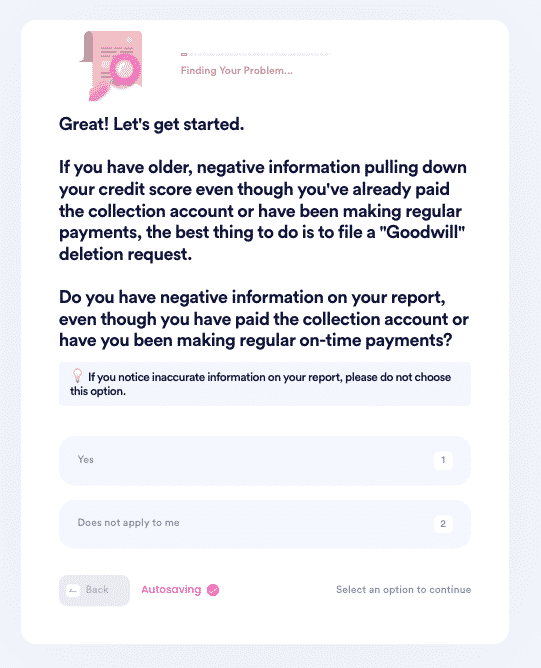

- Let us guide you through the 4 potential options:

- If you've already paid off your debt, we'll help you file a Goodwill Removal Request to get it removed.

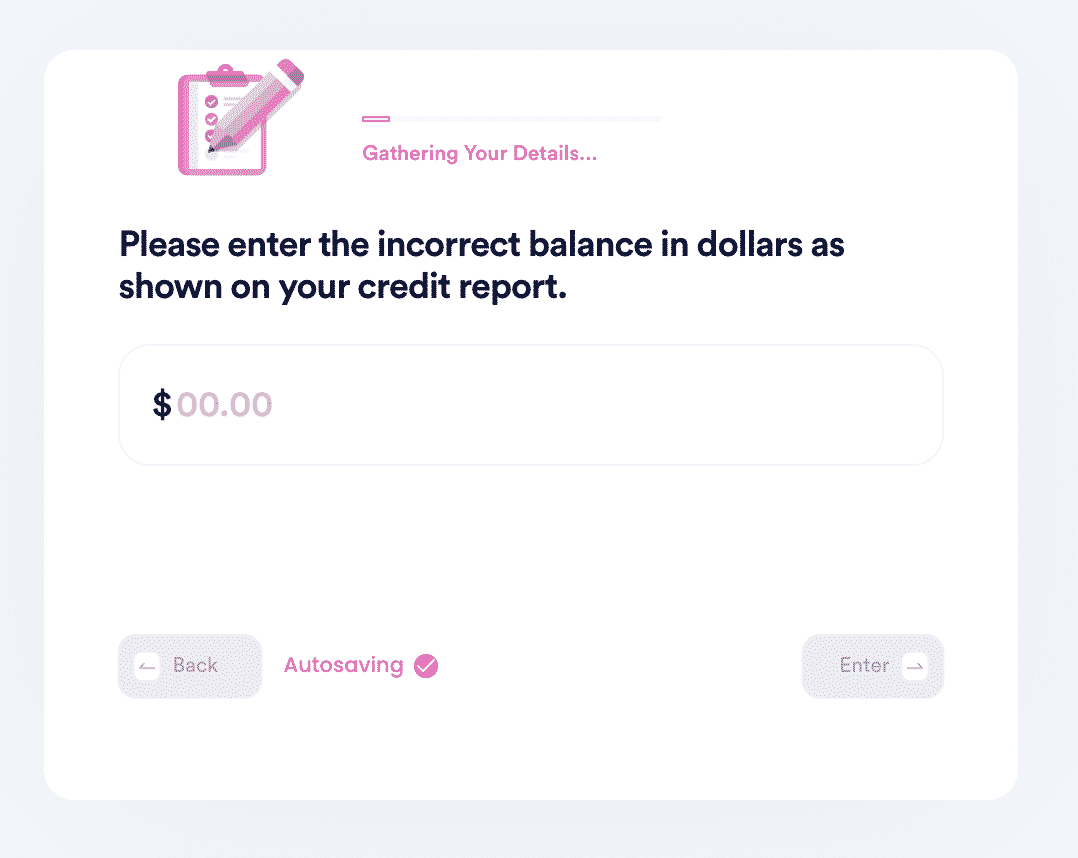

- If you notice any errors in your report (we have a list of common errors you can use!), we'll help you file a credit dispute with the creditor or major credit bureaus.

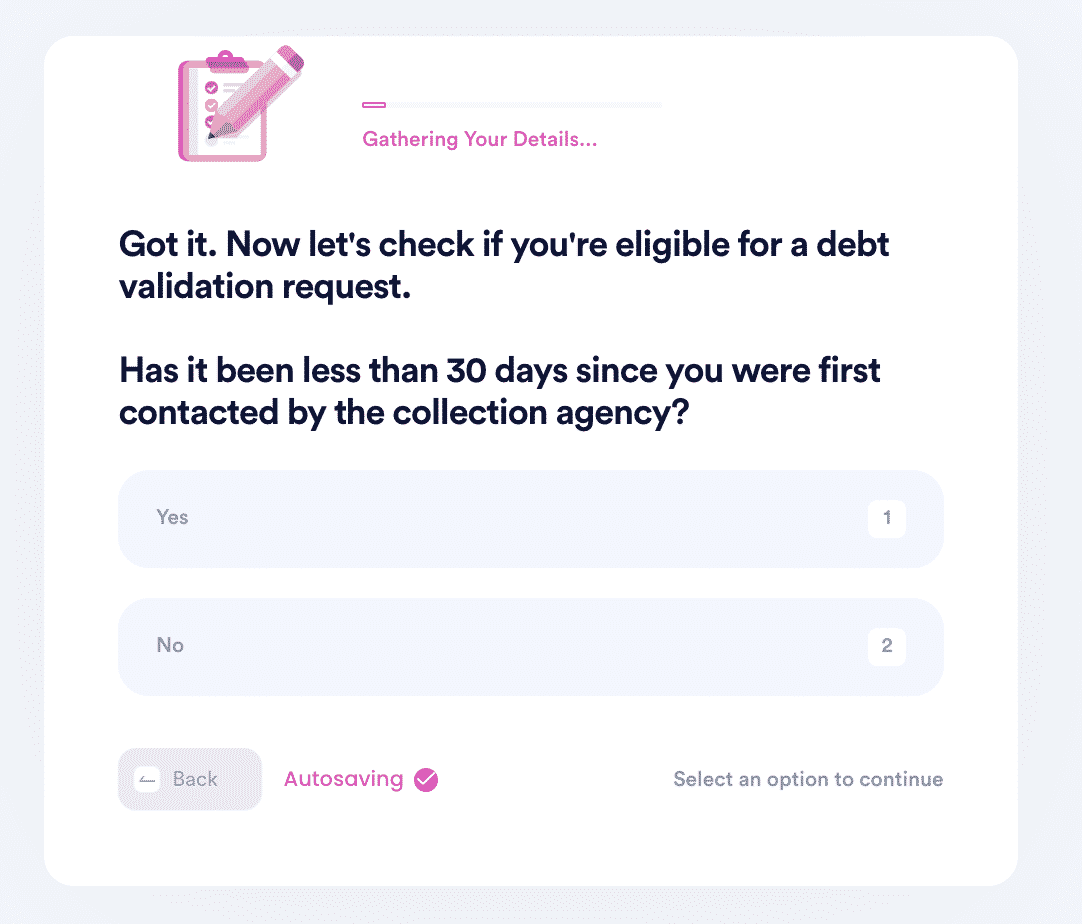

- If there are no errors, we'll check if you're still eligible to file a debt validation request. If they can't validate your debt, they're required to remove it from your report and they can't collect it!

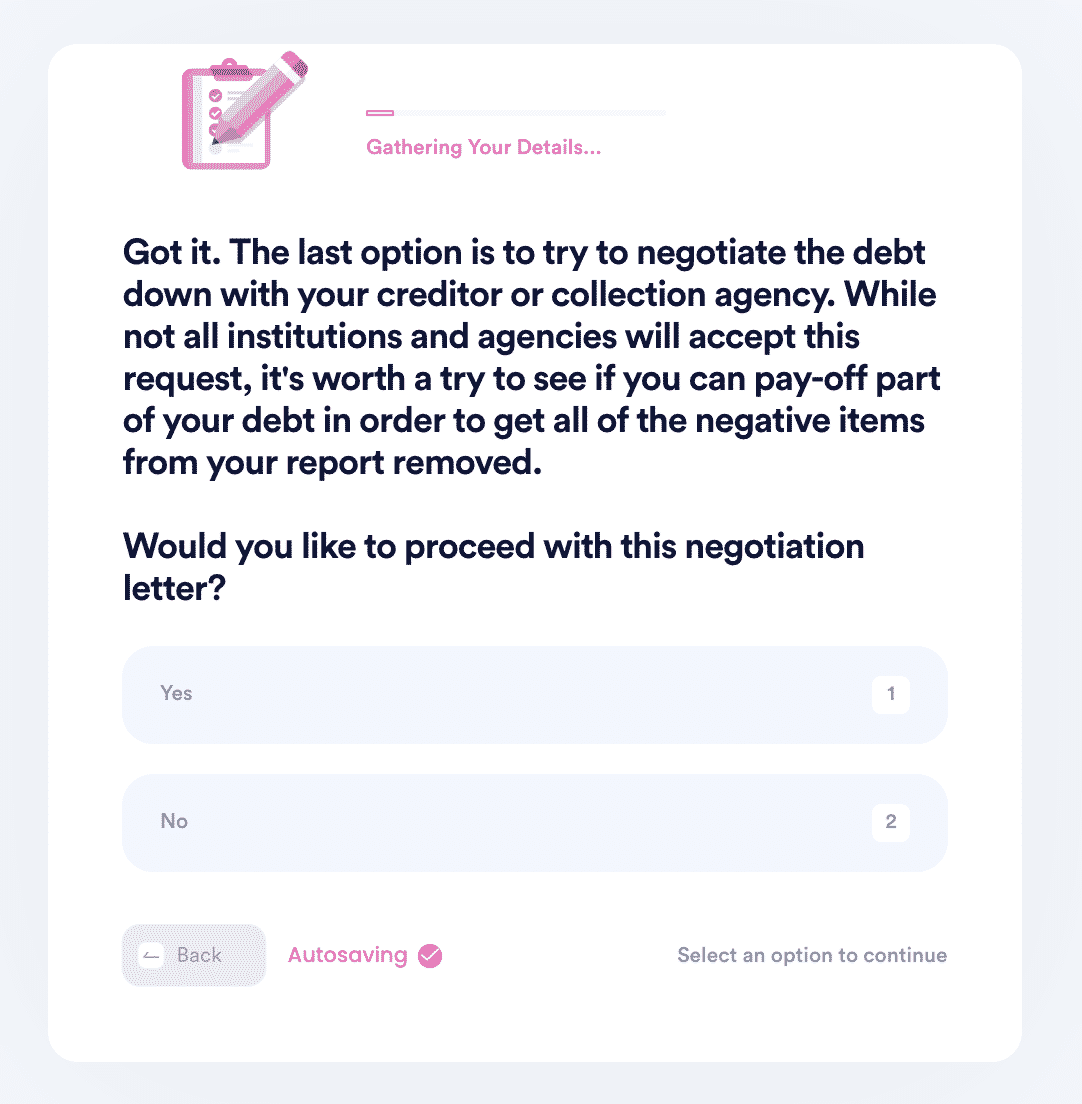

- Lastly, if none of the above options works, we'll help you file a pay-to-delete negotiation letter. You can customize the amount you are willing to pay in exchange for getting the item removed.

You can also check out our other credit products, including Credit Limit Increase, Get My Credit Report, Keep Unused Cards Active, and more.

Why Use DoNotPay To Get Experianprotectmyid Reviews?

DoNotPay helps you resolve this and many other issues for the following reasons:

- Fast—with the help of an automated platform, you can resolve any issues within minutes

- Easy—the platform is easy to use as most processes are automated. You won't have to fill out any forms as DoNotPay will do so on your behalf

- Successful—once you have submitted your request, you can relax and wait for positive feedback You can rest assured knowing we'll make the best case for you

DoNotPay Can Help You With Many Other Issues

With the help of DoNotPay's automated platform, you can also access the following services:

- Writing a debt validation letter

- How to remove a collection from credit reports

- How to remove late payments from credit report

- Getting a credit dispute letter

- How to fox credit score