Did Someone Steal Your Identity? DoNotPay Can Help You Resolve Experian Identity Theft

Experian is one of the three major credit bureaus that companies look at to decide if they'll offer you credit. This makes it essential that your Experian credit file is always in excellent condition.

However, if you're experiencing Experian identity theft, it's also affecting your creditworthiness and your ability to open new credit accounts. It can also leave you owing thousands of dollars for accounts you didn't open.

You can try to resolve an on your own, but it isn't easy. It can take months or years to correct, especially if you handle it alone. With DoNotPay, you can solve the problem of Experian identity theft much more quickly.

What Is Identity Theft?

Identity theft is a crime where someone else uses your personal information. They might use your personal information to open credit accounts or make expensive purchases, such as a car or a home. In some cases, the person might steal your identity to rent an apartment or secure a job.

The longer the person uses your identity directly affects the amount of damage they can do to your name. It's always difficult to prove identity theft and get your finances in order because the creditors have a signature on file that they believe was yours.

Signs That You May Be a Victim of Experian Identity Theft

When you're a victim of Experian identity theft, there will be early warning signs that you need to know to act more quickly before too much damage is done. Here are a few signs to consider:

- New accounts on your credit report that you didn't open

- Calls from creditors where you don't have an account

- Inquiries on your credit report that you didn't approve

What to Do If Someone Stole Your Identity

When someone steals your identity, you might not know what steps to take to resolve the situation. Here are some steps to take:

- File a Police Report. Identity theft is a crime, but you need to report it. You can go to your local police department, file a report online or request an officer visit your home.

- Freeze Your Credit Report. All the major credit bureaus offer a way to freeze your credit. You can do this on your own or work with DoNotPay to do this.

- Call the Creditors. If you're the victim of identity theft and know the fraudulent accounts, you can call the creditors to let them know. However, it may take additional steps to resolve the issue.

How to Prevent Identity Theft

You don't want to find yourself in a position where someone steals your identity, which means preventing identity theft. Here are some things you can do to prevent identity theft:

- Don't give out personal information over the phone or email unless you initiate the contact.

- Keep your personal information, such as Social Security cards and account information, in a safe place.

- Beware of scams to get your personal information.

How to Freeze Your Credit Report When You Experience Experian Identity Theft

After discovering an Experian identity theft, you'll need to freeze your credit report to limit the misinformation. You'll need to call each of the credit bureaus. When they freeze your credit, they will give you a password to unfreeze it after you've dealt with the issue, so keep the password in a safe place. You can call them at:

| Equifax | 800-349-9960 |

| TransUnion | 888-909-8872 |

| Experian | 888-397-3742 |

Solve the Challenges of Dealing With Experian Identity Theft With the Help of DoNotPay

It's a serious issue when you experience Experian identity theft, so you need to resolve it as quickly as possible not to damage your credit permanently. It can be a challenge trying to deal with it on your own, and you can spend months trying to resolve the issue without results. DoNotPay can make it easier.

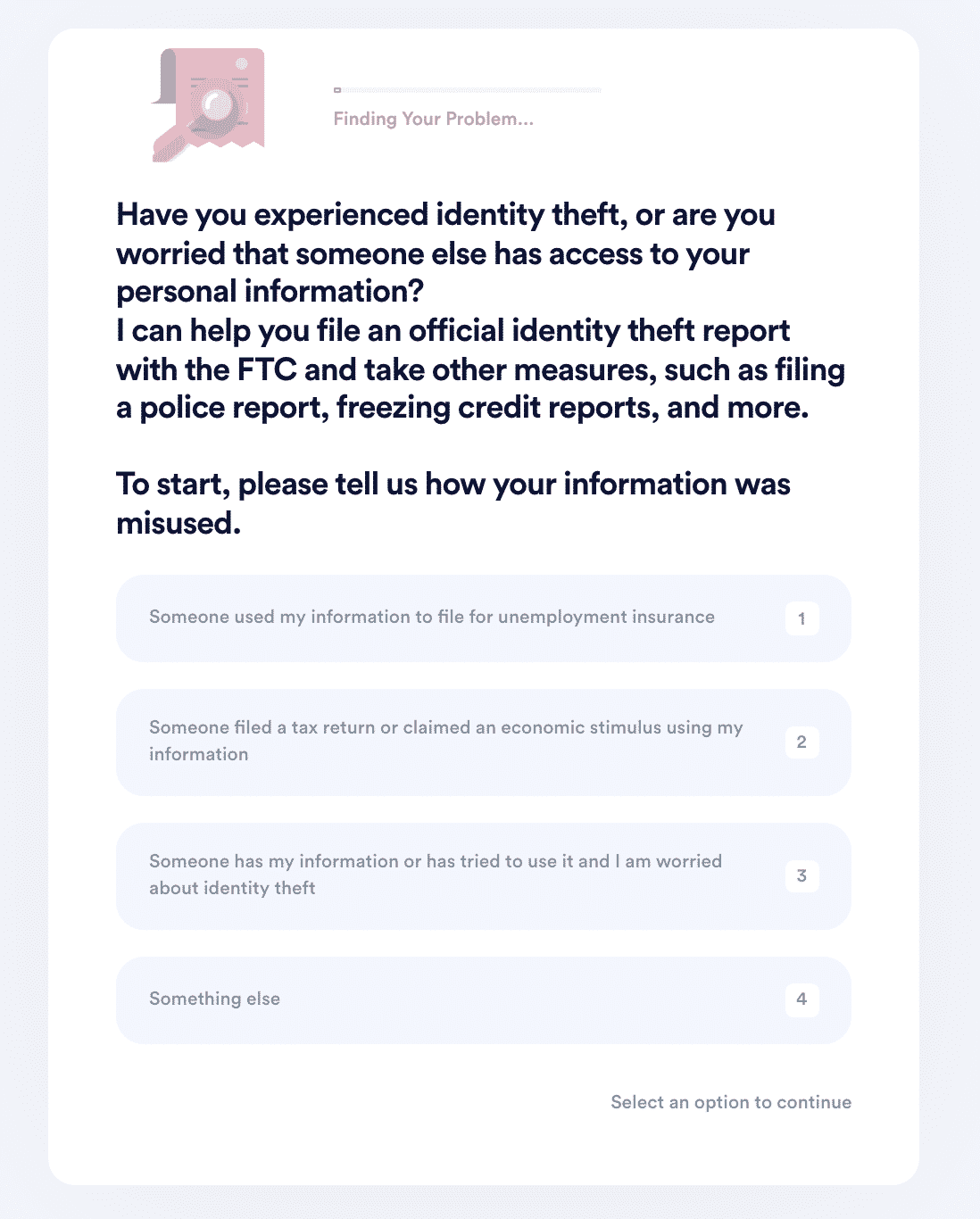

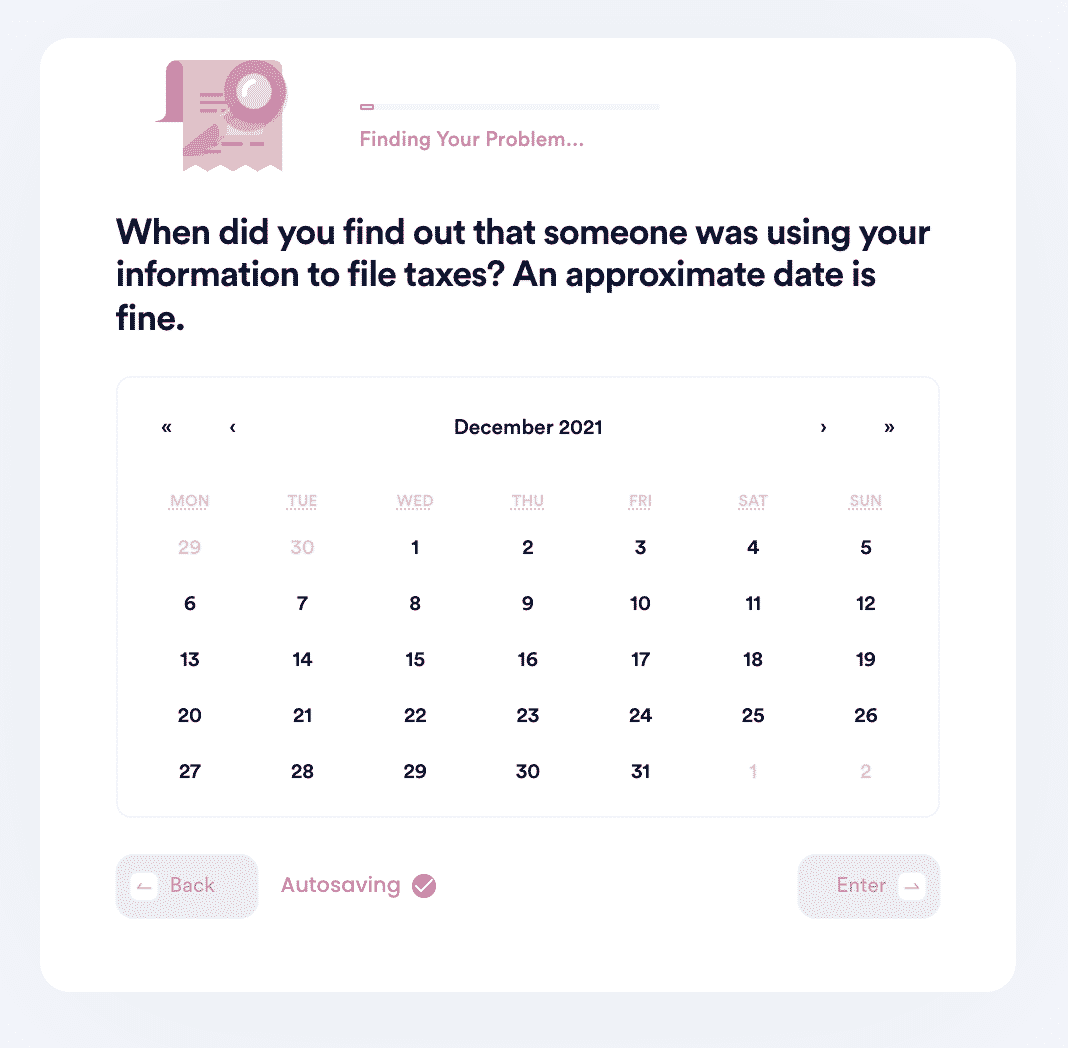

How to deal with identity theft using DoNotPay in three easy steps:

- Search "identity theft" on DoNotPay and select the type of incident you would like to report.

- Tell us more about the incident that occurred, including the location, date, time, financial loss, and any suspect information you may have.

- We'll identify whether you should file an FTC report, contact the IRS, freeze your credit report, contact state agencies, or file a police report. Once we guide you through the best options, we'll automatically submit the reports on your behalf.

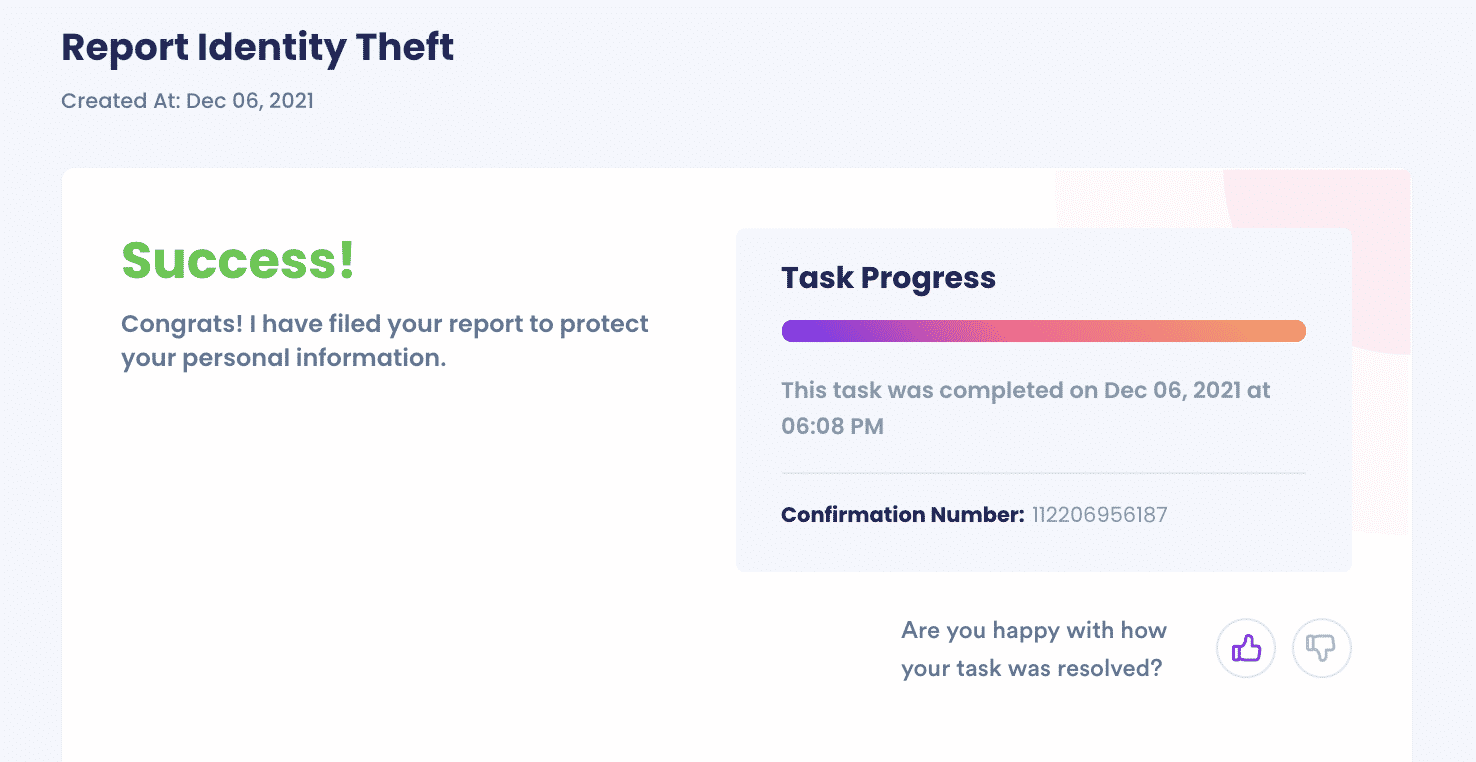

And that's it. DoNotPay will make sure your issue gets sent to the right place. We'll upload confirmation documents to your task for you to view, and if the contacts need more information, they will reach out to you personally via email or mail.

Why Use DoNotPay to Help You Deal With Experian Identity Theft

While you might try to solve your problem with Experian identity theft yourself, you need to use all the tools available to you, including DoNotPay. Here are the three main reasons:

| Fast | You don't have to spend hours trying to solve the issue. |

| Easy | You don't have to struggle to fill out tedious forms or keep track of all the steps involved in solving your problem. |

| Successful | You can rest assured knowing we'll make the best case for you. |

DoNotPay Works Across all Companies/Entities/Groups With the Click of a Button

After using DoNotPay to resolve your Experian identity theft, you'll have family members and friends who ask you how you did it. The DoNotPay app can help anyone who experiences any type of identity theft. Here's a look at a few of them:

- Stolen stimulus check

- Equifax identity theft

- How much can you send demand letters to for identity theft

What Else Can DoNotPay Do?

After DoNotPay helps you with your Experian identity theft issues, you can explore other ways the app can help. Some of the most popular include:

- File a lawsuit in small claims court

- Get compensation as the victim of a crime

And more!

Begin reclaiming your life after Experian identity theft with the help of DoNotPay today.