How to Handle California Lottery Taxes After Your Big Win

So, "lady luck" chose to be on your side this time and you just won the lottery, hurray! Before you think of how to spend your money, "Uncle Sam" needs his share. Well, just how much can you take home after your big win?

Winning the lottery is a once-in-lifetime opportunity. Chances are, you've been playing for a while and have probably made significant losses over the years. It's natural to think you can keep it all since the winnings are not exactly "earned income." Well, that might not be the case.

Tax laws vary from state to state . So before you make huge expenditure plans, find out how much of your wins belong to the government. DoNotPay can help you answer any questions regarding laws and help you explore your options when you win a lottery game.

Are Lottery Taxes Deductible in California?

According to the California Tax codes, lottery winnings are not subject to state tax withholding. Similarly, losses incurred for purchasing lottery tickets are not tax- deductible. However, lottery winnings are still subject to federal tax deductions. This means that the state of California can withhold your prize money on behalf of the federal government as a mandate by the IRS.

The California lottery tax exemption only applies to residents of California. If you win a lottery in California but are a resident of a different state, your winnings are subject to your state's tax deductions.

The California government reports lottery winnings above $600. While federal lottery taxes only apply to winnings above $5,000, what is reported is still reflected as income and you may be obligated to pay federal income tax in the next filing year.

How to Claim Your Lottery Winnings in California

Lottery winners in California have three options on how to claim their prizes depending on the prize money.

1. Claims Under $5,000

Claims under $5,000 also have different requirements before you can get a payout.

|

Lottery retailer |

Lottery prizes under $600 can be claimed in cash at a lottery retailer. Visit any retailer and issue your lottery ticket to claim cash on the spot. |

|

District office |

Claims over $600 but under $5,000 must have a claim form before they are issued. The state of California has 9 lottery district offices. Visit a district office near you and fill in a claim form. You can find the claim form at the District office or any lottery retailer. Sign the form, attach your lottery ticket and your national identification document. Remember to keep a copy of the form and your lottery ticket. |

|

Claim via mail |

To claim your lottery winnings via mail, fill out the claim form, attach your lottery ticket and a copy of your ID, driver's license, or US passport, and mail it to California Lottery, 730 North 10th Street, Sacramento, CA 95811. |

2. Claims Over $5,000

Lottery winnings above $5,000 can only be claimed with a notarized claim form. Download the claim form online or get it from the district office. Fill out the form, attach the ticket and your identification document, and submit it to the District office in person or via mail.

Select one of two payment methods:

- Lump-sum- Payable via check or bank deposit within 60 days of the claim

- Annuity- Payable in annual or other periodic installments.

Paying Taxes on California Lottery Winnings

While lottery winnings are not taxable in the state of California, the state withholds federal taxes. The federal tax rate is subject to revision from time to time but is currently as follows:

- 25% for US citizens and residents with a social security number

- 28% for US citizens and residents without social security number

- 30% for non-citizens and non-residents

The IRS codes require all lottery winners to fill a Form W-2G when filing their tax returns to show their lottery winnings and tax withheld. Winnings that are not withheld are still payable to the IRS, so make sure to account for that before you spend your prize money.

How to Report Lottery Wins and Other Prizes With DoNotPay

Filing lottery taxes and other gambling taxes is a hassle. Most people choose to hire a professional to help with filing to avoid accidentally cheating taxes. However, there 's a much better and simpler alternative with DoNotPay.

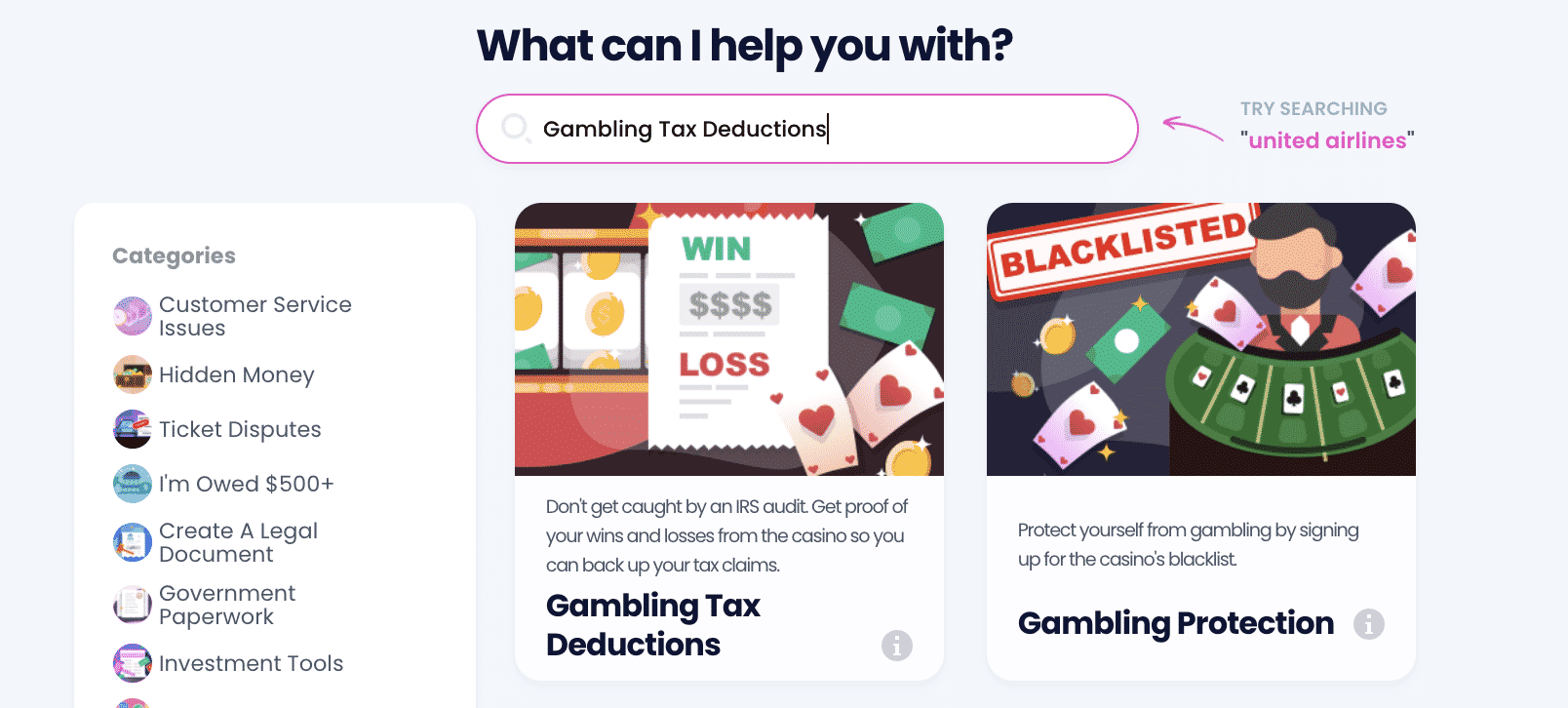

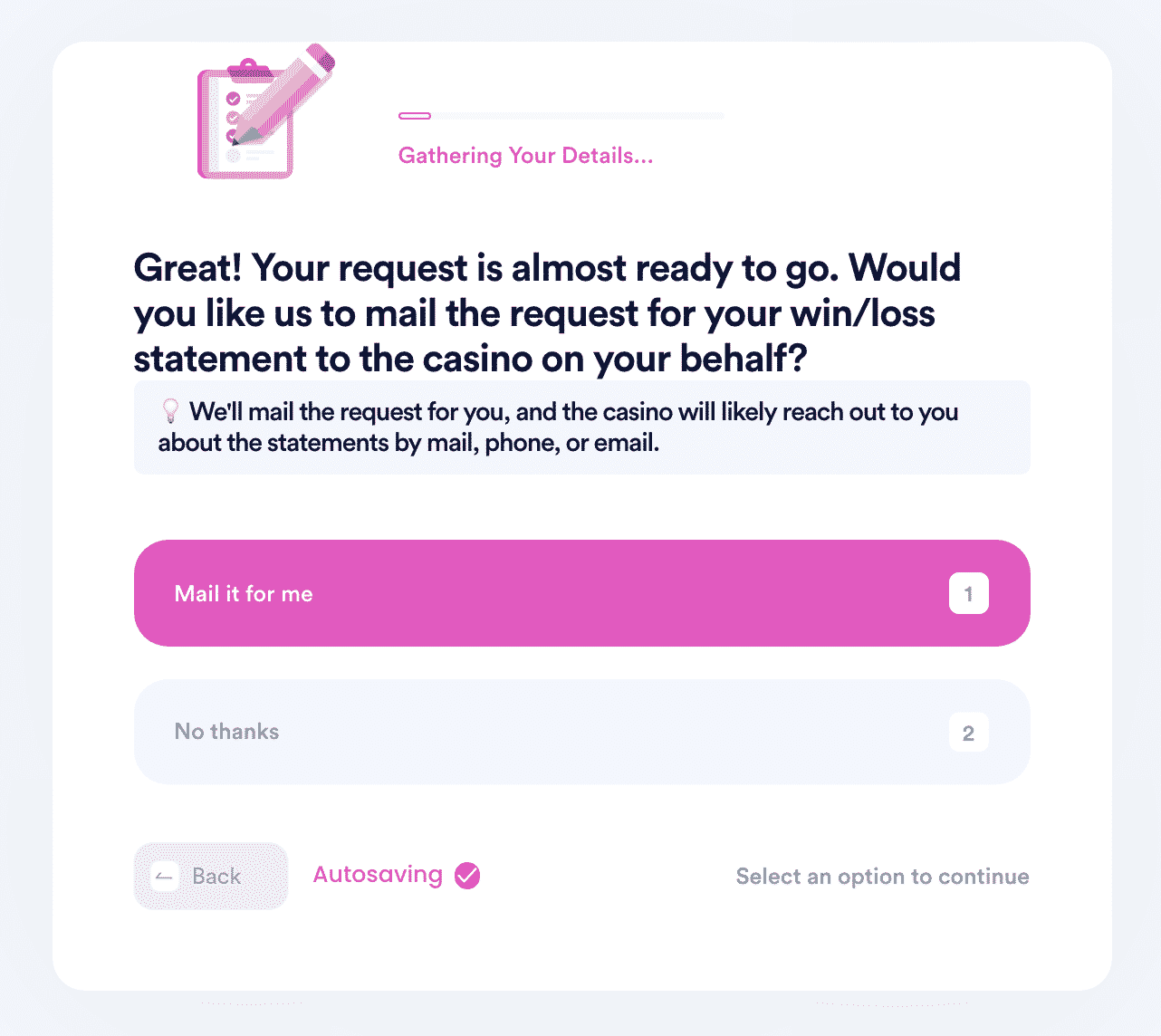

If you want to request a gambling wins/losses statement but don't know where to start, DoNotPay has you covered in 5 easy steps:

1. Search gambling tax deduction on DoNotPay.

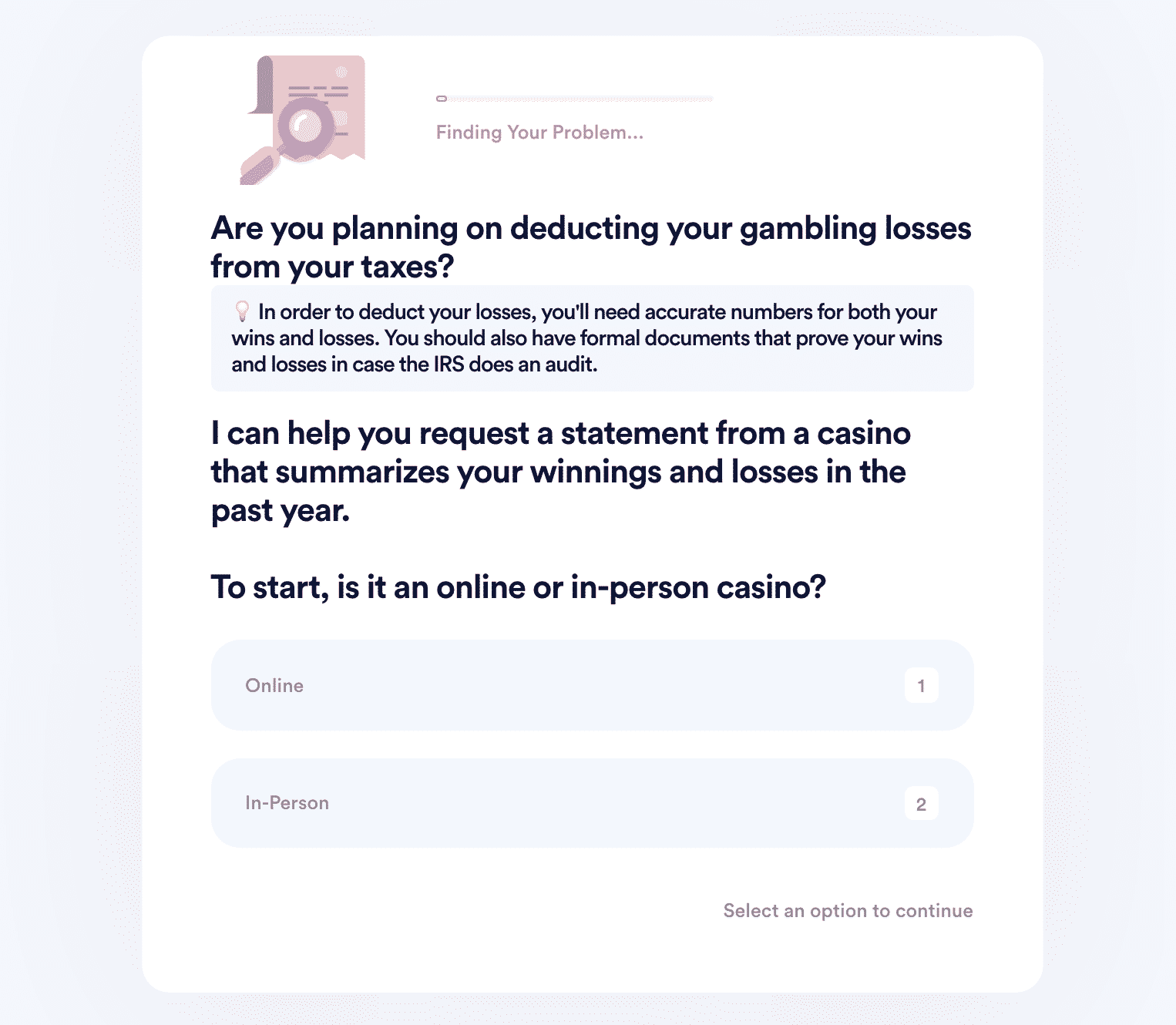

2. Enter the name of the casino and indicate whether it 's online or in- person.

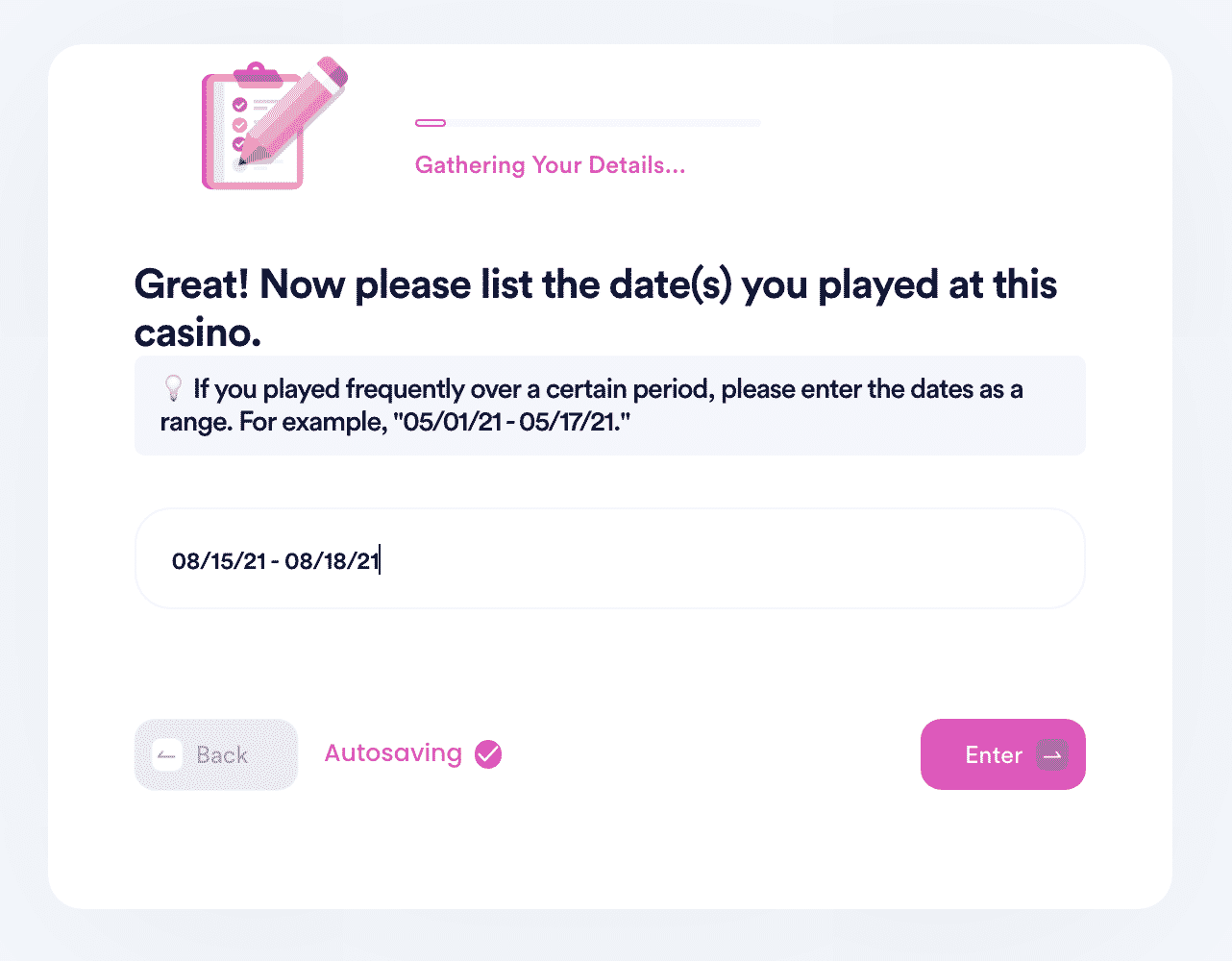

3. Tell us more about the dates and games you played, so the casino can identify your playing records.

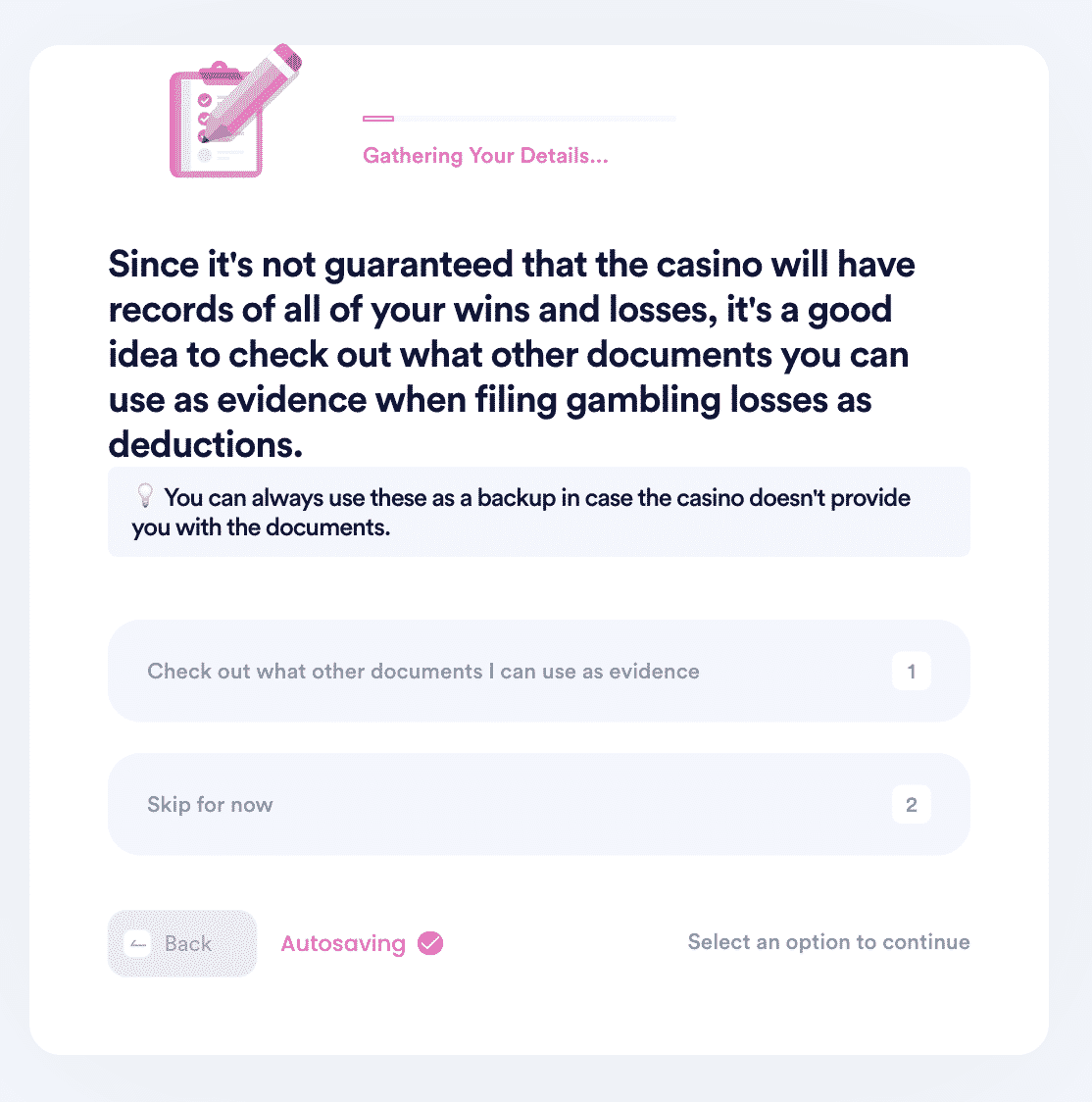

4. Select whether you have a players card or other form of membership with the casino and enter the relevant details. You also have the option to review other documents you can use as evidence when filing deductions.

5. Select whether you want DoNotPay to mail the form for you.

Why Use DoNotPay to Help You File Lottery Taxes

The IRS is very vigilant in prosecuting tax crimes. Failing to report your lottery winnings or underreporting is considered tax fraud and triggers an audit. A closer look at your finances by the IRS opens the floodgates to a lot of problems. DoNotPay helps you stay compliant by providing you with a convenient way to report your winnings and file your hassle- free.

In addition, we work with all companies and service providers to grant you access to all records and documentation on one platform.

DoNotPay Can Help You Find More Money

Winning the lottery is just one way of getting money in your pocket. Proper budgeting and keeping track of your expenditure goes a long way in saving you more money. DoNotPay can help you achieve this by:

- Canceling any subscriptions you're not using

- Appealing parking tickets

- Reducing your property taxes

- Getting college fee waivers

- Filing warranty claims on broken merchandise

Sign up with DoNotPay today and learn to save more by limiting your expenses.

By

By