Remove Universal Credit Services From Your Credit Report With DoNotPay

Located in Hartland, Michigan, is a third-party debt collection agency that's been active since 1992. If this company has shown up on your credit report, it means that it's just purchased one or more of your delinquent debts. It also means that you may have a hard time qualifying for an auto loan, a home loan, or any other type of financing. The good news is that DoNotPay can help you eliminate accounts like these. Whether you've already paid the debt in question, would like to negotiate a reasonable settlement amount, or don't believe that the debt is valid, DoNotPay has got you covered.

Taking the time to regularly review your credit report is the best way to identify and address reporting errors and other issues that are driving your purchasing power down. This is especially true when you've got the world's very first AI Consumer Champion on your team. DoNotPay can help you remove inquiries from your credit report, draft a credit dispute letter, and submit a debt validation letter. With DoNotPay, you can even learn how to remove late payments and credit inquiries from your credit report.

What Is Universal Credit Services?

Universal Credit Services is a national credit reporting agency that provides:

- Merged credit reports

- Employment verification reports

- Portfolio monitoring services

- Appraisal management

- Title monitoring

This company is also an authorized provider of reports for Day 1 Certainty for Fannie Mae.

What Does It Mean if Universal Credit Services Is on My Credit Report?

Of all the services that Universal Credit Services provides, this company is best-known among consumers as a third-party collection agency. When businesses cannot collect debts from consumers themselves, they often sell these debts to Universal Credit Services at a lesser cost. If you find an entry from Universal Credit Services on your credit report, this likely means that one of your delinquent accounts has been sold to this agency.

How to Dispute a Charge From Universal Credit Services on Your Credit Report

There are several solid reasons to dispute charges from Universal Credit Services and other companies like it. For instance, you should dispute this charge if:

- You believe that this debt belongs to someone else

- You've already paid the debt

- The debt has already been discharged as part of a bankruptcy filing

- This reported amount is greater than the amount that you owe

Should You Just Pay Your Debt With Universal Credit Services Instead?

If you're still learning how to improve your credit score, you may think that this process is as easy as paying all of your debts off, even ones from companies like Universal Credit Services. In reality, however, credit repair is a bit more complex. Paying certain debt types can work against you. This is certainly the case with collectors. Paying any third-party collection agency will change the status of your debt from "unpaid" to "paid". However, once paid, this debt will remain on your credit report for a full seven years. This means that other lenders will continue to see it and that it may have an ongoing impact on your ability to get financing.

There's also the important question of whether or not you've paid your debt off already, or whether the debt being reported should have already been discharged. When Universal Credit Services misreports a debt in any way, it's possible to have this debt removed from your credit report entirely. Best of all, you'll never have to hear from or deal with this company again.

Strategies for Successfully Disputing Inaccuracies on Your Credit Report

Companies are legally obligated to report their debts correctly. Unfortunately, they don't always get this right. When you review your credit report, you may find that you're being held responsible for charges that belong to someone with a similar name, the same birthdate, or a similar social security number. Numbers and letters can be easily transposed. Details such as the wrong address, the wrong name spelling, and more can result in your credit score doing down due to debts that you don't owe. There are even times when names and contact information are accurate, but debt amounts are wrong.

Not only are companies and third-party collection agencies responsible for accurate reporting, but they are also responsible for updating your report when accounts are charged off, closed, sold, discharged, and more. Fortunately, you can:

- Notify the three main credit bureaus

- Contact the company that furnished the inaccurate information to the credit bureau

- Wait for a suitable response from each of these entities

The three main credit bureaus are:

| Credit Bureaus | Mailing Address | Phone |

| Equifax | P.O. Box 740241

Atlanta, GA 30374 | 1 (888) 548-7878 |

| Experian | P.O. Box 4500

Allen, TX 75013 | 1 (888) 397-3742 |

| Transunion | P.O. Box 1000

Chester, PA 19022 | 1 (800) 916-8800 |

Send demand letters to Universal Credit Services for Unresolved Credit Report Disputes

There's also the option to send demand letters to Universal Credit Services for unresolved credit report disputes. You should give Universal Credit Services approximately 45 to respond to your inquiry or dispute. If you've already contacted this company and to no avail, DoNotPay can help you take your case to small claims court. You simply need to use the Send demand letters to Now product from DoNotPay to escalate your issue.

Send demand letters to Now is an effective tool to use when companies have made missteps, have been informed about their missteps, and still refuse to budge. Many consumers have used DoNotPay to successfully send demand letters to companies like:

- Mortgage companies

- Health insurance companies

- Cable companies

- Phone companies like Verizon and AT&T

You Have the Right to Send demand letters to Universal Credit Services Under the Fair Credit Reporting Act

Effective as of October 26, 1970, the Fair Credit Report Act exists to protect information that consumer credit bureaus collect. Under the Fair Credit Reporting Act, you have the right to have all of your consumer credit information reported accurately. If Universal Credit Reporting has made reporting errors and fails to respond to your inquiries, requests, or outright demands in a timely fashion, you also have the right to send demand letters to them.

How to Remove Universal Credit Services From Your Credit Report on Your Own

If you've contacted Universal Credit Services about your concerns and are unhappy with the response you've received, consider using the online dispute process for each of the three credit reporting bureaus. You can also reach out to the Consumer Financial Protection Bureau (CFPB) to submit a complaint. You can submit a complaint to the CFPB here:

| Company | CFPB |

| Mailing Address | Consumer Financial Protection Bureau PO Box 27170

Washington, DC 20038 |

| Phone Number | (855) 411-2372 |

| Email or Contact Form | Email Portal |

What to Do if You Can't Remove Universal Credit Services From Your Credit Report on Your Own

Contacting credit bureaus, third-party collection agencies, and the CFPB takes time. If you attempt to solve the problem on your own by taking the matter to small claims court, this will take time as well. These delays can be especially frustrating if you're trying to prime your credit score in advance of any major, big-ticket purchase. Fortunately, working with DoNotPay is a simple and sure way to get an expedited resolution.

Let DoNotPay Solve the Problem for You

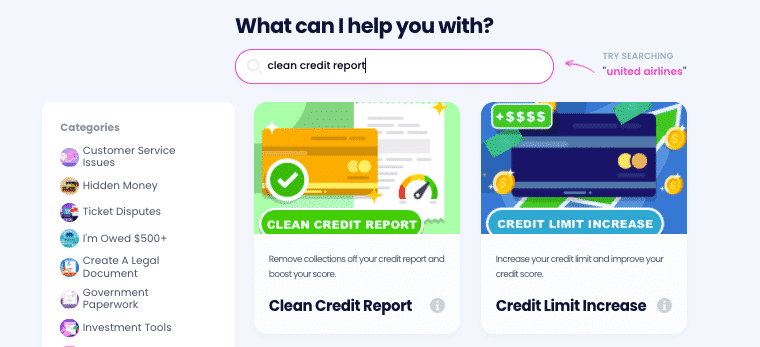

The Clean Credit Report product from DoNotPay offers an all-inclusive solution for consumers who are eager to improve their consumer credit profiles and increase their purchasing power. This is the perfect tool to use if you're considering purchasing a house, a new car, or any other big-ticket item. Given that more employers are running credit checks as part of their hiring process, subscribing to DoNotPay and using this service can also be a great way to boost your professional marketability.

How to clean up your credit report using DoNotPay:

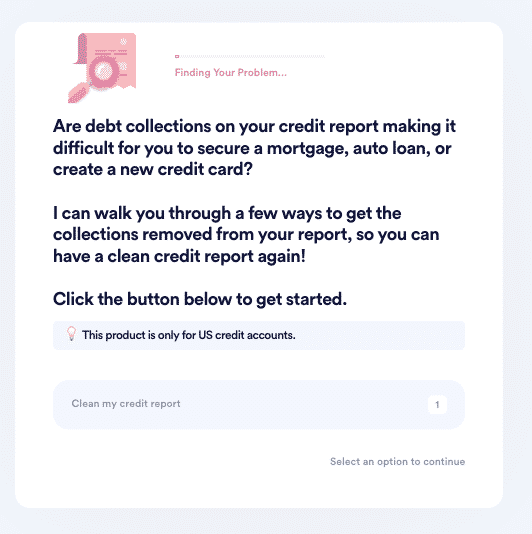

If you want to clean up your credit report but don't know where to start, DoNotPay has you covered in 3 easy steps:

- Search Clean Credit Report on DoNotPay.

- Prepare a recent copy of your credit report that you can use as reference.

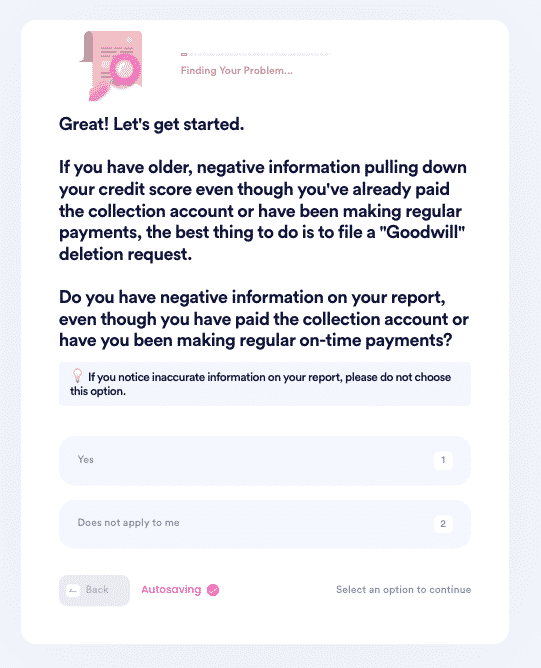

- Let us guide you through the 4 potential options:

- If you've already paid off your debt, we'll help you file a Goodwill Removal Request to get it removed.

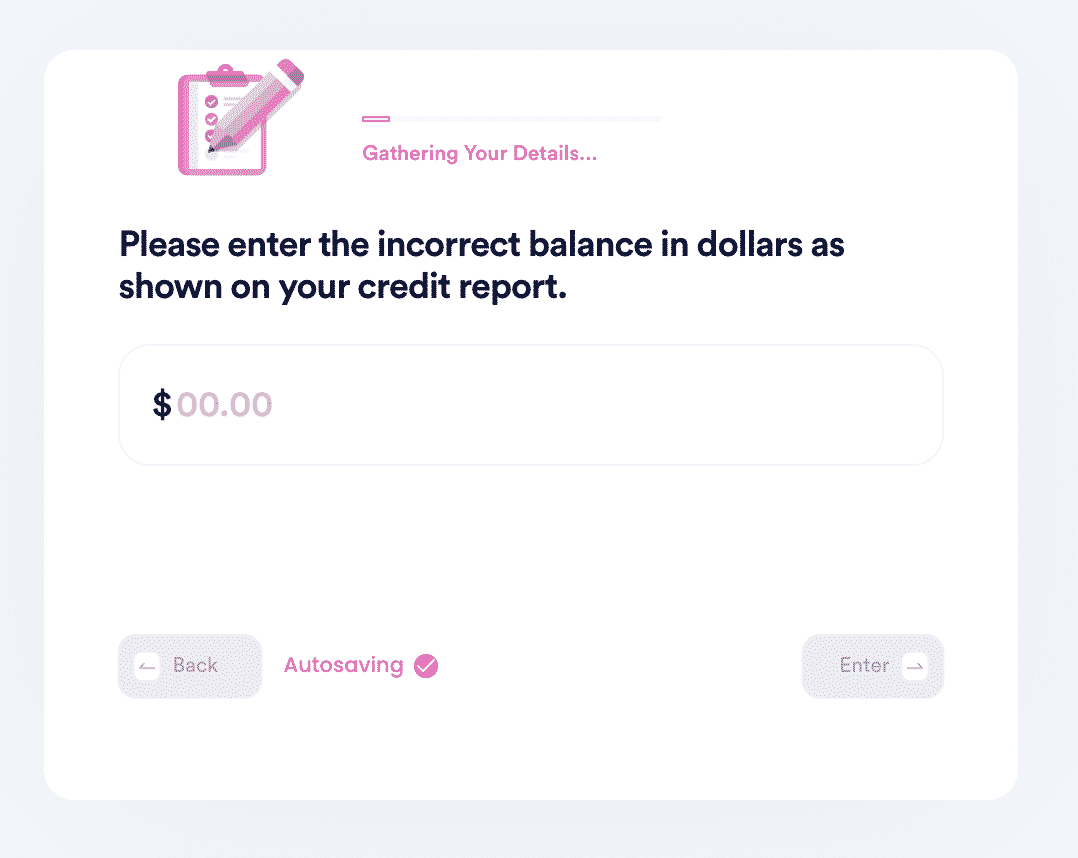

- If you notice any errors in your report (we have a list of common errors you can use!), we'll help you file a credit dispute to the creditor or major credit bureaus.

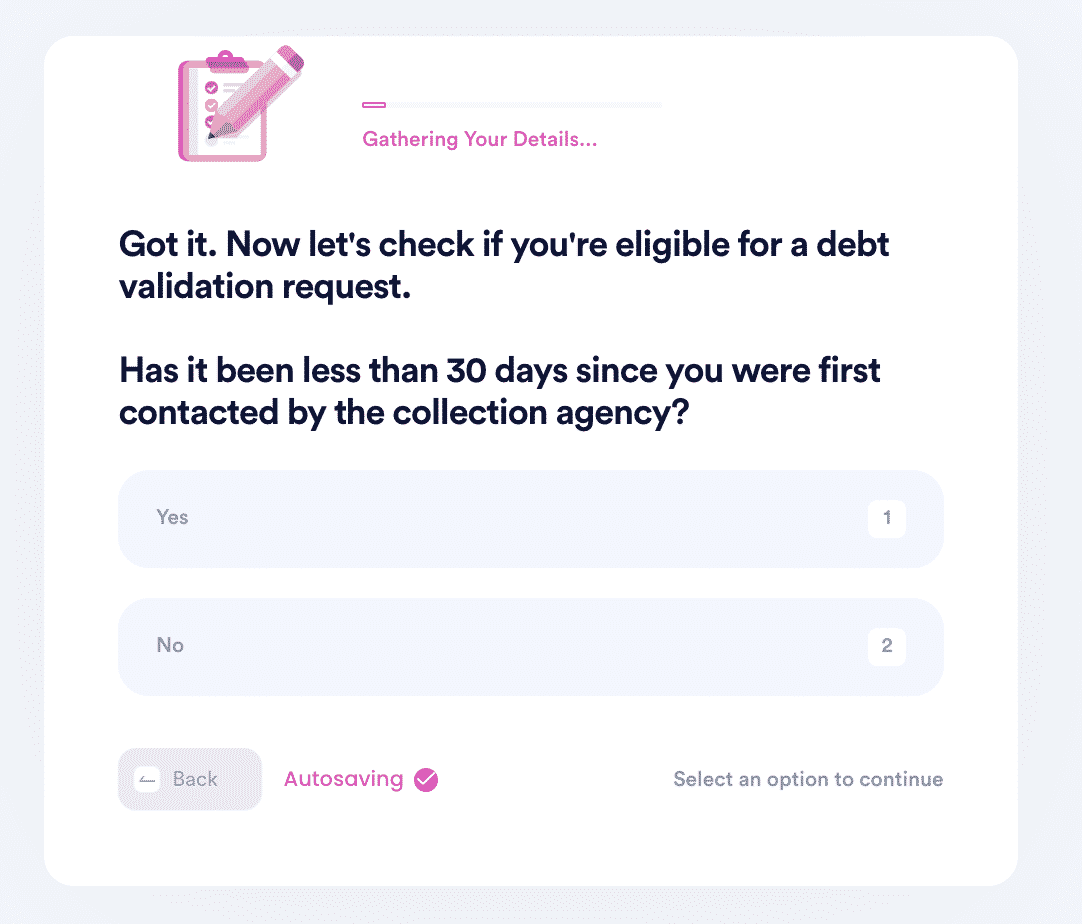

- If there are no errors, we'll check if you're still eligible to file a debt validation request. If they can't validate your debt, they're required to remove it from your report and they can't collect it!

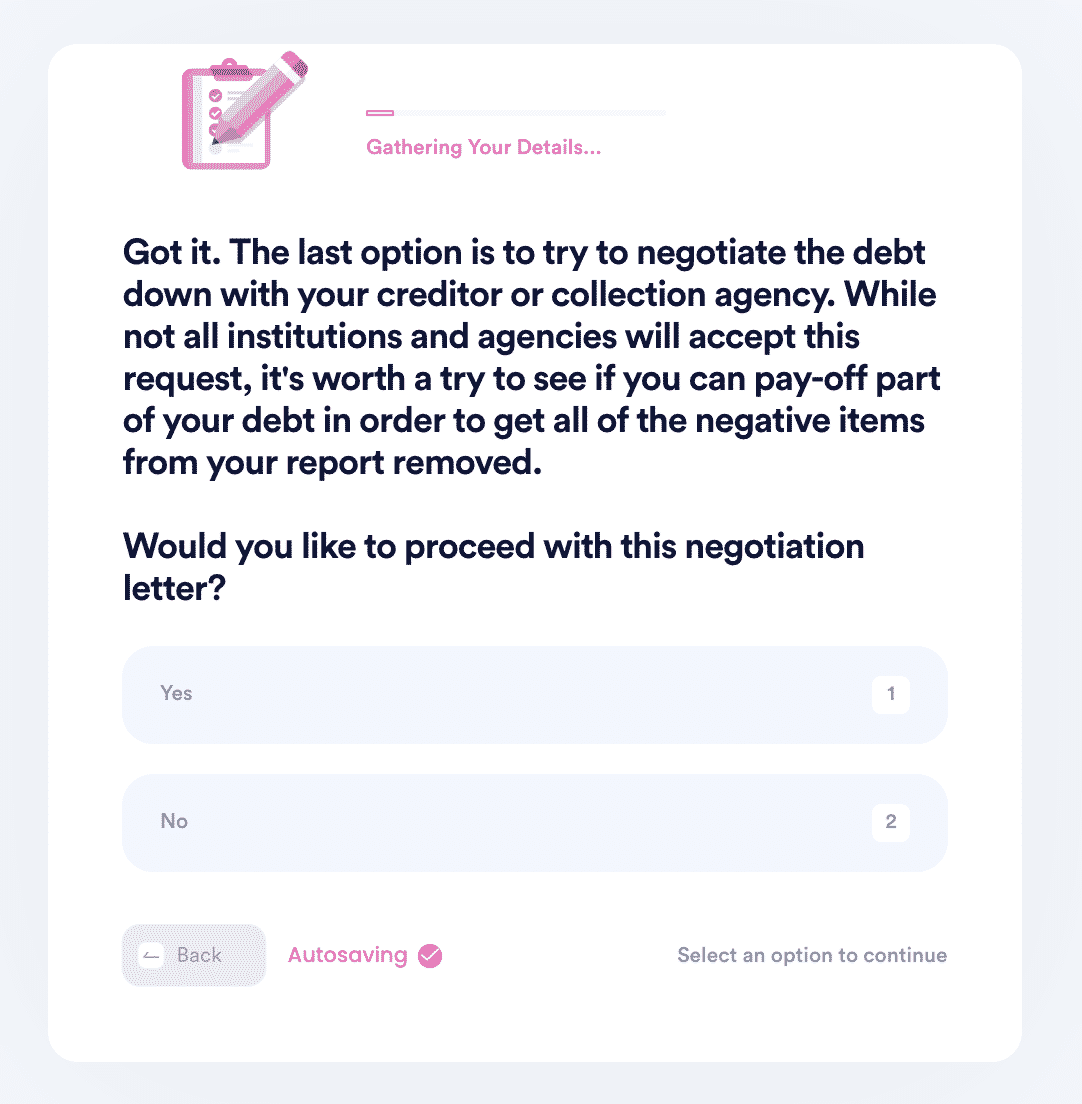

- Lastly, if none of the above options work, we'll help you file a pay-to-delete negotiation letter. You can customize the amount you are willing to pay in exchange for getting the item removed.

You can also check out our other credit products, including Credit Limit Increase, Get My Credit Report, Keep Unused Cards Active, and more.

Why Use DoNotPay to Clean Up Your Credit Report?

DoNotPay is built to solve problems like this one. Using DoNotPay is faster than tackling this Herculean task on your own, and far more likely to be successful. You don't have to spend countless hours arguing with creditors, and you don't have to draft dispute letters by yourself. With DoNotPay, you can find and leverage the perfect solution every time.

DoNotPay Works Across All Agencies and Entities With a Single Click

Like many consumers, you may have more than one collection agency on your credit report. The good news is that DoNotPay can help you dispute credit report entries from multiple companies. DoNotPay works across all agencies, companies, and entities with just one click. If you've got multiple reporting errors or other discrepancies to clear, let DoNotPay handle all of them for you in just minutes.

DoNotPay Can Help You Solve Many Other Problems

DoNotPay can do far more than removing from your credit report. There are countless financial problems that DoNotPay can resolve. You can use DoNotPay to save money, make money, and take care of time-consuming, frustrating tasks in mere minutes. For instance, DoNotPay can help you:

- Submit financial aid appeal letters

- How to remove collectors from credit report

- Cancel unwanted subscriptions

- Get help with your unpaid bills

If you're ready to fix your credit score, sign up for DoNotPay right now to get started!

By

By