How to Calculate Winnings From the Texas Lottery After Taxes

Congratulations! You chose the winning numbers in the lottery! But did you know that you will walk away with a prize much smaller than what you won because of the taxes that are withheld? To minimize the amount of taxes you pay from winning the Texas lottery , there are some things you can do and DoNotPay can make the process simple and quick.

The federal government before one penny is awarded to a lottery winner in Texas. Though there is no upfront withholding of taxes for the state of Texas like there is in other states such as Ohio, the additional income will probably change your tax bracket and therefore, the amount of money you owe during regular tax filings. You can use this handy lottery tax calculator to determine the amount of taxes you will owe. DoNotPay can help you with calculated losses as well, lowering your taxable winnings.

Are Gambling Losses Tax-Deductible?

You can win small amounts of lottery winnings without paying taxes, but it is always a good idea to keep good records. Gambling losses are tax-deductible. The trick is that you must be able to show proof to the IRS if audited. That is difficult to do since you probably paid cash for your ticket. Tax-deductible gambling losses that can be used to reduce your tax includes:

- Scratch tickets

- Casino losses

- Online losses

What if I Cannot Remember My Wins and Losses?

If you play lotto or gamble at a casino regularly, you probably are just having fun and not keeping track of the small amounts of wins and losses. But if you win a jackpot, you will wish that you had kept better records. To track your winnings and losses, try:

- Keeping a spreadsheet of wins and losses each time you play lotto.

- Include any online and casino winnings and losses on your spreadsheet.

- If you regularly play at certain casinos, join their membership or players club, and they can track your gambling losses.

- You can ask the casino to give you copies of those records for use when audited by the IRS.

How Can I Determine My Gambling Losses by Myself?

Of course, good record keeping is always important, but if you don't have a spreadsheet of what you spent and what you won, it may be difficult to reconstruct in a manner that an IRS audit will accept. If you gamble at casinos, you can file a request with your casino for a statement that summarizes your winnings and losses in the past twelve months. Wins and losses may be difficult to summarize unless they are sizable transaction, or if you hold a player's card or membership. If the casino has the information, a request from an individual may not receive the same priority treatment that would be given to a more official request.

What Else Can I Do if I Am Not Successful in Getting These Records?

If you have requested information from the casino, but they haven't responded or if you do not know how to go about getting the information, there are a couple of things you can do:

|

Reconstruct your gambling wins and losses |

You can examine credit card and bank statements to determine when you spent money at a casino or withdrew cash. |

|

Did you keep all those non-winning lottery tickets? |

If you did, you can use them to help in determining losses. |

|

Make a personal appearance at the casino |

You can ask to speak to a manager and ask for the information you need. |

|

Use DoNotPay |

DoNotPay can assist you get the records you need using the Gambling Tax Deduction Product |

How Can DoNotPay Help Me Get a Gambling Wins and Losses Statement?

If you want to request a gambling wins/losses statement but don 't know where to start, DoNotPay has you covered in 5 easy steps:

1. Search gambling tax deduction on DoNotPay.

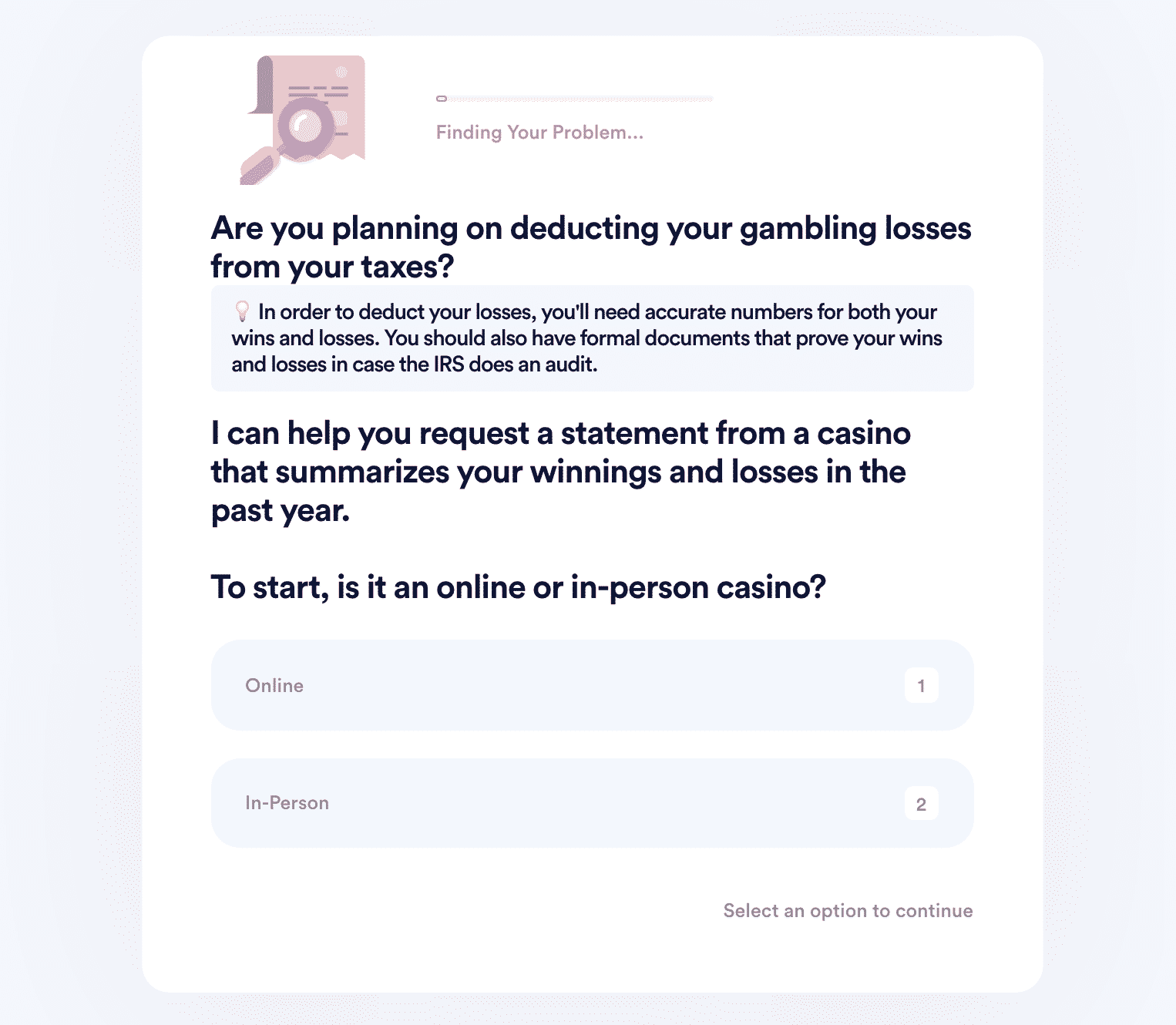

2. Enter the name of the casino and indicate whether it's online or in- person.

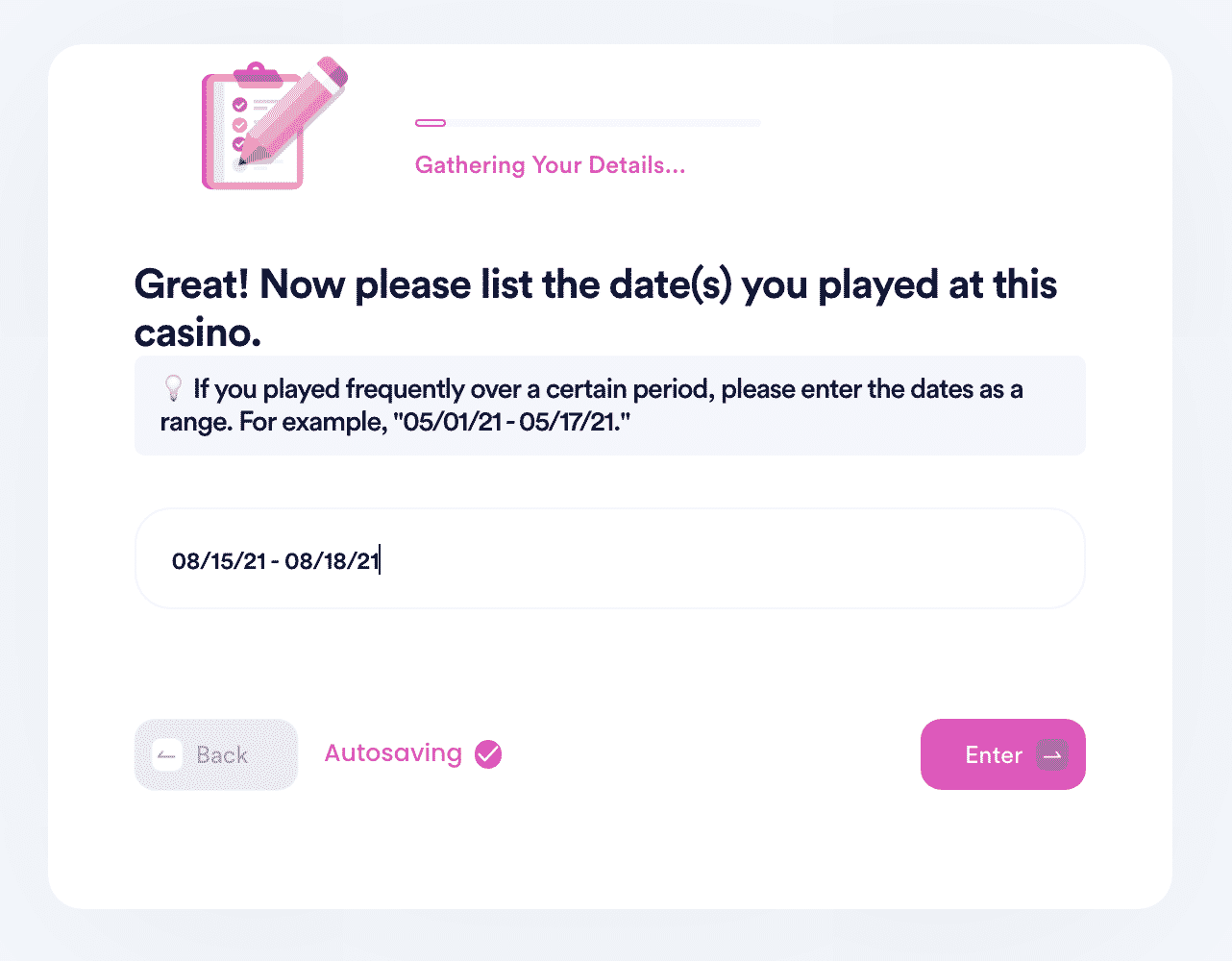

3. Tell us more about the dates and games you played, so the casino can identify your playing records.

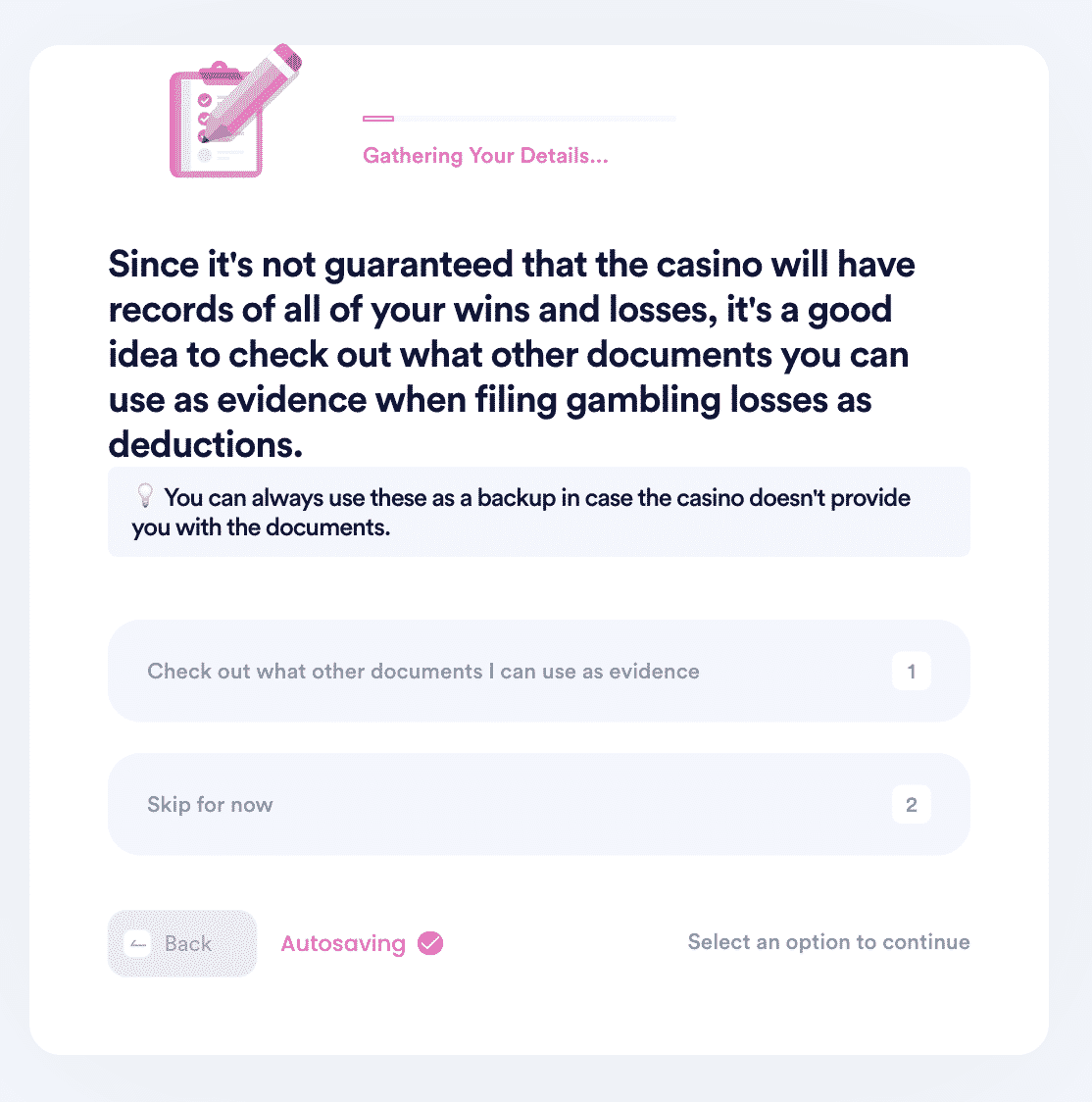

4. Select whether you have a players card or other form of membership with the casino and enter the relevant details. You also have the option to review other documents you can use as evidence when filing deductions.

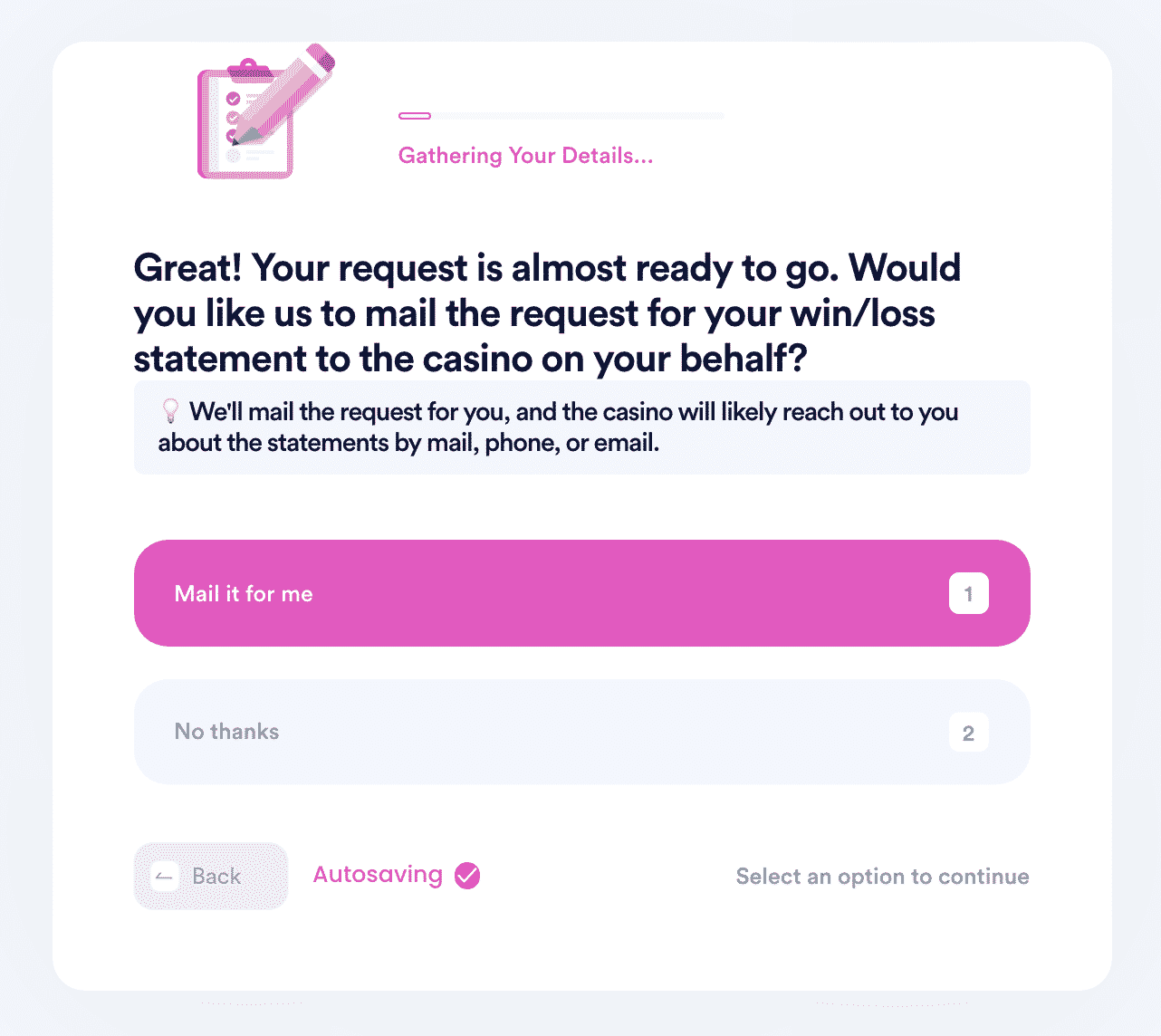

5. Select whether you want DoNotPay to mail the form for you.

And that's it! Often, a more official request will get faster attention than the request from an individual. DoNotPay will draft a statement request letter, so you can get a , which you can either deliver to the casino yourself or have DoNotPay mail it for you. If you choose the mailing option, you should receive a response from them via mail or email within 30 days.

What Else Can DoNotPay Do?

DoNotPay can not only help with the Texas Lottery after taxes , but also has solutions to many other problems you may need help with.

- If you are having an issue with getting chargebacks or refunds, DoNot Pay can help.

- Do you need to cancel a subscription or membership?

- Maybe you need a new passport photo or a virtual credit card.

- DoNotPay can help you file a complaint or locate missing money.

- Whatever the problem, let DoNotPay help you with a solution.

By

By