How to Close a Bank Account at TCF Bank

is known for its convenience and for being the first bank to have Sunday branch hours.

TCF Bank has headquarters in Wayzata, MN, with branch locations in Colorado, Illinois, Michigan, Minnesota, Ohio, South Dakota, and Wisconsin. Recently, TCF merged with Huntington Bank and will continue to operate as Huntington Bank beginning in the fourth quarter of 2021. TCF bank has been notoriously difficult to access if you move outside of the states with branch locations. TCF Bank is probably best known for opening its branch locations on Sundays.

If you no longer need to keep your TCF Bank account open or would prefer to bank elsewhere, you can take steps to close your account. DoNotPay can help you find your next account.

Reasons to Close a TCF Bank Account

Closing your TCF Bank Account can be a difficult decision. Reasons to close your TCF bank account could include:

- You have moved out of state and no longer have easy access to branch locations.

- You have a joint account with a partner who has passed away and you no longer need the account.

- You decide you would prefer to bank with a larger bank.

- Notoriously slow customer service.

- Personal issues with the way that the bank has handled your account.

- Federal sanctions that caused accounts to be closed.

- An account is dormant or has no activity for a certain amount of time.

Can TCF Bank Refuse to Close My Account?

TCF Bank hates losing its customers, but there is only one real reason they can refuse to close your account.

TCF bank can refuse to close your account if there are pending financial transactions. They might also refuse to close your account if your account is overdrawn and you owe the bank money for overdraft fees or overdue monthly maintenance charges.

Banks have the right to close accounts at their discretion. If they are the ones to initiate an account closure, they are not required to provide notification of their actions to the account holder(s). If your bank refuses to close visit DoNotPay for assistance with any options

Can I Close a Joint Bank Account if My Co-owner Passed Away?

If your co-owner has passed away, you need to provide proof to TCF bank to close the account.

If the co-owner on your joint account has died, you can close that account as long as you provide the proper documentation. The bank will require you to present a certified death certificate as proof that the co-owner has passed away.

What Happens to My Money if I Close My TCF Bank Account?

Your money is still your money whether you keep it in your TCF bank account or if you close your account.

No matter what the reason may be for the closure of your TCF bank account, the bank is still required to return your money to you. The bank should return your money to you in the form of a check unless you are closing the account in person where you can request your funds in cash.

Will Closing My TCF Bank Account Affect My Credit?

When you close your bank account, there is no direct effect on your credit score unless the account is closed with a negative balance.

How Do I Close a TCF Bank Account?

, but depending on the circumstances, closing your account might become complicated.

There are a few different ways for you to close a bank account.

Closing Your Account in Person

You can choose to close your account in person all you have to do is:

- Go to your branch office.

- Wait in line for a teller.

- Tell the teller that you would like to close your account.

- Wait while the teller looks at your account and then goes to get their manager.

- Wait some more while the manager reviews your account.

- Tell the bank how you would like to receive your funds, either in cash or in the form of a cashier's check.

- Sign papers acknowledging the closure of your bank account.

Closing Your Account Online

If you can’t go to your bank you can close your account online:

- Access your account through online banking.

- Log in to your account.

- Search within the site for 'close my account.'

- Answer the questions as to why you want to close your account.

- Upload any documentation requested by the bank.

- Wait for the bank to mail a check to your address if they agree to close your account.

Closing Your Account by Phone

You can also choose to close your account by phone by:

- Call the bank's customer service line.

- Enter your bank account number when prompted to do so.

- Enter your PIN number

- Listen to the current balance and activity on your account.

- Through their multiple-choice system, select the option to speak to a banker.

- Listen to annoying hold music and advertisements for banking products while you wait for the next available representative.

- Once a banker comes on the line, repeat your account number and PIN number as well as any other information that will confirm your identity.

- Tell the banker that you want to close your account and why.

- Wait while the banker leaves you on hold and confers with their manager about your account.

- Go through the process to confirm that you are closing your account.

- Request that your funds be returned to you in the form of a check and confirm your mailing address.

- Wait for your check to arrive in the mail.

Closing Your Account by Mail

If for some reason you want to close your account by mail you can:

- Write the bank a letter requesting that your account be closed.

- Include your name, address, and account number.

- Include in the letter the reasons why you are requesting account closure.

- Include copies of any necessary documentation to prove your identity.

- Put the letter in an envelope.

- Go to the post office and mail your letter. Don't forget the stamp!

- Wait for the bank to process your request.

- Call the bank to confirm that they received your letter.

- Wait for the bank to return your funds in the form of a cashier's check.

What Do I Do if I Can’t Close My TCF Bank Account by Myself?

Occasionally, you may have trouble closing your TCF bank account without help.

If you are unable to close your account on your own, look to DoNotPay to help you close your TCF bank account starting with a touch of a button.

How to Quickly and Easily Close a TCF Bank Account With DoNotPay?

Getting help from is the easiest way to close your TCF bank account.

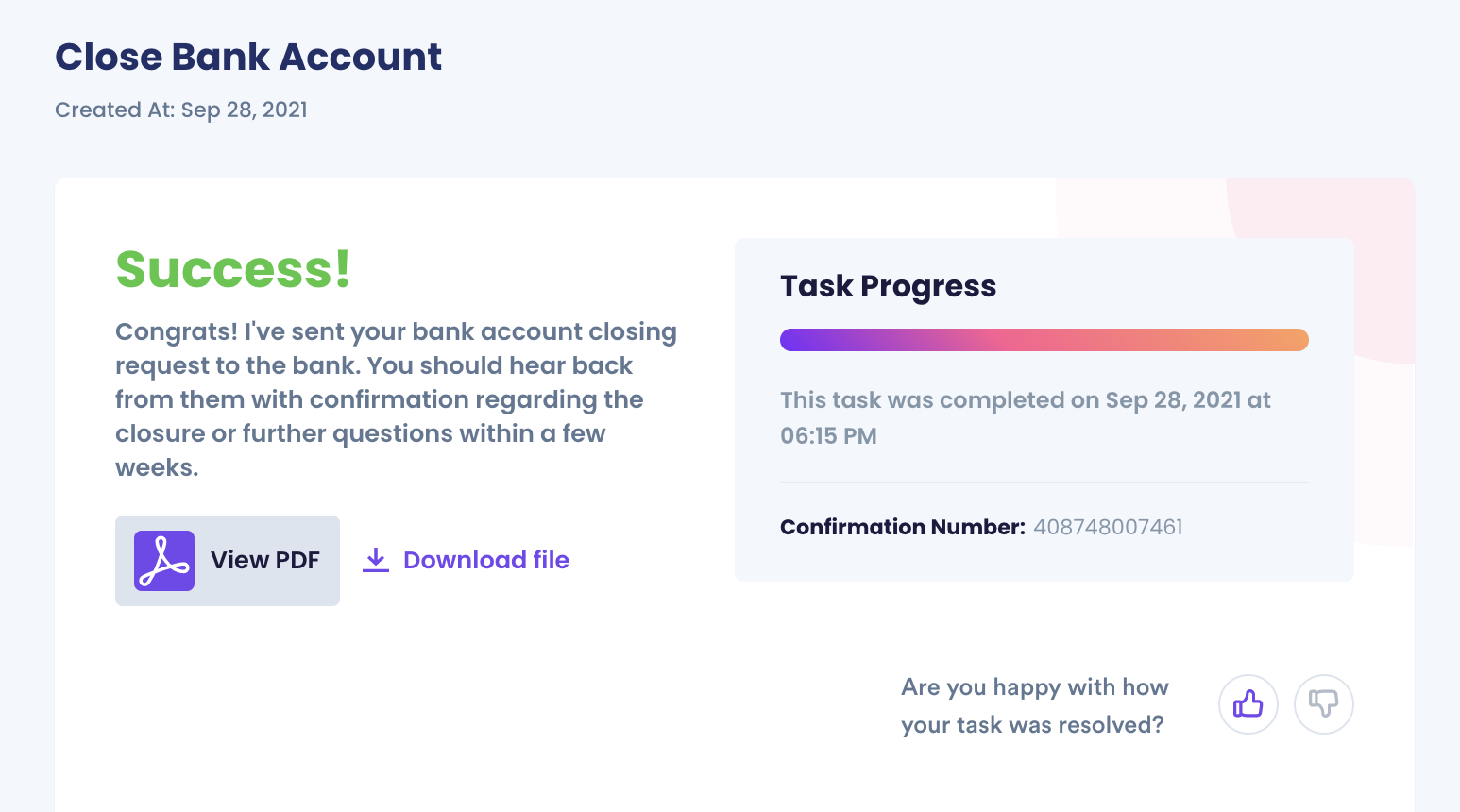

If you want to Quickly/Easily Close a TCF Bank Account but don't know where to start, DoNotPay has you covered. Create your own cancellation letter in 6 easy steps:

- Go to the Close Bank Accounts product on DoNotPay.

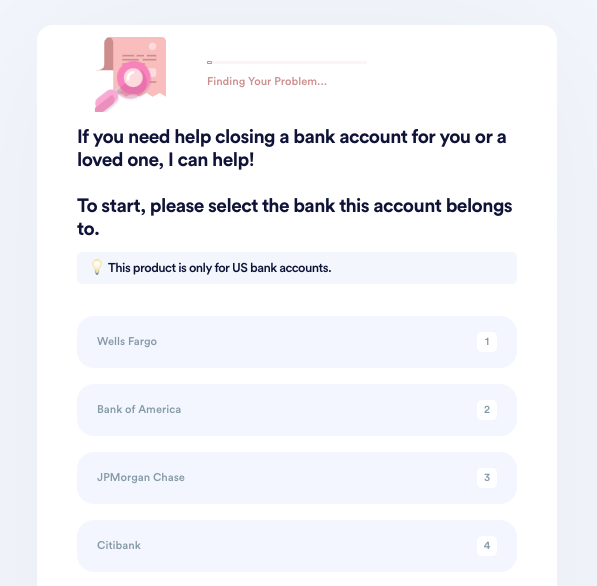

- Select which bank the account was opened under, and enter the account type, account number, and your local branch location.

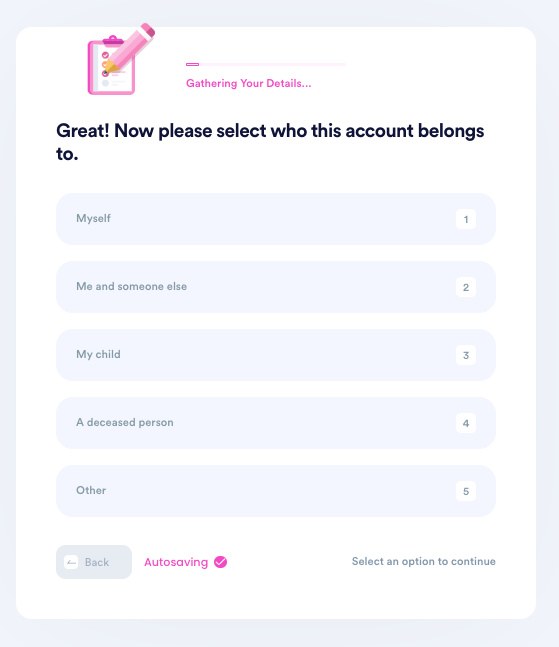

- Indicate who this account belongs to. If the owner or co-owner has passed away, upload a death certificate or other formal evidence. If you are not the original account owner, upload evidence of your relationship with the owner.

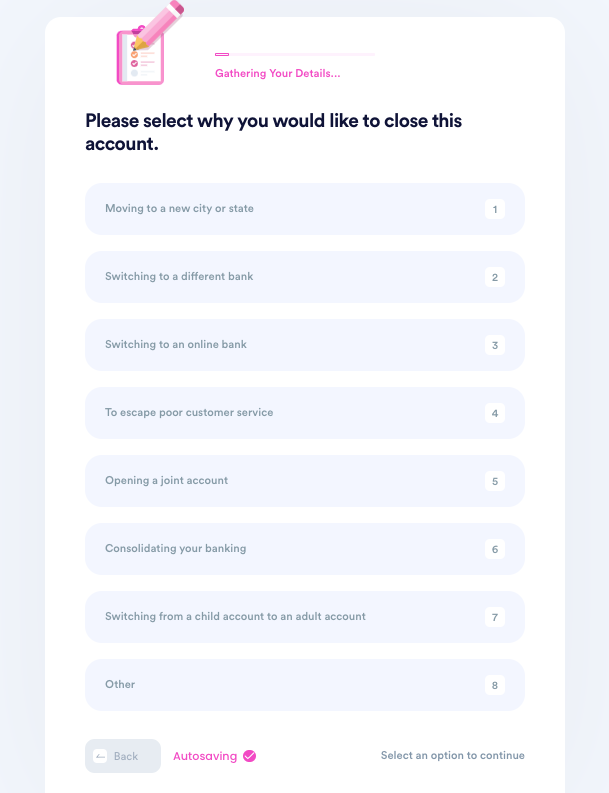

- Tell us why you need to close this account.

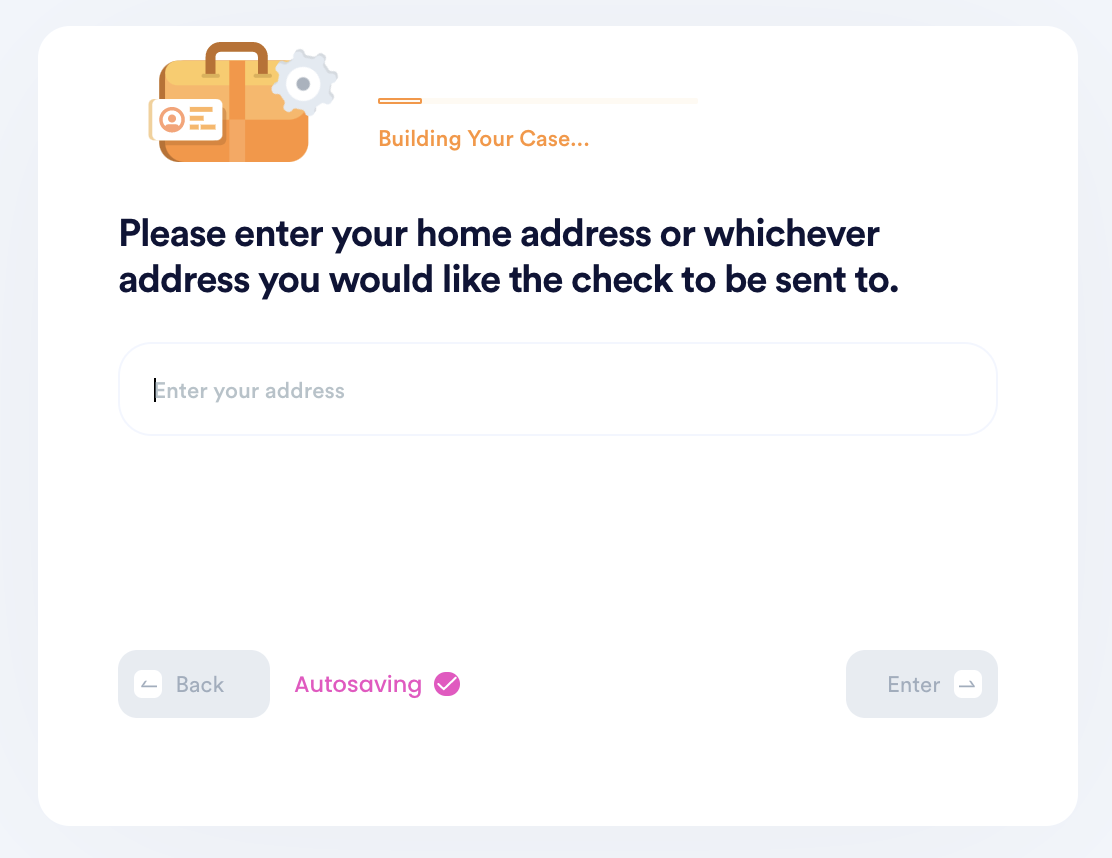

- Enter your contact information, including email, phone number, and the address you want any remaining funds to be sent to.

- Submit your task! DoNotPay will mail the request letter on your behalf. You should hear back from the bank with confirmation or a request for more information within a few weeks.

Why Use DoNotPay to Close a TCF Bank Account?

DoNotPay is your best option when you need to close a TCF bank account.

When you choose to use DoNotPay, you know that they won't miss any required steps. Using DoNotPay is:

| Fast | With a click of a button, you are answering the questions needed to solve your problem. |

| Easy | DoNotPay takes care of all of the details so that you don't have to worry. They make everything seem easy. |

| Successful | When DoNotPay is helping you, you won't miss any tedious details. They even offer virtual notary services. |

DoNotPay Can Help With Many Other Services With a Click of a Button

There are a number of different areas where DoNotPay can help you solve problems.

DoNotPay can help you with a lot more than just closing your bank account. Check out these other services provided by DoNotPay:

- Get a Death Certificate

- Credit cards

- Get help with bills

- Reducing your property taxes

Whenever you need to find solutions to financial or any other type of issue, visit DoNotPay where help is just a click of a button away.

By

By