All You Need to Know About Section 8 Income Limits

Nobody wants to be homeless. Unfortunately, rental costs across the country seem to keep rising these days and it is increasingly difficult for more and more people to afford even a simple apartment to rent.

What can you do in this situation? Fortunately, there is a program funded by the federal government which gives financial rental assistance to people who have low income, are elderly, or are disabled. Funding comes from the US Department of Housing and Urban Development (HUD).

This program is commonly known as "Section 8" but is more formally referred to as the Housing Choice Voucher Program. To qualify for the program, however, your income must be under a certain limit.

Applying for the program and attempting to determine what your income level must be is a tough and lengthy process. Here, we offer an explanation of and provide you with a fast, simple way to handle the details.

How Does Section 8 Work?

Although details vary a bit among all locations across the US, the basics are the same.

- The program is run in local areas by public housing agencies (PHAs) that receive funding from HUD

- Each PHA determines how much financial help a participating family will receive and pays it to the landlord directly

- The family pays the remainder due for rent and utilities – this must be at least 30% of household income

- Once approved, the family and landlord sign a lease, and the PHA signs a contract with the landlord to make payments on the family's behalf

Is There a Fixed Income Limit That Covers Everyone?

No, income limits vary based on family size, housing location, and other factors.

To view a 2021 list of income limits for locations across the country, visit this resource about income limits. This list presents various areas within all 50 states, and for each location, a few different limits are shown.

- "Extra Low Income" shows the maximum income allowed to qualify for rental payment of 30% of that income

- "Very Low Income" indicates how much income a family may have if they qualify for a payment of 50% of that income

Amounts under these categories differ across locations, and across family sizes for any single location.

What Are Some Location Examples?

Listed below are randomly selected locations and their income limits.

| Tucson, Arizona | ||

| 1 Person | Extra Low Income | $14,450 |

| 4 People | Extra Low Income | $26,400 |

| 1 Person | Very Low Income | $24,050 |

| 4 People | Very Low Income | $34,300 |

| Bakersfield, California | ||

| 1 Person | Extra Low Income | $14,650 |

| 4 People | Extra Low Income | $26,500 |

| 1 Person | Very Low Income | $24,400 |

| 4 People | Very Low Income | $34,850 |

| Syracuse, New York | ||

| 1 Person | Extra Low Income | $16,700 |

| 4 People | Extra Low Income | $26,500 |

| 1 Person | Very Low Income | $27,850 |

| 4 People | Very Low Income | $39,750 |

What Else Is Required Besides Income Limitations?

Various other conditions of eligibility must be met to be accepted for the Section 8 housing program. These include family status, citizenship status, and student status. Every year, HUD determines based on family size and the median income in the area in which housing is desired by the applicant.

HUD provides guidance to local PHAs to take into consideration when determining eligibility requirements for their local areas. These include:

- Income must be considered very low-income or low-income and meet additional criteria

- The household must qualify as a family as determined by HUD

- Students not residing with parents must meet additional criteria

- Applicants must prove U.S. citizenship or eligible immigration status

To learn more about eligibility requirements, take a look at HUD's Housing Choice Voucher Program Guidebook or contact your local PHA.

Is There an Easier Way to Apply for Section 8?

Exploring Section 8 options and applying for assistance can be tricky and time-consuming. Remember that we offer a handy product to help you learn about and apply them using a simple method.

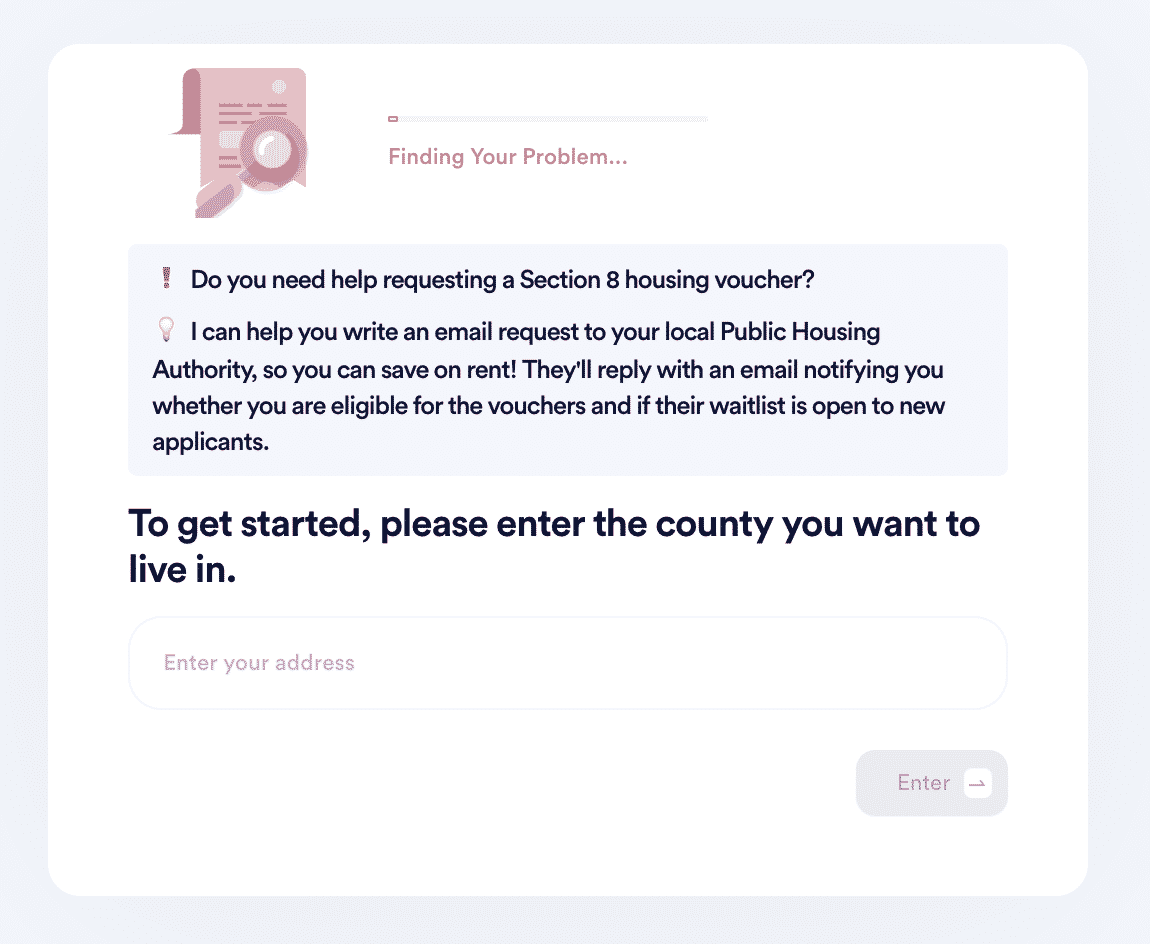

How to Apply for Section 8 Housing With DoNotPay

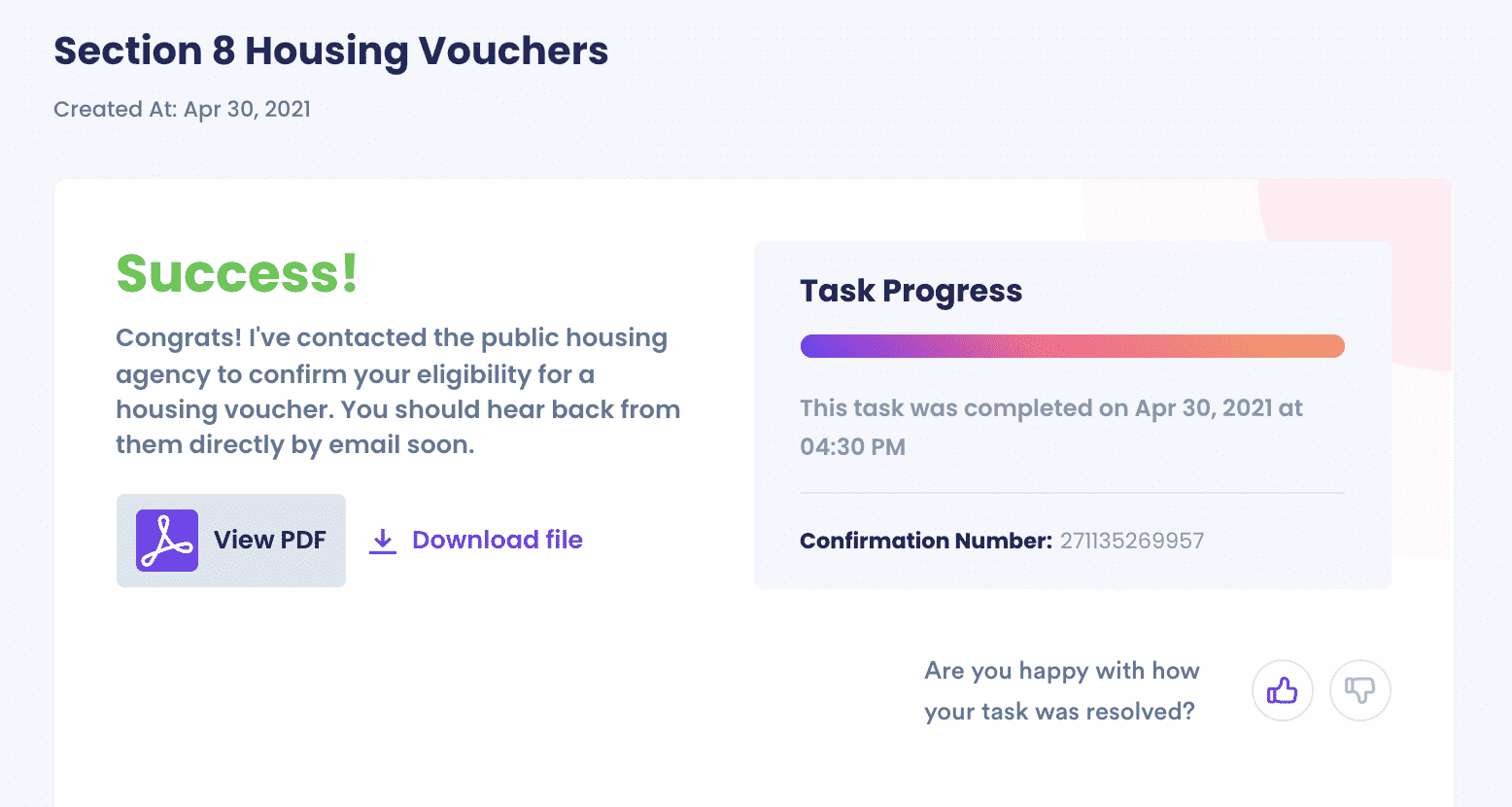

If you want to apply for Section 8 Housing but don't know where to start, DoNotPay has you covered in 2 easy steps:

- Answer a few questions about your income, family size, veteran/disability status, which county you hope to live in, etc.

- DoNotPay will find the PHA in charge of that county and contact them with all of your eligibility information to determine if you can start applying. They'll get back to you directly via email with the next steps.

Can DoNotPay Help Me With Other Section 8 Inquiries?

Yes! Consult these related articles regarding problems for which we can provide help:

- Section 8

- Get Section 8 immediately

- Section 8 vouchers

- Section 8 rental assistance programs

- Where do I apply for Section 8?

- Section 8 application form

- Section 8 Government Housing

What Else Can DoNotPay Do?

DoNotPay can give you a quick and automated way to help with a wide list of problems. We offer many additional products to help simplify your life, including (but not limited to):

- Small-claims court

- DMV appointments

- File a complaint

- Missing money

- Lowering property taxes

- Help with bills

- Free trials

- Find and apply for scholarships

Our products can provide you with easy, smooth ways to deal with the difficulties of Section 8 issues, and they can certainly help with other tedious and annoying tasks we encounter in life. Sign up today to jump the queue for Section 8 housing!

By

By