How to File an LAPD Identity Theft Report

Identity theft is scary, confusing, and always difficult for anyone. It's frustrating to resolve, not to mention costly, if not resolved on time. Sadly, 47% of Americans were victims of financial identity theft in 2020.

So, how should you proceed when your identity is stolen?

After someone steals your identity in LA, it's crucial to . While the police may not always be able to track your imposter, having a copy of a police report will help protect you in the future should your identity be used in a crime. Also, credit institutions and banks may require a police report verifying your identity theft report.

What Exactly Is Identity Theft?

happens when someone uses your personal information to make purchases, access employment benefits, or steal money without your consent. Your personal information can include credit card numbers, social security numbers, driver license numbers, addresses, and bank account details.

Even if you haven't experienced financial losses, it's still considered identity theft if an imposter uses your information to access services, goods, and credit fraudulently. Identity theft can come in several forms, including:

- Medical fraud— When an imposter claims your benefits or charges bills to your account by using your personal information

- Tax fraud— Happens when an imposter uses your information to apply or receive tax returns from the IRS

- Criminal fraud— when imposters use your details to pay for speeding tickets, steal money, or during arrests

- Credit card fraud— when someone uses your credit card information to make purchases or steal money

- Employment fraud— when an imposter uses your details to gain access to your employment benefits or pass a background check

If you are a victim of identity theft, you need to report the identity theft to a financial institution within two days. Failure to do so can make you liable for the losses after identity theft. However, your liability is usually limited to no more than the first $50 of the identity theft losses.

If you fail to report within the first 60 days of an identity theft incident, you may end up losing all your money in the fraud.

What Should You Do if Your Identity is Stolen?

Finding out that someone stole your identity will be devastating, not to mention confusing. On top of that, the process of making things right after identity theft is usually lengthy. That said, if you find yourself in this situation, here are the steps you need to take instantly:

|

Check your accounts |

Monitor all your bank accounts and credit card accounts to check for suspicious activity. Are there any new accounts? Any missed payments? Do you spot any purchased items or services that don't ring a bell? Or are there any accounts on default? You can access your credit card reports for free on either Experian, Equifax, or Transunion on a bi-weekly basis. Whether something is suspicious with your accounts or not, move to the next step. |

|

Inform all linked institutions |

Make calls to your bank, your credit provider, and insurance companies to notify them of the issue of stolen identity. Doing so ensures that they take an extra step of caution when requested for an account opening or withdrawal using your details. If your credit cards have been used for fraud, request a new credit card and account numbers. Also, make sure to notify your utility providers should someone try to order services using your information. Next, put an extra layer of protection by placing a fraud alert and credit report freeze to avoid further losses. Tip: According to the LAPD, request that your old credit card accounts be processed as "account closed at consumer's request." This is better than "card stolen or lost," as it can be interpreted as blaming you for your loss. |

|

File an FTC Identity Theft report |

To file a report with the FTC, you'll need to provide as much information as you can remember and provide documented evidence. Sometimes, an FTC identity theft report can stand in for a police report, but there are exceptions to this. |

|

File a police report |

If a creditor, bank, or another institution requests one, you'll need to file a police report. Filing for a police report earlier can expedite the process and help to stop further losses. Tip: When dealing with institutions, make sure to have copies and logs of all conversations in writing. Include dates, telephone numbers, names, and expenses used to resolve your case. Likewise, make sure your correspondence to companies is sent through certified mail and that you have a signed copy of all information received. |

Signs That You May Be a Victim of Identity Theft

Here are a few signs that you may be an identity theft victim:

- You get charged for things you didn't buy

If you hear from a bill collector or spot purchases on your credit report that you didn't make, it's a sign of identity theft. - You stopped receiving bills

This happens if someone changes your billing address and may end up with you losing access to your utility services. - Spotting withdrawals you didn't make on your bank accounts

If this happens, make sure to report to your bank, and work with them to correct the fraudulent actions.

How to File an LAPD Identity Theft Report on Your Own

The easiest way to file for an is online. However, you can only make an online report if the amount lost is $20,000 or less. Here's how you can file an LAPD identity theft report online.

- Go to LAPD online.org and choose your language to start with the report (the languages available are English and Spanish).

- Select identity theft in the incident type

- State whether you are a resident or non-resident, your age, and the value of everything stolen through false identity.

- Indicate whether you are a business or an individual.

- Enter your personal information and be as detailed as possible.

- Select the time and date your identity was first and last used, location of identity theft incident, e.g., bank, clothing store, etc. Also, input the date you discovered identity theft, the amount you lost, and the type of identity theft.

- Submit your report.

After submission, the LAPD will review your submission within 24 hours. An investigating officer may or may not get back to you regarding your report, so you won't always know if progress is made.

Next Steps to File an LAPD Identity Theft Report if You Can't Do it Yourself

If you cannot report identity theft to LAPD online, you will have to do it in person at their police department. First, you have to drive through cumbersome traffic, stay in line waiting for your turn, and finally discuss the whole thing all over again with one of the officers.

And after filing the report, recovering your reimbursement, or getting your credit card health back to where it was will be a long, tiresome process. That's where DoNotPay comes in. Our AI assistant simplifies the process of filing a report to just a few minutes.

Here's How DoNotPay Can Help You File a Police Report

How to deal with identity theft using DoNotPay:

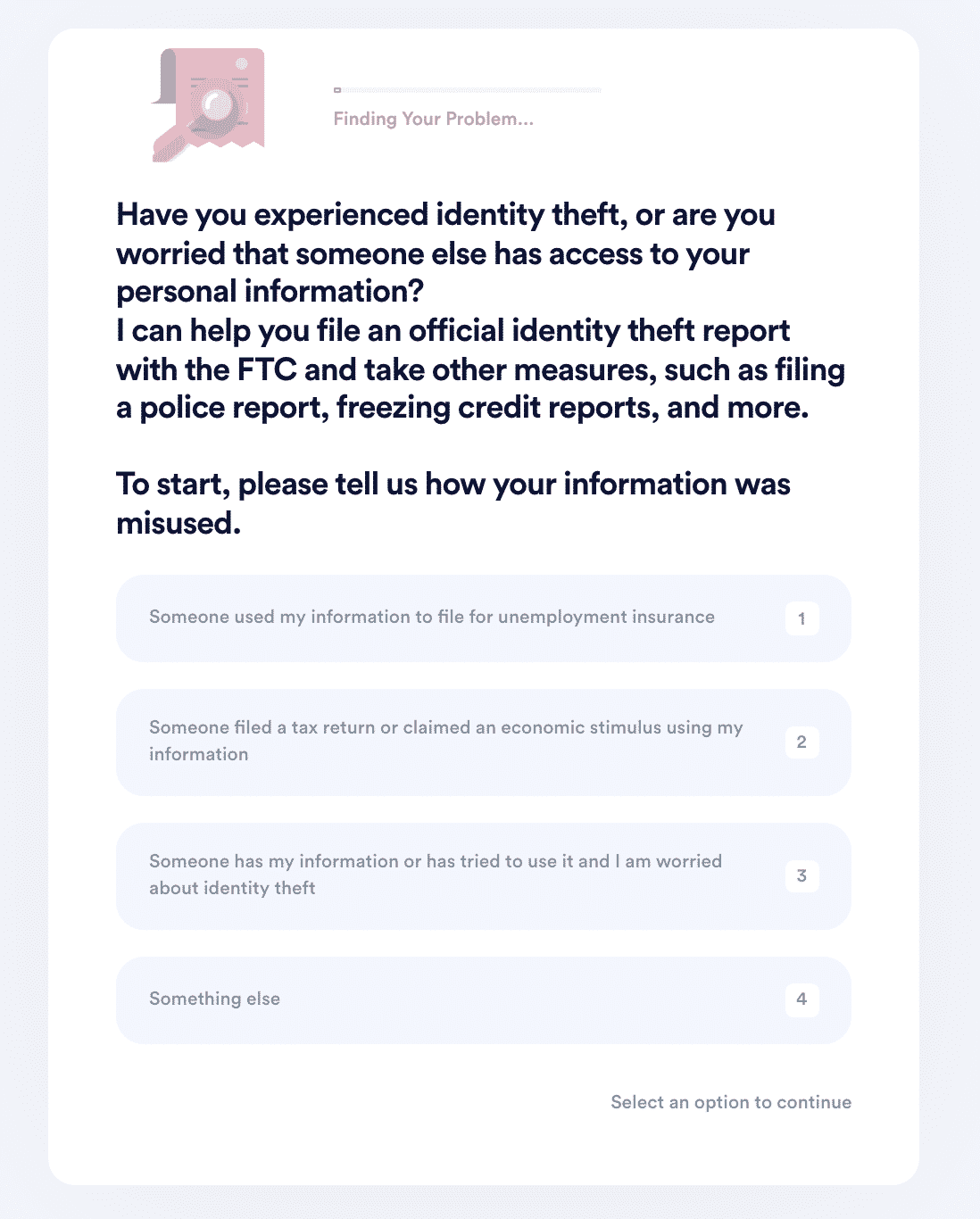

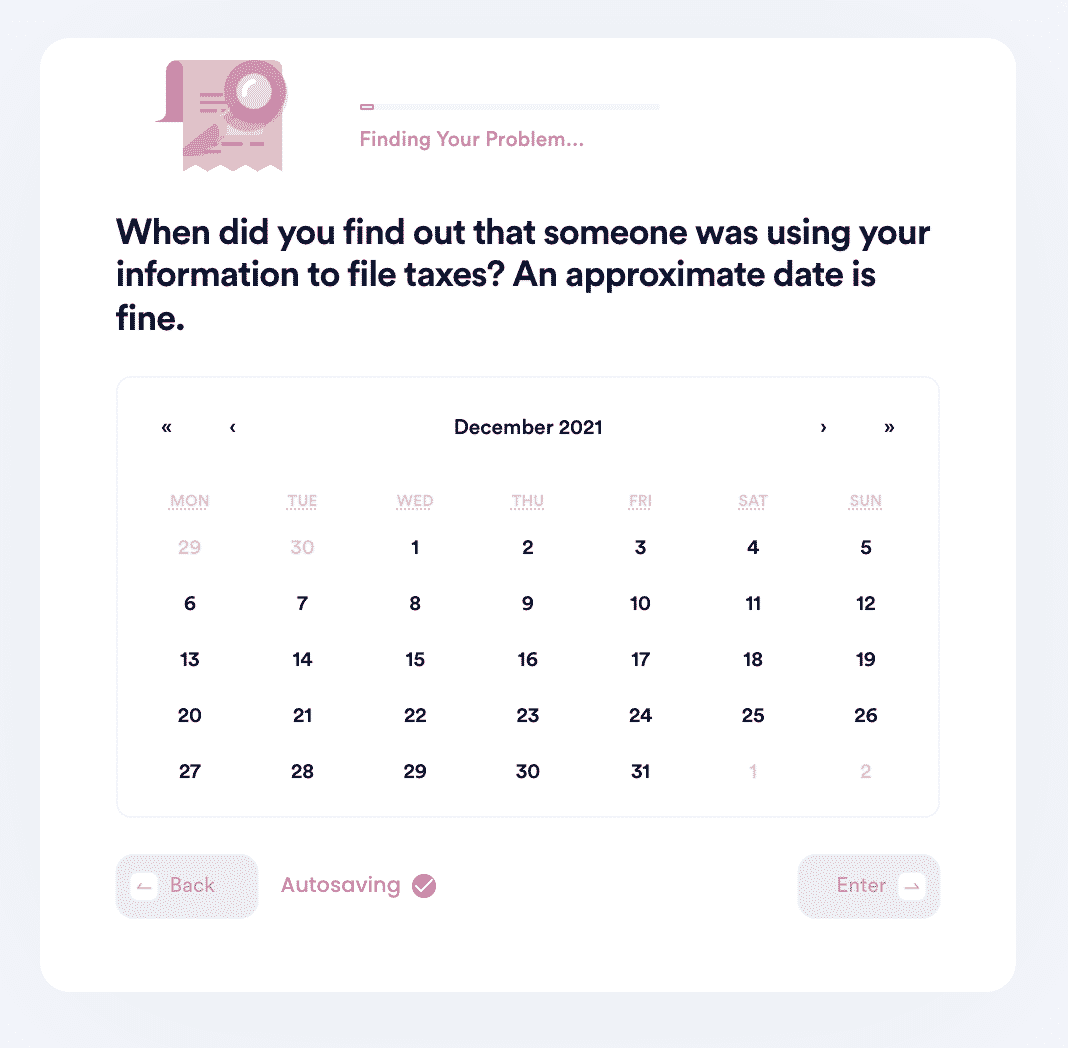

- Search "identity theft" on DoNotPay and select the type of incident you would like to report.

- Tell us more about the incident that occurred, including the location, date, time, financial loss, and any suspect information you may have.

- We'll identify whether you should file an FTC report, contact the IRS, freeze your credit report, contact state agencies, or file a police report. Once we guide you through the best options, we'll automatically submit the reports on your behalf!

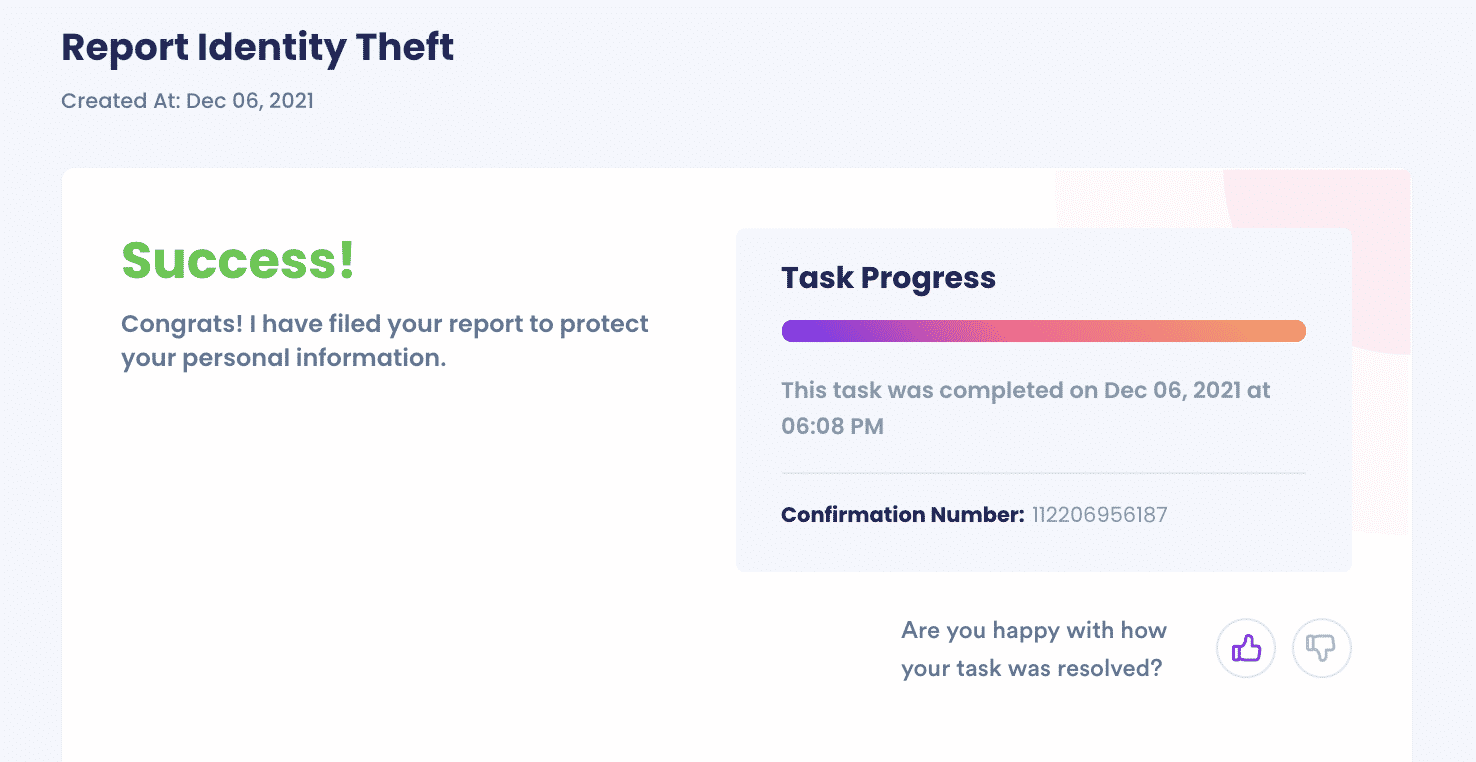

And that's it. DoNotPay will make sure your issue gets sent to the right place. We'll upload confirmation documents to your task for you to view, and if the contacts need more information, they will reach out to you personally via email or mail.

Why Is DoNotPay the Easiest Way to File an LAPD Identity Theft Report

DoNotPay cuts your identity theft report process in half. You don't have to wait in line for extended amounts of time. Simply fill in your information and attach supporting documents, and we will take it from there.

It's effective. After an identity theft, there's too much to do with too little time. DoNotPay ensures that you are filing the proper report and notifying the right institutions at the right time.

Always a success. You can rest assured that DoNotPay fights for your needs so you can avert losses and protect yourself from future identity thefts.

DoNotPay Works Across Institutions and Government Agencies to Help You Solve Identity Theft

Our AI assistant works across a wide range of institutions and agencies. You can:

- File an FTC report

- Set up fraud alerts on major credit bureaus

- Contact IRS for tax fraud reports

- Notify state agencies concerning insurance fraud

How Else Can DoNotPay Simplify Your Life?

As your personal assistant, DoNotPay helps you solve issues that can make your life frustrating. For instance, we can help you claim compensation if you are a crime victim, contact government representatives fast, and ask for chargebacks and refunds. If things escalate, we walk with you every step of the way when filing a small claims case or when claiming your insurance.

By

By