Reporting a Pump and Dump Scheme to the SEC

Pump and dump schemes manipulate the stock market by artificially increasing a stock's value through misinformation. The two-part scheme begins when the scammers purchase a company's stock at a low price. They then flood the investment market with false information to encourage people to buy stock in the company. As more investors buy stock, the stock's value increases. The fraudsters sell their stock at a higher price, which triggers a sell-off by other investors that ultimately lowers the stock's value. If you are a victim of this form of market manipulation, here 's

How to Identify a Pump and Dump Scheme

If an investment tip appears too good to be true, investigate the company thoroughly before investing.

| Research the company | Market manipulators target Microcap companies because they have limited public information. See the SEC website for information on Microcap Stocks. |

| Avoid high-pressure pitches | If a broker vigorously pushes a specific stock, be skeptical. Consider filing an SEC complaint against the broker if the interaction seems inappropriate. |

| Verify claims | Investors can contact the company, state securities regulators, or the federal government for information. |

| Determine where the stock trades | Microcap stocks trade on over-the-counter (OTC) systems such as the OTCBB and OTC Link, LLC. |

If the investigation shows market manipulation, see .

Modern Variations on Pump and Dump

Although pump-and-dump schemes have been around since the start of market trading, modern variations continue to trick investors.

- The FBI recommends that investors check their online brokerage accounts for suspicious activity. Foreign cybercriminals are hijacking accounts to coordinate stock purchases that pump up the stock's value before selling them at a higher price and moving the funds to an untraceable account. If you see any suspicious activity, file an SEC complaint.

- The SEC issued a warning regarding publicly-traded companies that claim their products or services can cure or prevent disease, specifically coronavirus. These criminals promote false research reports that stipulate a target price for the stock once it reaches the market. This scheme is an SEC violation and should be reported immediately.

Because pump and dump schemes can be difficult to prove, anyone filing an SEC complaint must complete the form carefully to ensure prosecution. If a whistleblower wants to receive a reward, the form should be error-free with supporting documentation.

How to Report a Pump and Dump Scheme Yourself

The SEC website has a complaint form for reporting an SEC violation. The form may be completed online, mailed, or faxed to the SEC. Before starting the process, be sure to read the Investor Bulletin that explains what happens once a complaint is filed. To claim a whistleblower reward, complainants must file a TCR form under the whistleblower program.

The complaint form requires the following information:

- Personal data

- Investment firm details

- Type of investment

- Description of events

- Supporting documentation

- Resolution attempts

Part of the difficulty in reporting market manipulation schemes is deciding where to file the report, what information to include, and where to send the completed complaint. One misstep can send the filing back to square one.

How to Get Help to File a Pump and Dump Complaint

If filing an SEC complaint is overwhelming, consider contacting the following organizations for assistance:

| Attorneys | representation is always an option. There are lawyers who specialize in security fraud; however, they charge an hourly rate for preparing and filing the information. Attorneys will typically set up a meeting in their offices during normal business hours to discuss options and collect information. |

| Arbitration Clinics | Some law schools provide mediation and arbitration services free of charge. However, these services are provided as part of a teaching clinic and are subject to law school course requirements. |

| Financial Industry Regulatory Authority (FINRA) | FINRA may help resolve a dispute with a financial services professional, which is an option if the complaint is against an individual and not a company. |

Unfortunately, these options mean taking time out of a busy day to meet with the individual or agency. In most cases, the attorney or agency will require multiple meetings, taking up more valuable time.

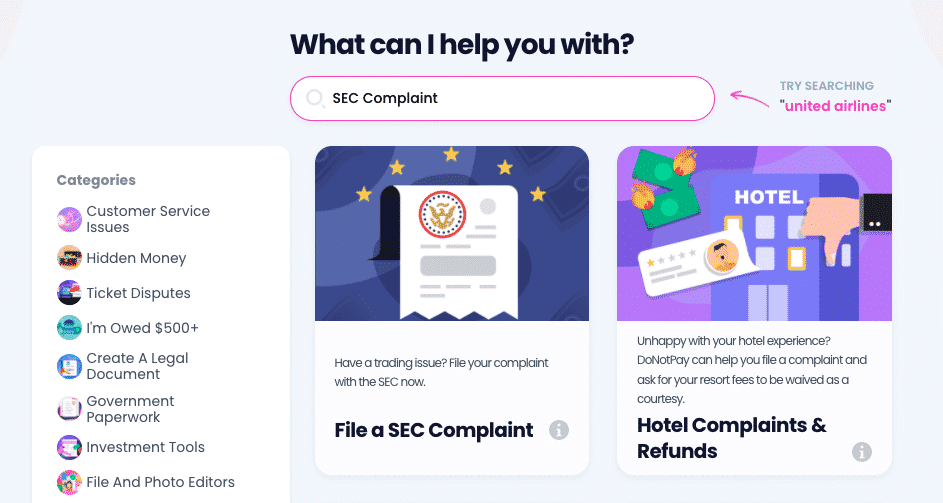

How to Report a Pump and Dump Scheme with DoNotPay

If you want to file an SEC complaint but don 't know where to start, DoNotPay has you covered. Just follow these three easy steps:

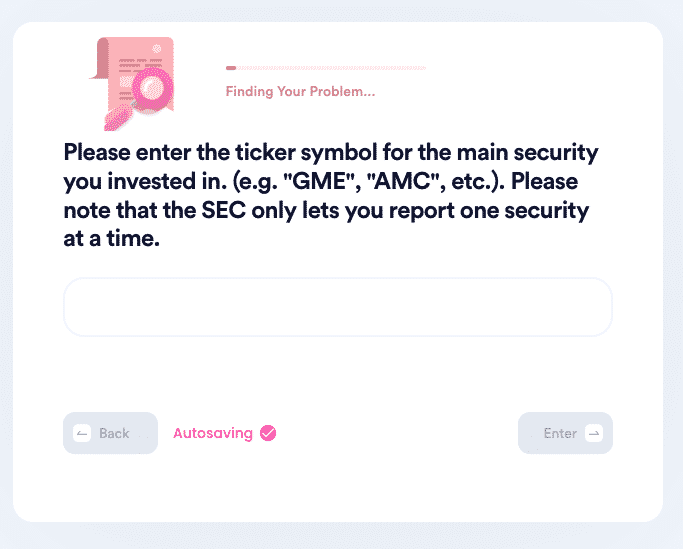

- Search SEC Complaint on DoNotPay.

- Answer basic questions about the complaint (you can also use an automatically generated complaint template).

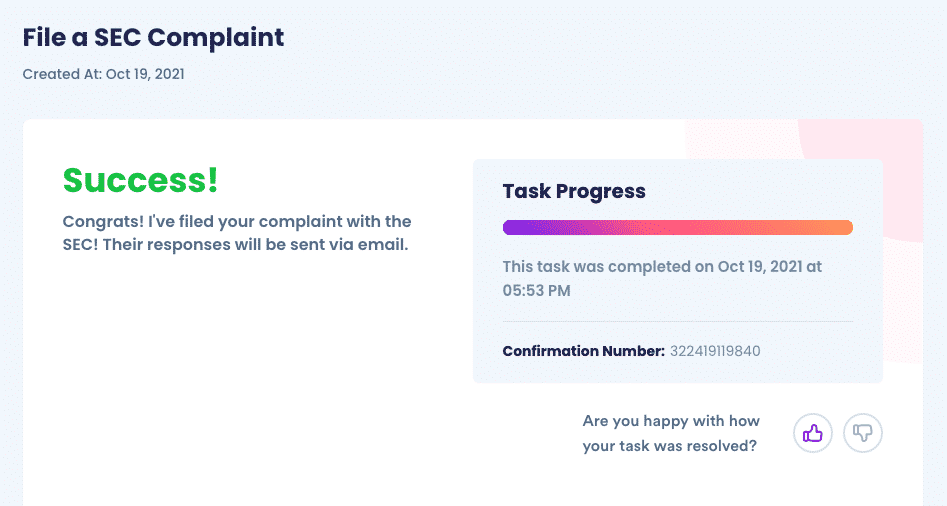

- DoNotPay will automatically run a bot to work on your behalf and securely fill out your SEC complaint form.

The DoNotPay process avoids lengthy meetings that consume valuable time and financial resources.

Why Use DoNotPay?

DoNotPay provides a fast and convenient process that can:

- Save time. You don't have to spend hours meeting with attorneys or agencies to file a report or resolve the complaint.

- Reduce frustration. You don't have to deal with the system and the federal government, trying to make sure every step is followed in the right sequence.

- Ensure peace of mind. You know DoNotPay provides the best service to ensure your peace of mind.

What More Can DoNotPay Do?

DoNotPay can do more than help file SEC reports. It can help:

- Report insider trading

- Appeal parking tickets

- Ask for a college fee waiver

- Fight email spam

With DoNotPay, problems are solved with the click of a button.

By

By