How to Draft a Delaware Shareholder Information Rights Letter

You may be a shareholder in some serious blue-chip corporations. If you contribute to your company-sponsored 401(k) plan, or invest in mutual funds, chances are pretty good that you own stock in companies like Apple, Exxon, or more of the thousands of publicly traded corporations in the US. Did you know that you have shareholder rights for those companies? In fact, guarantees shareholders access to certain company information to ensure ethical business practices and transparency. Here’s what you need to know.

How Much Stock Do I Have To Own To Have Shareholder Rights?

Even if you own a fraction of a fraction of a corporation like Google or Delta Airlines, you still have the same rights to information as the biggest institutional stockholders (most corporation's largest shareholders are entities like pension funds, insurance companies, and other large organizations). You actually have a vote in the running of the company, although most individual owners let their proxy (mutual fund, 401(k) administrators, brokerage houses) do the actual voting at the annual meeting.

What Rights Do Shareholders Have?

Your rights vary, depending on the size of the corporation. Large, publicly traded companies define shareholder rights in the Certificate of Incorporation and the governing documents of the corporation. Under Delaware law, where the vast majority of corporations are chartered, there are default rules that determine shareholder rights if the bylaws don't address a specific issue, and outline some shareholder's rights that the corporation cannot waive.

These are some of the rights that shareholders in Delaware corporations have.

1. Right to a prorated share of dividends

2. One vote per share of common stock in all matters that holders of common stock vote on

3. Right to vote on any amendment to the corporate governing documents, regardless of share class. These amendments usually deal with the following issues.

- Change the number of shares available in such class

- Change the par value of shares of such class

- Have a negative impact on the powers, preferences, or special rights of the outstanding shares of such class

4. Right to inspect the corporation's books and records

5. Right to attend the annual meeting, either in person, by telephone, or video call

What Does Inspecting The Books And Records Mean?

Many people are surprised to learn that they have the right to access the books—ledgers—and records of a corporation they own stock in. What this means is that if you own a bit of stock in a company, you can review the books and general correspondence if you have credible proof that the board has acted improperly—called "proper purpose" in governance lingo. In Delaware, this is Section 220 of the Delaware General Corporation Law (DGCL).

How Do Shareholders Demand Their Rights?

The first thing you need to do is establish your credible proof that the corporation has not acted in the best interest of the stockholders. Here's an example. Company A's prospectus says that demand for the product is at an all-time high and the board deserves more compensation for this increased demand. Sales figures don't back up the claims, though, but the board votes itself a raise anyway. There is credible evidence here that the board did not act in the shareholder's interest.

Writing A Shareholder Information Demand Letter For A Delaware Corporation

You can send the letter from anywhere in the US, but the original must go to the corporation's Delaware address since the Chancery Court of Delaware has jurisdiction over the matter. Here's what you have to include:

- Your oath that you either own stock in the company, or represent someone who does via a Power of Attorney

- Credible evidence of wrongdoing

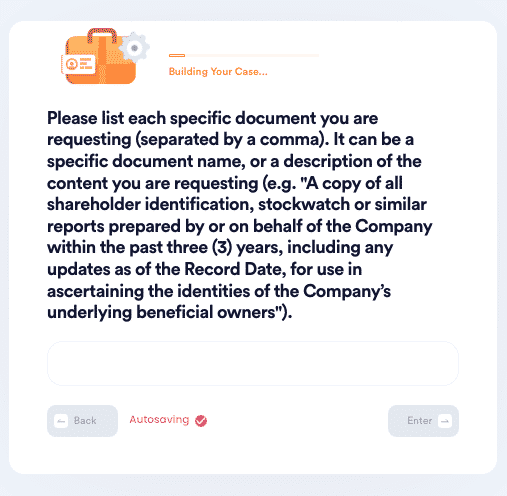

- The exact records you want to examine. Recently, the courts have allowed electronic records to be inspected. These would include emails and any other correspondence, ledgers, transaction records, and any other documentation that you believe will strengthen your case.

Some of the records that you might specifically ask to examine include:

| Type Of Record: | Why To Include It: |

| Insider Share Holdings | You should want to examine how many shares the insiders are holding because you want to see if they are actively holding onto those shares or if they are dropping them quickly as they see potential issues inside the company. |

| Board Minutes | Board meetings that are held outside of the view of the public can still be accessed. Those who own shares in the company are entitled to request the minutes from these meetings in order to gain some insights into what happened during the board meetings, and why it mattered. |

| Risk Factors | Known risk factors can be requested by the shareholders of the company. They can be called up so that any individual shareholder who wants access to this information will have no problem tracking it down. |

There Is A Better Way To Write Your Shareholder Rights Letter

Don't get bogged down in the governance mumbo jumbo. Let DoNotPay write the demand on your behalf.

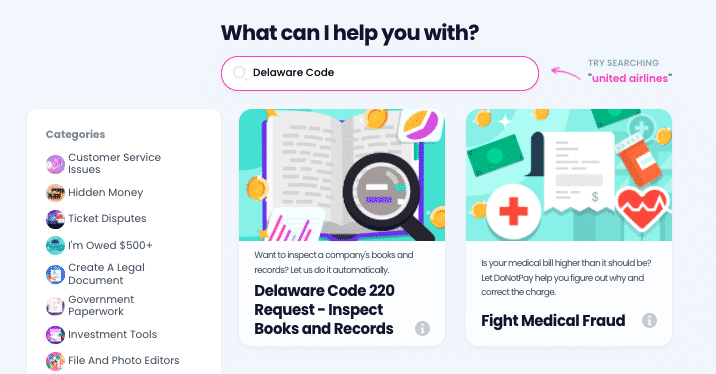

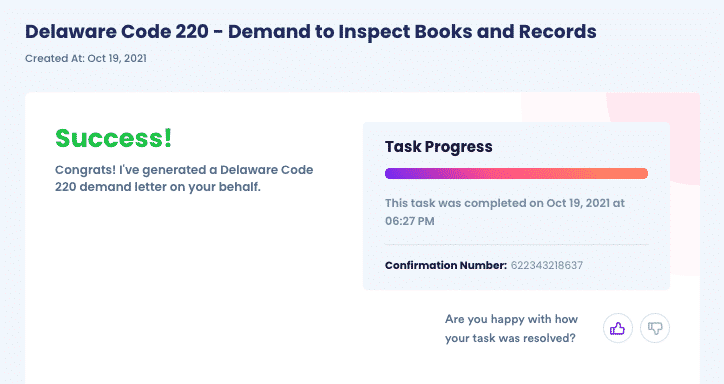

If you want to submit a Delaware Code 220 request but don't know where to start, DoNotPay has you covered. Create your own letter in 3 easy steps:

- Search Delaware Code or Stock Inspection on DoNotPay.

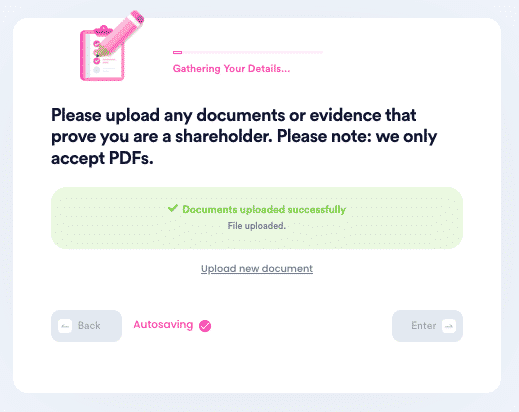

- Confirm that the company you are hoping to inspect is a Delaware Corporation and that you are a stockholder.

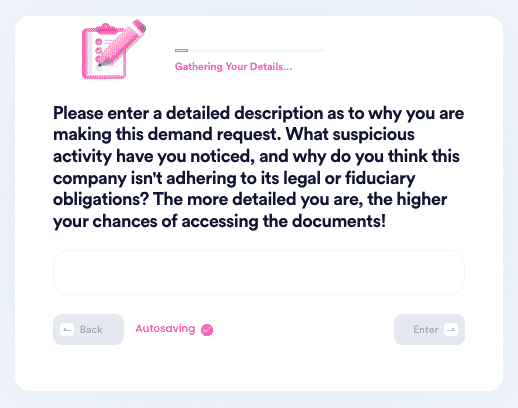

- Tell us why you are requesting the information and what you plan on doing with it.

- Specify the names or types of documents you are requesting.

- That's it! DoNotPay will generate the formal request letter on your behalf and send it to the company.

Why Use DoNotPay?

We are the solution to your corporate governance and shareholder headaches. Our state of the art AI lets us craft the demand letter for you, so all you have to do is sign in and enter the information our chatbot requests. It's fast—you provide basic information—it's easy, and it works. We have the expertise to draft a letter that's written for the profession, so you can be assured it's using the correct language for the task at hand.

That's Awesome. What Else Can DoNotPay Do For Me?

DoNotPay can help untangle all kinds of red tape in your life. We can file other complaints with the SEC, help you appeal your property taxes, and even work with credit card companies for chargebacks when you travel abroad. When you sign up with DoNotPay, you've got the peace of mind of knowing your problems are in the right hands for a quick resolution.

By

By