Smart Hack That'll Get Your Chime Fees Waived

Chime is a financial technology service that boasts no hidden fees and no overdraft fees. But like all services, there are typically fees associated with the account. Unfortunately, many banks don't speak openly about their fees, which can come as a surprise to account holders. If you have an account with Chime, you may be wondering whether there are any .

The good news is that waiving fees with any bank may be possible with the right steps. At DoNotPay, we're here to help Chime account holders only pay what they deserve. Today we're going to discuss chime fees, how you can fight bank fees, and why using DoNotPay is the best solution to getting your fees waived.

What Are Chime Fees?

Chime is one of the few bank accounts that does not have excessive amount of fees. But there are a few fees you can expect as an account holder. There are two main fees that you will see associated with your Chime account. This includes a .

Cash Withdrawal Fee

Chime account holders will receive a cash withdrawal fee every time they withdraw money from their bank account. Unfortunately, Chime does not specify how much you will be charged per withdrawal. A cash withdrawal fee applies to:

- ATM withdrawal

- Over-the-counter withdrawal

Transaction Fee

Another fee that Chime account holders will experience is a transaction fee. Transaction fees are $2.50 per transaction. You will not receive a fee if you make a transaction at any of the following ATMs:

- MoneyPass (MoneyPass ATMs not located within a 7-Eleven are subject to fees)

- AllPoint

- Visa Plus Alliances

- ATMs located at 7-Eleven locations

Chime states that if account holders use an ATM for any transaction that's not owned by Chime, a fee may be charged by the ATM operator. This fee may be charged even if you are not making a withdrawal.

Does Chime Have Hidden Fees?

Chime is transparent about what fees will be associated with your account. Chime requires no minimum balance, no monthly fees, or overdraft fees for account holders. However, the only way to deposit money with Chime is to go to one of their partner locations. Many of these retailers may charge a fee of up to $4.95, which can become costly over time. This is one downside of a bank such as Chime.

How to Waive Bank Fees on Your Own

Unfortunately, Chime has set fees that are unable to be waived. Their Cash Withdrawal Fee and ATM fee are standard fees that all account holders have. The good news is that Chime is one of the few banks that do not charge their customers' excessive fees, such as overdraft fees.

Additionally, Chime does not practice including hidden fees, which means that account holders always know what they'll be charged. But if you have another bank that's charging you excessive fees and you want to fight to get them waived, there are a few steps that you can follow.

- Contact the Bank: The first step to follow with any bank fee is to contact the customer service center of your bank. You can easily ask the customer service representative to waive a fee. Sometimes, the representative will look over your account and remove the fee over the phone.

- Write a Letter: If talking to a customer service representative is unsuccessful, the next step is to write a formal letter asking for the bank fee to be removed.

- Wait for a Response: Regardless of whether you contact customer service or write a formal letter, you may need to wait for a response. The response time will vary, depending on your bank.

It's important to note that certain account holders have a better chance of getting any bank fee removed. In fact, account holders with an established history with their bank are more likely to get their fee waiver request honored. Additionally, account holders who have kept their account in good standing or who haven't requested a fee waiver recently, such as for an overdraft, are more likely to get fees removed.

How to Waive Bank Fees with DoNotPay

Have you been hit with a bank fee that's hurting your pockets? Let DoNotPay help you get it removed. It's not uncommon for account holders to experience unexpected bank fees, which can certainly be quite stressful. Even more, getting bank fees removed is often a lengthy process, depending on who you bank with. Let DoNotPay take out the hassle and appeal any fee on your behalf.

How it works:

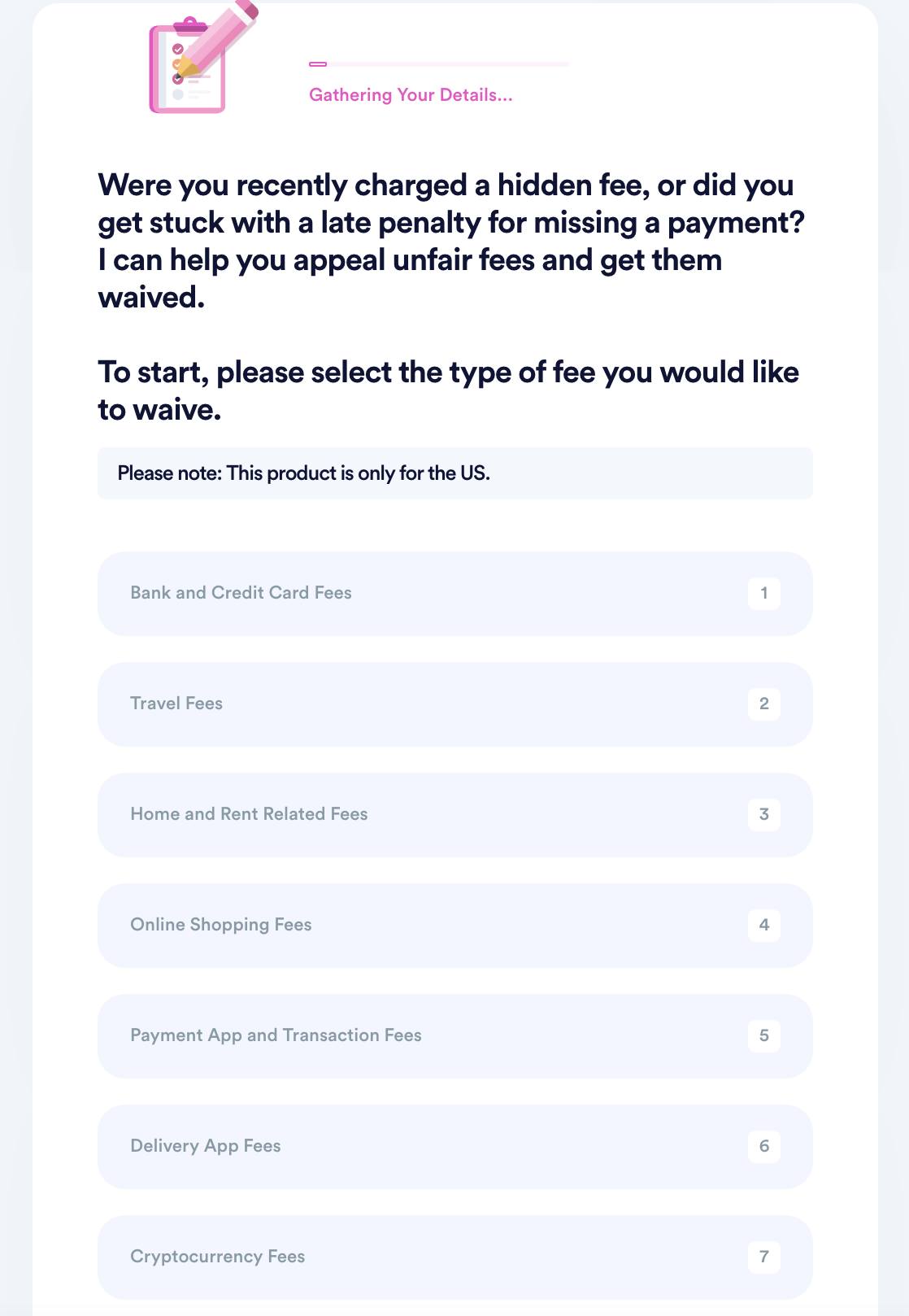

- Search "appeal fees" on DoNotPay, choose the Fight and Waive Fees product, and select the type of fee you want to appeal.

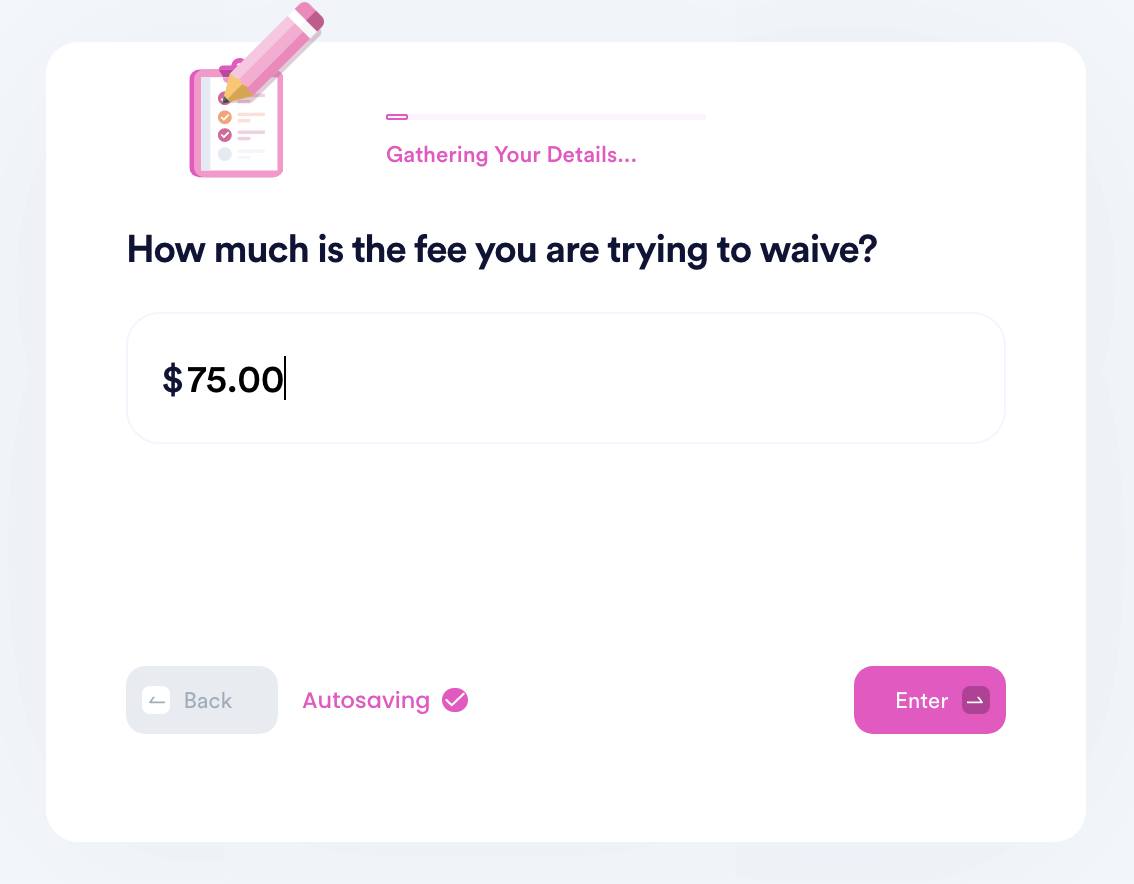

- Select the merchant you want to appeal fees for and enter the details of your transaction, including an associated account if you have one.

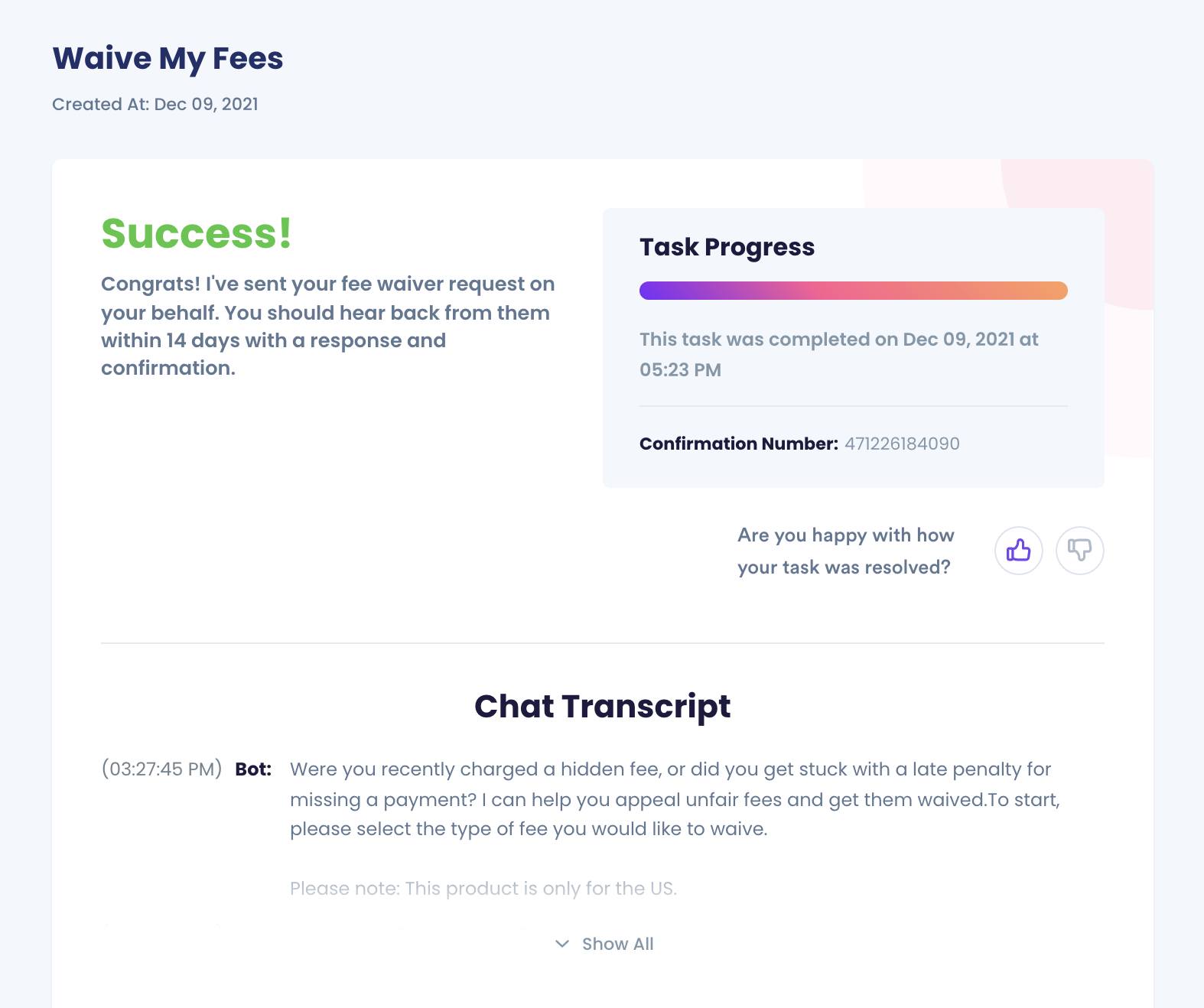

- Submit your case! DoNotPay will generate the best argument for your case and make sure your fee waiver request gets sent to the merchant for processing.

And that's it! DoNotPay will send a request on your behalf to appeal all applicable fees and to ensure you get your money back!

DoNotPay Works Across Multiple Platforms

DoNotPay provides a fast and easy solution for getting any fees appealed successfully! DoNotPay also works in fighting against additional fees that other companies may try to add on. To learn about some of the many fees DoNotPay can assist you with, check out the following list below! Why not try it today and see how much of a difference can make in appealing unwanted fees!

| eBay fees | Coinbase fees |

| Robinhood fees | Paypal seller fees |

| Spirit Airlines baggage fees | American Airlines baggage fees |

| Chase Bank checking account fees | Etsy fees |

| Homeowners Association (HOA) fees | Shopify fees |

Appealing fees are simple with DoNotPay. If you're ready to successfully appeal a fee and only pay what you deserve, sign up with DoNotPay today to get started. DoNotPay is fast, easy, and successful at appealing fees on your behalf!

Chime Fees — Frequently Asked Questions

How can I speak to a human at Chime?

Chime offers 24/7 customer service. You can reach Chime at +1 (844) 244-6363 or support@chime.com. You can also use DoNotPay to resolve any difficult Chime customer service issues on your behalf.

Is Chime safe?

Chime is not a bank—it is an online fin-tech company that partners with 2 banks. However, all Chime accounts are FDIC insured up to a maximum of $250,000 per depositor.

Does Chime charge a fee to withdraw money?

It depends. If you use one of Chime's 60,000+ fee-free ATMs, you can withdraw up to $500 without a fee. However, there is a $2.50 charge every time you withdraw from an out-of-network ATM.

Is Chime the best option for me?

Although Chime allows you to build credit with no checks or fees, it has no in-person service and there have been complaints with regard to frozen Chime accounts and funds.

By

By