Waive Bank of America Checking Account Fees the Easy Way

As banking institutions go, Bank of America — or "B of A" — has a diabolical reputation for charging extra fees and taking advantage of their customers! And we'll talk more about that shortly. You're here because you want to fight back against unwanted , and DoNotPay can help.

The DoNotPay App is the world's first AI Consumer Champion. You can use it any time you want to stand up against a major financial institution like Bank of America, Chase, Coinbase, or Robinhood.

This piece covers four vital points:

- How to fight with DoNotPay. It's super easy and reliable.

- How to fight Bank of America checking account fees by yourself. It's not so easy.

- A little more information about Bank of America and their diabolical fees.

- And a few other battles DoNotPay can win for you.

If you're fed up with Bank of America checking fees, you're in the right place. Let's see how easy it is to waive them with DoNotPay.

How to Fight Unwanted Bank of America Fees With DoNotPay - It's Easy!

You can use DoNotPay to appeal "B of A" fees. Just follow three simple steps:

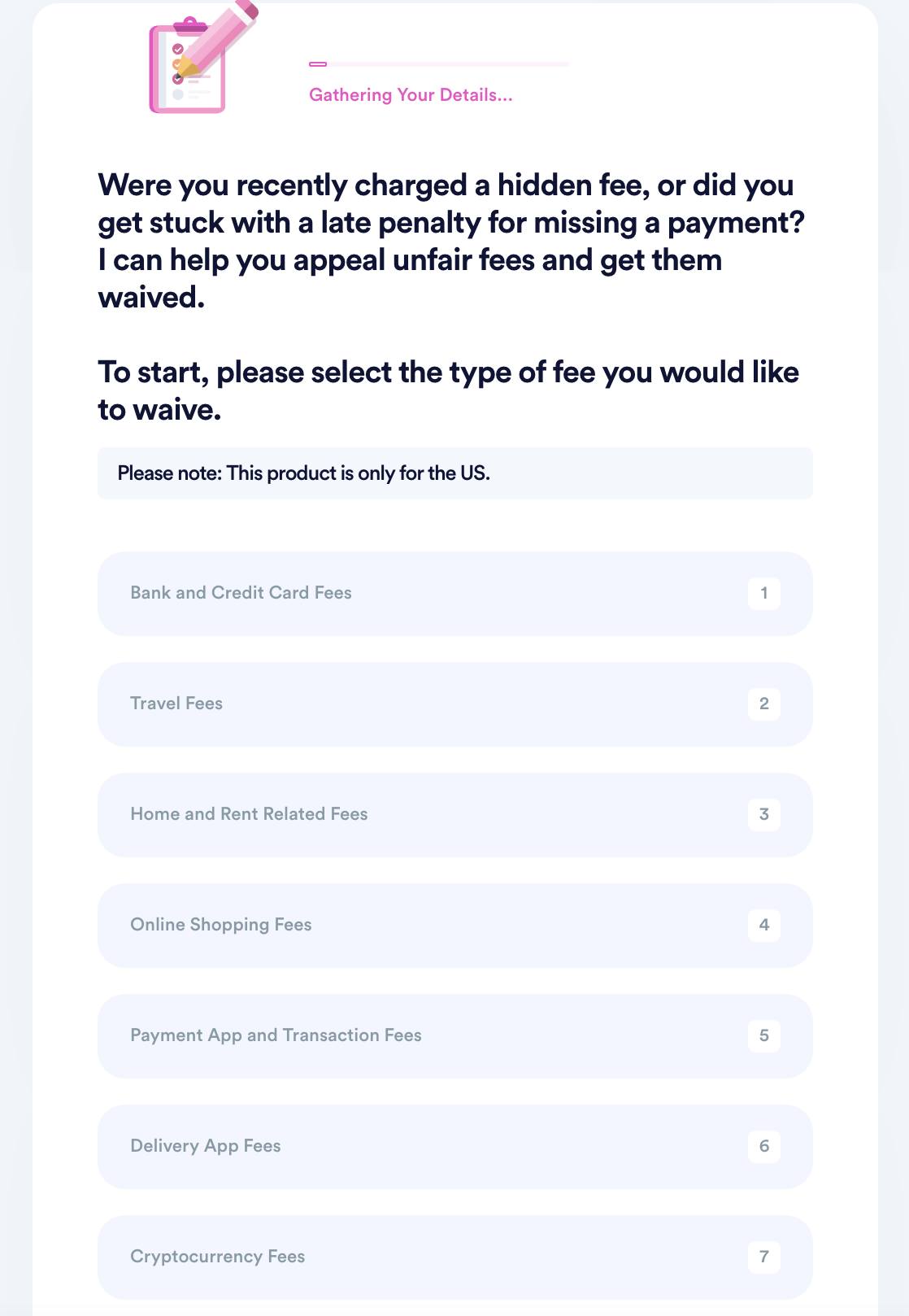

- Search "appeal fees" on DoNotPay, choose the Fight and Waive Fees product, and select the type of fee you want to appeal.

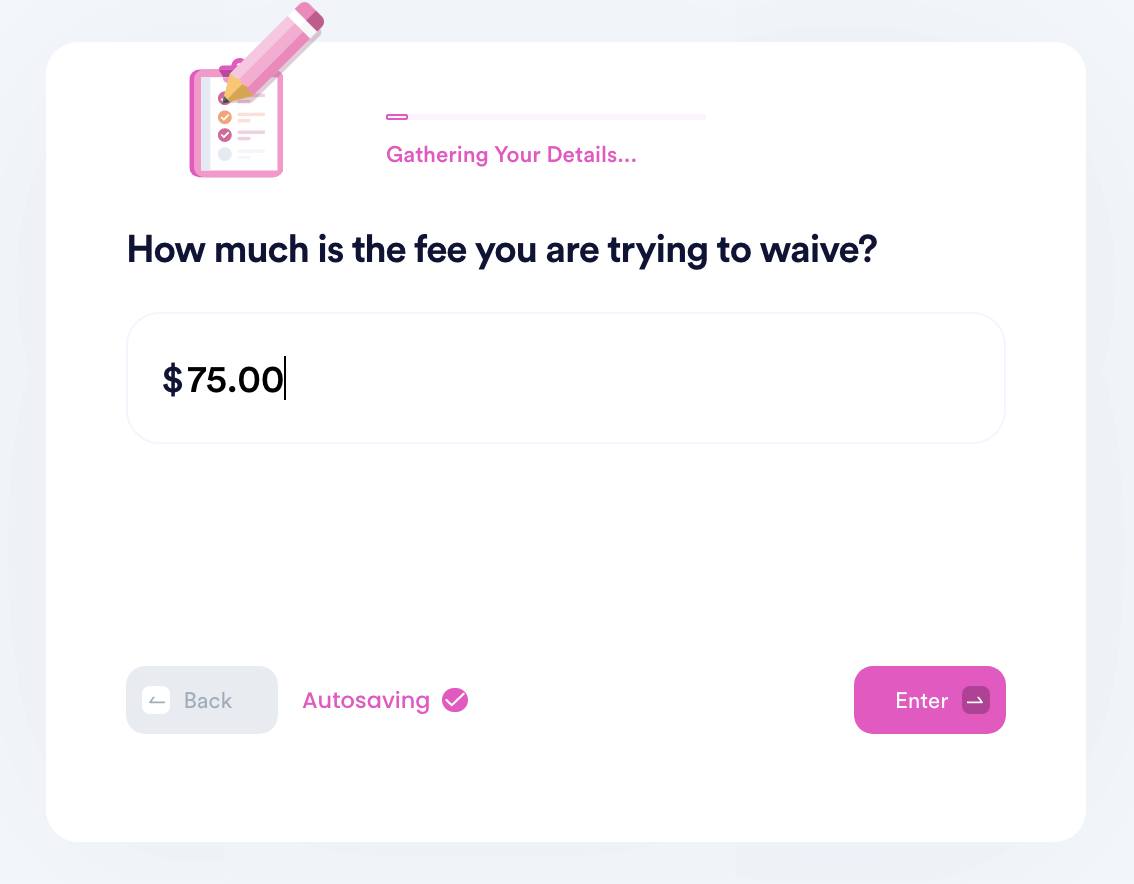

- Select the merchant you want to appeal fees for and enter the details of your transaction, including an associated account if you have one.

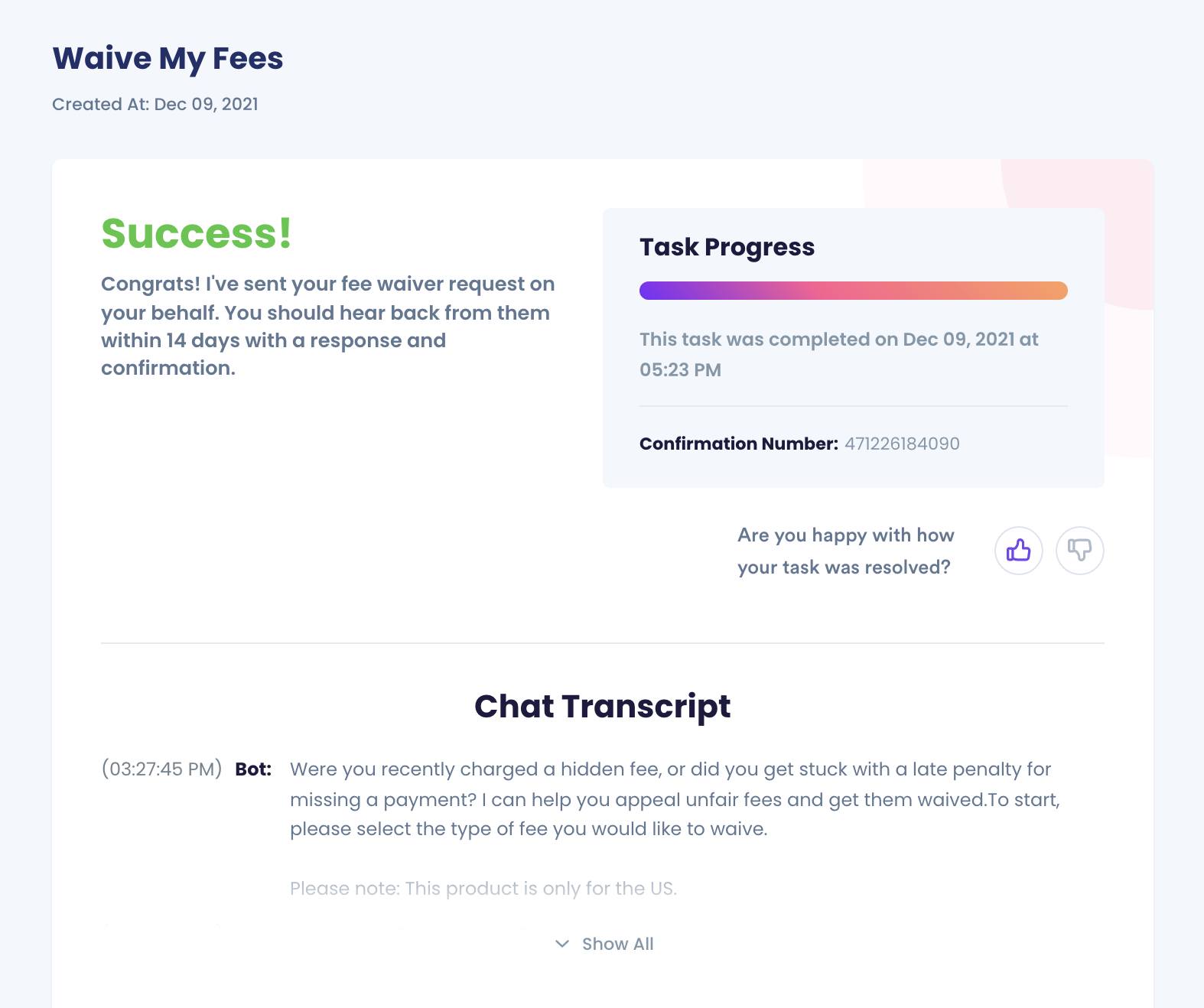

- Submit your case! DoNotPay will generate the best argument for your case and make sure your fee waiver request gets sent to the merchant for processing.

That's all you need to do! DoNotPay is the world's first AI Consumer Champion, and you can use it to take on the big financial monsters and tech giants.

You can also try to take on Bank of America by yourself. Be warned, it's going to take a long time. And you might not get far if you're not an attorney. Let's take a look.

How to Fight Bank of America Checking Account Fees by Yourself

Forbes says Americans paid more than $34 billion in overdraft fees in 2017. That's a ton of cheddar! You can fight them, but it's not easy. Most people give up after one or two phone calls or emails.

Gather Your Documents

Start by gathering all your paperwork. Think about:

- Deposit slips

- Canceled checks

- Bank statements from Bank of America

- Any relevant receipts

Contact Bank of America Customer Service

Call Bank of America customer service at (800) 432-1000. Remember to stay calm and rational, and explain the facts to the representative.

Calmly explain to them:

- The amount of the unfair fee

- The date the fee was put on your account

- Why you believe this fee was unfair

- And what you expect to be done about it

At first, they're not going to do much. They may put you on hold for an hour or "upgrade" your call to a more advanced customer service rep. You'll get lost in a phone system. The call will get dropped. You might need to make the same call and explain yourself ten times!

They Want You to Give Up

Know that Bank of America expects you to give up or give in. If you're not a professional paralegal or trained attorney, they won't take you very seriously. They'll probably provide you with a complaint number but say they cannot help you. Ask to speak to a supervisor! Remember, you need to stay calm and professional when talking to customer service agents, or they'll hang up.

Prove to them that the fee is unfair and ask for a refund! For example, perhaps they debited an amount on the same day your paycheck was deposited but took an extra few days to clear the paycheck. Or maybe you have an automatic debit scheduled to move funds from your checking account to a savings account, but B of A overdrafts your checking account, moves money into checking from savings, and took a fee for doing so. Bank of America is notorious for this!

Bank of America Has a Terrible Reputation for Customer Service

We alluded to this earlier in the piece. Bank of America is known for diabolical behavior, high overdraft fees and poor customer relationships. Check out the Better Business Bureau (BBB) to see what we mean.

At the time of writing, the BBB reports more than 6,500 consumer reports closed in the past three years! Complaints include fraudulent fees and behavior with checking accounts, unexplainable charges on debit and credit cards and tons of spam mail. That's something else DoNotPay can help you fix, by the way.

Let's take a moment to learn a few other things you can do with DoNotPay.

Other Ways to Use DoNotPay

Any time a financial organization, tech giant, or airline is taking advantage of you, fight back with DoNotPay!

Use it to fight and waive fees from:

| American Airlines | eBay | Etsy |

| Spirit Airlines | PayPal | Shopify |

Any time you think you're being treated unfairly by a person or organization, make DoNotPay your first resource. It even works for smaller organizations like your homeowner's association (HOA) fees, too. Give it a try today!

By

By