Remove Derogatory Marks from Your Credit Report Fast

Having a good credit score is key when looking to make large purchases, such as home mortgages to even new phones. Derogatory marks, including late payments, can harm a credit score and possibly prevent a person from obtaining such items. How can you dispute derogatory items on credit reports? This is DoNotPay's guide on .

What Are Derogatory Marks On Credit Reports?

Derogatory marks on a credit report are items that reflect negative information about things that were either neglected to be paid on time or not paid at all. This information can include the following:

- Accounts In Collections

- Charge-Offs

- Civil Judgements

- Debt Settlements

- Foreclosures And Repossessions

- Late Payments

- Tax Liens

Strategies for Successfully Disputing Your Credit Report

Derogatory items are easy to get on a report but harder to take off. However, it is possible to get these taken off a credit report. The following are the steps in which you can try on your own to remove derogatory marks:

| Take a close look at your credit report | The first step in taking off derogatory marks is to thoroughly check your credit report for any inaccuracies. You can do this by requesting a copy of your credit report from TransUnion, Experian, and/or Equifax. These agencies are required by the Federal Trade Commission to give you a free report once every twelve months. You can also create a free account with a finance company, such as Credit Karma or Credit Sesame, which allows you to view your credit scores daily. |

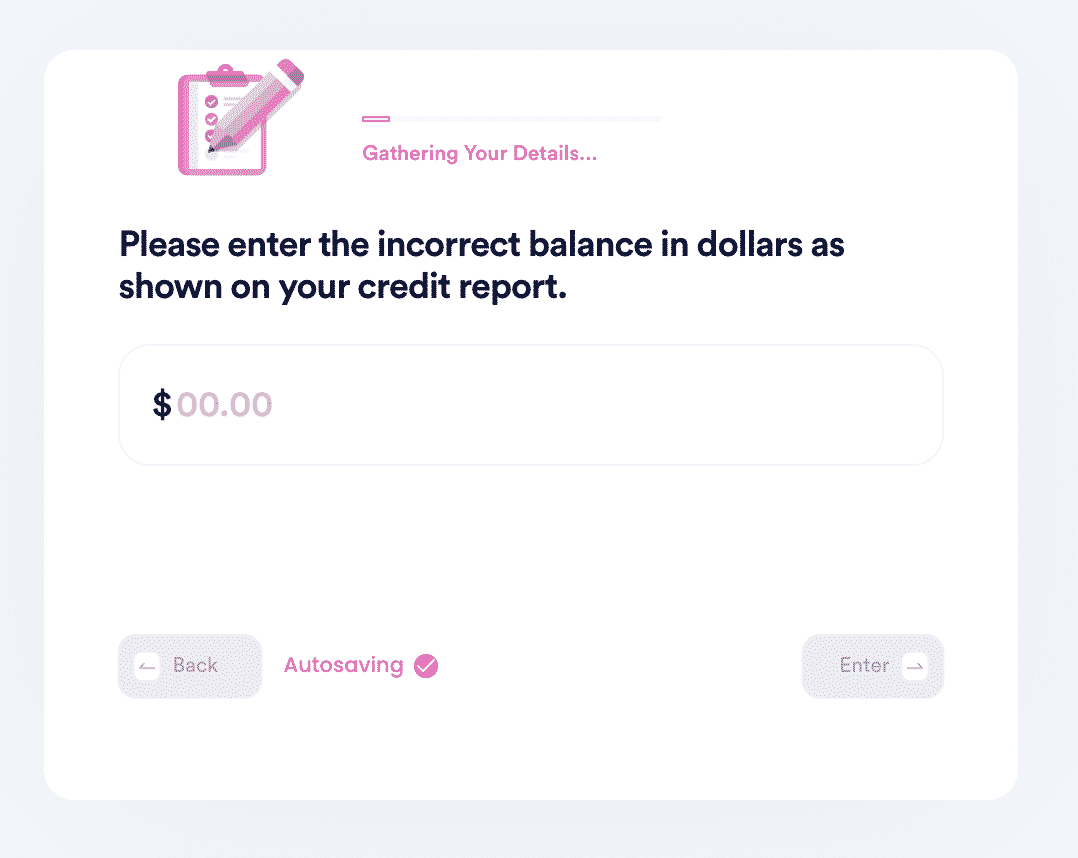

| Dispute any incorrect items | If you find any inaccurate information, you can make a dispute about the information to get it corrected. TransUnion, Experian, and Equifax all have online portals to dispute a derogatory credit mark. You will need to have the following three pieces of information to make sure your dispute gets processed easily and quickly:

|

| Wait for a response from the credit reporting agency | Once you have submitted the required information, all you need to do is wait for an update from the crediting agency. It can take about 30 days to get corrected and shown on your report. If the agency finds that an error was made, it will be automatically corrected. However, if they find the disputed information accurate, no changes will be made. If the credit agency refuses to remove the disputed information after the corrected information has been shown, you have the right to send demand letters to. DoNotPay offers an easy way to make a claim in small claims court. |

Correcting derogatory marks can seem daunting. With all the information and paperwork that needs to be sent to each agency, it can be a little stressful in getting all the information prepared. What if there was a simpler way to get a derogatory mark disputed? That is where DoNotPay comes in!

Solve Derogatory Credit Report Marks With the Help of DoNotPay

DoNotPay helps fix credit report errors in a fast, easy, and successful way! If you want to clean up your credit report but don't know where to start, DoNotPay has you covered in 3 easy steps:

- Search Clean Credit Report on DoNotPay.

- Prepare a recent copy of your credit report that you can use as reference.

- Let us guide you through the 4 potential options:

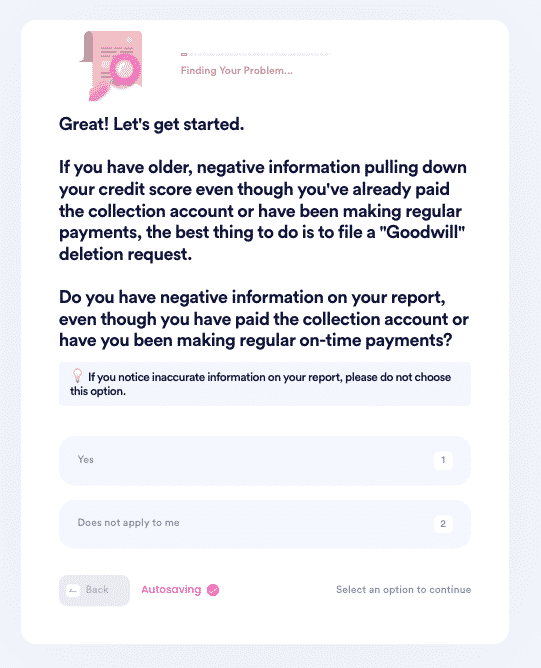

- If you've already paid off your debt, we'll help you file a Goodwill Removal Request to get it removed.

- If you notice any errors in your report (we have a list of common errors you can use!), we'll help you file a credit dispute to the creditor or major credit bureaus.

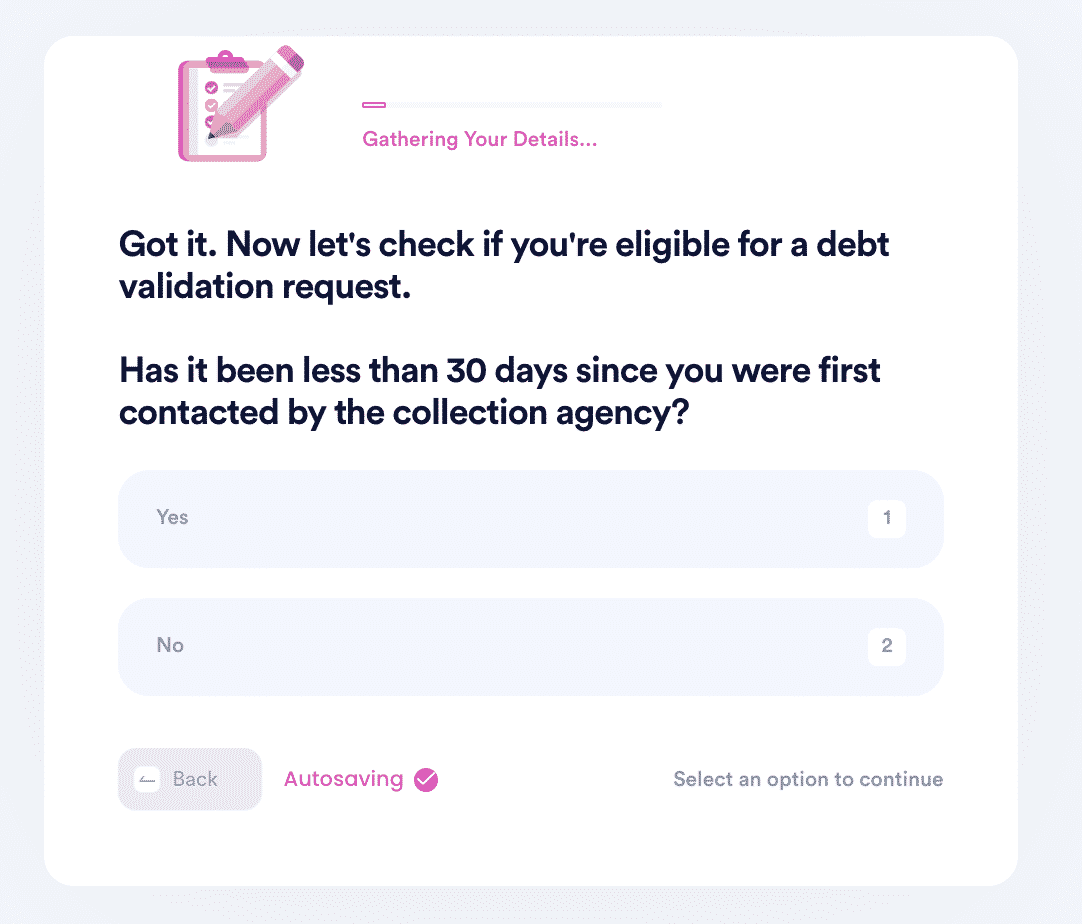

- If there are no errors, we'll check if you're still eligible to file a debt validation request. If they can't validate your debt, they're required to remove it from your report and they can't collect it!

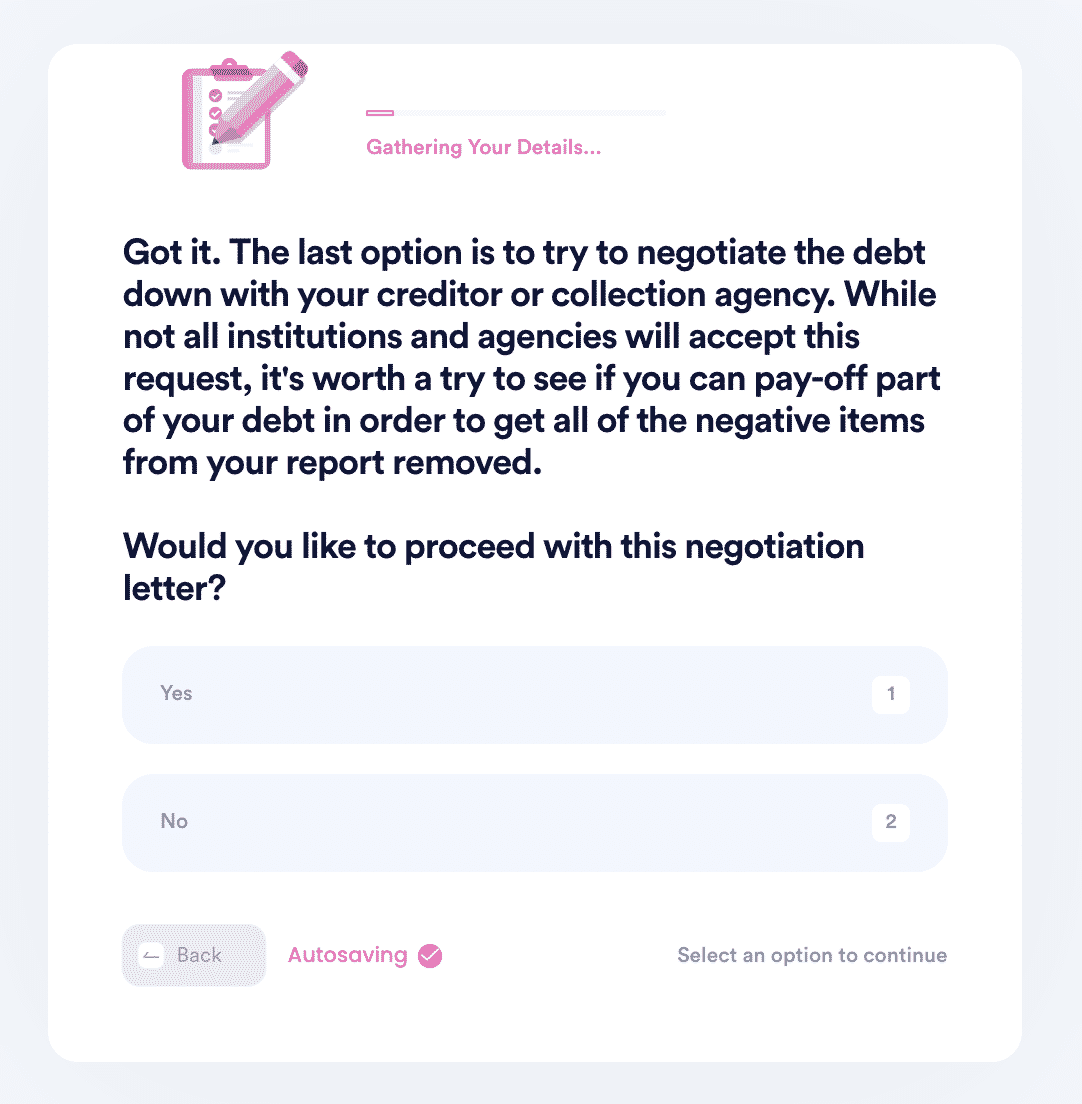

- Lastly, if none of the above options work, we'll help you file a pay-to-delete negotiation letter. You can customize the amount you are willing to pay in exchange for getting the item removed.

You can also check out our other credit products, including Credit Limit Increase, Get My Credit Report, Keep Unused Cards Active, and more! **

Other Credit Areas That DoNotPay Can Assist In

DoNotPay is the perfect solution for and more. Try DoNotPay for yourself and see the difference it can make! To learn more about other areas DoNotPay can help you with on your credit report, check out the following:

- How to Make a Credit Dispute Letter

- What Are Debt Validation Letters?

- How to Remove Inquiries from a Credit Report

By

By